New York Life Global Funding - Irish Stock Exchange

New York Life Global Funding - Irish Stock Exchange

New York Life Global Funding - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

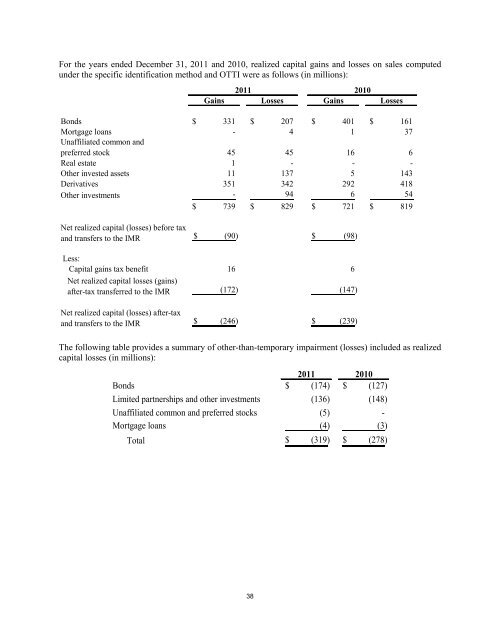

For the years ended December 31, 2011 and 2010, realized capital gains and losses on sales computed<br />

under the specific identification method and OTTI were as follows (in millions):<br />

2011 2010<br />

Gains Losses Gains Losses<br />

Bonds $ 331 $ 207 $ 401 $ 161<br />

Mortgage loans - 4 1 37<br />

Unaffiliated common and<br />

preferred stock 45 45 16 6<br />

Real estate 1 - - -<br />

Other invested assets 11 137 5 143<br />

Derivatives 351 342 292 418<br />

Other investments - 94 6 54<br />

$ 739 $ 829 $ 721 $ 819<br />

Net realized capital (losses) before tax<br />

and transfers to the IMR $ (90)<br />

$ (98)<br />

Less:<br />

Capital gains tax benefit 16 6<br />

Net realized capital losses (gains)<br />

after-tax transferred to the IMR<br />

(172) (147)<br />

Net realized capital (losses) after-tax<br />

and transfers to the IMR $ (246)<br />

$ (239)<br />

The following table provides a summary of other-than-temporary impairment (losses) included as realized<br />

capital losses (in millions):<br />

2011 2010<br />

Bonds $ (174) $ (127)<br />

Limited partnerships and other investments (136) (148)<br />

Unaffiliated common and preferred stocks (5) -<br />

Mortgage loans (4) (3)<br />

Total $ (319) $ (278)<br />

38