Monopoly, Monopolistic Competition, Oligopoly, and Optimal Choice ...

Monopoly, Monopolistic Competition, Oligopoly, and Optimal Choice ...

Monopoly, Monopolistic Competition, Oligopoly, and Optimal Choice ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

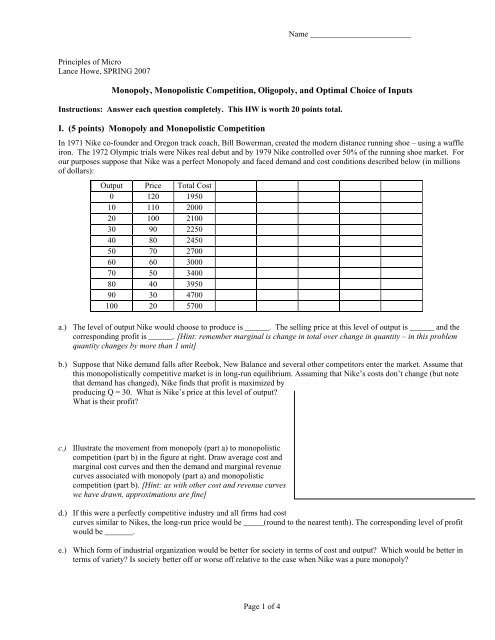

Name _________________________<br />

Principles of Micro<br />

Lance Howe, SPRING 2007<br />

<strong>Monopoly</strong>, <strong>Monopolistic</strong> <strong>Competition</strong>, <strong>Oligopoly</strong>, <strong>and</strong> <strong>Optimal</strong> <strong>Choice</strong> of Inputs<br />

Instructions: Answer each question completely. This HW is worth 20 points total.<br />

I. (5 points) <strong>Monopoly</strong> <strong>and</strong> <strong>Monopolistic</strong> <strong>Competition</strong><br />

In 1971 Nike co-founder <strong>and</strong> Oregon track coach, Bill Bowerman, created the modern distance running shoe – using a waffle<br />

iron. The 1972 Olympic trials were Nikes real debut <strong>and</strong> by 1979 Nike controlled over 50% of the running shoe market. For<br />

our purposes suppose that Nike was a perfect <strong>Monopoly</strong> <strong>and</strong> faced dem<strong>and</strong> <strong>and</strong> cost conditions described below (in millions<br />

of dollars):<br />

Output Price Total Cost<br />

0 120 1950<br />

10 110 2000<br />

20 100 2100<br />

30 90 2250<br />

40 80 2450<br />

50 70 2700<br />

60 60 3000<br />

70 50 3400<br />

80 40 3950<br />

90 30 4700<br />

100 20 5700<br />

a.) The level of output Nike would choose to produce is ______. The selling price at this level of output is ______ <strong>and</strong> the<br />

corresponding profit is ______. [Hint: remember marginal is change in total over change in quantity – in this problem<br />

quantity changes by more than 1 unit]<br />

b.) Suppose that Nike dem<strong>and</strong> falls after Reebok, New Balance <strong>and</strong> several other competitors enter the market. Assume that<br />

this monopolistically competitive market is in long-run equilibrium. Assuming that Nike’s costs don’t change (but note<br />

that dem<strong>and</strong> has changed), Nike finds that profit is maximized by<br />

producing Q = 30. What is Nike’s price at this level of output?<br />

What is their profit?<br />

c.) Illustrate the movement from monopoly (part a) to monopolistic<br />

competition (part b) in the figure at right. Draw average cost <strong>and</strong><br />

marginal cost curves <strong>and</strong> then the dem<strong>and</strong> <strong>and</strong> marginal revenue<br />

curves associated with monopoly (part a) <strong>and</strong> monopolistic<br />

competition (part b). [Hint: as with other cost <strong>and</strong> revenue curves<br />

we have drawn, approximations are fine]<br />

d.) If this were a perfectly competitive industry <strong>and</strong> all firms had cost<br />

curves similar to Nikes, the long-run price would be _____(round to the nearest tenth). The corresponding level of profit<br />

would be _______.<br />

e.) Which form of industrial organization would be better for society in terms of cost <strong>and</strong> output? Which would be better in<br />

terms of variety? Is society better off or worse off relative to the case when Nike was a pure monopoly?<br />

Page 1 of 4

II. (5 points) <strong>Monopolistic</strong> <strong>Competition</strong><br />

In Santa Monica there are seven bathing suit stores, each with the same schedule of costs <strong>and</strong> each facing an<br />

identical dem<strong>and</strong> curve. Swim N Style is a typical store that faces the dem<strong>and</strong> schedule <strong>and</strong> total costs shown<br />

below.<br />

Output Price Total<br />

Cost<br />

1 68 70<br />

2 66 80<br />

3 64 85<br />

4 62 90<br />

5 60 100<br />

6 58 115<br />

7 56 136<br />

8 54 164<br />

9 52 200<br />

10 50 245<br />

a. Using the blank columns, calculate total cost, marginal cost, average cost, total revenue, <strong>and</strong> marginal revenue<br />

at each level of sales.<br />

b. If Swim N Style is a profit maximizer, it sells ___ suits per hour. It’s price will be ___ <strong>and</strong> the corresponding<br />

profit will be ___.<br />

c. Is the Santa Monica bathing suit industry in long run equilibrium? Why or why not?<br />

d. What will happen in the industry over the next few years?<br />

Now suppose that seventeen new bathing suit stores enter the market, joining the seven that already existed. As a<br />

consequence, the dem<strong>and</strong> schedule facing Swim N Style (<strong>and</strong> all other stores) falls, while the cost schedules<br />

remain constant.<br />

Output Price Total<br />

Cost<br />

1 31.5 70<br />

2 28.5 80<br />

3 25.5 85<br />

4 22.5 90<br />

5 19.5 100<br />

6 16.5 115<br />

7 13.5 136<br />

8 10.5 164<br />

9 7.5 200<br />

10 4.5 245<br />

d. What number of suits will Swim N Style sell now?<br />

e. What price will Swim <strong>and</strong> Style charge? What will the level of profits be?<br />

f. Is the market in long-run equilibrium now? Explain.<br />

Page 2 of 4

III. (5 points) <strong>Oligopoly</strong> <strong>and</strong> Game Theory<br />

United <strong>and</strong> Continental are competing for holiday travelers on the Los Angeles-Chicago airline route. This is a<br />

market that can be described as oligopolistic: it has high barriers to entry <strong>and</strong> low variable costs of production. If<br />

each firm charges a high price each firm will earn profits of $300 million each. However, if one airline charges a<br />

low price while the other charges a high price the airline charging the low price earns profits of $440 million<br />

while the airline charging a high price earns profits of $100 million. If both airlines charge low prices they will<br />

make profits of $125 million.<br />

a. In the space below set up a payoff matrix for Continental <strong>and</strong> United.<br />

b. If United knows that Continental will charge a high price, <strong>and</strong> it has no reason to be concerned about<br />

retaliation, what is United’s best response?<br />

c. If Continental knows that United will charge a high price, <strong>and</strong> it has no reason to be concerned about<br />

retaliation, what is Continental’s best response?<br />

d. Find the Nash equilibrium for the game described above <strong>and</strong> briefly explain why it provides a solution to the<br />

game.<br />

e. From the results above, is (High Price, High Price) a stable equilibrium? What does this imply about the ability<br />

of firms to collude?<br />

f. How could your answers be different if this game were repeated several times?<br />

Page 3 of 4

IV. (5 points) <strong>Monopoly</strong> <strong>and</strong> <strong>Monopoly</strong> Power<br />

Suppose that Marlin, of Marlin’s Monster Fish Trips, is a the single provider of local fish trips in the city of<br />

Oxnard. His company provides day-long fish trips at the following prices <strong>and</strong> costs:<br />

Q S TC MC<br />

New<br />

MC<br />

AC P Q D TR MR<br />

0 40 100 0<br />

1 48 90 1<br />

2 62 80 2<br />

3 110 70 3<br />

4 170 60 4<br />

5 240 50 5<br />

a. The number of trips Marlin would choose to provide is ____. The selling price at this level of output is _____<br />

<strong>and</strong> the corresponding profit is ______.<br />

b. If all firms have cost curves similar to Marlin’s <strong>and</strong> this industry were characterized by perfect competition,<br />

what would be the long-run price?<br />

c. Suppose that Oxnard city counsel members are upset at Martin’s monopoly primarily because he is restricting<br />

the number of fishing trips relative to the number the counsel believes would be optimal. After some consultation<br />

the counsel decides to tax Marlin’s profits a flat 50%. They reason that he will need to provide more trips in order<br />

to increase his profits to the level they were before the tax. How many trips does Martin now provide? What will<br />

be the daily amount of Oxnard’s tax revenue? Does the counsel succeed in its goal of increasing Marlin’s output?<br />

d. After reviewing Marlin’s behavior, the city decides to eliminate the flat tax <strong>and</strong> imposes a “fishing tax” of $50<br />

per boat trip on Marlin. What is Marlin’s new level of output <strong>and</strong> price (Hint: Marlin’s cost per trip is increased<br />

by the amount of the tax)? What is the amount of the new tax revenue for the city? Again, has the city achieved<br />

its goal of increasing Marlins output?<br />

e. Disheartened in the effectiveness of the taxes the counsel decides to adopt a proposal that encourages entrants<br />

into the Oxnard fishing industry. All taxes are eliminated, <strong>and</strong> by the next year several fishing companies have<br />

opened. Suppose that the industry is now best characterized by monopolistic competition <strong>and</strong> is in long-run<br />

equilibrium. If Marlin is producing at a profit maximizing output level of 1 trip what price is he charging? What<br />

are his profits?<br />

f. What does this simple problem indicate about the key to monopoly power?<br />

Page 4 of 4