INCOME TAX ACT (CHAPTER 134, SECTION 43C) INCOME ... - IRAS

INCOME TAX ACT (CHAPTER 134, SECTION 43C) INCOME ... - IRAS

INCOME TAX ACT (CHAPTER 134, SECTION 43C) INCOME ... - IRAS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

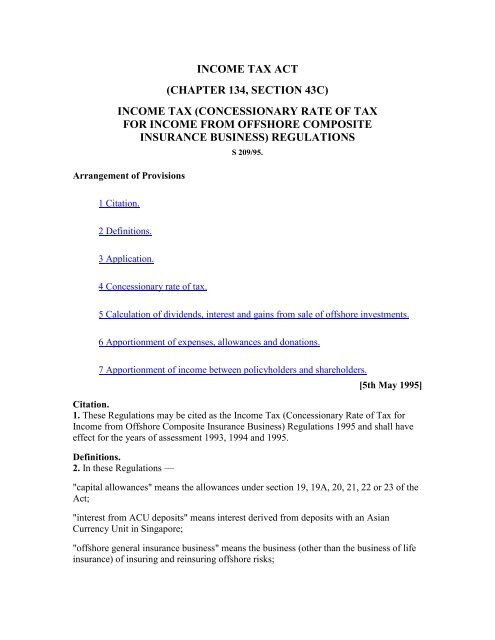

<strong>INCOME</strong> <strong>TAX</strong> <strong>ACT</strong><br />

(<strong>CHAPTER</strong> <strong>134</strong>, <strong>SECTION</strong> <strong>43C</strong>)<br />

<strong>INCOME</strong> <strong>TAX</strong> (CONCESSIONARY RATE OF <strong>TAX</strong><br />

FOR <strong>INCOME</strong> FROM OFFSHORE COMPOSITE<br />

INSURANCE BUSINESS) REGULATIONS<br />

Arrangement of Provisions<br />

S 209/95.<br />

1 Citation.<br />

2 Definitions.<br />

3 Application.<br />

4 Concessionary rate of tax.<br />

5 Calculation of dividends, interest and gains from sale of offshore investments.<br />

6 Apportionment of expenses, allowances and donations.<br />

7 Apportionment of income between policyholders and shareholders.<br />

[5th May 1995]<br />

Citation.<br />

1. These Regulations may be cited as the Income Tax (Concessionary Rate of Tax for<br />

Income from Offshore Composite Insurance Business) Regulations 1995 and shall have<br />

effect for the years of assessment 1993, 1994 and 1995.<br />

Definitions.<br />

2. In these Regulations —<br />

"capital allowances" means the allowances under section 19, 19A, 20, 21, 22 or 23 of the<br />

Act;<br />

"interest from ACU deposits" means interest derived from deposits with an Asian<br />

Currency Unit in Singapore;<br />

"offshore general insurance business" means the business (other than the business of life<br />

insurance) of insuring and reinsuring offshore risks;

"offshore investments" means —<br />

(a) stocks and shares denominated in any foreign currency of companies not incorporated<br />

and not resident in Singapore;<br />

(b) securities, other than stocks and shares, denominated in any foreign currency<br />

(including bonds, notes, certificates of deposit and treasury bills) issued by foreign<br />

governments, foreign banks outside Singapore and companies not incorporated and not<br />

resident in Singapore;<br />

(c) futures contracts denominated in any foreign currency made in any futures exchange;<br />

(d) any immovable property situated outside Singapore;<br />

(e) certificates of deposit, notes and bonds issued by Asian Currency Units in Singapore;<br />

(f) Asian Dollar Bonds approved under section 13 (1) (v) of the Act; and<br />

(g) foreign currency deposits with financial institutions outside Singapore;<br />

"offshore life business, “offshore life insurance surplus” and “offshore life policies" have<br />

the same meanings as in section 26 (5) of the Act.<br />

Application.<br />

3. —(1) These Regulations shall apply to any insurance company registered under the<br />

Insurance Act to carry on both general insurance business and life insurance business<br />

unless the insurance company has, by notice under paragraph (2), elected for the gains or<br />

profits from the whole of its offshore general insurance business and offshore life<br />

business and the shareholders’ funds supporting such business to be taxed at the rate<br />

under section 43 (1) (a) of the Act.<br />

Cap. 142.<br />

(2) Any election under paragraph (1) shall be irrevocable and shall be given by notice in<br />

writing to the Comptroller before 1st August 1995 and shall have effect for the year of<br />

assessment for which the election is to take effect and subsequent years of assessment.<br />

(3) Notwithstanding anything in paragraph (1), these Regulations shall not apply to any<br />

insurance company which has irrevocably elected under —<br />

(a) the revoked Income Tax (Concessionary Rate of Tax for Income from Offshore<br />

General Insurance Business) Regulations;<br />

(b) the Income Tax (Concessionary Rate of Tax for Income from Offshore General<br />

Insurance Business) Regulations; or<br />

Rg 20<br />

(1993 Ed.)<br />

Rg 20

(1996 Ed.)<br />

(c) the Income Tax (Concessionary Rate of Tax for Income from Offshore Life Insurance<br />

Business) Regulations,<br />

to be taxed at the rate under section 43 (1) (a) of the Act.<br />

Rg 19<br />

(1996 Ed.)<br />

Concessionary rate of tax.<br />

4. —(1) Tax shall be payable at the rate of 10% on the following income derived by an<br />

insurance company to which these Regulations apply:<br />

(a) the income derived from accepting general insurance covering offshore risks and<br />

reinsurance covering offshore risks;<br />

(b) the offshore life surplus (but excluding the investment income and gains or profits<br />

derived from the sale of investments and other income, whether derived from Singapore<br />

or elsewhere, of any life insurance fund established under the Insurance Act relating to<br />

offshore life policies); and<br />

(c) the dividends and interest derived from outside Singapore, the gains or profits realised<br />

from the sale of offshore investments, and interest from ACU deposits derived from —<br />

(i) subject to paragraph (2), the investment of its insurance fund established and<br />

maintained under the Insurance Act for the offshore general insurance business or<br />

offshore life business; and<br />

Cap. 142.<br />

(ii) the investment of its shareholders’ funds established in Singapore which are used to<br />

support the offshore general insurance business or offshore life business as ascertained<br />

under regulation 5.<br />

(2) Where the Comptroller is satisfied that any part of the insurance fund referred to in<br />

sub-paragraph (c) (i) of paragraph (1) is not required to support the offshore general<br />

insurance business or offshore life business of an insurance company to which these<br />

Regulations apply, he may adopt such reduced amount of the dividends, interest and<br />

gains or profits under that sub-paragraph as appears to him to be reasonable in the<br />

circumstances.

Calculation of dividends, interest and gains from sale of offshore investments.<br />

5. —(1) The dividends and interest under regulation 4 (1) (c) (ii) derived by an insurance<br />

company to which these Regulations apply for the basis period for any year of assessment<br />

shall be ascertained by the formula —<br />

where<br />

P o is the amount of the gross premiums received or receivable during the basis period in<br />

respect of policies underwritten by the insurance company in the course of carrying on its<br />

business in Singapore from the offshore general insurance business;<br />

P i is the amount of the gross premiums received or receivable during the basis period in<br />

respect of policies underwritten by the insurance company in the course of carrying on its<br />

business in Singapore from the general insurance business other than offshore general<br />

insurance business;<br />

P oL is the amount of gross premiums received or receivable during the basis period in<br />

respect of policies underwritten by the insurance company in the course of carrying on its<br />

business in Singapore from the offshore life business;<br />

P iL is the amount of gross premiums received or receivable during the basis period in<br />

respect of policies underwritten by the insurance company in the course of carrying on its<br />

business in Singapore from the life insurance business other than offshore life business;<br />

I is the total amount of dividends and interest derived from Singapore and elsewhere by<br />

the insurance company during the basis period from the investment of its shareholders’<br />

funds established in Singapore less any expenses directly attributable to the production of<br />

such dividends and interest allowable under the Act;<br />

X is —<br />

(a)

(b)<br />

where<br />

Y is the total amount of dividends and interest derived from Singapore (but excluding<br />

interest from ACU deposits) by the insurance company during the basis period from the<br />

investment of its shareholders’ funds established in Singapore, less any expenses directly<br />

attributable to the production of such dividends and interest allowable under the Act.<br />

(2) The gains or profits from the sale of offshore investments under regulation 4 (1) (c)<br />

(ii) derived by an insurance company to which these Regulations apply for the basis<br />

period for any year of assessment shall be ascertained by the formula —<br />

where<br />

P o , P i , P oL and P iL have the same meanings as in paragraph (1); and<br />

K is the net amount (after deducting losses from the gains or profits) realised during the<br />

basis period from the sale of offshore investments acquired by the insurance company<br />

using its shareholders’ funds established in Singapore less any expenses directly<br />

attributable to the production of such gains or profits allowable under the Act.<br />

(3) For the purposes of paragraphs (1) and (2), where the Comptroller is satisfied that any<br />

part of the shareholders’ funds of the insurance company is not required to support its<br />

offshore general insurance business or offshore life business, he may adopt such reduced<br />

amount of I or K as appears to him to be reasonable in the circumstances.

Apportionment of expenses, allowances and donations.<br />

6. Any item of expenditure not directly attributable to the offshore general insurance<br />

business or offshore life business of an insurance company to which these Regulations<br />

apply, and capital allowances and donations, allowable to the insurance company under<br />

the Act, shall be apportioned between such business and the other insurance business of<br />

the insurance company; and the portion attributable to such business shall be ascertained<br />

by using the fraction —<br />

where P o , P i , P oL , and P iL have the same meanings as in regulation 5.<br />

Apportionment of income between policyholders and shareholders.<br />

7. Any income derived from offshore life business by an insurance company to which<br />

these Regulations apply for any year of assessment taxable at the rate of 10% in<br />

accordance with regulation 4 (1) (b) and (c) (i) shall, for the purposes of section 26 (3B)<br />

(b) and (c) of the Act, be apportioned between the policyholders and shareholders of the<br />

insurance company in the same ratio as the offshore life insurance surplus for the basis<br />

period for that year of assessment is allocated by the insurance company between its<br />

policyholders and shareholders in that basis period or, where no such allocation is made<br />

by the insurance company, be deemed to be apportioned wholly to its shareholders.