REQUEST FOR BOARD OF INLAND REVENUE APPROVAL

REQUEST FOR BOARD OF INLAND REVENUE APPROVAL

REQUEST FOR BOARD OF INLAND REVENUE APPROVAL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

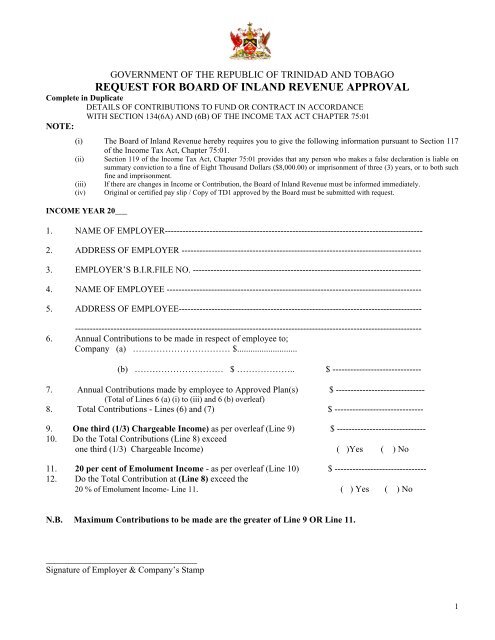

GOVERNMENT <strong>OF</strong> THE REPUBLIC <strong>OF</strong> TRINIDAD AND TOBAGO<br />

<strong>REQUEST</strong> <strong>FOR</strong> <strong>BOARD</strong> <strong>OF</strong> <strong>INLAND</strong> <strong>REVENUE</strong> <strong>APPROVAL</strong><br />

Complete in Duplicate<br />

DETAILS <strong>OF</strong> CONTRIBUTIONS TO FUND OR CONTRACT IN ACCORDANCE<br />

WITH SECTION 134(6A) AND (6B) <strong>OF</strong> THE INCOME TAX ACT CHAPTER 75:01<br />

NOTE:<br />

(i) The Board of Inland Revenue hereby requires you to give the following information pursuant to Section 117<br />

of the Income Tax Act, Chapter 75:01.<br />

(ii) Section 119 of the Income Tax Act, Chapter 75:01 provides that any person who makes a false declaration is liable on<br />

summary conviction to a fine of Eight Thousand Dollars ($8,000.00) or imprisonment of three (3) years, or to both such<br />

fine and imprisonment.<br />

(iii) If there are changes in Income or Contribution, the Board of Inland Revenue must be informed immediately.<br />

(iv) Original or certified pay slip / Copy of TD1 approved by the Board must be submitted with request.<br />

INCOME YEAR 20___<br />

1. NAME <strong>OF</strong> EMPLOYER---------------------------------------------------------------------------------------<br />

2. ADDRESS <strong>OF</strong> EMPLOYER ---------------------------------------------------------------------------------<br />

3. EMPLOYER’S B.I.R.FILE NO. -----------------------------------------------------------------------------<br />

4. NAME <strong>OF</strong> EMPLOYEE --------------------------------------------------------------------------------------<br />

5. ADDRESS <strong>OF</strong> EMPLOYEE----------------------------------------------------------------------------------<br />

---------------------------------------------------------------------------------------------------------------------<br />

6. Annual Contributions to be made in respect of employee to;<br />

Company (a) …………………………… $...........................<br />

(b) ………………………… $ ……………….. $ ------------------------------<br />

7. Annual Contributions made by employee to Approved Plan(s) $ ------------------------------<br />

(Total of Lines 6 (a) (i) to (iii) and 6 (b) overleaf)<br />

8. Total Contributions - Lines (6) and (7) $ ------------------------------<br />

9. One third (1/3) Chargeable Income) as per overleaf (Line 9) $ ------------------------------<br />

10. Do the Total Contributions (Line 8) exceed<br />

one third (1/3) Chargeable Income) ( )Yes ( ) No<br />

11. 20 per cent of Emolument Income - as per overleaf (Line 10) $ -------------------------------<br />

12. Do the Total Contribution at (Line 8) exceed the<br />

20 % of Emolument Income- Line 11. ( ) Yes ( ) No<br />

N.B. Maximum Contributions to be made are the greater of Line 9 OR Line 11.<br />

__________________________________<br />

Signature of Employer & Company’s Stamp<br />

1

EMOLUMENT INCOME COMPUTATION<br />

Round figures to the nearest dollar, omit cents<br />

1. Emolument Income<br />

(Inclusive of contributions to S.134 (6) plans)<br />

(a) $ ----------------------<br />

(b) $ ---------------------<br />

TOTAL EMOLUMENT INCOME $ ------------------------<br />

2. Add: Other Income (Net) $ ------------------------<br />

3. TOTAL NET INCOME $-------------------------<br />

4. Deduct: (1) Personal Allowance (Residents only - $60,000.) $---------------------<br />

(2) Tertiary Education Expenses (Limited to $60,000) $--------------------<br />

(3) First Time Home Owner $--------------------<br />

(Limited to $10,000; up to Income Year 2009)<br />

5. Assessable Income $ ------------------------<br />

6. Deduct:<br />

(a) Contributions/Premiums Paid<br />

(i) Government Widows and Orphans Fund $ ---------------------<br />

(ii) Approved Pension Fund Plan $ ---------------------<br />

(iii) Approved Deferred Annuity Plan $ ---------------------<br />

(b) N.I.S. (70%) $ ---------------------<br />

7. Total Lines 6(a) (i) to (iii) and (b) limited to $30,000 $ ---------------------------<br />

8. Chargeable Income (Line 5 minus Line 7) $ ---------------------------<br />

9. One third (1/3) Chargeable Income $ ---------------------------<br />

10. Twenty (20) % of Line (1) Total Emolument Income $....................................<br />

_________________________________<br />

Employee’s Signature/Date<br />

_________________________________<br />

Employee’s B.I.R. File No.<br />

2

This document was created with Win2PDF available at http://www.daneprairie.com.<br />

The unregistered version of Win2PDF is for evaluation or non-commercial use only.