Rabobank Nederland - Robeco.com

Rabobank Nederland - Robeco.com

Rabobank Nederland - Robeco.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

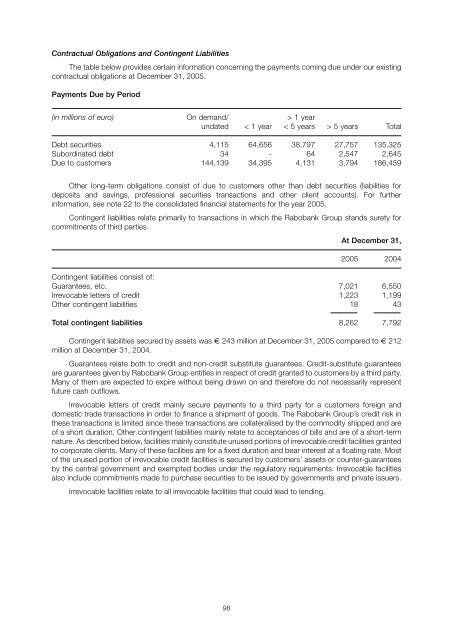

Contractual Obligations and Contingent Liabilities<br />

The table below provides certain information concerning the payments <strong>com</strong>ing due under our existing<br />

contractual obligations at December 31, 2005.<br />

Payments Due by Period<br />

(in millions of euro) On demand/ > 1 year<br />

undated < 1 year < 5 years > 5 years Total<br />

Debt securities 4,115 64,656 38,797 27,757 135,325<br />

Subordinated debt 34 - 64 2,547 2,645<br />

Due to customers 144,139 34,395 4,131 3,794 186,459<br />

Other long-term obligations consist of due to customers other than debt securities (liabilities for<br />

deposits and savings, professional securities transactions and other client accounts). For further<br />

information, see note 22 to the consolidated financial statements for the year 2005.<br />

Contingent liabilities relate primarily to transactions in which the <strong>Rabobank</strong> Group stands surety for<br />

<strong>com</strong>mitments of third parties.<br />

At December 31,<br />

2005 2004<br />

Contingent liabilities consist of:<br />

Guarantees, etc. 7,021 6,550<br />

Irrevocable letters of credit 1,223 1,199<br />

Other contingent liabilities 18 43<br />

Total contingent liabilities 8,262 7,792<br />

Contingent liabilities secured by assets was € 243 million at December 31, 2005 <strong>com</strong>pared to € 212<br />

million at December 31, 2004.<br />

Guarantees relate both to credit and non-credit substitute guarantees. Credit-substitute guarantees<br />

are guarantees given by <strong>Rabobank</strong> Group entities in respect of credit granted to customers by a third party.<br />

Many of them are expected to expire without being drawn on and therefore do not necessarily represent<br />

future cash outflows.<br />

Irrevocable letters of credit mainly secure payments to a third party for a customers foreign and<br />

domestic trade transactions in order to finance a shipment of goods. The <strong>Rabobank</strong> Group’s credit risk in<br />

these transactions is limited since these transactions are collateralised by the <strong>com</strong>modity shipped and are<br />

of a short duration. Other contingent liabilities mainly relate to acceptances of bills and are of a short-term<br />

nature. As described below, facilities mainly constitute unused portions of irrevocable credit facilities granted<br />

to corporate clients. Many of these facilities are for a fixed duration and bear interest at a floating rate. Most<br />

of the unused portion of irrevocable credit facilities is secured by customers’ assets or counter-guarantees<br />

by the central government and exempted bodies under the regulatory requirements. Irrevocable facilities<br />

also include <strong>com</strong>mitments made to purchase securities to be issued by governments and private issuers.<br />

Irrevocable facilities relate to all irrevocable facilities that could lead to lending.<br />

98