Foreign Trusts For US Family Members: Use of Section 645 Election

Foreign Trusts For US Family Members: Use of Section 645 Election

Foreign Trusts For US Family Members: Use of Section 645 Election

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

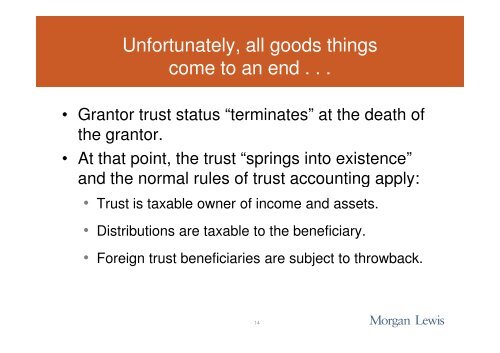

Unfortunately, all goods things<br />

come to an end . . .<br />

• Grantor trust status “terminates” at the death <strong>of</strong><br />

the grantor.<br />

• At that point, the trust “springs into existence”<br />

and the normal rules <strong>of</strong> trust accounting apply:<br />

• Trust is taxable owner <strong>of</strong> income and assets.<br />

• Distributions are taxable to the beneficiary.<br />

• <strong><strong>For</strong>eign</strong> trust beneficiaries are subject to throwback.<br />

14