New York Life Global Funding - Irish Stock Exchange

New York Life Global Funding - Irish Stock Exchange

New York Life Global Funding - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

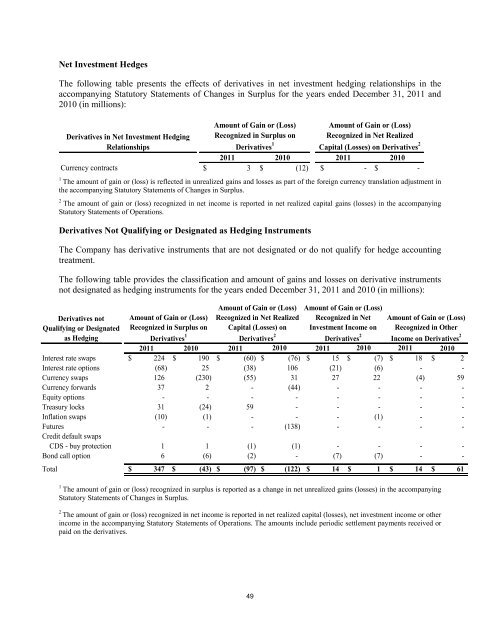

Net Investment Hedges<br />

The following table presents the effects of derivatives in net investment hedging relationships in the<br />

accompanying Statutory Statements of Changes in Surplus for the years ended December 31, 2011 and<br />

2010 (in millions):<br />

Derivatives in Net Investment Hedging<br />

Relationships<br />

Currency contracts 3<br />

Amount of Gain or (Loss)<br />

Recognized in Surplus on<br />

Derivatives 1<br />

Amount of Gain or (Loss)<br />

Recognized in Net Realized<br />

Capital (Losses) on Derivatives 2<br />

2011 2010 2011 2010<br />

$ $ (12) $ - $<br />

-<br />

1<br />

The amount of gain or (loss) is reflected in unrealized gains and losses as part of the foreign currency translation adjustment in<br />

the accompanying Statutory Statements of Changes in Surplus.<br />

2<br />

The amount of gain or (loss) recognized in net income is reported in net realized capital gains (losses) in the accompanying<br />

Statutory Statements of Operations.<br />

Derivatives Not Qualifying or Designated as Hedging Instruments<br />

The Company has derivative instruments that are not designated or do not qualify for hedge accounting<br />

treatment.<br />

The following table provides the classification and amount of gains and losses on derivative instruments<br />

not designated as hedging instruments for the years ended December 31, 2011 and 2010 (in millions):<br />

Amount of Gain or (Loss)<br />

Recognized in Net Realized<br />

Capital (Losses) on<br />

Amount of Gain or (Loss)<br />

Recognized in Net<br />

Investment Income on<br />

Derivatives not<br />

Qualifying or Designated<br />

as Hedging<br />

Amount of Gain or (Loss)<br />

Recognized in Surplus on<br />

Derivatives 1<br />

Derivatives 2<br />

Derivatives 2<br />

Amount of Gain or (Loss)<br />

Recognized in Other<br />

Income on Derivatives 2<br />

2011 2010 2011 2010 2011 2010 2011 2010<br />

Interest rate swaps $ 224 $ 190 $ (60) $ (76) $ 15 $ (7) $ 18 $ 2<br />

Interest rate options (68) 25 (38) 106 (21) (6) - -<br />

Currency swaps 126 (230) (55) 31 27 22 (4) 59<br />

Currency forwards 37 2 - (44) - - - -<br />

Equity options - - - - - - - -<br />

Treasury locks 31 (24) 59 - - - - -<br />

Inflation swaps (10) (1) - - - (1) - -<br />

Futures - - - (138) - - - -<br />

Credit default swaps<br />

CDS - buy protection 1 1 (1) (1) - - - -<br />

Bond call option 6 (6) (2) - (7) (7) - -<br />

Total $ 347 $ (43) $ (97) $ (122) $ 14 $ 1 $ 14 $ 61<br />

1<br />

The amount of gain or (loss) recognized in surplus is reported as a change in net unrealized gains (losses) in the accompanying<br />

Statutory Statements of Changes in Surplus.<br />

2<br />

The amount of gain or (loss) recognized in net income is reported in net realized capital (losses), net investment income or other<br />

income in the accompanying Statutory Statements of Operations. The amounts include periodic settlement payments received or<br />

paid on the derivatives.<br />

49