SUPPLEMENTAL INFORMATION MEMORANDUM XENON ...

SUPPLEMENTAL INFORMATION MEMORANDUM XENON ...

SUPPLEMENTAL INFORMATION MEMORANDUM XENON ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

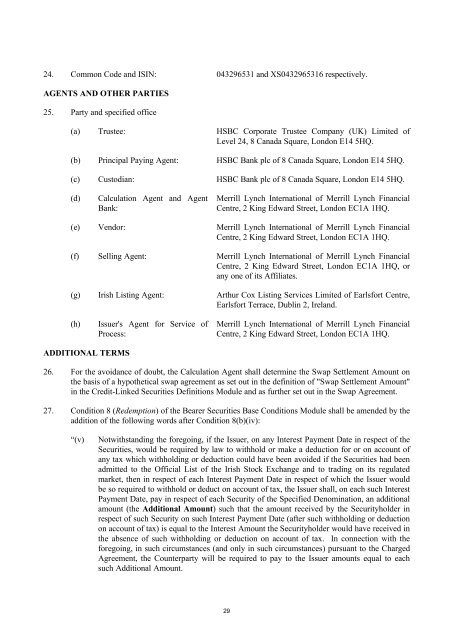

24. Common Code and ISIN: 043296531 and XS0432965316 respectively.<br />

AGENTS AND OTHER PARTIES<br />

25. Party and specified office<br />

(a) Trustee: HSBC Corporate Trustee Company (UK) Limited of<br />

Level 24, 8 Canada Square, London E14 5HQ.<br />

(b) Principal Paying Agent: HSBC Bank plc of 8 Canada Square, London E14 5HQ.<br />

(c) Custodian: HSBC Bank plc of 8 Canada Square, London E14 5HQ.<br />

(d)<br />

Calculation Agent and Agent<br />

Bank:<br />

Merrill Lynch International of Merrill Lynch Financial<br />

Centre, 2 King Edward Street, London EC1A 1HQ.<br />

(e) Vendor: Merrill Lynch International of Merrill Lynch Financial<br />

Centre, 2 King Edward Street, London EC1A 1HQ.<br />

(f) Selling Agent: Merrill Lynch International of Merrill Lynch Financial<br />

Centre, 2 King Edward Street, London EC1A 1HQ, or<br />

any one of its Affiliates.<br />

(g) Irish Listing Agent: Arthur Cox Listing Services Limited of Earlsfort Centre,<br />

Earlsfort Terrace, Dublin 2, Ireland.<br />

(h)<br />

Issuer's Agent for Service of<br />

Process:<br />

Merrill Lynch International of Merrill Lynch Financial<br />

Centre, 2 King Edward Street, London EC1A 1HQ.<br />

ADDITIONAL TERMS<br />

26. For the avoidance of doubt, the Calculation Agent shall determine the Swap Settlement Amount on<br />

the basis of a hypothetical swap agreement as set out in the definition of "Swap Settlement Amount"<br />

in the Credit-Linked Securities Definitions Module and as further set out in the Swap Agreement.<br />

27. Condition 8 (Redemption) of the Bearer Securities Base Conditions Module shall be amended by the<br />

addition of the following words after Condition 8(b)(iv):<br />

“(v)<br />

Notwithstanding the foregoing, if the Issuer, on any Interest Payment Date in respect of the<br />

Securities, would be required by law to withhold or make a deduction for or on account of<br />

any tax which withholding or deduction could have been avoided if the Securities had been<br />

admitted to the Official List of the Irish Stock Exchange and to trading on its regulated<br />

market, then in respect of each Interest Payment Date in respect of which the Issuer would<br />

be so required to withhold or deduct on account of tax, the Issuer shall, on each such Interest<br />

Payment Date, pay in respect of each Security of the Specified Denomination, an additional<br />

amount (the Additional Amount) such that the amount received by the Securityholder in<br />

respect of such Security on such Interest Payment Date (after such withholding or deduction<br />

on account of tax) is equal to the Interest Amount the Securityholder would have received in<br />

the absence of such withholding or deduction on account of tax. In connection with the<br />

foregoing, in such circumstances (and only in such circumstances) pursuant to the Charged<br />

Agreement, the Counterparty will be required to pay to the Issuer amounts equal to each<br />

such Additional Amount.<br />

29