full report - Jefferies

full report - Jefferies

full report - Jefferies

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

INDUSTRY NOTE<br />

Rating | Target | Estimate Change<br />

Healthcare | Pharmaceuticals May 28, 2013<br />

Pharmaceuticals<br />

Deconstructing Global Pharmaceuticals:<br />

Hunting for Restructuring Opportunities<br />

Key Takeaway<br />

As the Pharmaceuticals Industry looks towards restructuring and separation<br />

of undervalued assets we have prepared a highly proprietary sum of the parts<br />

analysis for our coverage universe to find the best opportunities. As a result we<br />

have upgraded Bayer and Merck & Co. to Buy from Hold and Eli Lilly to Hold<br />

from U/P, though it remains our least preferred stock. Novartis and Abbott are<br />

now our Top European and US picks respectively.<br />

Pharma remains attractive; Restructuring plays may offer the best upside:<br />

Whilst we have found dividend yield dislocations to be a great tool for stock selection over<br />

the past 12-18 months, the majority of these have now been neutralized. Whilst we are still<br />

highly focused on dividend yield as a relative and absolute driver of future performance, we<br />

now feel that restructuring plays may offer the best upside as the valuation discount to other<br />

sectors narrows. This <strong>report</strong> details sum of the parts valuations and strategic reviews for all<br />

of the diversified companies in our coverage universe in a highly detailed and systematic<br />

way that we believe has not been available to investors in the past.<br />

EQUITY RESEARCH GLOBAL<br />

Best Restructuring Plays; Upgrading Bayer and Merck to Buy: Our analysis shows<br />

that Abbott, Bayer, Merck & Co. and Novartis are the best restructuring plays in the group<br />

when considering the likelihood as well as the upside that could be generated by such<br />

activities. Bayer has one of the most attractive SOTP valuations in the group at €115.23, 36%<br />

above the stock price. We believe MaterialScience has become such as small component of<br />

group EBITDA (c15%) that its divestment is inevitable given the significant conglomerate<br />

discount it generates. Merck & Co. is likely to be forced into restructuring by investors as<br />

the Pharmaceuticals business underperforms. We see the probability of significant spin-outs<br />

or disposals increasing into 2014, with Animal and Consumer Health being the most likely<br />

candidates. Our SOTP valuation for Merck is $54.30, 15% above the stock price.<br />

Lilly upgraded to Hold from U/P; Remains least preferred stock: We have<br />

upgraded Eli Lilly to Hold from U/P as it lacks near term downside risk catalysts and the 3.6%<br />

dividend yield should protect the shares for now. We see EPS 5-10% below consensus in the<br />

mid term (2014E-15E) and limited or no restructuring options to rescue valuation should the<br />

pipeline continue to miss expectations over the next 12-18 months.<br />

Jeffrey Holford, PhD, ACA *<br />

Equity Analyst<br />

(212) 336-7409 jholford@jefferies.com<br />

Ian Hilliker §<br />

Equity Analyst<br />

44 (0) 20 7029 8672 ihilliker@jefferies.com<br />

Terence McManus, PhD §<br />

Equity Analyst<br />

44 (0) 20 7029 8274 tmcmanus@jefferies.com<br />

Swayampakula Ramakanth, PhD, MBA *<br />

Equity Associate<br />

(212) 336-7054 sramakanth@jefferies.com<br />

* <strong>Jefferies</strong> LLC<br />

§ <strong>Jefferies</strong> International Limited<br />

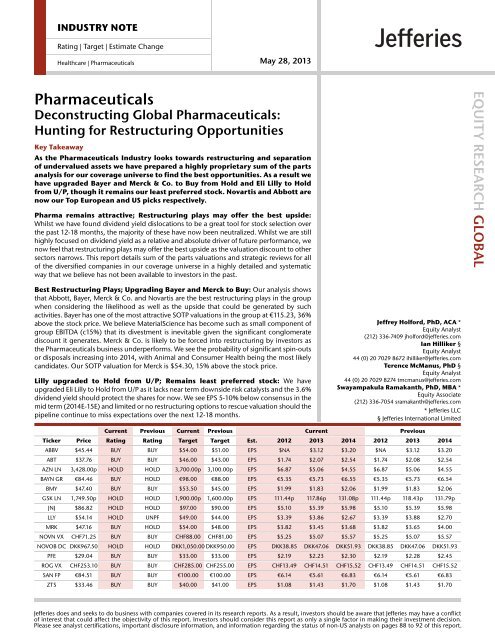

Current Previous Current Previous Current Previous<br />

Ticker Price Rating Rating Target Target Est. 2012 2013 2014 2012 2013 2014<br />

ABBV $45.44 BUY BUY $54.00 $51.00 EPS $NA $3.12 $3.20 $NA $3.12 $3.20<br />

ABT $37.76 BUY BUY $46.00 $43.00 EPS $1.74 $2.07 $2.54 $1.74 $2.08 $2.54<br />

AZN LN 3,428.00p HOLD HOLD 3,700.00p 3,100.00p EPS $6.87 $5.06 $4.55 $6.87 $5.06 $4.55<br />

BAYN GR €84.46 BUY HOLD €98.00 €88.00 EPS €5.35 €5.73 €6.55 €5.35 €5.73 €6.54<br />

BMY $47.40 BUY BUY $53.50 $45.00 EPS $1.99 $1.83 $2.06 $1.99 $1.83 $2.06<br />

GSK LN 1,749.50p HOLD HOLD 1,900.00p 1,600.00p EPS 111.44p 117.86p 131.08p 111.44p 118.43p 131.79p<br />

JNJ $86.82 HOLD HOLD $97.00 $90.00 EPS $5.10 $5.39 $5.98 $5.10 $5.39 $5.98<br />

LLY $54.14 HOLD UNPF $49.00 $44.00 EPS $3.39 $3.86 $2.67 $3.39 $3.88 $2.70<br />

MRK $47.16 BUY HOLD $54.00 $48.00 EPS $3.82 $3.45 $3.68 $3.82 $3.65 $4.00<br />

NOVN VX CHF71.25 BUY BUY CHF88.00 CHF81.00 EPS $5.25 $5.07 $5.57 $5.25 $5.07 $5.57<br />

NOVOB DC DKK967.50 HOLD HOLD DKK1,050.00 DKK950.00 EPS DKK38.85 DKK47.06 DKK51.93 DKK38.85 DKK47.06 DKK51.93<br />

PFE $29.04 BUY BUY $33.00 $33.00 EPS $2.19 $2.23 $2.30 $2.19 $2.28 $2.45<br />

ROG VX CHF253.10 BUY BUY CHF285.00 CHF255.00 EPS CHF13.49 CHF14.51 CHF15.52 CHF13.49 CHF14.51 CHF15.52<br />

SAN FP €84.51 BUY BUY €100.00 €100.00 EPS €6.14 €5.61 €6.83 €6.14 €5.61 €6.83<br />

ZTS $33.46 BUY BUY $40.00 $41.00 EPS $1.08 $1.43 $1.70 $1.08 $1.43 $1.70<br />

<strong>Jefferies</strong> does and seeks to do business with companies covered in its research <strong>report</strong>s. As a result, investors should be aware that <strong>Jefferies</strong> may have a conflict<br />

of interest that could affect the objectivity of this <strong>report</strong>. Investors should consider this <strong>report</strong> as only a single factor in making their investment decision.<br />

Please see analyst certifications, important disclosure information, and information regarding the status of non-US analysts on pages 88 to 92 of this <strong>report</strong>.

Healthcare<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

Executive Summary<br />

We have made significant changes to our ratings, Price Targets and order of preference<br />

across our coverage universe to reflect what we think will be the most important drivers<br />

of share price performance for the Large Cap Pharmaceuticals sector. We have intensified<br />

our focus on dividend yield as a relative and absolute driver of stock performance as well<br />

as integrating a thorough review of restructuring potential across our universe into our<br />

valuation methodology.<br />

Changes to our recommendations, Price Targets and order of preference are summarized<br />

in Exhibit 1 and Exhibit 2, with the most significant being:<br />

• Novartis is now our Top Pick due to the greatest total upside available versus<br />

current prices as well as having the most restructuring potential over the next<br />

12-18 months in our view,<br />

• Abbott has been moved to 3 rd place from 7 th previously and is now our Top US<br />

Pick as we anticipate a positive inflection in revenue and earnings growth from<br />

H2’13 as the Established Pharmaceuticals business performance improves.<br />

Abbott also has significant further restructuring potential in our view, which is<br />

not well recognized by the market,<br />

• We have Upgraded Bayer to Buy from Hold to reflect the positive momentum in<br />

the Pharmaceuticals and CropScience divisions as well as some of the most<br />

significant upside potential from restructuring, which we believe could be<br />

crystallized over the next 12-24 months,<br />

• We have upgraded Merck & Co. to Buy from Hold as management clearly<br />

begins to recognize pressure from shareholders for better returns by the<br />

activation of an accelerated share repurchase program. We believe that further<br />

pressure over the next 12-18 months will lead to some restructuring of the<br />

business with Consumer and Animal Health being the most likely assets that<br />

could be sold or spun out,<br />

• We have upgraded Eli Lilly to Hold from Underperform as, even though it has<br />

been the worst performing US Large Cap Pharmaceuticals stock year to date, we<br />

do not see enough downside over the next 3-6 months to justify an<br />

Underperform rating. Furthermore we believe that the 2013E dividend yield of<br />

3.6% yield will protect it to a degree for now. We also see positive headline risk<br />

from ramucirumab in breast cancer over the summer, though we believe that<br />

the detailed data expected to be presented at the San Antonio Breast Cancer<br />

Symposium in December will show that the product is unlikely to gain approval<br />

in this indication. Eli Lilly remains our least preferred stock within the entire<br />

Large Cap Pharmaceuticals group,<br />

• Roche and Bristol-Myers have both dropped 3 places (Roche to 7 th , Bristol-Myers<br />

to 9 th ) as recent outperformance of the shares has reduced the upside potential<br />

relative to other stocks based on our current target prices.<br />

page 2 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Healthcare<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

Exhibit 1: Global Pharmaceuticals coverage and order of preference<br />

Rank Prior Company Rating Positive attributes Negative attributes<br />

1 2 Novartis Buy Data (QVA149; Tasigna, Afinitor, Farydak, AIN457; Dovitinib);<br />

QVA149/ Relaxin EU reg decisions; Restructuring; Glivec patent<br />

2 1 Sanofi Buy Data (U300, otamixiban, iniparib, PCSK9, JAK-2, sarilumab,<br />

Lyxumia); Lemtrada reg. decision; Aubagio launch; Tresiba delay<br />

<br />

3 7 Abbott Buy Nutrition divison growth; Product cross-registrations in EPD;<br />

MitraClip/ ABSORB and Xpedition regulatory approvals/ launches<br />

4 3 AbbVie Buy Data (ABT-199, veliparib, Elagolix, GLPG0634, Hep C portfolio); +ve<br />

Humira revisions<br />

<br />

5 9 Bayer Buy Data (Nexavar, tedizolid, Eylea); Eylea/ regorafenib/ Xarelto/<br />

alpharadin/ Lemtrada/ Riociguat reg. decisions and launches<br />

Lucentis/ Gilenya/ Afinitor competition; Generics (US Diovan<br />

Sep'12); OTC manufacturing; DPPIV safety<br />

Generics (Plavix May'12/ Eloxatin Aug'12); Lantus competition/<br />

biosimilars; Lantus-Lixi delay; GLP-1 safety; EM/ AH growth<br />

European pricing pressure in EPD; MD pricing/ volume pressures<br />

Competitive data in Hep C; Xeljanz launch; AndroGel generics;<br />

Biosimilars<br />

Betaseron/ Nexavar/ Kogenate/ Xarelto competitive threats; YAZ<br />

litigation; Tough comps in CropScience; MaterialScience margins<br />

6 5 Zoetis Buy N. America drought resolution; Margin expansion Avian Flu; Pfizer share exchange offer<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

7 4 Roche Buy Data (GA101, crenezumab, anti-PD-L1; ABT-199); Perjeta/ TDM-1/<br />

Erivedge launches/ reg decisions; Capital allocation changes<br />

8 11 Merck & Co. Buy Data (preladenant; anti-PD1;MK-7009; MK-5172; V419; V503);<br />

suvorexant reg. decision; yield support; share repurchases<br />

9 6 Bristol-Myers Buy Data (HCV portfolio, anti-PD1, Yervoy prostate, Onglyza [SAVOR]);<br />

Forxiga US reg. decision; Eliquis launch<br />

10 8 Pfizer Buy Data (Dacomitinib, pablociclib, Prevnar-13, Eliquis, tofacitinib);<br />

Restructuring/ Buybacks; Eliquis/ Xeljanz launches<br />

11 10 Johnson &<br />

Johnson<br />

Source: <strong>Jefferies</strong> research<br />

Hold<br />

Data (TMC 435, canagliflozin, Ibrutinib, ACC-001); Restructuring<br />

(OCD); Buy backs; Pharma Review; Xarelto reg. decisions<br />

12<br />

13<br />

13<br />

14<br />

GlaxoSmithKline<br />

AstraZeneca<br />

Hold<br />

Hold<br />

Data (albiglutide, migalastat, MAGE 3, Arzerra, darapladib); Tykerb/<br />

BRAF/ MEK/ Relvar/ Dolutegravir/ ANORO reg decisions;<br />

Restructuring<br />

Data (fostamatinib, olaparib, selumetinib, lesinurad, phase II<br />

portfolio); Yield support; Forxiga US refiling & reg decision<br />

14 12 Novo Nordisk Hold Data (Victoza obesity, LArFVIII, NN8828); Turoctocog alpha reg.<br />

decisions; Ex-US Tresiba launch<br />

= 15 15 Eli Lilly Hold Data (dulaglutide, empagliflozin, insulins, baricitinib, Edivoxetine,<br />

ramucirumab, Enzastaurin, necitumumab)<br />

Lucentis/ Pegasys/ Zelboraf/ Actemra competition; Biosimilars;<br />

Diabetes Care pricing, reimbursement<br />

Januvia growth; Generics (Singulair Aug'12); Odanacatib safety;<br />

DPPIV safety<br />

Generics (Plavix May'12); anti-PD-1 competitors; DPPIV/ GLP-1<br />

safety; DPPIV market slowdown; High PE multiple<br />

CAPiTA downside risk to Prevnar-13; Patent expiry drag<br />

MD pricing/ volume pressures; Consumer manufacturing; Zytiga/<br />

Xarelto/ Remicade competition; DPPIV safety<br />

Advair generic approvals timing visibility (EU); European/ US<br />

pricing pressure; GLP-1 safety<br />

Crestor/ Seroquel XR substitution; Pulmicort generics; DPPIV/ GLP-<br />

1 safety<br />

Tresiba/ Ryzodeg regulatory delays (US); GLP-1 competition/<br />

biosimilars/ safety; Prandin generics; Index reweighting<br />

Alimta challenge; Insulin share losses; High PE multiple; Cashflow;<br />

R&D setbacks (sola, tabalumab, basal insulin); DPPIV/ GLP-1 safety<br />

Exhibit 2: Summary of Global Pharmaceuticals coverage and recommendations<br />

Company Ticker Rating MV MV Price Target Up/down Dividend Total Revenue EPS PEG<br />

L.C. $m 24-May-13 price side Yield Return CAGR CAGR 12A-17E<br />

L.C. L.C. 2013E (%) 12A-17E 12A-17E 2013 PE<br />

Abbott ABT BUY $59,372m $59,372 $37.76 $46 21.8% 1.5% 23.3% 8.4% 19.0% 0.96<br />

AbbVie* ABBV BUY $72,340m $72,340 $45.44 $54 18.8% 3.5% 22.4% 5.9% *14.4% *1.01<br />

AstraZeneca AZN LN HOLD £44,641m $67,582 3428p 3700p 7.9% 5.4% 13.3% -4.0% -6.9% NA<br />

Bayer BAYN GR BUY €69,906m $90,391 €84.54 €98 15.9% 2.3% 18.2% 4.9% 12.2% 1.21<br />

Bristol-Myers BMY BUY $80,016m $80,016 $47.40 $53.5 12.9% 3.0% 15.8% 3.5% 9.9% 2.62<br />

Eli Lilly LLY HOLD $62,824m $62,824 $54.14 $49 -9.5% 3.6% -5.9% -0.4% -3.6% NA<br />

GlaxoSmithKline GSK LN HOLD £88,315m $133,699 1750p 1900p 8.6% 4.5% 13.1% 5.1% 10.3% 1.44<br />

Johnson & Johnson JNJ HOLD $238,328m $238,328 $86.82 $97 11.7% 3.0% 14.7% 3.9% 6.8% 2.33<br />

Merck & Co. MRK BUY $143,555m $143,555 $47.16 $54 14.5% 3.7% 18.2% 0.0% 3.5% 3.91<br />

Novartis NOVN VX BUY CHF172,332m $179,363 CHF71.25 CHF88 23.5% 3.3% 26.8% 3.3% 7.3% 1.99<br />

Novo Nordisk NOVOB DC HOLD DKK538,767m $93,476 DKK967.50 DKK1050 8.5% 2.3% 10.8% 6.9% 13.6% 1.51<br />

Pfizer PFE BUY $218,919m $218,919 $29.04 $33 13.6% 3.3% 17.0% 0.2% 3.8% 3.42<br />

Roche ROG VX BUY CHF214,522m $223,274 CHF253.10 CHF285 12.6% 3.1% 15.7% 4.0% 9.2% 1.89<br />

Sanofi SAN FP BUY €112,781m $145,831 €84.51 €100 18.3% 3.3% 21.6% 5.0% 11.3% 1.34<br />

Zoetis ZTS BUY $16,897m $16,897 $33.46 $40 19.5% 0.8% 20.3% 6.0% 17.7% 1.32<br />

Pan Euro Sector (wtd) $933,617 3.4% 4.0% 8.9% 1.52<br />

US Sector (wtd) $892,252 3.1% 2.5% 6.7% 2.50<br />

EU+US Average (wtd) $1,825,870 3.3% 3.3% 7.8% 2.00<br />

*Note: ABBV EPS CAGR and PEG based on 2013E-17E<br />

Source: Thomson One DataStream, <strong>Jefferies</strong> estimates<br />

page 3 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Dividend Yield<br />

2014E P/E<br />

Healthcare<br />

Jan-09<br />

Apr-09<br />

Jul-09<br />

Oct-09<br />

Jan-10<br />

Apr-10<br />

Jul-10<br />

Oct-10<br />

Jan-11<br />

Apr-11<br />

Jul-11<br />

Oct-11<br />

Jan-12<br />

Apr-12<br />

Jul-12<br />

Oct-12<br />

Jan-13<br />

Apr-13<br />

2014E P/E<br />

US Pharma Dividend Yield Spread<br />

Jan-09<br />

Apr-09<br />

Jul-09<br />

Oct-09<br />

Jan-10<br />

Apr-10<br />

Jul-10<br />

Oct-10<br />

Jan-11<br />

Apr-11<br />

Jul-11<br />

Oct-11<br />

Jan-12<br />

Apr-12<br />

Jul-12<br />

Oct-12<br />

Jan-13<br />

Apr-13<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

Absolute yield trade still on, but relative trade<br />

drying up<br />

We have previously made the observation that there appeared to be a stronger than usual<br />

influence of dividend yield against the performance of our Large Cap Pharmaceuticals<br />

universe and little correlation of P/E multiples against future growth over the past few<br />

years (Exhibit 3 and Exhibit 4).<br />

Exhibit 3: 2014E P/E versus 2012A-17E EPS CAGR for US<br />

Large Cap Pharmaceuticals universe<br />

LLY<br />

24X<br />

20X<br />

16X<br />

12X<br />

8X<br />

4X<br />

MRK<br />

PFE<br />

JNJ<br />

0X<br />

-5.0% 0.0% 5.0% 10.0% 15.0% 20.0%<br />

2012E-2017E EPS CAGR<br />

Source: DataStream, <strong>Jefferies</strong> research<br />

BMY<br />

ABBV<br />

Exhibit 4: 2014E P/E versus 2012A-17E EPS CAGR for<br />

European Large Cap Pharmaceuticals universe<br />

AZN<br />

20X<br />

16X<br />

12X<br />

8X<br />

4X<br />

0X<br />

-10.0% -5.0% 0.0% 5.0% 10.0% 15.0%<br />

2012E-2017E EPS CAGR<br />

Source: DataStream, <strong>Jefferies</strong> research<br />

NOVN<br />

ROG<br />

GSK<br />

SAN<br />

NOVOB<br />

BAYN<br />

This trend had helped us to be positive towards the sector overall given the well covered<br />

attractive yields available for many of the names that we cover. However, as dividend<br />

yields (particularly across the US names, which are less influenced in terms of relative<br />

performance by local market moves and FX) have coalesced, the ‚easy money‛ trades<br />

based on yield alone, such as AbbVie, have mostly disappeared.<br />

Exhibit 5: 2013E Dividend yield over time for US Large Cap<br />

Pharmaceuticals universe<br />

7.5%<br />

7.0%<br />

6.5%<br />

6.0%<br />

5.5%<br />

5.0%<br />

4.5%<br />

4.0%<br />

3.5%<br />

3.0%<br />

2.5%<br />

Exhibit 6: Dividend yield spread (Highest vs. lowest) for US<br />

Pharmaceuticals universe from January 2009<br />

350bps<br />

300bps<br />

250bps<br />

200bps<br />

150bps<br />

100bps<br />

50bps<br />

0bps<br />

ABBV BMY JNJ LLY MRK PFE<br />

Source: DataStream, <strong>Jefferies</strong> research<br />

Source: DataStream, <strong>Jefferies</strong> research<br />

page 4 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Dividend Yield<br />

Dividend Yield<br />

Healthcare<br />

EU Pharma Div Yield Spread<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

Whilst this trend has been less pervasive in the European names due to the influence of FX<br />

movements and other local market factors, we have seen it become more apparent over<br />

the last 12 months (Exhibit 7 and Exhibit 8).<br />

Exhibit 7: 2013E Dividend yield over time for European<br />

Large Cap Pharmaceuticals Universe<br />

8.0%<br />

7.0%<br />

6.0%<br />

5.0%<br />

4.0%<br />

3.0%<br />

2.0%<br />

1.0%<br />

Exhibit 8: Dividend yield spread (Highest vs. lowest) for<br />

European Pharmaceuticals universe from May 2012<br />

500bps<br />

450bps<br />

400bps<br />

350bps<br />

300bps<br />

250bps<br />

200bps<br />

150bps<br />

100bps<br />

50bps<br />

0bps<br />

AZN GSK NOVN NOVOB<br />

SAN ROG BAYN<br />

Source: DataStream, <strong>Jefferies</strong> research<br />

Source: DataStream, <strong>Jefferies</strong> research<br />

As a result we now expect performance to once again be more linked to earnings growth<br />

(as a driver of future yield) as well as other factors that could help stocks to ‚break out‛<br />

from their peer groups on yield, such as major R&D breakthroughs, corporate<br />

restructuring, M&A and other shareholder friendly actions.<br />

Whilst we already closely monitor future drivers of dividend growth and yield for our<br />

coverage universe (Exhibit 9 and Exhibit 10) and potential restructuring opportunities, we<br />

have not previously formally reviewed the latter across our entire coverage universe in<br />

detail.<br />

Exhibit 9: Dividend yield estimates for US Large Cap Pharmaceuticals, 2012A-17E<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

ABT ABBV BMY JNJ LLY MRK PFE ZTS<br />

2012A 2013E 2014E 2015E 2016E 2017E<br />

Source: <strong>Jefferies</strong> estimates, Thomson One DataStream<br />

page 5 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Dividend Yield<br />

Healthcare<br />

US$ (billions)<br />

Growth rate<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

Exhibit 10: Dividend yield estimates for European Large Cap Pharmaceuticals, 2012A-17E<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

AZN BAYN GSK NOVN NOVO ROG SAN<br />

2012A 2013E 2014E 2015E 2016E 2017E<br />

Source: <strong>Jefferies</strong> estimates, Thomson One DataStream<br />

Restructuring is the new diversification<br />

As the industry began to see the 2012 patent cliff forming ahead during the last decade<br />

there was a strong push towards diversification used to justify bolt-on acquisitions as well<br />

as mega-mergers. With the patent cliff now mostly in the ‚rear view mirror‛ for the sector<br />

(Exhibit 11), management teams now appear to be once again focused on maximizing<br />

the potential of their ‚Core‛ Pharmaceuticals divisions.<br />

Exhibit 11: Consolidated Core Pharmaceuticals Revenue Growth, 2007A-17E<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

-2%<br />

-4%<br />

-6%<br />

Pharma Revenues<br />

Pharma Revenue Growth<br />

Source: <strong>Jefferies</strong> estimates, company data<br />

Recent examples would include the spin-off of Mead Johnson (MJN, $84.44, NC) by<br />

Bristol-Myers, the disposal of Nutrition assets and spin-off of Zoetis by Pfizer and the spinoff<br />

of AbbVie from Abbott. All three of these were ultimately well received by the market<br />

as it appears that the sum of the parts was greater than the whole in all cases.<br />

page 6 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Healthcare<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

Hunting for the next restructuring investment opportunities<br />

Seeking out the next most likely Large Cap Pharmaceuticals restructuring opportunities<br />

for investors would seem to be a worthwhile pursuit given the rising interest and<br />

valuations in the sector. Weeding out the first few companies that are unlikely contenders<br />

is relatively straightforward as they are those that have little or no diversification to their<br />

business.<br />

Exhibit 12 shows how our universe looks in terms of revenue diversification across the<br />

group, with AbbVie, Bristol-Myers, AstraZeneca, Novo Nordisk and Zoetis being the least<br />

diversified companies and hence the least likely to be able to perform any kind of valueenhancing<br />

restructuring.<br />

Exhibit 12: 2014E revenue diversification as a percentage of Group revenues by key operating segments<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Core Pharma Est. Pharma Vaccines Consumer Generics<br />

Diagnostics Devices Nutrition Animal Health Specialty Chemicals<br />

Cropscience Opthalmology Biosimilars<br />

Source: <strong>Jefferies</strong> research<br />

page 7 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Healthcare<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

Spin Doctors - Who, When, How and<br />

How Much?<br />

The main focus of this <strong>report</strong> has been to review the remainder of our coverage list in<br />

detail for the best restructuring plays, given that we believe this will become an increasing<br />

industry trend. We have based our conclusions as to which companies might be the most<br />

attractive in this regard based on our sum of the parts (SOTP) analyses as well as recent<br />

management commentary regarding this specific issue as well as our own intuition, based<br />

on our experience of covering the broad US and European Large Cap Pharmaceuticals<br />

group.<br />

We have summarized our view on which companies have restructuring potential in<br />

Exhibit 13.<br />

Exhibit 13: Summary of JEF expectations for potential restructuring opportunities within Large Cap Pharmaceuticals<br />

Company Management Support* Separation Candidates Likelihood Accretion/ Potential JEF Price Mean Group SOTP vs.<br />

Dilution** Timing Target SOTP Valuation Stock Price<br />

Abbott Has historically performed spin-outs Nutrition/ Established Pharma; High<br />

16.4% 2015 $46 $48 27%<br />

Diagnostics;<br />

High<br />

1.5% 2015<br />

Medical Devices<br />

High<br />

-0.9% 2015<br />

Bayer<br />

Eli Lilly<br />

Glaxo<br />

SmithKline<br />

Johnson &<br />

Johnson<br />

Merck & Co.<br />

Novartis<br />

Pfizer<br />

Roche<br />

Sanofi<br />

Has indicated MaterialScience spin-out<br />

could be used to fund Healthcare<br />

acquisitions<br />

MaterialScience;<br />

Healthcare/ CropScience<br />

Has commented that it is not infavour of Animal Health;<br />

separation of the Animal Health business, Core Pharma<br />

but could be forced to consider it if the R&D<br />

pipeline misses expectations<br />

Has indicated potential to separate<br />

Established Pharma and ViiV<br />

Has indicated OCD will likely be separated;<br />

has not previously supported large scale<br />

break up<br />

Has previously indicated some interest in<br />

exploring strategic options for Consumer<br />

Health, but less so for Animal Health<br />

Established Pharma;<br />

ViiV;<br />

Consumer Health<br />

Ortho Clinical Diagnostics;<br />

Consumer Health<br />

Consumer Health;<br />

Animal Health;<br />

Vaccines<br />

Management has indicated Roche stake is Roche Bearer shares;<br />

for sale at the right premium and it will Vaccines;<br />

conduct a portfolio review over the next 24- OTC Consumer;<br />

36 months<br />

Animal Health;<br />

Diagnostics<br />

Management has inidicated it is considering Animal Health;<br />

separating Established Products over the Established Products;<br />

next 3 years<br />

Consumer Health<br />

Management has commented that it does<br />

not support separation of Diagnostics from<br />

the Group<br />

Management has stated that it is reviewing<br />

strategic options for Established<br />

Pharmaceutical tail products<br />

*Note – refers to JEF interpretation of management commentary on specific restructuring opportunities<br />

**Note – based on assuming cash proceeds are used to repurchase shares at the current market valuation<br />

Source: <strong>Jefferies</strong> research<br />

High<br />

High<br />

Low<br />

Low<br />

High<br />

High<br />

Low<br />

High<br />

Low<br />

Medium<br />

Medium<br />

Low<br />

High<br />

High<br />

Medium<br />

Medium<br />

Low<br />

High<br />

Medium<br />

Low<br />

1.8%<br />

37.6%<br />

2.9%<br />

-11.6%<br />

-0.4%<br />

1.3%<br />

8.4%<br />

0.1%<br />

9.5%<br />

2.5%<br />

3.4%<br />

2.4%<br />

4.3%<br />

3.3%<br />

4.8%<br />

1.6%<br />

-0.2%<br />

1.2%<br />

-2.0%<br />

2.4%<br />

2014<br />

2014<br />

NA<br />

NA<br />

2015<br />

2015<br />

NA<br />

2013<br />

NA<br />

2014<br />

2014<br />

NA<br />

2013<br />

2014<br />

2015<br />

2015<br />

NA<br />

2013<br />

2016<br />

NA<br />

€ 98 € 115 36%<br />

$49 $48 -11%<br />

1,900p 1,817p 4%<br />

$97 $91 5%<br />

$54 $54 15%<br />

CHF 88 CHF 85 19%<br />

$33 $32 10%<br />

Diagnostics Low -1.7% NA CHF 285 CHF 280 11%<br />

Established Pharma;<br />

Animal Health;<br />

Consumer Health<br />

Medium<br />

Low<br />

Low<br />

-0.1%<br />

3.1%<br />

5.1%<br />

2015<br />

NA<br />

NA<br />

€ 100 € 102 21%<br />

page 8 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Healthcare<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

Best Restructuring Plays – ABT, BAYN, MRK, NOVN<br />

We see Abbott, Bayer, Merck & Co. and Novartis as the best restructuring plays within the<br />

Large Cap Pharmaceuticals universe when considering both the likelihood of any action as<br />

well as the ultimate level of upside versus the current share price that could be generated<br />

by such activities.<br />

Abbott - Significant restructuring potential that could surprise investors<br />

Abbott management has one of the industry’s strongest pedigrees when it comes to M&A<br />

and restructuring, in our view. Over the next two years we expect that management will<br />

execute their plan of strong top line growth through geographic expansion, new product<br />

launches and bolt-on acquisitions whilst laying the foundation for the next major<br />

restructuring of the group, which still contains four separate and distinct segments in<br />

Nutrition, Pharmaceuticals, Medical Devices and Diagnostics. In our view this will likely be<br />

followed by further break-up of the group, potentially into three pieces.<br />

We believe that Nutrition and Established Pharmaceuticals will likely be separated into a<br />

single company by 2015. We would then expect that the Medical Devices and Diagnostics<br />

businesses would be sold to other players or spun out around the same timeline as these<br />

industry segments likely consolidate in the future.<br />

Our mean sum of the parts valuation for Abbott is $47.81 per share versus the current<br />

price of $37.76 and our official Target Price of $46.<br />

Bayer – Upgrade to Buy as we wait for the inevitable separation of<br />

MaterialScience<br />

Even though MaterialScience now only represents circa 15% of EBITDA we believe that it<br />

still drags on the Group’s multiple due to its volatility and recent margin weakness.<br />

Management has clearly positioned it to one side, highlighting the synergies between<br />

Healthcare and CropScience and stating that MaterialScience could be used to fund<br />

further acquisitions in Healthcare if a suitably large opportunity came up.<br />

We are increasingly optimistic about the future prospects for the Pharmaceuticals division<br />

due the strong flow of new products and improving R&D productivity evident within the<br />

business. We now see a 5% revenue CAGR and 12% EPS CAGR for the business between<br />

2012A-17E, which are some of the highest growth rates in the group.<br />

As the future growth profile of the Pharmaceuticals business becomes increasingly<br />

attractive, we believe that the pressure to isolate it from the MaterialScience business will<br />

increase to realize the best overall valuation. Whilst we only see marginal accretion from<br />

theoretically monetizing MaterialScience and using the proceeds for share repurchases,<br />

we see significant upside to the valuation of the Pharmaceuticals and Healthcare business<br />

by separating them from it.<br />

The various sum of the parts valuation methodologies used by us provide a valuation<br />

range of €112 to €118 per share, with a mean valuation of €115 per share. This<br />

represents a mean of 36% upside and a maximum of 40% upside, relative to the current<br />

share price of €84.46. Our current target price based on valuing the 2014E earnings at a<br />

30% to 35% P/E premium relative to the German market is €98.<br />

Bayer currently trades on a 19% P/E premium to the German market based on 2014E EPS,<br />

which we believe does not give <strong>full</strong> credit to its above average growth profile. As a result<br />

of our increasing enthusiasm for Bayer’s Pharmaceuticals business, significant<br />

restructuring potential and attractive valuation we have upgraded the shares to Buy from<br />

Hold.<br />

page 9 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Healthcare<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

Merck & Co. – Upgrade to Buy as mounting shareholder pressure will likely<br />

lead to restructuring<br />

Merck & Co. faces multiple challenges including several patent expiries over the next few<br />

years, a worrying decline in the growth of the DPP-IV class (including Januvia), safety<br />

concerns on the incretin class (which includes DPP-IVs and GLP-1s) and poor R&D<br />

productivity. Whilst management has taken action to address these issues, including<br />

announcing significant additional share repurchases at the Q1’13 results as well as the<br />

appointment of a new head of R&D, these actions do not <strong>full</strong>y address the significant midterm<br />

issues that face the company.<br />

The success of Pfizer’s and Abbott’s recent corporate reorganizations has only added to<br />

the pressure on Merck & Co.’s management to respond to a lackluster share price<br />

performance versus its peers to make more significant changes to its strategy. We suspect<br />

that as the DPP-IV market likely undergoes a further slow down and the company appears<br />

to fall further behind in R&D that shareholders will demand the separation of one or two<br />

of the non-core businesses, which we believe could include Animal Health and Consumer<br />

Health. We estimate that the separation of these businesses and use of cash proceeds to<br />

fund further share repurchases would be circa 6% accretive to 2014E EPS and potentially<br />

focus the market towards a sum of the parts based valuation of the business, which by<br />

our estimates could drive up to 15% upside versus the current valuation. Furthermore,<br />

Merck & Co. continues to have one of the most attractive yields in the US Large Cap<br />

Pharmaceuticals universe at 3.7% versus the sector average of 3.3%.<br />

Our mean sum of the parts valuation for Merck & Co. is $54.30 per share versus the<br />

current price of $47.16 and our official Target Price of $54. Based on our valuation and<br />

belief that pressure to increase returns to shareholders will lead to divestments we have<br />

raised our PT to $54 from $48 and raised our rating to Buy from Hold.<br />

Novartis – Strong evidence of multiple divestments in place<br />

We have focused on Novartis as a restructuring play since September 2012, after which<br />

time we have seen Daniel Vasella step down as Chairman as well as management talk<br />

about the potential sales of the Roche Bearer share stake at valuations in excess of the<br />

current market value as well as the potential for a strategic review of the current portfolio.<br />

We continue to believe that there is a high probability of a disposal of the Roche stake in<br />

either H2’13 or 2014 followed by the divestment of the Vaccines business in 2014 with<br />

Merck & Co., Pfizer and Johnson & Johnson being the most logical potential acquirers.<br />

We then also see a decent probability that this could be followed by the disposal of the<br />

OTC Consumer and Animal Health businesses from 2015, by which time margins and<br />

revenue growth should be restored to normal after the recent manufacturing issues.<br />

Our mean sum of the parts valuation for Novartis is CHF84.59 per share versus the current<br />

price of CHF71.25 and our official Target Price of CHF88.<br />

page 10 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Healthcare<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

Potential Opportunities – GSK, JNJ, PFE<br />

Whilst we see a high likelihood that GlaxoSmithKline and Pfizer will undergo some form of<br />

further restructuring over the next few years, we do not see these potential events as<br />

investment opportunities given our sum of the parts valuations versus the current stock<br />

prices. Johnson & Johnson may also complete some asset disposals, such as OCD over the<br />

next year or so, though the more significant upside from a disposal of its Consumer unit is<br />

much less likely to occur in our view.<br />

GlaxoSmithKline – Restructuring lacks appeal on valuation<br />

GlaxoSmithKline has been active in divesting non-core businesses in the recent past (e.g.<br />

Australian brands, non-Core OTC brands) and has signaled that further divestments are in<br />

process (Lucozade and Ribena brands), as well as recently discussing potential future<br />

options for the newly formed Global Established Products portfolio and ViiV joint venture.<br />

We have been impressed with management's willingness to consider major restructuring<br />

of the business, which was a positive surprise when it was announced at the Q1’13<br />

results. However, we struggle to see how the separation of this business on its own can<br />

generate shareholder value as it would likely trade or be priced at a discount to the<br />

current Group multiple in our view. Our mean sum of the parts valuation for<br />

GlaxoSmithKline is 1,817p per share versus the current price of 1,749p and our official<br />

Target Price of 1,900p. Therefore, even though we see potential restructuring at<br />

GlaxoSmithKline as being highly likely over the next few years, we have maintained our<br />

Hold recommendation on the shares.<br />

Johnson & Johnson – Small moves on restructuring raise hopes of bigger<br />

things to come<br />

Management has repeatedly stated its commitment to remaining a diversified healthcare<br />

conglomerate with its Pharmaceuticals, Medical Devices & Diagnostics and Consumer<br />

units being core businesses within that strategy. However, a change in leadership last year<br />

and the recent announcement that the Ortho Clinical Diagnostic (OCD) business could be<br />

sold or spun out at the Q1’13 results may have raised market expectations for more<br />

significant changes within the Group structure.<br />

Aside from the separation of OCD business, which we see as being neutral in terms of its<br />

impact on earnings accretion/ dilution, the only other major piece we envisage being a<br />

potential disposal candidate is the Consumer Health business. Valued by us at circa $51bn<br />

we see it as a potential spin out candidate that would be circa 9% accretive to earnings if<br />

the proceeds were used to fund share repurchases. Our mean sum of the parts valuation<br />

for Johnson & Johnson is $91.38 per share versus the current price of $86.82 and our<br />

official Target Price of $97.<br />

Pfizer – The restructuring teaser turns into a saga<br />

Pfizer has been one of the most proactive companies in the sector within the last few<br />

years in terms of driving shareholder value through financial engineering and<br />

restructuring. With the Nutrition disposal success<strong>full</strong>y completed and Zoetis likely to be<br />

<strong>full</strong>y divested through a share exchange offer during June, investors have been hungry for<br />

more news of a potential break up of the Pharmaceuticals business into separate<br />

‚Innovative Core‛ and ‚Value Core‛ pieces, the latter of which likely has a weaker growth<br />

profile, but pays a decent dividend.<br />

However, as management significantly pushed back timing expectations on this potential<br />

transaction to 2016 at the earliest at the Q1’13 earnings call, and many questions remain<br />

unanswered as to how such a separation could actually work in practice, there is little<br />

upside for shareholders from this in the near term at least, it seems. Such a business<br />

separation could even destroy value given that the ‚Established Products‛ piece would<br />

page 11 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Healthcare<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

likely trade at a discount to the Group unless it paid a hefty dividend, which may be<br />

unsustainable in the mid- to long-term.<br />

We have also considered the potential value implications of the completion of the Zoetis<br />

share exchange offer in this <strong>report</strong>, which appears to only be 1.1% accretive to 2014E EPS<br />

as well as the potential divestment of the Consumer Health business, which we calculate<br />

would drive 2.4% EPS accretion if the proceeds were used to repurchase shares.<br />

Our mean sum of the parts valuation for Pfizer is $31.87 per share versus the current price<br />

of $29.04 and our official Target Price of $33.<br />

Least Likely - LLY, SAN, ROG<br />

Other companies that could consider restructuring include Eli Lilly, Sanofi, and Roche, in<br />

our view. However, each of these appears very unlikely for the reasons described here.<br />

Eli Lilly – Animal health could spin out, but only if the pipeline blows up<br />

It is sometimes mooted by investors and stock market commentators that management<br />

could unlock value from the company through a reorganization of the business into its<br />

Core Pharmaceuticals and Animal Health components. However, our analysis shows that<br />

this is unlikely to be the case unless the stock undergoes a significant decline in value<br />

given that the Animal Health business would be unlikely to trade at a significant premium<br />

to the current Group multiple. Furthermore the Core Pharmaceuticals business might<br />

struggle to maintain the current level of dividend if separated from the cash flow<br />

generating Animal Health business.<br />

We estimate that the Core Pharma business would have a valuation of circa $44.5bn if it<br />

existed as a separate entity today, whilst the Animal Health businesses could be spun out<br />

or sold for circa $8.0bn. On this basis our mean sum of the parts valuation for Eli Lilly is<br />

$48.29 per share versus the current price of $54.14 and our Target Price of $49.<br />

We have upgraded Eli Lilly to Hold from Underperform as, even though it has been the<br />

worst performing US Large Cap Pharmaceuticals stock year to date, we do not see<br />

enough downside over the next 3-6 months to justify an Underperform rating.<br />

Furthermore we believe that the 2013E dividend yield of 3.6% will protect it to a degree<br />

for now. We also see positive headline risk from ramucirumab in breast cancer over the<br />

summer, though we believe that the detailed data expected to be presented at the San<br />

Antonio Breast Cancer Symposium in December will show that the product is unlikely to<br />

gain approval in this indication. Eli Lilly remains our least preferred stock within the entire<br />

Large Cap Pharmaceuticals group.<br />

Sanofi – Diversification has worked well at Sanofi so no need to change it<br />

With Sanofi set to return to sustained double-digit earnings growth from Q4’13, we see<br />

little pressure for management to embark on re-structuring or disposals beyond perhaps<br />

Western European Established Products. Each of the non-pharmaceutical divisions are key<br />

parts of management’s growth strategy, being identified growth drivers which form part<br />

of the company’s long-term guidance. In addition, none of the non-pharmaceuticals<br />

divisions are sub-scale. There remains the possibility for specific disposals, such as the<br />

Animal Health, Consumer Health, Vaccines, Generics or Established Pharmaceuticals<br />

segments.<br />

We see Animal Health and the Vaccines businesses as being assets which are set to<br />

perform well, with comparable margins to Core Pharmaceuticals business. In addition the<br />

Vaccines business is too large and well-integrated with the Pharmaceuticals business to be<br />

considered as a spin-off. With sub-Group estimated EBITDA margins and growth, Generics<br />

and Consumer Health business units may be seen as viable divestment options. However<br />

both divisions remain integral to management’s strategy for diversified growth. Sanofi<br />

page 12 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Healthcare<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

management has recently commented about exploring options with Western European<br />

tail products. This follows Pfizer’s and GlaxoSmithKline’s moves to separately <strong>report</strong> tail<br />

products in Established Products business units and talk openly about potential<br />

divestment options in the future. However, valuation of such a business and the<br />

practicalities of separation make this unlikely any time soon.<br />

Our sum of the parts valuation for Sanofi is €102 per share, a c21% premium to the<br />

current share price, though very much in line with the €100 Price Target we already place<br />

on the business on the basis of remaining a diversified healthcare conglomerate.<br />

Roche – Few real options for restructuring; more likely to buy and build<br />

Roche consists of two main divisions, Pharmaceuticals and Diagnostics, between which<br />

the actual level of synergy is frequently debated in financial markets. The diagnostics<br />

division could theoretically exist as a stand-alone entity. However, the drive towards<br />

personalized medicine and the continuing growth in the use of companion diagnostics to<br />

correctly target novel treatments, which in turn helps raise their success rate, firmly links<br />

the Diagnostics division with the Core Pharma business in the eyes of management.<br />

Recent press speculation that Roche might also look to sell off the Diabetes Care unit<br />

seems unlikely for a number of reasons. Roche is already the leading global player in<br />

Diabetes care, accounting for almost a third of the market. Whilst a potential buyer might<br />

want to merge this business into its own operations and strip cost out, it would only be<br />

feasible for other major players, which would likely run into anti-trust issues.<br />

We believe that separating the Diagnostics division from the rest of the business would<br />

actually be dilutive to shareholders as it would be unlikely to achieve the group multiple<br />

as a standalone entity. For this reason, as well as management’s general aversion to any<br />

kind of restructuring we believe that separation of the Diagnostics division is highly<br />

unlikely. Instead we believe that Roche is more likely to add further businesses to both its<br />

Pharmaceuticals and Diagnostics divisions. We see AbbVie as a logical ‚bolt-on‛ to the<br />

Pharmaceuticals division to create another major business outside of oncology, whilst<br />

management also appear to be actively pursuing various strategies to add additional<br />

sequencing platforms to the Diagnostics division.<br />

Our mean sum of the parts valuation of circa CHF280 for Roche represents potential<br />

upside of circa 11%, versus the current share price of CHF253.10. Our current Target Price<br />

based on valuing 2014E earnings at a 25% to 30% P/E relative premium to the Swiss<br />

market is CHF285.<br />

ABBV, BMY and ZTS remain potential consolidation<br />

targets; AZN remains “in limbo”<br />

As already discussed, AbbVie, AstraZeneca, Bristol-Myers and Zoetis are not considered to<br />

be restructuring candidates by us due to their sole focus on Pharmaceuticals or Animal<br />

Health products in the case of Zoetis. However, several of these companies are potential<br />

acquisition targets in our view because of this focus, which could lead them to be viewed<br />

as large ‚bolt-on‛ transactions, particularly in the cases of AbbVie, Bristol-Myers and<br />

Zoetis.<br />

AbbVie – Looks like a prime consolidation target for Roche, maybe Novartis<br />

and Novo Nordisk too<br />

We believe that AbbVie presents an attractive consolidation target due to the focus of the<br />

business on Humira. This would make it an exceptionally easy company to integrate<br />

versus other large cap acquisitions due to the relative lack of complexity in its product<br />

mix, manufacturing and marketing infrastructure. Furthermore the dominance of Humira<br />

page 13 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Healthcare<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

on AbbVie’s earnings would be significantly diluted if acquired by another larger<br />

Pharmaceuticals company.<br />

Roche makes the most sense to us as a strategic acquirer of AbbVie given its need to<br />

diversify away from oncology in the long run, its focus on protein manufacturing, strong<br />

hepatitis C platform and low financing costs. However, we also see Novartis and Novo<br />

Nordisk as potential candidates to acquire AbbVie.<br />

AstraZeneca – Looks unattractive as a consolidation target; needs to fix R&D<br />

We believe that AstraZeneca is likely to be left on the sidelines as far as any industry<br />

consolidation over the next year or so is concerned due to an extended patent cliff<br />

through to 2017. A strong dividend yield of 5.4% should support the shares in the<br />

meantime as it progresses its internal R&D pipeline as well as potentially adds further<br />

assets via bolt on acquisitions.<br />

Bristol-Myers – Chances of a take-out from Pfizer diminishing as valuation<br />

soars<br />

We have previously stated that Bristol-Myers would make an excellent strategic fit for<br />

Pfizer given their collaboration on Eliquis and Bristol-Myers strong internal R&D efforts in<br />

cancer. Since that time the valuation of Bristol-Myers has risen substantially and may now<br />

be too expensive for Pfizer to justify an acquisition. Or it could be that PD-1 and Yervoy<br />

will be such attractive assets that Pfizer ultimately pays more than we previously expected<br />

to gain access to some of the most attractive products in the Pharmaceuticals industry.<br />

Zoetis – Likely acquisition target once the tax implications disappear in 2015<br />

We continue to believe that Zoetis remains an attractive acquisition target for other<br />

healthcare conglomerates without a significant presence in Animal Health such as<br />

GlaxoSmithKline and Johnson & Johnson. However, we believe that the negative tax<br />

implications of acquiring Zoetis prior to 2015 will keep any potential M&A interest on the<br />

sidelines.<br />

page 14 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Healthcare<br />

EBITDA margin (2014E)<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

Abbott (Buy; PT $46)<br />

Well positioned, but the best is yet to come<br />

Abbott management has one of the industry’s strongest pedigrees when it comes to M&A<br />

and restructuring in our view, boasting possibly one of the best acquisitions ever in the<br />

Pharmaceuticals industry (Knoll Pharma in 2001) as well as the successful spin-outs of<br />

Hospira (HSP, $35.18, NC) in 2003 and AbbVie as recently as January 2013. Whilst the<br />

‚stump‛ business at Abbott still appears well positioned for future growth even without<br />

AbbVie, we believe that the next few years are likely to see further value creation for<br />

shareholders through significant restructuring.<br />

Over the next two years we expect that management will execute their plan of strong top<br />

line growth through geographic expansion, new product launches and bolt-on<br />

acquisitions whilst laying the foundation for the next major restructuring of the group,<br />

which still contains four separate and distinct segments in Nutrition, Pharmaceuticals,<br />

Medical Devices and Diagnostics. In our view this will likely be followed by further break<br />

up of the group, potentially into three pieces.<br />

Three is better than one – 27% better in the case of Abbott<br />

We believe that Nutrition and Established Pharmaceuticals will likely be separated into a<br />

single company once the majority of the planned aggressive margin expansion inside<br />

Nutrition is completed by 2015. This will likely be complemented by a significant inflexion<br />

in revenue and operating profit growth within Established Pharmaceuticals as likely<br />

hundreds of products are cross-licensed into new geographic markets as a result of the<br />

Solvay and Piramal acquisitions. We would then expect that the Medical Devices and<br />

Diagnostics businesses would be sold to other players or spun out around the same<br />

timeline as these industry segments likely consolidate in the future.<br />

We estimate that the combined Nutrition/ Established Pharmaceuticals business would<br />

have a market capitalization of circa $44.7bn if it existed as a separate entity today, whilst<br />

the Medical Devices and Diagnostics businesses could be sold for circa $14.1bn and<br />

$12.5bn respectively each. On this basis our mean sum of the parts valuation for Abbott is<br />

$47.81 per share versus the current price of $37.76 and our official Target Price of $46.<br />

Exhibit 14: 2014E EBITDA margin versus growth (2014E-17E) by division<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

Medical Devices<br />

$1,497m<br />

Diagnostics<br />

$1,185m<br />

Est. Pharma<br />

$1,684m<br />

Nutrition<br />

$1,871m<br />

10%<br />

5%<br />

0%<br />

0% 5% 10% 15% 20%<br />

EBITDA CAGR (2014E-2017E)<br />

Source: <strong>Jefferies</strong> estimates, company data<br />

page 15 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Healthcare<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

Exhibit 15, Exhibit 16, and Exhibit 17 give a snapshot of our estimates for 2014E revenues,<br />

EBITDA and EPS split across the four main business segments, which we have used as the<br />

basis for our sum of the parts calculations.<br />

Exhibit 15: Estimated 2014E revenue<br />

contribution split ($m)<br />

Exhibit 16: Estimated 2014E EBITDA<br />

contribution split ($m)<br />

Exhibit 17: Estimated 2014E EPS<br />

contribution split ($ per share)<br />

Est. Pharma<br />

$5,928m<br />

Nutrition<br />

$7,874m<br />

Est. Pharma<br />

$1,684m<br />

Nutrition<br />

$1,871m<br />

Est. Pharma<br />

$0.70<br />

Nutrition<br />

$0.78<br />

Medical<br />

Devices<br />

$6,027m<br />

Diagnostics<br />

$5,038m<br />

Medical<br />

Devices<br />

$1,497m<br />

Diagnostics<br />

$1,185m<br />

Medical<br />

Devices<br />

$0.62<br />

Diagnostics<br />

$0.49<br />

Source: <strong>Jefferies</strong> estimates<br />

Source: <strong>Jefferies</strong> estimates<br />

Source: <strong>Jefferies</strong> estimates<br />

Nutrition/ Established Pharma make a nice combo with a juicy valuation of<br />

circa $44.7bn<br />

The broad geographic reach of the Nutrition and Established Pharmaceuticals businesses<br />

with their focus on Emerging Markets in particular make them a perfect combination as a<br />

stand alone business in our view. Whilst Abbott does not give detailed margin<br />

information for each individual segment of the business, we estimate that the Nutrition<br />

and Established Pharmaceuticals businesses are the two most profitable in the group from<br />

both an EBITDA and EPS perspective (Exhibit 16 and Exhibit 17). We also estimate that<br />

they are the highest growth opportunities within the group as well (Exhibit 14).<br />

We expect that management will separate these assets from the remainder of the group<br />

once Nutrition has completed the majority of the ongoing restructuring, implemented to<br />

achieve an operating margin target of >20% by 2015 from the lowly historic margins of<br />

13% back in 2011. During the same time we expect that the Established Pharmaceuticals<br />

business will enter a new rapid phase of growth and margin expansion as significant<br />

revenue synergies are achieved through the cross-registration and launches of products<br />

from the Solvay and Piramal acquisitions.<br />

We have separately valued each of these assets at $27.6bn for Nutrition (c3.5x sales;<br />

c14.8x EBITDA; c22.9x earnings) and $17.1bn for Established Pharmaceuticals (c2.9x<br />

sales; c10.2x EBITDA; c15.7x earnings), which we calculate is c$7.3bn or 16% higher than<br />

their combined implied valuation within the current Abbott stock price.<br />

Medical Devices likely to end up as a consolidation target worth $14.1bn<br />

We would expect that the Medical Devices and Diagnostics units would likely end up as<br />

consolidation targets or further spin-offs in the event that Nutrition and Established<br />

Pharma are separated from the group. The Medical Devices business could be a good<br />

consolidation play for companies looking to broaden their offering to hospitals to try to<br />

offset the dominant force of Johnson & Johnson in the sector.<br />

We would expect that such an asset would fetch at least $14.1bn (c2.3x sales; c9.4x<br />

EBITDA; c14.6x earnings) in this instance. Whilst this is not a particularly attractive<br />

valuation versus the current group P/E multiple of 14.8x, it would be less than 1% dilutive<br />

by our estimates and by far offset by the gains from separating Nutrition and Established<br />

Pharma.<br />

page 16 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Valuation/ Share<br />

Healthcare<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

Diagnostics most likely to be spun out into a $12.5bn market cap entity<br />

We see few strategic partners for Abbott’s diagnostics business and the most logical way<br />

to separate it from the Nutrition and Established Pharma businesses may be through an<br />

IPO. On this basis we would expect it to achieve a market capitalisation of circa $12.5bn<br />

(2.5x sales; c10.6x EBITDA; c16.4x earnings), which would equate to c1.5% accretion<br />

versus its implied valuation within the group as it stands today.<br />

SOTP Valuations yield c27% upside<br />

Assuming that a ‚real-world‛ sum of the parts for Abbott is achieved by separating the<br />

business into three entities as described, we estimate that the group is worth circa $47.81<br />

per share, a c27% premium to the current share price. We have summarised the various<br />

SOTP valuations for Abbott in this section in Exhibit 18 alongside our more conventional<br />

P/E relative valuation for the shares of $46 (based on 25-30% 2014E P/E premium to the<br />

US market).<br />

Exhibit 18: Summary of share price evaluation by different valuation<br />

methodologies ($ per share)<br />

$60<br />

$50<br />

$46.00<br />

$48.86<br />

$47.48 $47.09<br />

$40<br />

$30<br />

$20<br />

$10<br />

$0<br />

PE REL EV/Sales EV/EBITDA P/E multiple<br />

Source: <strong>Jefferies</strong> estimates<br />

The individual SOTP valuations based on EV/Sales, EV/EBITDA and P/E multiples are<br />

included in this <strong>report</strong> in Exhibit 20, Exhibit 21 and Exhibit 22. Exhibit 19 summarises<br />

these as well as providing a comparison of how the average of these valuations for each<br />

business unit compares to their valuation based on our estimate of earnings on the<br />

current group multiple.<br />

Exhibit 19: Summary of share price evaluation by different valuation methodologies ($ per share)<br />

EV/sales EV/EBITDA P/E SOTP Mean<br />

Valuation<br />

Value at Group<br />

Multiple<br />

Multiple<br />

Arbitrage/<br />

share<br />

Nutrition $17.31 $17.62 $17.07 $17.33 $11.53 $5.81<br />

Diagnostics $7.91 $7.81 $7.86 $7.86 $7.30 $0.56<br />

Medical Devices $9.46 $8.46 $8.69 $8.87 $9.22 ($0.35)<br />

Est. Pharma $11.17 $10.57 $10.47 $10.74 $10.37 $0.36<br />

Non-operating income/(expense) NA NA NA NA ($0.68) NA<br />

Net cash/ (debt) - 2012A $3.01 $3.01 $3.01 $3.01 NA NA<br />

Group $48.86 $47.48 $47.09 $47.81 $37.74 $6.38<br />

Source: <strong>Jefferies</strong> estimates<br />

page 17 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Healthcare<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

SOTP Valuation Tables<br />

EV/Sales valuation<br />

Our EV/Sales valuation for Abbott yields $48.86 on a sum of the parts basis. This<br />

represents a 29% premium to the current stock price of $37.76.<br />

Exhibit 20: EV/Sales SOTP valuation summary ($m or $ per share where indicated)<br />

Sales<br />

2014E ($m)<br />

% Sales<br />

Contribution<br />

EV/Sales Multiple Implied EV ($m) Valuation per<br />

share ($)<br />

Nutrition $7,874m 32% 3.5x $27,560m $17.31<br />

Diagnostics $5,038m 20% 2.5x $12,594m $7.91<br />

Medical Devices $6,027m 24% 2.5x $15,068m $9.46<br />

Est. Pharma $5,928m 24% 3.0x $17,783m $11.17<br />

Group sales $24,867m 100% $73,006m $45.85<br />

Net cash/ (debt) - 2012A $4,787m $3.01<br />

Avg. shares outstanding (2012A) 1,592<br />

Group EV/Sales (SOTP) valuation $77,793m $48.86<br />

Source: <strong>Jefferies</strong> estimates<br />

EV/EBITDA valuation<br />

Our EV/EBITDA valuation for Abbott yields $47.48 on a sum of the parts basis. This<br />

represents a 26% premium to the current stock price of $37.76.<br />

Exhibit 21: EV/EBITDA SOTP valuation summary ($m or $ per share where indicated)<br />

EBITDA<br />

2014E<br />

($M)<br />

EBITDA<br />

Contribution<br />

2014E<br />

EV/EBITDA<br />

2014<br />

Implied EV ($m)<br />

Valuation per<br />

share ($)<br />

Nutrition $1,871m 30.0% 15.0x $28,062m $17.62<br />

Diagnostics $1,185m 19.0% 10.5x $12,441m $7.81<br />

Medical Devices $1,497m 24.0% 9.0x $13,470m $8.46<br />

Est. Pharma $1,684m 27.0% 10.0x $16,837m $10.57<br />

Total EBITDA $6,236m 100.0% $70,809m $44.47<br />

Net cash/ (debt) - 2012A $4,787m $3.01<br />

Avg. shares outstanding (2012A) 1,592<br />

Group EV/EBITDA (SOTP) Valuation $75,596m $47.48<br />

Source: <strong>Jefferies</strong> estimates<br />

P/E Multiple valuation<br />

Our P/E multiple based valuation for Abbott yields $47.09 on a sum of the parts basis.<br />

This represents a 25% premium to the current stock price of $37.76.<br />

Exhibit 22: P/E SOTP valuation summary ($m or $ per share where indicated)<br />

P/E (SOTP) Summary<br />

Operating<br />

Profit 2014E<br />

Operating<br />

Margin 2014E<br />

Net Income<br />

2014E<br />

Division<br />

EPS<br />

2014E<br />

P/E multiple<br />

Valuation per<br />

share ($)<br />

Nutrition $1,527m 19% $1,208m $0.78 22.0x $17.07<br />

Diagnostics $967m 82% $765m $0.49 16.0x $7.86<br />

Medical Devices $1,221m 82% $966m $0.62 14.0x $8.69<br />

Est. Pharma $1,374m 82% $1,087m $0.70 15.0x $10.47<br />

Non-operating income/(expense) ($90m) ($71m) ($0.05) - NA<br />

Net cash/ (debt) - 2012A $3.01<br />

Total $5,088m 20.5% $3,954m $2.54 18.5x $47.09<br />

Source: <strong>Jefferies</strong> estimates<br />

page 18 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Healthcare<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

Bayer (Buy; PT €98)<br />

Restructuring continues to look inevitable<br />

Marijn Dekkers was appointed as CEO at Bayer on 1 st October 2010. He was the first<br />

external appointee to take the top job in the company’s near 150 year history and his<br />

arrival caused much speculation as to the implications of the move. He had previously<br />

been at Thermo Fisher (TMO, $87.22, Buy), where he was known as a deal maker having<br />

transformed the company with numerous acquisitions into the world’s largest laboratory<br />

equipment maker.<br />

As the largest remaining pharmaceuticals/ chemicals conglomerate in Europe,<br />

expectations focused on the likelihood that Bayer could be broken up, with chemicals<br />

disposals likely used to help finance pharmaceutical acquisitions. Management<br />

commentary did not play down the expectations, either. At the time of his appointment<br />

as CEO, Dr Dekkers had suggested he would like to further build up the Pharmaceuticals<br />

unit, noting that Bayer could finance a transaction similar in size to the earlier circa €17bn<br />

Schering AG acquisition. By mid-2011, this had further evolved into a potential ‘merger of<br />

equals’ for the healthcare unit and the observation that there could be three or four<br />

companies that might be good strategic options for Bayer.<br />

Meanwhile on the subject of disposals, at the time of his appointment Dr Dekkers<br />

commented that he wouldn’t consider shedding either of the CropScience,<br />

MaterialScience or Healthcare divisions unless they lost their positions of market<br />

leadership. He noted “We have a leading position in all three areas….we don’t have two<br />

favourite children and a stepchild” (Bloomberg, 28 th Sept 2010).<br />

However, by early 2011 the commentary had progressed with recognition that the<br />

disposal of the MaterialScience division could be used to help finance a larger transaction<br />

in Healthcare. Dr Dekkers was quoted as saying that it would only be sold if “we wanted<br />

to do something so big that we had to use it as currency”. He further clarified that “We’ll<br />

stay with the three strategic groups as long as they are competitive in their particular<br />

areas”(Financial Times, 22 nd Feb 2011).<br />

At the recent Meet Management day at Leverkusen in March 2013, it was increasingly<br />

apparent that the MaterialScience division continues to be positioned apart from the rest<br />

of the company. In his introduction, Dr Dekkers noted, “Another way to depict our business<br />

is along the lines of Life Sciences and MaterialScience..….Life Science is, basically, Healthcare<br />

and CropSciences, which represents human health, animal health and plant health,<br />

representing 70% of revenue, and MaterialScience 30%......when you look at ….adjusted<br />

EBITDA for 2012, Life Science is represented at 85% of EBITDA, and MaterialScience 15%. So,<br />

a significant portion of our financials are driven by our two Life Sciences businesses”.<br />

Whilst the overall commentary seems to point in the direction of an eventual<br />

MaterialScience separation, it also seems the transaction will most likely occur as a<br />

consequence of a larger acquisition within Healthcare. With large healthcare acquisition<br />

opportunities more elusive than ever, there appears to be little immediate urgency.<br />

Moreover, following a difficult couple of quarters it’s likely management may want to see<br />

some clear improvements at MaterialScience to help maximize value before considering<br />

any disposal options.<br />

page 19 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Healthcare<br />

EBITDA margin (2014E)<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

Significant restructuring options exist and make sense for shareholders<br />

Exhibit 23 illustrates how the company is dominated by the Pharmaceuticals division,<br />

which has the highest uEBITDA margins and uEBITDA growth expectations, out of all the<br />

divisions. This is closely followed by CropScience.<br />

Exhibit 23: 2012A EBITDA margin versus growth (2014E-17E) by division<br />

50%<br />

45%<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

Medical Care,<br />

€749<br />

Animal Health,<br />

€457<br />

Consumer Care,<br />

€874<br />

Pharmaceuticals,<br />

€3,789<br />

CropScience,<br />

€2,360<br />

10%<br />

5%<br />

MaterialScience,<br />

€1,331<br />

0%<br />

0% 2% 4% 6% 8% 10%<br />

Source: <strong>Jefferies</strong> estimates, company data<br />

EBITDA CAGR (2014E-2017E)<br />

Whilst Bayer discloses revenues for its three Consumer sub-divisions (Consumer Care,<br />

Medical care and Animal Health) it does not disclose their individual uEBITDA margins.<br />

However, we have been able to make estimates for these based on our knowledge of<br />

other comparable companies. Within the Consumer division, the OTC focused Consumer<br />

Care business is expected to deliver the most robust growth, with Animal Health close<br />

behind reflecting good longer term growth prospects, particularly in emerging markets.<br />

However, Medical Care (which consists of Diabetes care as well as contrast imaging<br />

agents and medical devices) is likely to be a significant drag on the overall Consumer<br />

division growth due to the increasingly challenging conditions within diabetes care.<br />

Increasing competition is being compounded by austerity measures in Europe and CMS<br />

reimbursement cutbacks in the US which are pressuring diabetes care margins and<br />

hampering growth in the short to medium term, despite the attractive longer term<br />

fundamentals of the diabetes market. Outside Medical Care, MaterialScience has the<br />

weakest growth/ uEBITDA margin combination.<br />

Separating both the MaterialScience and the Medical Care operations should leave a<br />

higher growth, higher margin business behind. However, whilst we have already<br />

established that MaterialScience is the most likely candidate for disposal, Bayer appears<br />

more wedded to Medical/Diabetes Care. At the Q1’13 results Wolfgang Plischke<br />

(Chairman of Bayer Healthcare and Member of the Board) said, “….we are committed to<br />

this business…we are doing quite well if you compare this with other competitors…. In<br />

addition….this business is providing quite a significant cashflow for us, which is important for<br />

our overall performance….”.<br />

However, this commitment may be more a function of necessity, than desire. In July 2012,<br />

the Financial Times Deutschland <strong>report</strong>ed ‘sources’ as saying Bayer was in talks to sell its<br />

blood glucose meter business. However, by December 2012 Reuters <strong>report</strong>ed that Sanofi,<br />

the last remaining bidder, had pulled out of a deal that could have been valued at around<br />

$1.5bn.<br />

page 20 of 92<br />

Jeffrey Holford, PhD, ACA, Equity Analyst, (212) 336-7409, jholford@jefferies.com<br />

Please see important disclosure information on pages 88 - 92 of this <strong>report</strong>.

Healthcare<br />

Rating | Target | Estimate Change<br />

May 28, 2013<br />

Exhibit 24: Estimated 2014E revenue<br />

contribution split (€m)<br />

MaterialScience<br />

€ 12,134<br />

Reconciliation,<br />

€ 1,261<br />

Core Pharma,<br />

€ 12,172<br />

Exhibit 25: Estimated 2014E EBITDA<br />

contribution split (€m)<br />

MaterialScience,<br />

€ 1,331<br />