December 2008 / January 2009 - Association of Dutch Businessmen

December 2008 / January 2009 - Association of Dutch Businessmen

December 2008 / January 2009 - Association of Dutch Businessmen

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

November Review<br />

Pareto<br />

is different from<br />

competitors in that<br />

it <strong>of</strong>fers ‘packaged’<br />

solutions both<br />

from an acquisition<br />

perspective<br />

as well as a<br />

corporate finance<br />

perspective.<br />

Services are<br />

aimed to build<br />

the company’s<br />

balance sheet in<br />

every stage <strong>of</strong><br />

its development<br />

backed by shipbroking<br />

activities.<br />

The goal is to<br />

increase company’s<br />

entreprise value<br />

by <strong>of</strong>fering equity<br />

and debt finance<br />

solutions, and<br />

additionally, to<br />

provide aftermarket<br />

services<br />

for companies<br />

with publicly listed<br />

securities.<br />

balance sheet in every stage <strong>of</strong> its development backed by ship-broking activities. The goal is to increase<br />

company’s entreprise value by <strong>of</strong>fering equity and debt finance solutions, and additionally, to provide<br />

after- market services for companies with publicly listed securities. Aftermarket services include equity<br />

research to improve market awareness and thus promote liquidity in coherence with securities brokerage.<br />

Pareto’s Private Equity division in Singapore is active in sale-and-leaseback transactions, much like the<br />

<strong>Dutch</strong> CV system and the German KG system, but it is not tax-driven.<br />

The structure works under a so called “Kommandittselskap” which is a Norwegian Limited Partnership<br />

that has the attraction <strong>of</strong> limited liability for its limited partners. The structure is essentially that <strong>of</strong><br />

an operating lease, whereby the effective operating lessor is a group <strong>of</strong> Norwegian investors generally<br />

consisting <strong>of</strong>:<br />

Participants: Domestic and international investors from the public that own around 55% - 75% <strong>of</strong><br />

the share capital.<br />

Commercial Manager: Normally owns 15% - 35% <strong>of</strong> the shares in the KS. The role <strong>of</strong> the commercial<br />

manager will be to ensure the charterer’s obligations under the bareboat / time charter, supervise any<br />

inspection <strong>of</strong> vessels and records, and assist the KS in maximising shareholder value.<br />

General Partner: (Usually owned by the commercial manager) owns up to 10% <strong>of</strong> the KS and<br />

has unlimited responsibility for the company’s engagements, unlike the other participants whose<br />

responsibilities are limited to their invested capital.<br />

As the Business Manager (Pareto) provides Investor Services; the business manager will look after the<br />

company’s interests towards the lenders and shareholders, prepare tax information for the participants<br />

and the company, prepare annual reports, organize board meetings and general meetings, in addition<br />

to maintaining a secondary market for the shares.<br />

One <strong>of</strong> the interesting features <strong>of</strong> the KS system is that there is an active stock market in KS<br />

Shares, allowing investors to diversify their exposure to the shipping market into various sectors. For<br />

instance, an investor can own 1/60 <strong>of</strong> a product tanker and 1/80 <strong>of</strong> a Panamax bulk carrier and trade<br />

these exposures actively. This makes the shares freely tradable and adds to the attractiveness to invest<br />

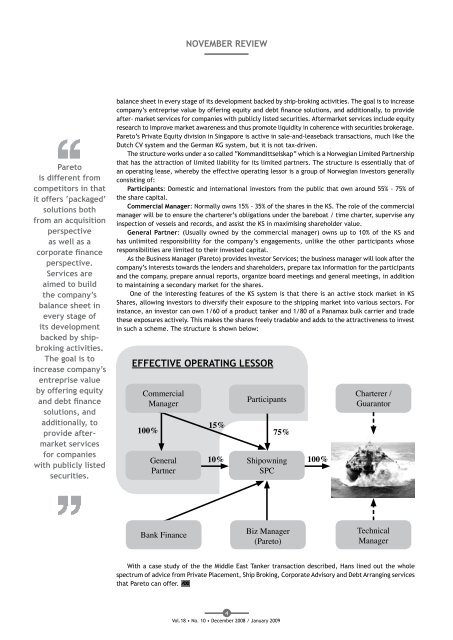

in such a scheme. The structure is shown below:<br />

Effective Operating Lessor<br />

Commercial<br />

Manager<br />

100%<br />

General<br />

Partner<br />

15%<br />

Participants<br />

75%<br />

10% Shipowning<br />

SPC<br />

100%<br />

Charterer /<br />

Guarantor<br />

Bank Finance<br />

Biz Manager<br />

(Pareto)<br />

Technical<br />

Manager<br />

With a case study <strong>of</strong> the the Middle East Tanker transaction described, Hans lined out the whole<br />

spectrum <strong>of</strong> advice from Private Placement, Ship Broking, Corporate Advisory and Debt Arranging services<br />

that Pareto can <strong>of</strong>fer.<br />

<br />

Vol.18 • No. 10 • <strong>December</strong> <strong>2008</strong> / <strong>January</strong> <strong>2009</strong>