Switzerland - IRAS

Switzerland - IRAS

Switzerland - IRAS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

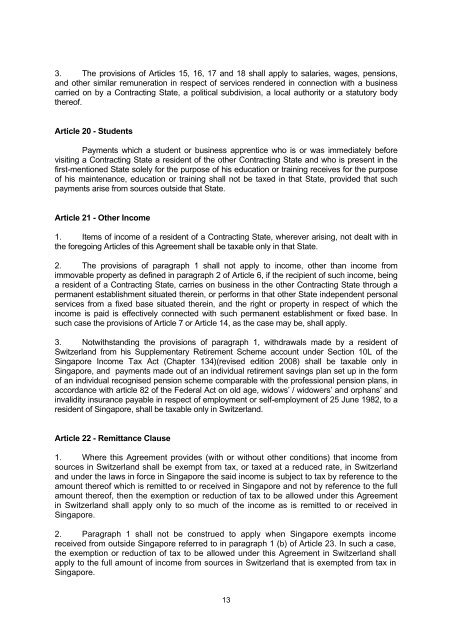

3. The provisions of Articles 15, 16, 17 and 18 shall apply to salaries, wages, pensions,<br />

and other similar remuneration in respect of services rendered in connection with a business<br />

carried on by a Contracting State, a political subdivision, a local authority or a statutory body<br />

thereof.<br />

Article 20 - Students<br />

Payments which a student or business apprentice who is or was immediately before<br />

visiting a Contracting State a resident of the other Contracting State and who is present in the<br />

first-mentioned State solely for the purpose of his education or training receives for the purpose<br />

of his maintenance, education or training shall not be taxed in that State, provided that such<br />

payments arise from sources outside that State.<br />

Article 21 - Other Income<br />

1. Items of income of a resident of a Contracting State, wherever arising, not dealt with in<br />

the foregoing Articles of this Agreement shall be taxable only in that State.<br />

2. The provisions of paragraph 1 shall not apply to income, other than income from<br />

immovable property as defined in paragraph 2 of Article 6, if the recipient of such income, being<br />

a resident of a Contracting State, carries on business in the other Contracting State through a<br />

permanent establishment situated therein, or performs in that other State independent personal<br />

services from a fixed base situated therein, and the right or property in respect of which the<br />

income is paid is effectively connected with such permanent establishment or fixed base. In<br />

such case the provisions of Article 7 or Article 14, as the case may be, shall apply.<br />

3. Notwithstanding the provisions of paragraph 1, withdrawals made by a resident of<br />

<strong>Switzerland</strong> from his Supplementary Retirement Scheme account under Section 10L of the<br />

Singapore Income Tax Act (Chapter 134)(revised edition 2008) shall be taxable only in<br />

Singapore, and payments made out of an individual retirement savings plan set up in the form<br />

of an individual recognised pension scheme comparable with the professional pension plans, in<br />

accordance with article 82 of the Federal Act on old age, widows’ / widowers’ and orphans’ and<br />

invalidity insurance payable in respect of employment or self-employment of 25 June 1982, to a<br />

resident of Singapore, shall be taxable only in <strong>Switzerland</strong>.<br />

Article 22 - Remittance Clause<br />

1. Where this Agreement provides (with or without other conditions) that income from<br />

sources in <strong>Switzerland</strong> shall be exempt from tax, or taxed at a reduced rate, in <strong>Switzerland</strong><br />

and under the laws in force in Singapore the said income is subject to tax by reference to the<br />

amount thereof which is remitted to or received in Singapore and not by reference to the full<br />

amount thereof, then the exemption or reduction of tax to be allowed under this Agreement<br />

in <strong>Switzerland</strong> shall apply only to so much of the income as is remitted to or received in<br />

Singapore.<br />

2. Paragraph 1 shall not be construed to apply when Singapore exempts income<br />

received from outside Singapore referred to in paragraph 1 (b) of Article 23. In such a case,<br />

the exemption or reduction of tax to be allowed under this Agreement in <strong>Switzerland</strong> shall<br />

apply to the full amount of income from sources in <strong>Switzerland</strong> that is exempted from tax in<br />

Singapore.<br />

13