- Page 1 and 2:

OFFERING MEMORANDUM £300,000,000 Q

- Page 3 and 4:

SPECIAL NOTE REGARDING FORWARD-LOOK

- Page 5 and 6:

Interest Payment Date and no QBE Au

- Page 7 and 8:

• “Issuer” means QBE Capital

- Page 9 and 10:

elevant payment by QBE UK (or at th

- Page 11 and 12:

FINANCIAL INFORMATION PRESENTATION

- Page 13 and 14:

EXCHANGE RATES AND CONTROLS For you

- Page 15 and 16:

Jersey United Kingdom There are no

- Page 17 and 18:

Operations Performance Our operatio

- Page 19 and 20:

The investment committee of our boa

- Page 21 and 22:

As at December 31, 2005, 54% of our

- Page 23 and 24:

Years ended December 31, 2005 and 2

- Page 25 and 26:

Years ended December 31, 2004, 2003

- Page 27 and 28:

THE OFFERING Capital Securities ...

- Page 29 and 30:

those distributions (including any

- Page 31 and 32:

for such failure is the failure of

- Page 33 and 34:

Securities will be exchanged for QB

- Page 35 and 36:

anks senior or equal to the QBE Pre

- Page 37 and 38:

unless and until, • in the case o

- Page 39 and 40:

excluding the date of liquidation,

- Page 41 and 42:

Definitive certificates will not be

- Page 43 and 44:

TRANSACTION DIAGRAM 41

- Page 45 and 46:

substantial fall in the equity mark

- Page 47 and 48:

Changes in government policy, regul

- Page 49 and 50:

There can be no assurance that we w

- Page 51 and 52:

Furthermore, our right to participa

- Page 53 and 54:

Our obligations will be deeply subo

- Page 55 and 56:

that, if the Exchange Event is the

- Page 57 and 58:

You will not be able to participate

- Page 59 and 60:

QBE CAPITAL FUNDING LP The Issuer i

- Page 61 and 62:

USE OF PROCEEDS On the Closing Date

- Page 63 and 64:

RATIOS OF EARNINGS TO FIXED CHARGES

- Page 65 and 66:

Year ended December 31, 2005 2005 2

- Page 67 and 68:

Year ended December 31, 2005 2005 2

- Page 69 and 70:

Year ended December 31, 2004 2003 2

- Page 71 and 72:

(5) Combined operating ratio is cal

- Page 73 and 74:

• the Americas; and • Investmen

- Page 75 and 76:

similar to cash flow hedges. The ga

- Page 77 and 78:

driven by seeking value for our sha

- Page 79 and 80:

Year ended December 31, 2005 2004 (

- Page 81 and 82:

We translate income and expense ite

- Page 83 and 84:

PACE. A$536 million compared to A$5

- Page 85 and 86:

atio decreased to 10.6% for 2005 fr

- Page 87 and 88:

• the Americas division had a net

- Page 89 and 90:

strong premium rate increases and i

- Page 91 and 92:

Profit Before Income Tax As a resul

- Page 93 and 94:

incentives not to convert their LYO

- Page 95 and 96:

and at the balance date. The fair v

- Page 97 and 98:

Credit risk The credit risk on our

- Page 99 and 100:

BUSINESS Overview We are Australia

- Page 101 and 102:

Recent Acquisitions During 2006 to

- Page 103 and 104:

(1) Includes property excess of los

- Page 105 and 106:

exposure to terrorism risks. Many g

- Page 107 and 108:

any particular agent. Certain broke

- Page 109 and 110:

As part of our strategy to rational

- Page 111 and 112:

General Insurance From the late 199

- Page 113 and 114:

In November 2003 and 2004, we restr

- Page 115 and 116:

Investments We manage our worldwide

- Page 117 and 118:

among operating regions and delegat

- Page 119 and 120:

information to estimate the IBNR li

- Page 121 and 122:

Year ended December 31, 2005 Curren

- Page 123 and 124:

growth opportunities; marketing and

- Page 125 and 126:

Employees As of December 31, 2005 w

- Page 127 and 128:

• regardless of the method used t

- Page 129 and 130:

understand APRA presently intends f

- Page 131 and 132:

• insurance agents who provide in

- Page 133 and 134:

foreign insurers and their operatio

- Page 135 and 136:

Regulatory Reporting. Our London Ma

- Page 137 and 138:

Investigation and Intervention. The

- Page 139 and 140:

usiness, rates for insurance busine

- Page 141 and 142:

Until the full extent of the integr

- Page 143 and 144:

OUR BOARD AND MANAGEMENT Overview O

- Page 145 and 146:

May 1990 until March 2001. Mr. Blea

- Page 147 and 148:

Investment Committee The membership

- Page 149 and 150:

A$1.5 million. Such fees are apport

- Page 151 and 152:

Executive Officers The following ta

- Page 153 and 154:

(3) “Other” includes the deemed

- Page 155 and 156:

DESCRIPTION OF THE CAPITAL SECURITI

- Page 157 and 158:

Business Day, the distribution othe

- Page 159 and 160:

set at the absolute discretion of A

- Page 161 and 162:

Management Office in the paper “F

- Page 163 and 164:

See “Description of the Capital S

- Page 165 and 166:

stamp duty payable to the Australia

- Page 167 and 168:

and privileges of the Capital Secur

- Page 169 and 170:

edemption or liquidation payment un

- Page 171 and 172:

Prior to the expiration of the 40th

- Page 173 and 174:

Redemption and exchange notices wil

- Page 175 and 176:

Under the Capital Securities Guaran

- Page 177 and 178:

the Capital Securities—Limitation

- Page 179 and 180:

The holders of a majority of the ag

- Page 181 and 182:

• any payment or declaration of a

- Page 183 and 184:

with, or will be exempt from, any s

- Page 185 and 186:

Notwithstanding whether or not QBE

- Page 187 and 188:

The “UK Capital Securities Make W

- Page 189 and 190:

exceptions as would apply with resp

- Page 191 and 192:

Limitations on Issuance If the Exch

- Page 193 and 194:

Payment Date during a 12 consecutiv

- Page 195 and 196:

Securities Make Whole Redemption Pr

- Page 197 and 198:

edemption, buy-back or cancellation

- Page 199 and 200:

or junior to the QBE Preferred Secu

- Page 201 and 202:

TAXATION Certain United States Fede

- Page 203 and 204:

Redemption of the UK Capital Securi

- Page 205 and 206:

Foreign Currency Rules The US tax r

- Page 207 and 208:

eportable event, (ii) the US holder

- Page 209 and 210:

them by the Issuer. Australian inco

- Page 211 and 212:

Certain United Kingdom Tax Conseque

- Page 213 and 214:

No UK SDRT will be payable on an ag

- Page 215 and 216:

ERISA CONSIDERATIONS To ensure comp

- Page 217 and 218:

If the Initial Purchasers create a

- Page 219 and 220:

(iv) no prospectus or product discl

- Page 221 and 222:

any transfer of interests in the Re

- Page 223 and 224:

INVESTED (COLLECTIVELY, A “PLAN

- Page 225 and 226:

LEGAL MATTERS The validity of the C

- Page 227 and 228:

INDEX TO FINANCIAL STATEMENTS QBE I

- Page 229 and 230:

Directors’ report continued FOR T

- Page 231 and 232:

Directors’ report continued FOR T

- Page 233 and 234:

Directors’ report continued FOR T

- Page 235 and 236:

Directors’ report continued FOR T

- Page 237 and 238:

Directors’ report continued FOR T

- Page 239 and 240:

Directors’ report continued FOR T

- Page 241 and 242:

Directors’ report continued FOR T

- Page 243 and 244:

Balance sheets AS AT 31 DECEMBER 20

- Page 245 and 246:

Statements of cash flows FOR THE YE

- Page 247 and 248:

Notes to the financial statements c

- Page 249 and 250:

Notes to the financial statements c

- Page 251 and 252:

Notes to the financial statements c

- Page 253 and 254:

Notes to the financial statements c

- Page 255 and 256:

Notes to the financial statements c

- Page 257 and 258:

Notes to the financial statements c

- Page 259 and 260:

Notes to the financial statements c

- Page 261 and 262:

Notes to the financial statements c

- Page 263 and 264:

Notes to the financial statements c

- Page 265 and 266:

Notes to the financial statements c

- Page 267 and 268:

Notes to the financial statements c

- Page 269 and 270:

Notes to the financial statements c

- Page 271 and 272:

Notes to the financial statements c

- Page 273 and 274:

Notes to the financial statements c

- Page 275 and 276:

Notes to the financial statements c

- Page 277 and 278:

Notes to the financial statements c

- Page 279 and 280:

Notes to the financial statements c

- Page 281 and 282:

Notes to the financial statements c

- Page 283 and 284:

Notes to the financial statements c

- Page 285 and 286:

Notes to the financial statements c

- Page 287 and 288:

Notes to the financial statements c

- Page 289 and 290:

Notes to the financial statements c

- Page 291 and 292:

Notes to the financial statements c

- Page 293 and 294:

Notes to the financial statements c

- Page 295 and 296:

Notes to the financial statements c

- Page 297 and 298:

Notes to the financial statements c

- Page 299 and 300:

Notes to the financial statements c

- Page 301 and 302:

Notes to the financial statements c

- Page 303 and 304:

Notes to the financial statements c

- Page 305 and 306:

Notes to the financial statements c

- Page 307 and 308:

Notes to the financial statements c

- Page 309 and 310:

Independent audit report TO THE MEM

- Page 311 and 312:

DIRECTORS’ REPORT FOR THE YEAR EN

- Page 313 and 314:

DIRECTORS’ REPORT FOR THE YEAR EN

- Page 315 and 316: Statements of financial position AS

- Page 317 and 318: Notes to the financial statements F

- Page 319 and 320: NOTES TO THE FINANCIAL STATEMENTS F

- Page 321 and 322: NOTES TO THE FINANCIAL STATEMENTS F

- Page 323 and 324: NOTES TO THE FINANCIAL STATEMENTS F

- Page 325 and 326: NOTES TO THE FINANCIAL STATEMENTS F

- Page 327 and 328: NOTES TO THE FINANCIAL STATEMENTS F

- Page 329 and 330: NOTES TO THE FINANCIAL STATEMENTS F

- Page 331 and 332: NOTES TO THE FINANCIAL STATEMENTS F

- Page 333 and 334: NOTES TO THE FINANCIAL STATEMENTS F

- Page 335 and 336: NOTES TO THE FINANCIAL STATEMENTS F

- Page 337 and 338: NOTES TO THE FINANCIAL STATEMENTS F

- Page 339 and 340: NOTES TO THE FINANCIAL STATEMENTS F

- Page 341 and 342: NOTES TO THE FINANCIAL STATEMENTS F

- Page 343 and 344: NOTES TO THE FINANCIAL STATEMENTS F

- Page 345 and 346: NOTES TO THE FINANCIAL STATEMENTS F

- Page 347 and 348: NOTES TO THE FINANCIAL STATEMENTS F

- Page 349 and 350: NOTES TO THE FINANCIAL STATEMENTS F

- Page 351 and 352: NOTES TO THE FINANCIAL STATEMENTS F

- Page 353 and 354: NOTES TO THE FINANCIAL STATEMENTS F

- Page 355 and 356: NOTES TO THE FINANCIAL STATEMENTS F

- Page 357 and 358: NOTES TO THE FINANCIAL STATEMENTS F

- Page 359 and 360: NOTES TO THE FINANCIAL STATEMENTS F

- Page 361 and 362: NOTES TO THE FINANCIAL STATEMENTS F

- Page 363 and 364: Directors’ declaration The direct

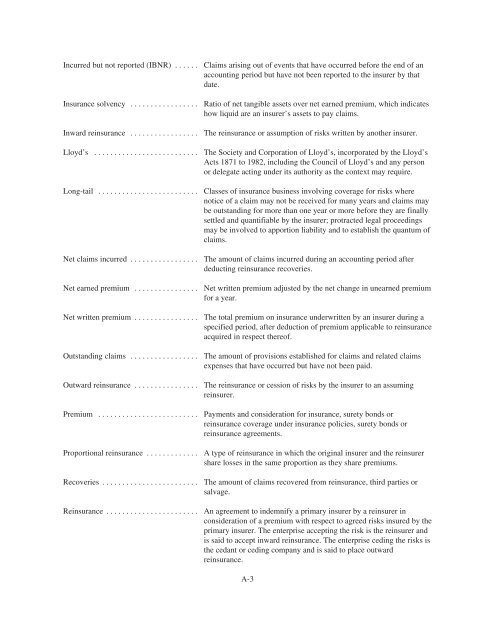

- Page 365: APPENDIX A: GLOSSARY TO CERTAIN INS

- Page 369: £300,000,000 QBE Capital Funding L