New York Life Global Funding - Irish Stock Exchange

New York Life Global Funding - Irish Stock Exchange

New York Life Global Funding - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

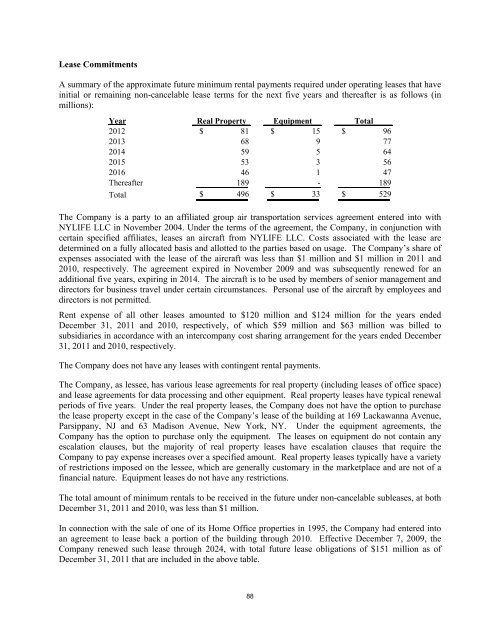

Lease Commitments<br />

A summary of the approximate future minimum rental payments required under operating leases that have<br />

initial or remaining non-cancelable lease terms for the next five years and thereafter is as follows (in<br />

millions):<br />

Year Real Property Equipment Total<br />

2012 $ 81 $ 15 $ 96<br />

2013 68 9 77<br />

2014 59 5 64<br />

2015 53 3 56<br />

2016 46 1 47<br />

Thereafter 189 - 189<br />

Total $ 496 $ 33 $ 529<br />

The Company is a party to an affiliated group air transportation services agreement entered into with<br />

NYLIFE LLC in November 2004. Under the terms of the agreement, the Company, in conjunction with<br />

certain specified affiliates, leases an aircraft from NYLIFE LLC. Costs associated with the lease are<br />

determined on a fully allocated basis and allotted to the parties based on usage. The Company’s share of<br />

expenses associated with the lease of the aircraft was less than $1 million and $1 million in 2011 and<br />

2010, respectively. The agreement expired in November 2009 and was subsequently renewed for an<br />

additional five years, expiring in 2014. The aircraft is to be used by members of senior management and<br />

directors for business travel under certain circumstances. Personal use of the aircraft by employees and<br />

directors is not permitted.<br />

Rent expense of all other leases amounted to $120 million and $124 million for the years ended<br />

December 31, 2011 and 2010, respectively, of which $59 million and $63 million was billed to<br />

subsidiaries in accordance with an intercompany cost sharing arrangement for the years ended December<br />

31, 2011 and 2010, respectively.<br />

The Company does not have any leases with contingent rental payments.<br />

The Company, as lessee, has various lease agreements for real property (including leases of office space)<br />

and lease agreements for data processing and other equipment. Real property leases have typical renewal<br />

periods of five years. Under the real property leases, the Company does not have the option to purchase<br />

the lease property except in the case of the Company’s lease of the building at 169 Lackawanna Avenue,<br />

Parsippany, NJ and 63 Madison Avenue, <strong>New</strong> <strong>York</strong>, NY. Under the equipment agreements, the<br />

Company has the option to purchase only the equipment. The leases on equipment do not contain any<br />

escalation clauses, but the majority of real property leases have escalation clauses that require the<br />

Company to pay expense increases over a specified amount. Real property leases typically have a variety<br />

of restrictions imposed on the lessee, which are generally customary in the marketplace and are not of a<br />

financial nature. Equipment leases do not have any restrictions.<br />

The total amount of minimum rentals to be received in the future under non-cancelable subleases, at both<br />

December 31, 2011 and 2010, was less than $1 million.<br />

In connection with the sale of one of its Home Office properties in 1995, the Company had entered into<br />

an agreement to lease back a portion of the building through 2010. Effective December 7, 2009, the<br />

Company renewed such lease through 2024, with total future lease obligations of $151 million as of<br />

December 31, 2011 that are included in the above table.<br />

88