USER GUIDE ON FILING OBJECTION ON ANNUAL VALUES ... - IRAS

USER GUIDE ON FILING OBJECTION ON ANNUAL VALUES ... - IRAS

USER GUIDE ON FILING OBJECTION ON ANNUAL VALUES ... - IRAS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

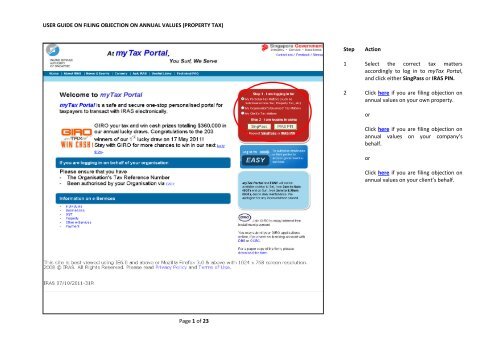

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 Select the correct tax matters<br />

accordingly to log in to myTax Portal,<br />

and click either SingPass or <strong>IRAS</strong> PIN.<br />

2 Click here if you are filing objection on<br />

annual values on your own property.<br />

or<br />

Click here if you are filing objection on<br />

annual values on your company’s<br />

behalf.<br />

or<br />

Click here if you are filing objection on<br />

annual values on your client’s behalf.<br />

Page 1 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

<strong>FILING</strong> OBJECTI<strong>ON</strong> TO <strong>ANNUAL</strong> VALUE <strong>ON</strong> YOUR OWN PROPERTY<br />

Page 2 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 Once you have successfully logged<br />

in under My Personal Tax Matters,<br />

you will see this Homepage. Select<br />

Other PT e-Services from the menu<br />

on the left.<br />

Page 3 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 You will see a list of Property Tax e-<br />

Services. Select File objections to<br />

Annual Value.<br />

Page 4 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 Select either of the search options<br />

from the dropdown list:<br />

Property Address<br />

Property Tax Reference No.<br />

Land<br />

2 Enter the property details.<br />

3 Click Search for property.<br />

Note:<br />

Click Clear if you wish to remove all the<br />

details entered.<br />

Page 5 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 Complete the relevant details in this<br />

page. Fields marked with * are<br />

compulsory.<br />

2 Once completed, click Proceed to next<br />

page to proceed to the Confirmation<br />

Page.<br />

Notes:<br />

At Section C: Grounds of Objection, you are<br />

required to click Add once you have entered<br />

the Desired Annual Value & Desired Effective<br />

Date. The details will be displayed in a table.<br />

Click the<br />

icon to access online help.<br />

Click Back to previous page if you wish to<br />

return to the previous page.<br />

Click Clear if you wish to remove all the details<br />

entered.<br />

Click Cancel this form if you do not wish to<br />

continue filing for objection.<br />

Page 6 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 Please confirm that the entries are<br />

correct.<br />

2 If correct, click Submit this form and<br />

the form will be sent to <strong>IRAS</strong> for<br />

processing. Upon submission, an<br />

acknowledgement page will be<br />

displayed.<br />

Notes:<br />

Click Amend previous entries if you wish to<br />

make any amendment.<br />

Click Print this page if you wish to print a copy<br />

of the confirmation page.<br />

Click Cancel this page if you do not wish to<br />

continue filing for objection.<br />

Page 7 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 You will receive an acknowledgement<br />

page with an acknowledgement<br />

number if your filing is successfully<br />

transmitted to <strong>IRAS</strong>.<br />

Notes:<br />

Click Submit Another objection if you wish to<br />

file an objection for another property.<br />

Click View objection status if you wish to check<br />

on the status of your submission.<br />

Click Go to PT e-services suite to return to the<br />

list available e-services.<br />

Click Go to Main Menu to return back to<br />

Homepage.<br />

Page 8 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

<strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> VALUE <strong>ON</strong> YOUR COMPANY’S BEHALF<br />

Page 9 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 Once you have successfully logged<br />

in under My Organisation/<br />

Business Tax Matters, you will<br />

see this Homepage. Select Other<br />

PT e-Services from the menu on<br />

the left.<br />

Page 10 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 You will see a list of Property Tax e-<br />

Services. Select File objections to<br />

Annual Value.<br />

Page 11 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 Select either of the search options from<br />

the dropdown list:<br />

Property Address<br />

Property Tax Reference No.<br />

Land<br />

2 Enter the property details.<br />

3 Click Search for property.<br />

Note:<br />

Click Clear if you wish to remove all the details<br />

entered.<br />

Page 12 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 Complete the relevant details in this<br />

page. Fields marked with * are<br />

compulsory.<br />

2 Once completed, click Proceed to next<br />

page to proceed to the Confirmation<br />

Page.<br />

Notes:<br />

At Section C: Grounds of Objection, you are<br />

required to click Add once you have entered<br />

the Desired Annual Value & Desired Effective<br />

Date. The details will be displayed in a table.<br />

Click the<br />

icon to access online help.<br />

Click Back to previous page if you wish to<br />

return to the previous page.<br />

Click Clear if you wish to remove all the details<br />

entered.<br />

Click Cancel the form if you do not wish to<br />

continue filing for objection.<br />

Page 13 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 Please confirm that the entries are<br />

correct.<br />

2 If correct, click Submit this form & the<br />

form will be sent to <strong>IRAS</strong> for<br />

processing. Upon submission, an<br />

Acknowledgement page will be<br />

displayed.<br />

Notes:<br />

Click Amend previous entries if you wish to<br />

make any amendment.<br />

Click Print this page if you wish to print a copy<br />

of the confirmation page.<br />

Click Cancel this form if you do not wish to<br />

continue filing for objection.<br />

Page 14 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 You will receive an acknowledgement<br />

page with an acknowledgement<br />

number if your filing is successfully<br />

transmitted to <strong>IRAS</strong>.<br />

Notes:<br />

Click Submit Another objection if you wish to<br />

file an objection for another property.<br />

Click View objection status if you wish to check<br />

on the status of your submission.<br />

Select Go to PT e-services suite to return to the<br />

list of available e-services.<br />

Select Go to Main Menu to return back to<br />

Homepage.<br />

Page 15 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

<strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> VALUE <strong>ON</strong> YOUR CLIENT’S BEHALF<br />

Page 16 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 Once you have successfully logged in,<br />

under My Client’s Tax Matters, you will<br />

see this Homepage. Select Other PT e-<br />

Services from the menu on the left.<br />

Page 17 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 You will see a list of Property Tax e-<br />

Services. Select File objections to<br />

Annual Value.<br />

Page 18 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 As you have logged in for your<br />

Client’s Tax Matters, you will be<br />

prompted to key client’s tax<br />

number.<br />

2 Select your client’s Tax Reference<br />

number type from the dropdown<br />

list, enter your client’s tax reference<br />

number and click Proceed.<br />

Page 19 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 Select either of the search options<br />

from the dropdown list:<br />

Property Address<br />

Property Tax Reference No.<br />

Land<br />

2 Enter the property details.<br />

3 Click Search for property<br />

Note:<br />

Click Clear if you wish to remove all the<br />

details entered.<br />

Page 20 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 Complete the relevant details in this<br />

page. Fields marked with * are<br />

compulsory.<br />

2 Once completed, click Proceed to next<br />

page to proceed to the Confirmation<br />

Page.<br />

Notes:<br />

At Section C: Grounds of Objection, you are<br />

required to click Add once you have entered<br />

the Desired Annual Value & Desired Effective<br />

Date. The details will be displayed in a table.<br />

Click the<br />

icon to access online help.<br />

Click Back to previous page if you wish to<br />

return to the previous page.<br />

Click Clear if you wish to remove all the details<br />

entered.<br />

Click Cancel this form if you do not wish to<br />

continue filing for objection.<br />

Page 21 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 Please confirm that the entries are<br />

correct.<br />

2 If correct, click Submit this form & the<br />

form will be sent to <strong>IRAS</strong> for<br />

processing. Upon submission, an<br />

acknowledgement page will be<br />

displayed.<br />

Notes:<br />

Click Amend previous entries if you wish to<br />

make any amendment.<br />

Click Print this page if you wish to print a copy<br />

of the confirmation page.<br />

Click Cancel this form if you do not wish to<br />

continue filing for objection.<br />

Page 22 of 23

<strong>USER</strong> <strong>GUIDE</strong> <strong>ON</strong> <strong>FILING</strong> OBJECTI<strong>ON</strong> <strong>ON</strong> <strong>ANNUAL</strong> <strong>VALUES</strong> (PROPERTY TAX)<br />

Step<br />

Action<br />

1 You will receive an acknowledgement<br />

page with an acknowledgement<br />

number if your filing is successfully<br />

transmitted to <strong>IRAS</strong>.<br />

Notes:<br />

Click Submit Another objection if you wish to<br />

file an objection for another property.<br />

Click View objection Status if you wish to check<br />

on the status of your submission.<br />

Select Go to PT e-services suite to return to the<br />

list of available e-services.<br />

Select Go to Main Menu to return back to<br />

Homepage.<br />

Page 23 of 23