JPMORGAN CHASE & CO. - Irish Stock Exchange

JPMORGAN CHASE & CO. - Irish Stock Exchange

JPMORGAN CHASE & CO. - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(g)<br />

Definitions<br />

For the purposes of these Conditions:<br />

“Business Day” means a day which is both:<br />

(A)<br />

(B)<br />

a day on which commercial banks and foreign exchange markets settle payments and are open for<br />

general business (including dealing in foreign exchange and foreign currency deposits) in London and<br />

any Additional Business Centre specified in the applicable Final Terms or Prospectus; and<br />

either (1) in relation to any sum payable in a Specified Currency other than euro, a day on which<br />

commercial banks and foreign exchange markets settle payments and are open for general business<br />

(including dealing in foreign exchange and foreign currency deposits) in the principal financial centre<br />

of the country of the relevant Specified Currency (if other than London and any Additional Business<br />

Centre and which if the Specified Currency is Australian dollars or New Zealand dollars shall be<br />

Sydney or Auckland, respectively) or (2) in relation to any sum payable in euro, a day on which<br />

Trans-European Automated Real-Time Gross Settlement Express Transfer (TARGET) System which<br />

utilises a single shared platform and which was established on 19 November 2007, or any successor<br />

thereto (the “TARGET2 System”) is open.<br />

“Day Count Fraction” means, in respect of the calculation of an amount of interest for any Interest Period:<br />

(i)<br />

(ii)<br />

(iii)<br />

(iv)<br />

if “Actual/Actual” or “Actual/Actual — ISDA” is specified in the applicable Final Terms, the actual<br />

number of days in the Interest Period divided by 365 (or, if any portion of that Interest Period falls in a<br />

leap year, the sum of (A) the actual number of days in that portion of the Interest Period falling in a<br />

leap year divided by 366 and (B) the actual number of days in that portion of the Interest Period falling<br />

in a non-leap year divided by 365);<br />

if “Actual/365 (Fixed)” is specified in the applicable Final Terms, the actual number of days in the<br />

Interest Period divided by 365;<br />

if “Actual/360” is specified in the applicable Final Terms, the actual number of days in the Interest<br />

Period divided by 360;<br />

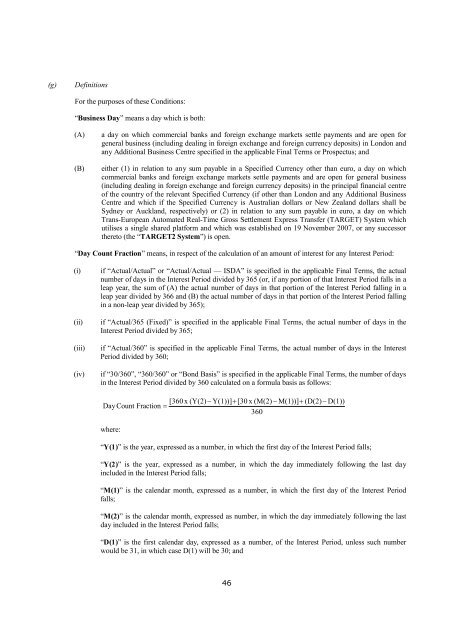

if “30/360”, “360/360” or “Bond Basis” is specified in the applicable Final Terms, the number of days<br />

in the Interest Period divided by 360 calculated on a formula basis as follows:<br />

[360 x (Y(2)-<br />

Y(1))] + [30 x (M(2) - M(1))] + (D(2)-<br />

D(1))<br />

Day Count Fraction =<br />

360<br />

where:<br />

“Y(1)” is the year, expressed as a number, in which the first day of the Interest Period falls;<br />

“Y(2)” is the year, expressed as a number, in which the day immediately following the last day<br />

included in the Interest Period falls;<br />

“M(1)” is the calendar month, expressed as a number, in which the first day of the Interest Period<br />

falls;<br />

“M(2)” is the calendar month, expressed as number, in which the day immediately following the last<br />

day included in the Interest Period falls;<br />

“D(1)” is the first calendar day, expressed as a number, of the Interest Period, unless such number<br />

would be 31, in which case D(1) will be 30; and<br />

46