300000000 QBE Capital Funding LP - Irish Stock Exchange

300000000 QBE Capital Funding LP - Irish Stock Exchange

300000000 QBE Capital Funding LP - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

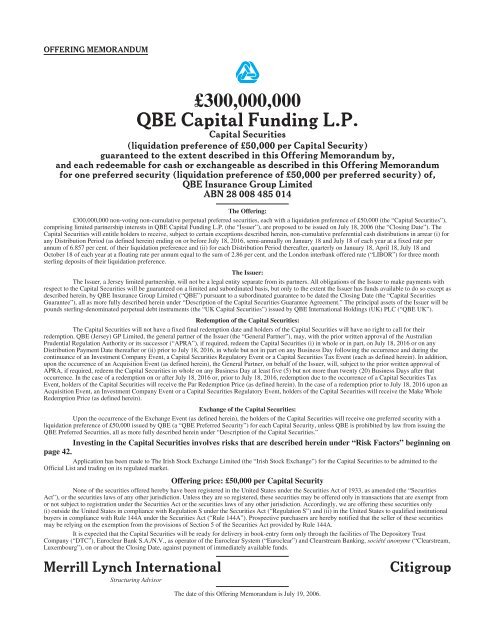

OFFERING MEMORANDUM<br />

£300,000,000<br />

<strong>QBE</strong> <strong>Capital</strong> <strong>Funding</strong> L.P.<br />

<strong>Capital</strong> Securities<br />

(liquidation preference of £50,000 per <strong>Capital</strong> Security)<br />

guaranteed to the extent described in this Offering Memorandum by,<br />

and each redeemable for cash or exchangeable as described in this Offering Memorandum<br />

for one preferred security (liquidation preference of £50,000 per preferred security) of,<br />

<strong>QBE</strong> Insurance Group Limited<br />

ABN 28 008 485 014<br />

The Offering:<br />

£300,000,000 non-voting non-cumulative perpetual preferred securities, each with a liquidation preference of £50,000 (the “<strong>Capital</strong> Securities”),<br />

comprising limited partnership interests in <strong>QBE</strong> <strong>Capital</strong> <strong>Funding</strong> L.P. (the “Issuer”), are proposed to be issued on July 18, 2006 (the “Closing Date”). The<br />

<strong>Capital</strong> Securities will entitle holders to receive, subject to certain exceptions described herein, non-cumulative preferential cash distributions in arrear (i) for<br />

any Distribution Period (as defined herein) ending on or before July 18, 2016, semi-annually on January 18 and July 18 of each year at a fixed rate per<br />

annum of 6.857 per cent. of their liquidation preference and (ii) for each Distribution Period thereafter, quarterly on January 18, April 18, July 18 and<br />

October 18 of each year at a floating rate per annum equal to the sum of 2.86 per cent. and the London interbank offered rate (“LIBOR”) for three month<br />

sterling deposits of their liquidation preference.<br />

The Issuer:<br />

The Issuer, a Jersey limited partnership, will not be a legal entity separate from its partners. All obligations of the Issuer to make payments with<br />

respect to the <strong>Capital</strong> Securities will be guaranteed on a limited and subordinated basis, but only to the extent the Issuer has funds available to do so except as<br />

described herein, by <strong>QBE</strong> Insurance Group Limited (“<strong>QBE</strong>”) pursuant to a subordinated guarantee to be dated the Closing Date (the “<strong>Capital</strong> Securities<br />

Guarantee”), all as more fully described herein under “Description of the <strong>Capital</strong> Securities Guarantee Agreement.” The principal assets of the Issuer will be<br />

pounds sterling-denominated perpetual debt instruments (the “UK <strong>Capital</strong> Securities”) issued by <strong>QBE</strong> International Holdings (UK) PLC (“<strong>QBE</strong> UK”).<br />

Redemption of the <strong>Capital</strong> Securities:<br />

The <strong>Capital</strong> Securities will not have a fixed final redemption date and holders of the <strong>Capital</strong> Securities will have no right to call for their<br />

redemption. <strong>QBE</strong> (Jersey) GP Limited, the general partner of the Issuer (the “General Partner”), may, with the prior written approval of the Australian<br />

Prudential Regulation Authority or its successor (“APRA”), if required, redeem the <strong>Capital</strong> Securities (i) in whole or in part, on July 18, 2016 or on any<br />

Distribution Payment Date thereafter or (ii) prior to July 18, 2016, in whole but not in part on any Business Day following the occurrence and during the<br />

continuance of an Investment Company Event, a <strong>Capital</strong> Securities Regulatory Event or a <strong>Capital</strong> Securities Tax Event (each as defined herein). In addition,<br />

upon the occurrence of an Acquisition Event (as defined herein), the General Partner, on behalf of the Issuer, will, subject to the prior written approval of<br />

APRA, if required, redeem the <strong>Capital</strong> Securities in whole on any Business Day at least five (5) but not more than twenty (20) Business Days after that<br />

occurrence. In the case of a redemption on or after July 18, 2016 or, prior to July 18, 2016, redemption due to the occurrence of a <strong>Capital</strong> Securities Tax<br />

Event, holders of the <strong>Capital</strong> Securities will receive the Par Redemption Price (as defined herein). In the case of a redemption prior to July 18, 2016 upon an<br />

Acquisition Event, an Investment Company Event or a <strong>Capital</strong> Securities Regulatory Event, holders of the <strong>Capital</strong> Securities will receive the Make Whole<br />

Redemption Price (as defined herein).<br />

<strong>Exchange</strong> of the <strong>Capital</strong> Securities:<br />

Upon the occurrence of the <strong>Exchange</strong> Event (as defined herein), the holders of the <strong>Capital</strong> Securities will receive one preferred security with a<br />

liquidation preference of £50,000 issued by <strong>QBE</strong> (a “<strong>QBE</strong> Preferred Security”) for each <strong>Capital</strong> Security, unless <strong>QBE</strong> is prohibited by law from issuing the<br />

<strong>QBE</strong> Preferred Securities, all as more fully described herein under “Description of the <strong>Capital</strong> Securities.”<br />

Investing in the <strong>Capital</strong> Securities involves risks that are described herein under “Risk Factors” beginning on<br />

page 42.<br />

Application has been made to The <strong>Irish</strong> <strong>Stock</strong> <strong>Exchange</strong> Limited (the “<strong>Irish</strong> <strong>Stock</strong> <strong>Exchange</strong>”) for the <strong>Capital</strong> Securities to be admitted to the<br />

Official List and trading on its regulated market.<br />

Offering price: £50,000 per <strong>Capital</strong> Security<br />

None of the securities offered hereby have been registered in the United States under the Securities Act of 1933, as amended (the “Securities<br />

Act”), or the securities laws of any other jurisdiction. Unless they are so registered, these securities may be offered only in transactions that are exempt from<br />

or not subject to registration under the Securities Act or the securities laws of any other jurisdiction. Accordingly, we are offering these securities only<br />

(i) outside the United States in compliance with Regulation S under the Securities Act (“Regulation S”) and (ii) in the United States to qualified institutional<br />

buyers in compliance with Rule 144A under the Securities Act (“Rule 144A”). Prospective purchasers are hereby notified that the seller of these securities<br />

may be relying on the exemption from the provisions of Section 5 of the Securities Act provided by Rule 144A.<br />

It is expected that the <strong>Capital</strong> Securities will be ready for delivery in book-entry form only through the facilities of The Depository Trust<br />

Company (“DTC”), Euroclear Bank S.A./N.V., as operator of the Euroclear System (“Euroclear”) and Clearstream Banking, société anonyme (“Clearstream,<br />

Luxembourg”), on or about the Closing Date, against payment of immediately available funds.<br />

Merrill Lynch International<br />

Structuring Advisor<br />

The date of this Offering Memorandum is July 19, 2006.<br />

Citigroup

You should rely only on the information contained in this Offering Memorandum. The Issuer, the<br />

General Partner, <strong>QBE</strong> UK and <strong>QBE</strong> have not, and Merrill Lynch International Limited and Citigroup<br />

Global Markets Limited (the “Initial Purchasers”) have not, authorized any other person to provide you<br />

with different information. If anyone provides you with different or inconsistent information, you should<br />

not rely on it. The Issuer, the General Partner, <strong>QBE</strong> UK and <strong>QBE</strong> are not, and the Initial Purchasers are<br />

not, making an offer to sell the securities offered hereby in any jurisdiction where the offer or sale is not<br />

permitted. The information contained in this Offering Memorandum is accurate only as of the date hereof.<br />

Our business, financial condition, results of operations and prospects may have changed since this date.<br />

In connection with the issue and distribution of any <strong>Capital</strong> Securities, the Initial Purchasers or<br />

any person acting for the Initial Purchasers may overallot or effect transactions with a view to supporting<br />

the market price of the <strong>Capital</strong> Securities at a level higher than that which might otherwise prevail for a<br />

limited period. However, there is no obligation on the Initial Purchasers or any of their respective agents<br />

to do this. Such stabilizing, if commenced, may be discontinued at any time and must be brought to an end<br />

after a limited period. See “Plan of Distribution—Price Stabilization and Short Positions.”<br />

This Offering Memorandum constitutes a prospectus for the purposes of Directive 2003/71/EC<br />

(the “Prospective Directive”). References throughout this document to “Offering Memorandum” shall be<br />

taken to read “Prospectus” for such purpose. Application has been made to the <strong>Irish</strong> Financial Services<br />

Regulatory Authority as competent authority under the Prospectus Directive, for the Prospectus to be<br />

approved. Such approval relates only to the <strong>Capital</strong> Securities which are to be admitted to trading on the<br />

regulated market of the <strong>Irish</strong> <strong>Stock</strong> <strong>Exchange</strong>. Application has been made to the <strong>Irish</strong> <strong>Stock</strong> <strong>Exchange</strong> for<br />

the <strong>Capital</strong> Securities to be admitted to the Official List and trading on its regulated market. We cannot<br />

guarantee that listing will be obtained on that exchange. Inquiries regarding our listing status on the <strong>Irish</strong><br />

<strong>Stock</strong> <strong>Exchange</strong> should be directed to our <strong>Irish</strong> listing agent, McCann FitzGerald Listing Services Limited,<br />

whose address is 2 Harbourmaster Place, International Financial Services Centre, Dublin 1, Ireland.<br />

This Offering Memorandum includes particulars given in compliance with the rules governing the<br />

listing of securities on the <strong>Irish</strong> <strong>Stock</strong> <strong>Exchange</strong>. The <strong>Irish</strong> <strong>Stock</strong> <strong>Exchange</strong> takes no responsibility for the<br />

contents of this Offering Memorandum and makes no representation as to their accuracy or completeness,<br />

and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon<br />

the whole or any part of the contents of this Offering Memorandum.<br />

This Offering Memorandum will be available free of charge at the office of each of the Agents (as<br />

defined herein).<br />

The investments described in this Offering Memorandum do not constitute a collective investment<br />

fund for the purpose of the Collective Investment Funds (Jersey) Law 1988, as amended, on the basis that<br />

they are investment products designed for financially sophisticated investors with specialist knowledge of,<br />

and experience of investing in, such investments, who are capable of fully evaluating the risks involved in<br />

making such investments and who have an asset base sufficiently substantial as to enable them to sustain<br />

any loss that they might suffer as a result of making such investments. These investments are not regarded<br />

by the Jersey Financial Services Commission (the “JFSC”) as suitable investments for any other type of<br />

investor. Any individual intending to invest in any investment described in this Offering Memorandum<br />

should consult his or her professional adviser and ensure that he or she fully understands all the risks<br />

associated with making such an investment and has sufficient financial resources to sustain any loss that<br />

may arise from it.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS<br />

This Offering Memorandum contains forward-looking statements. Examples of such forward-looking<br />

statements include, but are not limited to: (i) statements regarding our future results of operations and financial<br />

condition, (ii) statements of plans, objectives or goals, including those related to our products or services and<br />

(iii) statements of assumptions underlying such statements. Words such as “believes,” “anticipates,” “should,”<br />

“estimates,” “forecasts,” “expects,” “may,” “intends” and “plans” and similar expressions are intended to identify<br />

forward-looking statements but are not the exclusive means of identifying such statements.<br />

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general<br />

and specific, and as a result the predictions, forecasts, projections and other forward-looking statements may not<br />

be achieved. We caution investors that a number of important factors could cause actual results to differ<br />

materially from the plans, objectives, expectations, estimates and intentions expressed or implied in such<br />

forward-looking statements. These factors include, but are not limited to:<br />

• changes in economic conditions;<br />

• the performance of our investment portfolios;<br />

• the scope and frequency of catastrophes;<br />

• differences between our actual claims experience and our underwriting and reserving assumptions;<br />

• the financial strength of our insurance and reinsurance subsidiaries;<br />

• the level of competition;<br />

• our ability to obtain the appropriate level and type of reinsurance;<br />

• the financial condition of our reinsurance and retrocession counterparties and their performance under<br />

any reinsurance or retrocession arrangements we have in place;<br />

• changes in exchange rates;<br />

• changes in regulation and government policies;<br />

• changes in Lloyd’s rules and policies;<br />

• our strategy, including business plans and acquisitions;<br />

• potential litigation;<br />

• systems risks;<br />

• our dependency on key personnel;<br />

• our reliance on insurance agents and brokers;<br />

• our holding company structure; and<br />

• other factors discussed under “Risk Factors” and “Management’s Discussion and Analysis of<br />

Financial Condition and Results of Operations.”<br />

We caution that the foregoing list of factors is not exhaustive. When relying on forward-looking<br />

statements to make decisions with respect to an investment in the <strong>Capital</strong> Securities, investors should carefully<br />

consider the foregoing factors and other uncertainties and events. These forward-looking statements speak only<br />

as of the date of this Offering Memorandum, and we do not undertake any obligation to update or revise any of<br />

them, whether as a result of new information, future events or otherwise.<br />

1

CERTAIN DEFINED TERMS<br />

In this Offering Memorandum, unless the context otherwise requires, references to:<br />

• “Acquisition Event” means an offer being made to acquire 90% or more of the ordinary shares of<br />

<strong>QBE</strong> which, under the Corporations Act, is or becomes unconditional and the bidder has a relevant<br />

interest, as defined under that law, in 90% or more of the ordinary shares of <strong>QBE</strong> on issue;<br />

• “APRA” means the Australian Prudential Regulation Authority or any successor;<br />

• “APRA Condition,” with respect to any distribution payment on the <strong>Capital</strong> Securities or <strong>Capital</strong><br />

Securities Guarantee Payment (as defined herein) under the <strong>Capital</strong> Securities Guarantee Agreement<br />

on a Distribution Payment Date (as defined herein), other than a distribution payable on redemption<br />

of the <strong>Capital</strong> Securities, any interest payment on the UK <strong>Capital</strong> Securities on an Interest Payment<br />

Date (as defined herein), other than interest payable on redemption of the UK <strong>Capital</strong> Securities, or<br />

any dividend payment on the <strong>QBE</strong> Preferred Securities on a Dividend Payment Date (as defined<br />

herein), other than a dividend payable on redemption of the <strong>QBE</strong> Preferred Securities, means the<br />

occurrence of any of the following:<br />

(a) unless APRA otherwise agrees:<br />

(i) the determination by APRA in writing that the <strong>QBE</strong> Group does not comply with APRA’s<br />

then existing capital adequacy requirements as they apply to the <strong>QBE</strong> Group at the time;<br />

(ii) the issuance by APRA of a written direction to <strong>QBE</strong> under Section 36 of the Insurance Act<br />

1973 (Cth) of Australia for it to increase its capital;<br />

(iii) the revocation by APRA of the authorization of <strong>QBE</strong> pursuant to subsection 15(1) of the<br />

Insurance Act 1973 (Cth) of Australia;<br />

(iv) the appointment by APRA of a statutory manager to <strong>QBE</strong> or the assumption by APRA of<br />

control of <strong>QBE</strong> or the commencement of proceedings for the winding-up of <strong>QBE</strong>;<br />

(v) the retained earnings of the <strong>QBE</strong> Group having fallen below zero; or<br />

(vi) the distribution payment, the <strong>Capital</strong> Securities Guarantee Payment, the interest payment or<br />

the dividend payment, as the case may be, exceeding Distributable Profits as at the date for<br />

such payment; or<br />

(b) APRA otherwise objecting to the distribution payment, the <strong>Capital</strong> Securities Guarantee<br />

Payment, the interest payment or the dividend payment, as the case may be;<br />

• “Business Day” means any day other than a Saturday or Sunday that is not a day on which banking<br />

institutions in London, England, New York, New York or Sydney, New South Wales are authorized<br />

or obligated to close;<br />

• “<strong>Capital</strong> Securities” means the £300,000,000 non-voting non-cumulative perpetual preferred<br />

securities that the Issuer will issue to the Initial Purchasers and that are being offered pursuant to this<br />

Offering Memorandum;<br />

• “<strong>Capital</strong> Securities Guarantee” means the full and unconditional subordinated guarantee of <strong>QBE</strong> with<br />

respect to all of the Issuer’s obligations under the <strong>Capital</strong> Securities, but only (i) to the extent that the<br />

Issuer has funds available for distribution to holders of the <strong>Capital</strong> Securities and (ii) after the date, if<br />

any, on which the <strong>Exchange</strong> Event occurs, whether or not the Issuer has funds available for<br />

distribution to holders of the <strong>Capital</strong> Securities (if the <strong>Capital</strong> Securities remain outstanding), in the<br />

case of (i) or (ii), so long as no <strong>QBE</strong> Australia Stopper (as defined herein) or APRA Condition exists;<br />

provided that, if the <strong>Exchange</strong> Event is the failure of the Issuer to pay a distribution in full on or<br />

within twenty (20) Business Days after a Distribution Payment Date, the only reason for such failure<br />

is the failure of <strong>QBE</strong> UK to pay interest in full on the UK <strong>Capital</strong> Securities on the corresponding<br />

2

Interest Payment Date and no <strong>QBE</strong> Australia Stopper or APRA Condition exists with respect to that<br />

distribution, <strong>QBE</strong> will be deemed to have guaranteed payment of that distribution whether or not the<br />

Issuer has sufficient available funds;<br />

• “<strong>Capital</strong> Securities Guarantee Agreement” means the agreement between <strong>QBE</strong>, as guarantor and the<br />

Guarantee Trustee to be dated the Closing Date relating to the <strong>Capital</strong> Securities Guarantee;<br />

• “<strong>Capital</strong> Securities Regulatory Event” means:<br />

• the introduction of, or an amendment or clarification to or change in (or announcement of a<br />

prospective introduction of, amendment or clarification to or change in) a law or regulation of the<br />

Commonwealth of Australia or any State or Territory thereof or any directive, order, requirement,<br />

guideline or statement of APRA, after the Closing Date, which has the effect that the <strong>Capital</strong><br />

Securities are not eligible for inclusion in the Tier 1 capital, or its then equivalent, of the <strong>QBE</strong><br />

Group;<br />

• the receipt by <strong>QBE</strong> of any statement, notification or advice by APRA or a decision by any court,<br />

interpreting, applying or administering any such law or regulation, after the Closing Date, which<br />

has the effect that the <strong>Capital</strong> Securities are not eligible for inclusion in the Tier 1 capital, or its<br />

then equivalent, of the <strong>QBE</strong> Group; or<br />

• the receipt by <strong>QBE</strong> of an opinion of a nationally recognized independent legal counsel in Australia<br />

experienced in such matters, after the Closing Date, to the effect that the <strong>Capital</strong> Securities are not,<br />

or within 90 days of the date of the opinion will not be, eligible for inclusion in the Tier 1 capital,<br />

or its then equivalent, of the <strong>QBE</strong> Group.<br />

• “<strong>Capital</strong> Securities Tax Event” means:<br />

(a) a UK <strong>Capital</strong> Securities Tax Event; or<br />

(b) the receipt by <strong>QBE</strong> of an opinion of competent tax counsel to the effect that, as a result of the<br />

introduction of, or amendment or clarification to or change in (or announcement of a prospective<br />

introduction of, amendment or clarification to or change in) or in the interpretation or application<br />

of a law or regulation by any legislative body, court, governmental agency or regulatory<br />

authority in a Relevant Jurisdiction after the Closing Date, there is more than an insubstantial<br />

risk that:<br />

(i) payments on the <strong>Capital</strong> Securities, or payments under the <strong>Capital</strong> Securities Guarantee<br />

Agreement, are or will be subject to any Relevant Tax of whatever nature imposed or<br />

leveled by or on behalf of a Relevant Jurisdiction for which the Issuer or <strong>QBE</strong>, as the case<br />

may be, must pay Additional Amounts (as defined herein);<br />

(ii) interest payments on the UK <strong>Capital</strong> Securities or distributions on the <strong>Capital</strong> Securities are<br />

or will be treated as frankable distributions under Australian tax law (see “Taxation—<br />

Certain Australian Tax Consequences”);<br />

(iii) the Issuer or <strong>QBE</strong> would be exposed to more than a de minimis increase in its costs in<br />

relation to the <strong>Capital</strong> Securities as a result of any taxes, duties or other governmental<br />

charges or civil liabilities; or<br />

(iv) <strong>QBE</strong> would be exposed to more than a de minimis increase in its costs in relation to the<br />

<strong>Capital</strong> Securities Guarantee Agreement or the <strong>Exchange</strong> Agreement as a result of any<br />

taxes, duties or other governmental charges or civil liabilities;<br />

• “Closing Date” means July 18, 2006;<br />

3

• “Distributable Profits” means an amount calculated in accordance with the following formula (or<br />

such other formula as APRA may require):<br />

Distributable Profits = A - B<br />

where:<br />

“A” is the aggregate of the consolidated net profits after income tax of the <strong>QBE</strong> Group for the<br />

immediately preceding two six-monthly financial periods for which results have been publicly<br />

announced (or any other amount as determined by APRA in its discretion to be appropriate in <strong>QBE</strong>’s<br />

circumstances for the purposes of paying <strong>QBE</strong>’s Tier 1 capital obligations); and<br />

“B” is the aggregate amount of dividends, distributions, interest or other amounts paid, decided to be<br />

paid or liable to be paid by the <strong>QBE</strong> Group in the twelve months to and including the applicable<br />

Distribution Payment Date, the Interest Payment Date or the Dividend Payment Date, as the case<br />

may be, on:<br />

(i) the <strong>Capital</strong> Securities and the <strong>Capital</strong> Securities Guarantee or, if the <strong>Capital</strong> Securities are<br />

exchanged for the <strong>QBE</strong> Preferred Securities, the <strong>QBE</strong> Preferred Securities and the UK<br />

<strong>Capital</strong> Securities;<br />

(ii) any other Tier 1 qualifying capital security of the <strong>QBE</strong> Group to the extent dividends or<br />

distributions on those securities are funded by <strong>QBE</strong> or by instruments of <strong>QBE</strong>;<br />

(iii) any other share capital of <strong>QBE</strong> (including its ordinary shares); and<br />

(iv) any Upper Tier 2 qualifying instrument of the <strong>QBE</strong> Group;<br />

but excluding:<br />

(x) amounts payable with respect to the <strong>Capital</strong> Securities, the <strong>Capital</strong> Securities Guarantee, the<br />

UK <strong>Capital</strong> Securities or the <strong>QBE</strong> Preferred Securities on the applicable Distribution<br />

Payment Date, Interest Payment Date or Dividend Payment Date, as the case may be;<br />

(y) any such dividend, distribution, interest or other amount to which the <strong>QBE</strong> Group was or is<br />

beneficially entitled; and<br />

(z) any such dividend, distribution, interest or other amount which is included in the calculation<br />

of consolidated net profit after tax within the meaning of A;<br />

• “<strong>Exchange</strong> Agreement” means the agreement among <strong>QBE</strong>, the Issuer, the General Partner, <strong>QBE</strong> UK<br />

and the <strong>Exchange</strong> Trustee to be dated the Closing Date;<br />

• “<strong>Exchange</strong> Trustee” means Citibank, N.A. and its successors;<br />

• “FSA” means the UK Financial Services Authority or any successor;<br />

• “General Partner” means <strong>QBE</strong> (Jersey) GP Limited, a wholly owned subsidiary of <strong>QBE</strong> formed as a<br />

private limited company under the laws of the Bailiwick of Jersey, the Channel Islands;<br />

• “Guarantee Trustee” means Citibank, N.A. and its successors;<br />

• “Initial Purchasers” means Merrill Lynch International and Citigroup Global Markets Limited;<br />

• “Investment Company Event” means the receipt by <strong>QBE</strong> of an opinion of nationally recognized<br />

independent legal counsel in the United States experienced in practice under the US Investment<br />

Company Act of 1940, as amended (the “Investment Company Act”), that, as a result of the<br />

occurrence, after the Closing Date and prior to the occurrence of the <strong>Exchange</strong> Event, of a change in<br />

law or regulation or a change in the interpretation or application of law or regulation of any legislative<br />

body, court, governmental agency or regulatory authority, there is more than an insubstantial risk that<br />

the Issuer is or will be considered an “investment company” which is required to be registered under<br />

the Investment Company Act;<br />

4

• “Issuer” means <strong>QBE</strong> <strong>Capital</strong> <strong>Funding</strong> L.P., a Jersey limited partnership formed under the laws of the<br />

Bailiwick of Jersey, the Channel Islands;<br />

• “Limited Partnership Agreement” means the limited partnership agreement for the Issuer;<br />

• “Parity Securities” means any preference shares or other securities or instruments issued by <strong>QBE</strong> or<br />

any of its subsidiaries to the extent of distributions on those securities or instruments that are funded<br />

by instruments of <strong>QBE</strong> ranking equally with the <strong>Capital</strong> Securities Guarantee Agreement;<br />

• “<strong>QBE</strong>,” “<strong>QBE</strong> Group,” “we,” “us” and “our” each means <strong>QBE</strong> Insurance Group Limited (ABN 28<br />

008 485 014) and its consolidated entities; except that, on the cover page, under the headings<br />

“Offering Memorandum Summary—The Offering,” “Risk Factors—Risks related to the <strong>Capital</strong><br />

Securities,” “Description of the <strong>Capital</strong> Securities,” “Description of the <strong>Capital</strong> Securities Guarantee<br />

Agreement,” “Description of the UK <strong>Capital</strong> Securities,” “Description of the <strong>QBE</strong> Preferred<br />

Securities,” “Taxation,” “ERISA Considerations,” “Plan of Distribution” and “Notice to Investors,”<br />

and elsewhere in this Offering Memorandum where the terms of the securities offered hereby and the<br />

transaction documents are described, unless the context otherwise requires, references to “<strong>QBE</strong>,”<br />

“we,” “us” and “our” means only <strong>QBE</strong> Insurance Group Limited (ABN 28 008 485 014);<br />

• “<strong>QBE</strong> Australia Stopper” means a resolution adopted by the board of directors of <strong>QBE</strong> or an<br />

authorized committee thereof that on any Distribution Payment Date any unpaid distribution on the<br />

<strong>Capital</strong> Securities for a Distribution Period or any amount payable under the <strong>Capital</strong> Securities<br />

Guarantee not be paid in full;<br />

• “<strong>QBE</strong> Preferred Securities” means preferred securities to be issued by <strong>QBE</strong> upon the occurrence of<br />

the <strong>Exchange</strong> Event as described in this Offering Memorandum;<br />

• “<strong>QBE</strong> Regulatory Event” means:<br />

• the introduction of, or an amendment or clarification to or change in (or announcement of a<br />

prospective introduction of, amendment or clarification to or change in) a law or regulation of the<br />

Commonwealth of Australia or any State or Territory thereof or any directive, order, requirement,<br />

guideline or statement of APRA, after the Closing Date, which has the effect that the <strong>QBE</strong><br />

Preferred Securities are not eligible for inclusion in the Tier 1 capital, or its then equivalent, of the<br />

<strong>QBE</strong> Group;<br />

• the receipt by <strong>QBE</strong> of any statement, notification or advice by APRA or a decision by any court,<br />

interpreting, applying or administering any law or regulation, after the Closing Date, which has the<br />

effect that the <strong>QBE</strong> Preferred Securities are not eligible for inclusion in the Tier 1 capital, or its<br />

then equivalent, of the <strong>QBE</strong> Group; or<br />

• the receipt by <strong>QBE</strong> of an opinion of a nationally recognized independent legal counsel in Australia<br />

experienced in these matters, after the Closing Date, to the effect that the <strong>QBE</strong> Preferred Securities<br />

are not, or within 90 days of that opinion will not be, eligible for inclusion in the Tier 1 capital, or<br />

its then equivalent, of the <strong>QBE</strong> Group;<br />

• “<strong>QBE</strong> Tax Event” means that we have received an opinion of competent tax counsel to the effect that,<br />

as a result of the introduction of, or amendment or clarification to or change in (or announcement of a<br />

prospective introduction of, amendment or clarification to or change in) or in the interpretation or<br />

application of a law (including the termination, change or replacement of any treaty to which<br />

Australia is a party) or regulation by any legislative body, court, governmental agency or regulatory<br />

authority after the Closing Date, there is more than an insubstantial risk that (i) the Australian<br />

withholding tax payable on the dividends (or any part of the dividends) on the <strong>QBE</strong> Preferred<br />

Securities is or will be increased to greater than 30% of the dividends paid, (ii) the Australian<br />

withholding tax payable on the dividends (or any part of the dividends) on the <strong>QBE</strong> Preferred<br />

Securities which are paid to any person who is resident in the United Kingdom or the United States is<br />

or will be increased to greater than 15% of the dividends paid or (iii) we are or will be exposed to<br />

5

more than a de minimis increase in our costs in relation to the <strong>QBE</strong> Preferred Securities as a result of<br />

any taxes, duties or other governmental charges or civil liabilities;<br />

• “<strong>QBE</strong> UK” means <strong>QBE</strong>’s wholly owned subsidiary, <strong>QBE</strong> International Holdings (UK) PLC,<br />

registered number 2641728;<br />

• “<strong>QBE</strong> UK Stopper” means, with respect to any accrued and unpaid interest on the UK <strong>Capital</strong><br />

Securities otherwise payable on any Interest Payment Date, a resolution adopted by the board of<br />

directors of <strong>QBE</strong> UK or an authorized committee thereof that the payment of such interest be deferred<br />

in full or in part until redemption;<br />

• “Relevant Jurisdiction” means the Bailiwick of Jersey, the United Kingdom, Australia or any other<br />

jurisdiction from which a payment on the <strong>Capital</strong> Securities, the <strong>Capital</strong> Securities Guarantee or the<br />

UK <strong>Capital</strong> Securities, as the case may be, is made (or any respective political subdivision or taxing<br />

authority thereof or therein);<br />

• “Relevant Tax” means any present or future taxes, duties, assessments or governmental charges;<br />

• “September 11” means the terrorist attacks in the United States on September 11, 2001;<br />

• “UK <strong>Capital</strong> Securities” means the pounds sterling-denominated debt instruments issued by <strong>QBE</strong> UK<br />

to the Issuer;<br />

• “UK <strong>Capital</strong> Securities Regulatory Event” means:<br />

(i) the introduction of, or an amendment or clarification to or change in (or announcement of a<br />

prospective introduction of, amendment or clarification to or change in) a law or regulation of<br />

England or any directive, order, requirement, guideline or statement of the FSA after the Closing<br />

Date which has the effect that the UK <strong>Capital</strong> Securities are not eligible for inclusion in the Tier<br />

1 capital, or its then equivalent, of <strong>QBE</strong> UK;<br />

(ii) the receipt by <strong>QBE</strong> UK of any statement, notification or advice by the FSA or a decision by any<br />

court, interpreting, applying or administering any such law or regulation after the Closing Date<br />

which has the effect that the UK <strong>Capital</strong> Securities are not eligible for inclusion in the Tier 1<br />

capital, or its then equivalent, of <strong>QBE</strong> UK; or<br />

(iii) the receipt by <strong>QBE</strong> UK of an opinion of a nationally recognized independent legal counsel in<br />

England experienced in such matters after the Closing Date to the effect that the UK <strong>Capital</strong><br />

Securities are not, or within 90 days of such opinion will not be, eligible for inclusion in the Tier<br />

1 capital, or its then equivalent, of <strong>QBE</strong> UK;<br />

• “UK <strong>Capital</strong> Securities Tax Event” means the receipt by <strong>QBE</strong> UK or <strong>QBE</strong> of an opinion of competent<br />

tax counsel to the effect that, as a result of the introduction of, or amendment or clarification to or<br />

change in (or announcement of a prospective introduction of, amendment or clarification to or change<br />

in) or in the interpretation or application of a law or regulation by any legislative body, court,<br />

governmental agency or regulatory authority in a Relevant Jurisdiction after the Closing Date, there is<br />

more than an insubstantial risk that (i) payments of principal or interest on the UK <strong>Capital</strong> Securities<br />

are or will be subject to any Relevant Tax of whatever nature imposed or levied by or on behalf of a<br />

Relevant Jurisdiction for which <strong>QBE</strong> UK must pay Additional Amounts, (ii) there would be more<br />

than a de minimis adverse change in the deductibility by <strong>QBE</strong> UK of interest payments on the UK<br />

<strong>Capital</strong> Securities for UK tax purposes or (iii) <strong>QBE</strong> UK would be exposed to more than a de minimis<br />

increase in its costs in relation to the UK <strong>Capital</strong> Securities as a result of any taxes, duties or other<br />

governmental charges or civil liabilities; and<br />

• “UK Solvency Condition” means that the rights and claims of the holders of the UK <strong>Capital</strong><br />

Securities are subordinated to the claims of all Senior Creditors, in that payments in respect of the UK<br />

<strong>Capital</strong> Securities or arising therefrom (including interest payable in cash or by way of the issue of<br />

AISM Securities (as defined herein)) are conditional upon <strong>QBE</strong> UK being solvent at the time of the<br />

6

elevant payment by <strong>QBE</strong> UK (or at the time of issue of such AISM Securities) and in that no<br />

principal, premium or interest or any other amount shall be due and payable in respect of the UK<br />

<strong>Capital</strong> Securities (including interest payable in cash or by way of the issue of AISM Securities)<br />

except to the extent that <strong>QBE</strong> UK could make such payment and still be solvent immediately<br />

thereafter, in each case except in the winding-up of <strong>QBE</strong> UK. <strong>QBE</strong> UK shall be considered to be<br />

solvent if (x) it is able to pay its debts owed to its Senior Creditors as they fall due and (y) its Assets<br />

exceed its Liabilities (other than its Liabilities to persons who are not Senior Creditors). A certificate<br />

as to the solvency of <strong>QBE</strong> UK by two Directors shall, in the absence of manifest error, be treated and<br />

accepted by <strong>QBE</strong> UK and the holders of the UK <strong>Capital</strong> Securities and all other interested parties as<br />

correct and sufficient evidence thereof. For the purposes of this definition:<br />

• “Assets” means the unconsolidated gross assets of <strong>QBE</strong> UK, as shown in the latest published<br />

audited balance sheet of <strong>QBE</strong> UK, but adjusted for subsequent events in such manner as the board<br />

of directors of <strong>QBE</strong> UK may determine;<br />

• “Liabilities” means the unconsolidated gross liabilities of <strong>QBE</strong> UK, as shown in the latest<br />

published audited balance sheet of <strong>QBE</strong> UK, but adjusted for contingent liabilities and for<br />

subsequent events in such manner as the board of directors of <strong>QBE</strong> UK may determine; and<br />

• “Senior Creditors” means (a) creditors of <strong>QBE</strong> UK who are unsubordinated creditors of <strong>QBE</strong> UK,<br />

(b) creditors of <strong>QBE</strong> UK whose claims are, or are expressed to be, subordinated to the claims of<br />

other creditors of <strong>QBE</strong> UK other than those whose claims constitute, or would but for any<br />

applicable limitation on the amount of such capital, constitute, Tier 1 <strong>Capital</strong> (as defined by the<br />

FSA from time to time) or whose claims rank, or are expressed to rank pari passu with, or junior<br />

to, the claims of holders of the UK <strong>Capital</strong> Securities and (c) creditors of <strong>QBE</strong> UK whose claims<br />

are in respect of <strong>QBE</strong> UK’s outstanding debt securities which constitute Tier 2 <strong>Capital</strong> (as defined<br />

by the FSA from time to time), if any, (and such other securities outstanding from time to time<br />

which rank pari passu with, or senior to, any of such Tier 2 <strong>Capital</strong>, if any).<br />

Also in this Offering Memorandum, unless otherwise specified or the context otherwise requires:<br />

• references to distributions on the <strong>Capital</strong> Securities include Additional Amounts that are payable as<br />

described under “Description of the <strong>Capital</strong> Securities—Additional Amounts”;<br />

• references to payments on the <strong>Capital</strong> Securities Guarantee include Additional Amounts that are<br />

payable as described under “Description of the <strong>Capital</strong> Securities Guarantee Agreement—Additional<br />

Amounts”;<br />

• references to interest on the UK <strong>Capital</strong> Securities include interest payable as described herein on the<br />

Interest Payment Dates therefor and Additional Amounts, in each case, that are payable as described<br />

under “Description of the UK <strong>Capital</strong> Securities—Interest” and “—Additional Amounts”;<br />

• references to dividends and other payments on the <strong>QBE</strong> Preferred Securities include Additional<br />

Amounts that are payable as described under “Description of <strong>QBE</strong> Preferred Securities—Additional<br />

Amounts”; and<br />

• references to “redeem,” “redeemed” and “redemption” when used in connection with the <strong>QBE</strong><br />

Preferred Securities, includes a buy-back or cancellation (as part of a reduction of capital) of the <strong>QBE</strong><br />

Preferred Securities in addition to a redemption of the <strong>QBE</strong> Preferred Securities.<br />

For definitions of certain insurance terms used in this Offering Memorandum, see “Annex A—Glossary<br />

of Certain Insurance Terms.”<br />

7

AVAILABLE INFORMATION<br />

Neither we nor the Issuer, the General Partner or <strong>QBE</strong> UK is subject to the informational requirements<br />

of the US Securities <strong>Exchange</strong> Act of 1934, as amended (the “<strong>Exchange</strong> Act”). To preserve the exemptions for<br />

resales and transfers under Rule 144A, each of <strong>QBE</strong>, the Issuer, the General Partner and <strong>QBE</strong> UK has agreed it<br />

will promptly provide any holder or any prospective purchaser of <strong>Capital</strong> Securities information meeting the<br />

requirements of Rule 144A(d)(4), unless it either furnishes information to the SEC in accordance with Rule<br />

12g3-2(b) under the <strong>Exchange</strong> Act or furnishes information to the SEC pursuant to Section 13 or 15(d) of the<br />

<strong>Exchange</strong> Act. Following completion of this offering, neither we nor the Issuer, the General Partner or <strong>QBE</strong> UK<br />

is otherwise obligated to furnish holders or others with any supplemental information, discussion or analysis of<br />

its business or financial reports.<br />

Separate financial statements for the Issuer, the General Partner and <strong>QBE</strong> UK are not included in this<br />

Offering Memorandum because we do not believe those financial statements would be meaningful or provide<br />

investors in the <strong>Capital</strong> Securities with any important financial information. Each of the Issuer and the General<br />

Partner is a newly organized special purpose entity, has no operating history and no independent operations, and<br />

exists for the sole purpose of this offering and engaging in the other activities described herein.<br />

None of the information on our website is incorporated by reference herein or otherwise deemed<br />

to be a part of this Offering Memorandum. Any references to our website are for informational purposes<br />

only.<br />

ENFORCEMENT OF CIVIL LIABILITIES<br />

<strong>QBE</strong> is a public company incorporated with limited liability under the laws of the Commonwealth of<br />

Australia. All of the directors and most of the executive officers of <strong>QBE</strong> reside outside the United States. All or a<br />

substantial portion of the assets of these persons and of <strong>QBE</strong> are located outside the United States. As a result, it<br />

may not be possible for you to effect service of process within the United States upon these persons or to enforce<br />

against them judgments obtained in United States courts predicated upon the civil liability provisions of United<br />

States federal or state securities laws. <strong>QBE</strong> has been advised by its Australian counsel, Allens Arthur Robinson,<br />

that there is doubt as to the enforceability in Australia, in original actions in Australian courts or in actions for<br />

enforcement of judgments of United States courts, of certain civil liabilities predicated on the United States<br />

federal or state securities laws.<br />

The Issuer is a limited partnership formed under the laws of the Bailiwick of Jersey, the Channel<br />

Islands. The General Partner is a private limited company formed under the laws of the Baliwick of Jersey, the<br />

Channel Islands. <strong>QBE</strong> UK is a public limited company incorporated under the laws of England and Wales. All of<br />

the directors of each of the General Partner and <strong>QBE</strong> UK reside outside the United States. All or a substantial<br />

portion of the assets of these persons and of each of the Issuer, the General Partner and <strong>QBE</strong> UK are located<br />

outside the United States. As a result, it may not be possible for you to effect service of process within the United<br />

States upon these persons or to enforce against them judgments obtained in United States courts predicated upon<br />

the civil liability provisions of United States federal or state securities laws. The Issuer and the General Partner<br />

have been advised by their Jersey counsel, Voisin & Co., that there is doubt as to the enforceability in Jersey in<br />

original actions in Jersey’s courts or in actions for enforcement of judgments of United States courts of certain<br />

civil liabilities predicated on United States federal or state securities laws. <strong>QBE</strong> UK has been advised by its<br />

United Kingdom counsel, Linklaters, that there is doubt as to the enforceability in the United Kingdom in<br />

original actions in the United Kingdom’s courts or in actions for enforcement of judgments of United States<br />

courts of certain civil liabilities predicated on the United States federal or state securities laws.<br />

8

FINANCIAL INFORMATION PRESENTATION<br />

Our financial statements as at and for the year ended December 31, 2004 and prior years (our “historical<br />

Australian GAAP financial statements”) have been prepared in accordance with Australian generally accepted<br />

accounting principles (“historical Australian GAAP”), that were in existence at that time. Our financial<br />

statements as at and for the year ended December 31, 2005 (our “A-IFRS financial statements”) have been<br />

prepared in accordance with Australian equivalents to International Financial Reporting Standards (“A-IFRS”).<br />

The differences between A-IFRS and International Financial Reporting Standards as they apply to <strong>QBE</strong> are set<br />

out below. We applied Australian Accounting Standards Board (“AASB”) 1: First Time Adoption of Australian<br />

Equivalents to International Financial Reporting Standards in preparing our financial statements as at and for the<br />

year ended December 31, 2005. In preparing the financial statements, management amended certain accounting<br />

and valuation methods applied in the historical Australian GAAP financial statements to comply with A-IFRS<br />

and the comparative figures as at and for the year ended December 31, 2004 have been restated to reflect these<br />

adjustments. The information based on historical Australian GAAP is not comparable to information prepared in<br />

accordance with A-IFRS. See Notes 1 and 2 to our A-IFRS financial statements for a summary of our significant<br />

accounting policies under A-IFRS and the impact of the adoption of A-IFRS respectively.<br />

This Offering Memorandum includes and refers to financial statements and other financial information<br />

based on both A-IFRS and historical Australian GAAP. Because of the significant differences between A-IFRS<br />

and historical Australian GAAP, we have presented the information as at and for the years ended December 31,<br />

2005 and 2004 prepared in accordance with A-IFRS separately from the information as at and for the years ended<br />

December 31, 2004, 2003, 2002 and 2001 prepared in accordance with historical Australian GAAP.<br />

Each of A-IFRS and historical Australian GAAP differs in certain respects from US GAAP. If we were<br />

to present our financial statements in US GAAP, we would be required to make retroactively a number of<br />

subjective determinations and elections concerning the presentation of our financial statements. We have not<br />

made any such determinations or elections.<br />

If we were to change the presentation of our financial statements for the years 2005 and 2004 to US<br />

GAAP, we would expect differences would arise under A-IFRS as a result of, among other things, (i) the<br />

potential reclassification of certain gains or losses on our investment securities from the income statement to a<br />

component of equity under US GAAP; (ii) various adjustments to our expenses and reserves for claims and<br />

deferred acquisition costs; (iii) the potential impairment of intangibles and goodwill due to the application of<br />

differing impairment tests under A-IFRS and US GAAP; (iv) the restatement of owner occupied and investment<br />

properties to a historic cost basis of accounting under US GAAP; and (v) the potential remeasurement of certain<br />

balances such as intangibles and pension fund deficits due to the application of differing transitional provisions<br />

on the initial application of A-IFRS and US GAAP.<br />

If we were to change the presentation of our financial statements for the years 2004, 2003, 2002 and<br />

2001 to US GAAP, we would expect that, in addition to those items mentioned in the preceding paragraph, our<br />

financial statements for such years under US GAAP would differ from financial statements presented in<br />

accordance with historical Australian GAAP as a result of, among other things, (i) the mark to market of certain<br />

derivatives as required by US GAAP; (ii) the application of hedge accounting rules required by US GAAP; (iii)<br />

the reversal of goodwill amortisation taken under historical Australian GAAP; (iv) the translation of nonmonetary<br />

assets and liabilities in our Lloyd’s operations to Australian dollars using transaction rates of exchange<br />

as required by US GAAP; (v) the expense of equity based compensation through the income statement under US<br />

GAAP; and (vi) the recognition under US GAAP of the interest component of a forward contract designated as a<br />

hedge of a net investment in foreign operations in the income statement.<br />

We have not made any attempt to reconcile our financial statements to US GAAP or to quantify the<br />

differences between either A-IFRS and US GAAP or between historical Australian GAAP and US GAAP. In<br />

addition to the specific differences mentioned in the preceding paragraphs, there may be other differences not<br />

9

mentioned which could be of greater significance than the differences mentioned. We have no intention of<br />

reconciling such financial statements or quantifying such differences in the future.<br />

In making any investment decision in respect of the <strong>Capital</strong> Securities, you should rely on your own<br />

examination of our financial information and should consult your own professional advisors for an understanding<br />

of the differences between A-IFRS and US GAAP or historical Australian GAAP and US GAAP, and how those<br />

differences might affect the financial information presented in this Offering Memorandum.<br />

We record our transactions and prepare and will publish our consolidated financial statements in<br />

Australian dollars. In this Offering Memorandum, references to “A$” or “$” are to Australian dollars, references<br />

to “US$” or “US dollars” are to United States dollars and references to “£” are to pounds sterling.<br />

Any discrepancies between totals and sums of components within tables contained in this Offering<br />

Memorandum are due to rounding.<br />

Summary of differences between AIFRS and IFRS impacting <strong>QBE</strong><br />

General insurance contracts<br />

IFRS 4: Insurance Contracts and AASB 4: Insurance contracts address the definition of an insurance<br />

contract and related disclosure requirements. There are no significant differences between these standards. IFRS<br />

does not currently address the recognition and measurement of insurance contracts. Australian insurance<br />

companies are required to apply the provisions of AASB 1023: General Insurance Contracts which sets out the<br />

specific requirements for the recognition and measurement of insurance contracts.<br />

Investments<br />

AASB 1023 requires that all investments held to fund insurance provisions are measured in the balance<br />

sheet at fair value with changes in fair value reflected in the income statement, provided this treatment is<br />

permitted under AASB 139: Financial Instruments: Recognition and Measurement.<br />

Companies reporting under IFRS are permitted to classify investments as either:<br />

1. Financial assets held at fair value through profit or loss, subject to certain conditions;<br />

2. Held to maturity (carried at amortised cost); or<br />

3. Available for sale (carried at fair value with changes in fair value reflected directly in equity).<br />

Such classification is subject to a company’s national standard setter’s potential requirement to classify<br />

investments held to fund insurance provisions at fair value through profit and loss, such as in Australia.<br />

10

EXCHANGE RATES AND CONTROLS<br />

For your convenience, we have translated some Australian dollar amounts into US dollar amounts at the<br />

noon buying rate in The City of New York for cable transfers in Australian dollars as certified for customs<br />

purposes by the Federal Reserve Bank of New York (the “noon buying rate”). Unless otherwise stated, we have<br />

translated Australian dollars into US dollars at the noon buying rate on December 31, 2005 of A$1.00 =<br />

US$0.7342. We have translated US dollar amounts for our acquisitions and capital raisings at the closing rate for<br />

the relevant year end.<br />

For your convenience, we have translated some Australian dollar amounts into pounds sterling amounts<br />

at the spot settlement rate of exchange as published by the Bank of England (“spot settlement rate”). Unless<br />

otherwise stated, we have translated Australian dollars into pounds sterling at the spot settlement rate on<br />

December 31, 2005 of A$1.00 = £0.4274. In providing these translations, we are not representing that the<br />

Australian dollar amounts actually represent these US dollar amounts or pounds sterling amounts or that we<br />

could have converted those Australian dollars into US dollars or pounds sterling at the rates indicated.<br />

On July 6, 2006, the noon buying rate for Australian dollars into US dollars was A$1.00 = US$0.7459<br />

and the spot settlement rate for Australian dollars into pounds sterling was A$1.00 = £0.4060.<br />

The following table contains information for the noon buying rate for the Australian dollar into US<br />

dollars for the periods indicated.<br />

At<br />

Period<br />

End<br />

Average<br />

Rate(1) High Low<br />

Year ended December 31,<br />

2001 ........................................... 0.5117 0.5127 0.5712 0.4828<br />

2002 ........................................... 0.5625 0.5448 0.5748 0.5060<br />

2003 ........................................... 0.7520 0.6589 0.7520 0.5629<br />

2004 ........................................... 0.7805 0.7384 0.7979 0.6840<br />

2005 ........................................... 0.7342 0.7620 0.7974 0.7261<br />

Period<br />

January 2006 .................................... 0.7572 — 0.7572 0.7379<br />

February 2006 ................................... 0.7430 — 0.7548 0.7363<br />

March 2006 ..................................... 0.7165 — 0.7458 0.7056<br />

April 2006 ...................................... 0.7593 — 0.7593 0.7177<br />

May 2006 ...................................... 0.7509 — 0.7781 0.7509<br />

June 2006 ...................................... 0.7423 — 0.7527 0.7284<br />

(1) Determined by averaging noon buying rates on the last day of each month during the period.<br />

11

The following table contains information for the spot settlement rate for the Australian dollar into<br />

pounds sterling for the periods indicated.<br />

At<br />

Period<br />

End<br />

Average<br />

Rate (1) High Low<br />

Year ended December 31,<br />

2001 ........................................... 0.3518 0.3589 0.3819 0.3303<br />

2002 ........................................... 0.3499 0.3615 0.3940 0.3390<br />

2003 ........................................... 0.4208 0.3978 0.4299 0.3524<br />

2004 ........................................... 0.4082 0.4015 0.4272 0.3728<br />

2005 ........................................... 0.4274 0.4193 0.4400 0.4011<br />

Period<br />

January 2006 .................................... 0.4257 — 0.4283 0.4205<br />

February 2006 ................................... 0.4243 — 0.4270 0.4220<br />

March 2006 ..................................... 0.4111 — 0.4275 0.4039<br />

April 2006 ...................................... 0.4174 — 0.4211 0.4105<br />

May 2006 ...................................... 0.4028 — 0.4182 0.3991<br />

June 2006 ...................................... 0.4017 — 0.4070 0.3868<br />

(1) Determined by averaging the spot settlement rate on the last day of each month during the period.<br />

Fluctuations in the exchange rate between the Australian dollar and other currencies in which we<br />

generate revenue and expenses affect the Australian dollar amount of our profits, assets, liabilities and<br />

shareholders’ equity. See “Risk Factors—<strong>QBE</strong>’s Business Risk Factors—Our financial results are significantly<br />

affected by changes in exchange rates.”<br />

The Australian dollar is convertible into US dollars and pounds sterling at freely floating rates. Except<br />

as described below, there are currently no restrictions on the flow of currency among Australia, the United States,<br />

the United Kingdom and Jersey.<br />

Australia<br />

Transactions involving the transfer of funds or payments to, by the order of, or on behalf of prescribed<br />

entities, or any undertaking owned or controlled directly or indirectly, by prescribed entities, are not permitted<br />

without the specific approval of the Reserve Bank of Australia. Prescribed entities currently include:<br />

• supporters of the former government of the Federal Republic of Yugoslavia; and<br />

• specified Ministers and senior officials of the Government of Zimbabwe.<br />

Accounts of persons and entities identified by the Australian Minister for Foreign Affairs as being<br />

associated with terrorism can be frozen, and transactions with these persons and entities are prohibited under<br />

various Australian regulations.<br />

The Commonwealth of Australia has passed regulations to make effective the United Nations Security<br />

Council resolutions which impose a freeze on financial assets and foreign exchange dealings with certain persons<br />

and entities which currently include:<br />

• al-Qaeda, the Taliban and Osama Bin Laden and associated individuals and entities;<br />

• specified nationals of Bosnia/Serbia; and<br />

• the former Government of Iraq and its senior officials.<br />

12

Jersey<br />

United Kingdom<br />

There are no exchange control regulations in Jersey.<br />

Other than in certain emergency restrictions which may be in force from time to time, there are currently<br />

no United Kingdom foreign exchange controls or other restrictions on the export or import of capital.<br />

The foregoing summary is based upon exchange control laws and regulations now in effect and<br />

accurately interpreted and does not take into account possible changes in such laws, regulations and<br />

interpretations.<br />

13

OFFERING MEMORANDUM SUMMARY<br />

This summary highlights selected information about this offering and <strong>QBE</strong> and its subsidiaries,<br />

including the Issuer, the General Partner and <strong>QBE</strong> UK. It does not contain all of the information that may be<br />

important to you in deciding whether to purchase the <strong>Capital</strong> Securities. We encourage you to read the entire<br />

Offering Memorandum prior to deciding whether to purchase the <strong>Capital</strong> Securities. You should pay special<br />

attention to the “Risk Factors” section of this Offering Memorandum beginning on page 42 to determine whether<br />

an investment in the <strong>Capital</strong> Securities is appropriate for you.<br />

<strong>QBE</strong> <strong>Capital</strong> <strong>Funding</strong> L.P.<br />

The Issuer is a limited partnership formed under the laws of the Bailiwick of Jersey, the Channel<br />

Islands. The Issuer is not a legal entity separate from its partners and has no operating history. The general<br />

partner of the partnership will be the General Partner, a wholly owned subsidiary of <strong>QBE</strong> formed as a private<br />

limited company under the laws of the Bailiwick of Jersey, the Channel Islands. The business of the Issuer will<br />

be limited to issuing the <strong>Capital</strong> Securities, investing the proceeds of the <strong>Capital</strong> Securities in, and holding, the<br />

UK <strong>Capital</strong> Securities and engaging in only those other activities necessary or incidental thereto. Since its<br />

establishment, the Issuer has not commenced operations and has not prepared financial statements.<br />

<strong>QBE</strong> International Holdings (UK) PLC<br />

<strong>QBE</strong> UK, an indirect wholly owned subsidiary of <strong>QBE</strong>, is a public limited company incorporated under<br />

the laws of England and Wales. <strong>QBE</strong> UK is the holding company for the entities comprising our European<br />

operations, including our Lloyd’s operations. <strong>QBE</strong> UK has subordinated guaranteed floating rate notes listed on<br />

the London <strong>Stock</strong> <strong>Exchange</strong>. <strong>QBE</strong> UK’s principal executive office is located at Plantation Place, 30 Fenchurch<br />

Street, London, EC3M 3BD, United Kingdom. Its telephone number is 44-20-7105-4065. For more information<br />

on our European operations, see “Management’s Discussion and Analysis of Financial Condition and Results of<br />

Operations” and “Business.”<br />

<strong>QBE</strong> Insurance Group Limited<br />

We are Australia’s largest international general insurance and reinsurance group based on net earned<br />

premium. We underwrite commercial and personal lines business in 42 countries around the world. The<br />

following table sets forth information about our gross earned premium, net earned premium and general<br />

insurance and inward reinsurance premiums for the periods indicated.<br />

Year ended<br />

December 31,<br />

2005 2004<br />

(A$ millions except<br />

percentages, A-IFRS)<br />

Gross earned premium .............................................. 9,171 8,571<br />

Net earned premium ............................................... 7,386 6,781<br />

General insurance as a percentage of net earned premium .................. 78.2 76.4<br />

Inward reinsurance as a percentage of net earned premium ................. 21.8 23.6<br />

billion.<br />

As of December 31, 2005, our shareholders’ funds totaled A$5.1 billion and our assets totaled A$29.7<br />

14

Operations<br />

Performance<br />

Our operations are conducted through the following divisions:<br />

• Australia Pacific Asia Central Europe (APACE) consists of our operations in Australia, Asia-Pacific<br />

and Central Europe:<br />

Australian general insurance operations operates throughout Australia, providing all major lines<br />

of insurance cover for commercial and personal risks. Our principal insurance products in this<br />

division include compulsory third party motor vehicle personal injury insurance (“CTP”),<br />

professional and public liability, workers’ compensation, property, commercial packages, motor,<br />

householders’, travel, marine, aviation and trade credit;<br />

Pacific Asia Central Europe (PACE) provides personal, commercial and specialist insurance<br />

covers, including professional and general liability, marine, corporate property and trade credit in<br />

25 countries in the Asia-Pacific and Central European regions;<br />

• European operations consists of our United Kingdom and Western European operations and our<br />

Lloyd’s division (operating as Limit):<br />

<strong>QBE</strong> Insurance (Europe) provides product focused general insurance cover in the United<br />

Kingdom, Ireland, France, Spain and Germany and reinsurance business in the United Kingdom<br />

and Ireland;<br />

Lloyd’s division writes commercial insurance and reinsurance business in the Lloyd’s market.<br />

Through our acquisition of Limit plc (“Limit”) in August 2000 and our subsequent acquisitions of<br />

additional capacity in Lloyd’s syndicate 386, we are now the second largest managing agent at<br />

Lloyd’s with approximately 6.8% of Lloyd’s total market capacity for the 2006 underwriting year;<br />

• the Americas writes general insurance and reinsurance business in the Americas with headquarters in<br />

New York and operations in North, Central and South America and Bermuda;<br />

• Investments provides management of our investment funds; and<br />

• Equator Re is our captive reinsurance business based in Bermuda. (Equator Re’s intercompany<br />

transactions are eliminated upon consolidation of our overall group results. See Note 38 to our<br />

A-IFRS financial statements).<br />

Under A-IFRS, our net profit after tax, investment income (after unrealized gains/losses) and combined<br />

operating ratio were A$1,091 million, A$718 million and 89.1%, respectively, for the year ended December 31,<br />

2005 compared to A$857 million, A$519 million and 91.2%, respectively, for the year ended December 31, 2004.<br />

Under historical Australian GAAP, our net profit after tax, investment income (after unrealized gains/<br />

losses) and combined operating ratio were A$820 million, A$508 million and 91.2%, respectively, for the year<br />

ended December 31, 2004 and A$572 million, A$413 million and 93.8%, respectively, for the year ended<br />

December 31, 2003.<br />

Ratings<br />

<strong>QBE</strong> Insurance Group Limited has been assigned an A-, A3, A and bbb+ counterparty credit rating by<br />

each of Standard and Poor’s Ratings Services (“S&P”), Moody’s, Fitch and A.M. Best, respectively. Our main<br />

insurance and reinsurance subsidiaries have been assigned an A+ insurer financial strength rating by each of S&P<br />

and Fitch. Our insurance and reinsurance subsidiaries in the United States and our main insurance subsidiaries in<br />

Europe have been assigned an A rating by A.M. Best. See “Business—Ratings.”<br />

15

Recent Acquisitions<br />

During 2006 to date, we have purchased a small general aviation insurer in Denmark and hired a team of<br />

general aviation underwriters in the United Kingdom.<br />

In 2005, we acquired:<br />

• Central de Seguros in Colombia;<br />

• National Farmers Union Property and Casualty in the United States;<br />

• Greenhill underwriting agency operations in France, Germany and Spain;<br />

• MiniBus Plus underwriting agency in the UK;<br />

• British Marine Holdings, a specialist small tonnage marine underwriter;<br />

• the wholly owned business of Allianz in Vietnam; and<br />

• National Credit Insurance Brokers in Australia and New Zealand and Austral Mercantile Collections<br />

in Australia to support our trade credit operations.<br />

We paid a total of A$566 million for our acquisitions in 2005. We funded these acquisitions primarily<br />

through an increase in short-term borrowings and funds generated by operations.<br />

We have considered a number of acquisitions in recent times and are looking at a number of acquisitions<br />

in Australia, the Asia-Pacific region, the Americas and Europe. In the past 20 years, we have acquired over 90<br />

businesses or portfolios throughout the world. Our acquisition strategy has assisted our diversification by<br />

spreading our business across both general insurance and reinsurance businesses and by increasing our<br />

geographic and product spread. Our strategy as to the percentage of our business that should be general insurance<br />

or reinsurance is continuously considered according to conditions in both markets. Our acquisition strategy is<br />

driven by seeking value for our shareholders rather than focusing on specific business lines. While no major<br />

acquisitions are currently being pursued for the remainder of 2006, we will continue to review acquisition<br />

opportunities in the future.<br />

Strategy<br />

Our underwriting strategy is to achieve consistency in our underwriting results and reduce our risk of<br />

loss through:<br />

• geographic and product diversification;<br />

• selective acquisitions;<br />

• attracting and retaining quality underwriters;<br />

• ongoing actuarial assessment of premium pricing and outstanding claims reserves;<br />

• a decentralized regional operational management structure;<br />

• a group risk management strategy; and<br />

• effective use of reinsurance and retrocession protection with financially strong and highly rated<br />

reinsurers.<br />

16

The investment committee of our board of directors reviews our investment strategy at each committee<br />

meeting in respect of the investments we are permitted to make. The following table sets forth the percentage of<br />

our investments represented by cash (net of overdrafts), short-term deposits, fixed interest and other interest<br />

bearing securities, equities and investment properties for the periods indicated.<br />

Year ended December 31,<br />

2005 2004<br />

A$ % A$ %<br />

(in millions except percentages, A-IFRS)<br />

Cash (net of overdrafts) ......................................... 1,061 6.0 1,121 7.5<br />

Short-term deposits ............................................. 8,292 47.1 5,482 36.6<br />

Fixed interest and other interest bearing securities .................... 7,537 42.9 6,957 46.5<br />

Equities ...................................................... 674 3.8 1,383 9.2<br />

Investment properties ........................................... 33 0.2 32 0.2<br />

Total investments and cash ................................... 17,597 100.0 14,975 100.0<br />

We maintain a strategy of a low risk investment portfolio. Our general policy on investments is to<br />

reduce the risk to shareholders by investing in high quality fixed interest securities and having a modest exposure<br />

to equity investments. This is because of the risk we have already assumed in our insurance business.<br />

Our fixed interest investments continue to be short in duration to reduce the effect of the potential<br />

market volatility from rising interest rates. At December 31, 2005 our cash and fixed interest portfolio had an<br />

average maturity of 0.6 years with only one portfolio having an investment maturity over three years.<br />

Operational Summary<br />

Our portfolio of insurance and reinsurance business is geographically diversified, with 74% and 75% of<br />

our gross earned premium for the years ended December 31, 2005 and 2004, respectively, derived from<br />

non-Australian divisions.<br />

17

The following table sets forth information about the gross earned premium for each of our insurance<br />

divisions and our insurance product lines for the periods indicated.<br />

Year ended December 31,<br />

2005 2004<br />

A$ % A$ %<br />

(in millions except percentages, A-IFRS)<br />

Division(1)<br />

Australian general insurance operations ......................... 2,405 26.2 2,114 24.7<br />

Pacific Asia Central Europe (PACE) ........................... 688 7.5 684 8.0<br />

Australia Pacific Asia Central Europe (APACE) ...................... 3,093 33.7 2,798 32.7<br />

<strong>QBE</strong> Insurance (Europe) .................................... 2,370 25.8 2,154 25.1<br />

Lloyd’s division ........................................... 2,273 24.8 2,265 26.4<br />

European operations ............................................ 4,643 50.6 4,419 51.5<br />

the Americas .................................................. 1,435 15.7 1,354 15.8<br />

Total .................................................... 9,171 100.0 8,571 100.0<br />

Product lines<br />

Property(2) ................................................... 2,632 28.7 2,563 29.9<br />

Liability(3) ................................................... 2,008 21.9 1,868 21.8<br />

Motor and motor casualty(4) ..................................... 1,256 13.7 1,054 12.3<br />

Professional indemnity .......................................... 835 9.1 814 9.5<br />

Workers’ compensation(5) ....................................... 816 8.9 823 9.6<br />

Marine and aviation ............................................ 578 6.3 566 6.6<br />

Accident and health ............................................ 569 6.2 523 6.1<br />

Financial and credit ............................................ 229 2.5 206 2.4<br />

Other(6) ..................................................... 248 2.7 154 1.8<br />

Total .................................................... 9,171 100.0 8,571 100.0<br />

General insurance .............................................. 7,076 77.2 6,583 76.8<br />

Inward reinsurance(7) ........................................... 2,095 22.8 1,988 23.2<br />

Total .................................................... 9,171 100.0 8,571 100.0<br />

(1) We have not presented information on Equator Re separately because its gross earned premium is<br />

eliminated upon consolidation of our overall group results. See Note 38 to our A-IFRS financial statements.<br />

(2) Includes property excess of loss, engineering, war and energy.<br />

(3) Includes medical malpractice and general, public and product liability.<br />

(4) Includes CTP.<br />