BALANCE SHEET as at 31 December 2009 - Joseph Rowntree ...

BALANCE SHEET as at 31 December 2009 - Joseph Rowntree ...

BALANCE SHEET as at 31 December 2009 - Joseph Rowntree ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

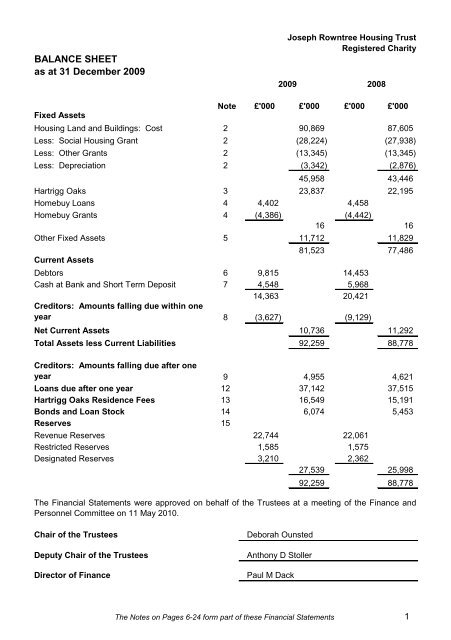

<strong>BALANCE</strong> <strong>SHEET</strong><br />

<strong>as</strong> <strong>at</strong> <strong>31</strong> <strong>December</strong> <strong>2009</strong><br />

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

<strong>2009</strong><br />

2008<br />

Fixed Assets<br />

Note £'000 £'000 £'000 £'000<br />

Housing Land and Buildings: Cost 2 90,869 87,605<br />

Less: Social Housing Grant 2 (28,224) (27,938)<br />

Less: Other Grants 2 (13,345) (13,345)<br />

Less: Depreci<strong>at</strong>ion 2 (3,342) (2,876)<br />

45,958 43,446<br />

Hartrigg Oaks 3 23,837 22,195<br />

Homebuy Loans 4 4,402 4,458<br />

Homebuy Grants 4 (4,386) (4,442)<br />

16 16<br />

Other Fixed Assets 5 11,712 11,829<br />

Current Assets<br />

81,523 77,486<br />

Debtors 6 9,815 14,453<br />

C<strong>as</strong>h <strong>at</strong> Bank and Short Term Deposit 7 4,548 5,968<br />

14,363 20,421<br />

Creditors: Amounts falling due within one<br />

year 8 (3,627) (9,129)<br />

Net Current Assets 10,736 11,292<br />

Total Assets less Current Liabilities 92,259 88,778<br />

Creditors: Amounts falling due after one<br />

year 9 4,955 4,621<br />

Loans due after one year 12 37,142 37,515<br />

Hartrigg Oaks Residence Fees 13 16,549 15,191<br />

Bonds and Loan Stock 14 6,074 5,453<br />

Reserves 15<br />

Revenue Reserves 22,744 22,061<br />

Restricted Reserves 1,585 1,575<br />

Design<strong>at</strong>ed Reserves 3,210 2,362<br />

27,539 25,998<br />

92,259 88,778<br />

The Financial St<strong>at</strong>ements were approved on behalf of the Trustees <strong>at</strong> a meeting of the Finance and<br />

Personnel Committee on 11 May 2010.<br />

Chair of the Trustees<br />

Deputy Chair of the Trustees<br />

Director of Finance<br />

Deborah Ounsted<br />

Anthony D Stoller<br />

Paul M Dack<br />

The Notes on Pages 6-24 form part of these Financial St<strong>at</strong>ements 1

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

INCOME AND EXPENDITURE ACCOUNT<br />

for the year ended <strong>31</strong> <strong>December</strong> <strong>2009</strong><br />

<strong>2009</strong> 2008<br />

Note £'000 £'000<br />

Turnover 18 20,701 20,033<br />

Less: Oper<strong>at</strong>ing Costs 18 (14,123) (11,940)<br />

Cost of Sales 18 (5,911) (7,205)<br />

Oper<strong>at</strong>ing Surplus 18 667 888<br />

Surplus on Sales 20 2,049 1,203<br />

Interest Receivable 18 136 249<br />

Interest Payable and similar charges 24 (1,<strong>31</strong>1) (1,167)<br />

Surplus for the Year 25 1,541 1,173<br />

Transfer (to)/from Restricted Reserves 15(b) (10) 718<br />

Transfer from/(to) Design<strong>at</strong>ed Reserves 15(c) (848) 694<br />

683 2,585<br />

Revenue Reserves <strong>at</strong> 1 January 22,061 19,476<br />

Revenue Reserves <strong>at</strong> <strong>31</strong> <strong>December</strong> 22,744 22,061<br />

There are no recognised gains or losses other than the Surplus for the year. The Surplus for the year<br />

is entirely gener<strong>at</strong>ed from continuing activities.<br />

Chair of the Trustees<br />

Deborah Ounsted<br />

Deputy Chair of the Trustees<br />

Anthony D Stoller<br />

Director of Finance<br />

Paul M Dack<br />

The Notes on Pages 6-24 form part of these Financial St<strong>at</strong>ements 2

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

CASH FLOW STATEMENT<br />

for the year ended <strong>31</strong> <strong>December</strong> <strong>2009</strong><br />

<strong>2009</strong> 2008<br />

£'000 £'000 £'000<br />

Net C<strong>as</strong>h Inflow from Oper<strong>at</strong>ing<br />

Activities (Note i)<br />

5,066<br />

Returns on Investments and Servicing of Finance<br />

Interest received<br />

Interest paid<br />

136 249<br />

(1,309) (1,129)<br />

(1,173)<br />

Capital Expenditure and Financial Investment<br />

Expenditure on Housing Land and Buildings<br />

(3,501) (12,953)<br />

Expenditure on Hartrigg Oaks<br />

(33) (929)<br />

Purch<strong>as</strong>e of Other Fixed Assets<br />

(363) (2,695)<br />

Sale of Other Fixed Assets 6 -<br />

Sale of Housing Properties (Note iv)<br />

810 835<br />

Homebuy Loans redeemed<br />

36 43<br />

Provision of Homebuy loans - (918)<br />

Homebuy Grant received<br />

- 918<br />

Social Housing Grant - received (Note v)<br />

176 875<br />

Financing<br />

(2,869)<br />

Capitalised Community Fees received<br />

293 54<br />

Hartrigg Oaks Residence Fees (Note vi)<br />

1,582 (93)<br />

Hartrigg Oaks Loans repaid<br />

(79) (476)<br />

Revolving Credit received<br />

- 14,000<br />

Revolving Credit repaid (8,000) -<br />

Bridging Loan received 4,676 1,818<br />

Bridging Loan repaid (9,306) -<br />

Housing Loans principal repayments<br />

(281) (266)<br />

Housing Loan received 8,000 -<br />

Bonds and Loan Stock received<br />

Bonds and Loan Stock repaid<br />

1,780 1,273<br />

(1,109) (1,743)<br />

(2,444)<br />

Net C<strong>as</strong>h (outflow)/inflow<br />

(1,420)<br />

The Notes on Pages 6-24 form part of these Financial St<strong>at</strong>ements 3

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

CASH FLOW STATEMENT<br />

for the year ended <strong>31</strong> <strong>December</strong> <strong>2009</strong><br />

NOTES TO THE CASH FLOW STATEMENT<br />

<strong>2009</strong><br />

£'000 £'000 £'000<br />

2008<br />

(i)<br />

Reconcili<strong>at</strong>ion of Oper<strong>at</strong>ing Surplus to Net<br />

C<strong>as</strong>h Inflow from Oper<strong>at</strong>ing Activities<br />

Oper<strong>at</strong>ing Surplus 667<br />

Depreci<strong>at</strong>ion of Housing Buildings 489 428<br />

Depreci<strong>at</strong>ion of Hartrigg Oaks 45 36<br />

Depreci<strong>at</strong>ion of Other Fixed Assets 287 162<br />

Amortis<strong>at</strong>ion of Non-refundable Residence<br />

Fees<br />

(245) (251)<br />

Amortis<strong>at</strong>ion of Capitalised Community Fees (106) (98)<br />

Decre<strong>as</strong>e/(Incre<strong>as</strong>e) in Loans 13 (22)<br />

Decre<strong>as</strong>e/(Incre<strong>as</strong>e) in Stock of M<strong>at</strong>erials 10 (9)<br />

Decre<strong>as</strong>e in Debtors 4,615 3,189<br />

(Decre<strong>as</strong>e) in Creditors (709) (180)<br />

4,399<br />

Net inflow from Oper<strong>at</strong>ing Activities 5,066<br />

(ii)<br />

Analysis of Net Debt<br />

At<br />

1.1.09<br />

£'000<br />

C<strong>as</strong>h<br />

Flow<br />

£'000<br />

C<strong>as</strong>h <strong>at</strong> Bank and Short Term Deposit<br />

5,968 (1,420)<br />

Revolving Credit (22,000) 8,000<br />

Bridging Loan (5,871) 4,630<br />

Housing Loans (14,891) (7,719)<br />

Hartrigg Oaks Loans (983) 79<br />

Bonds and Loan Stock (5,453) (621)<br />

Debt (49,198) 4,369<br />

Net Debt (43,230) 2,949<br />

The Notes on Pages 6-24 form part of these Financial St<strong>at</strong>ements 4

CASH FLOW STATEMENT<br />

for the year ended <strong>31</strong> <strong>December</strong> <strong>2009</strong><br />

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

NOTES TO THE CASH FLOW STATEMENT (continued)<br />

(iii)<br />

Reconcili<strong>at</strong>ion of Net C<strong>as</strong>h Flow to Movement in Net Debt<br />

<strong>2009</strong><br />

£'000<br />

(Decre<strong>as</strong>e)/Incre<strong>as</strong>e in c<strong>as</strong>h (1,420)<br />

C<strong>as</strong>h flows from decre<strong>as</strong>e/(incre<strong>as</strong>e) in debt 4,369<br />

2,949<br />

Net Debt <strong>at</strong> 1 January (43,230)<br />

Net Debt <strong>at</strong> <strong>31</strong> <strong>December</strong> (40,281)<br />

(iv) Sale of Existing Stock of Housing Properties<br />

<strong>2009</strong><br />

£'000<br />

Proceeds from sales (Note 20) 836<br />

Less: Direct Expenditure (Note 20) (26)<br />

810<br />

(v)<br />

Social Housing Grant Received<br />

<strong>2009</strong><br />

£'000<br />

Received in the year (Note 2) 170<br />

Social Homebuy Grant Repaid (Note 11) 6<br />

176<br />

(vi) Net C<strong>as</strong>h Movement on Hartrigg Oaks Properties<br />

<strong>2009</strong><br />

£'000<br />

Residence Fees received 2,225<br />

Residence Fees repaid (622)<br />

1,603<br />

Less: Direct Expenses (Note 20) (21)<br />

1,582<br />

The Notes on Pages 6-24 form part of these Financial St<strong>at</strong>ements 5

tree Housing Trust<br />

Registered Charity<br />

2008<br />

£'000<br />

4,143<br />

(880)<br />

(14,824)<br />

14,567<br />

3,006<br />

The Notes on Pages 6-24 form part of these Financial St<strong>at</strong>ements 6

tree Housing Trust<br />

Registered Charity<br />

2008<br />

£'000<br />

888<br />

3,255<br />

4,143<br />

At<br />

<strong>31</strong>.12.09<br />

£'000<br />

4,548<br />

(14,000)<br />

(1,241)<br />

(22,610)<br />

(904)<br />

(6,074)<br />

(44,829)<br />

(40,281)<br />

The Notes on Pages 6-24 form part of these Financial St<strong>at</strong>ements 7

tree Housing Trust<br />

Registered Charity<br />

2008<br />

£'000<br />

3,006<br />

(14,710)<br />

(11,704)<br />

(<strong>31</strong>,526)<br />

(43,230)<br />

2008<br />

£'000<br />

865<br />

(30)<br />

835<br />

2008<br />

£'000<br />

875<br />

-<br />

875<br />

2008<br />

£'000<br />

386<br />

(457)<br />

(71)<br />

(22)<br />

(93)<br />

The Notes on Pages 6-24 form part of these Financial St<strong>at</strong>ements 8

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

NOTES TO THE ACCOUNTS<br />

1 Accounting Policies<br />

(a)<br />

Accounting Convention<br />

The Financial St<strong>at</strong>ements of the Trust are prepared under the historical cost convention in<br />

accordance with applicable accounting standards, the St<strong>at</strong>ement of Recommended Practice for<br />

Registered Social Landlords upd<strong>at</strong>e 2008 and comply with the Accounting Requirements for<br />

Registered Social Landlords General Determin<strong>at</strong>ion 2006.<br />

(b)<br />

Fixed Assets<br />

Fixed Assets are st<strong>at</strong>ed <strong>at</strong> cost. Housing Land and Buildings and Other Freehold Land and<br />

Buildings includes properties in the course of construction which are being developed with a view<br />

to the Trust retaining a long-term interest. Cost of Housing Land and Buildings and Other<br />

Freehold Land and Buildings includes directly <strong>at</strong>tributable management expenses and directly<br />

<strong>at</strong>tributable finance costs which are capitalised until the property reaches practical completion.<br />

Costs of modernis<strong>at</strong>ion and reimprovements to existing properties are capitalised if those costs<br />

result in an enhancement of economic benefits arising from the property.<br />

(c)<br />

Shared Ownership Properties<br />

Included within Housing Land and Buildings is the Trust's outstanding interest in dwellings<br />

developed on Shared Ownership terms. Under Shared Ownership arrangements the purch<strong>as</strong>er<br />

acquires a portion of the equity of the property and h<strong>as</strong> an option to acquire <strong>at</strong> any time further<br />

portions up to a limit determined by the Trust: the price payable is a corresponding portion of the<br />

market value of the property <strong>at</strong> the d<strong>at</strong>e of the initial purch<strong>as</strong>e or the exercise of the option. A rent<br />

is payable on any portion of the equity which is retained in the Trust's ownership.<br />

At the discretion of the Trust the terms of tenure between rent, shared ownership and outright<br />

ownership can be varied over time.<br />

The book value of the Trust's outstanding interest in Shared Ownership properties is st<strong>at</strong>ed <strong>at</strong><br />

cost, plus cost of equity subsequently repurch<strong>as</strong>ed by the Trust.<br />

(d)<br />

Hartrigg Oaks<br />

Hartrigg Oaks represents the cost of construction of 152 bungalows, 42 rooms in the Care Centre,<br />

and communal facilities, together with apportioned management expenses, start-up costs, and<br />

directly <strong>at</strong>tributable finance costs incurred up to completion.<br />

On subsequent sales, when a new le<strong>as</strong>e for the occup<strong>at</strong>ion of a bungalow <strong>at</strong> Hartrigg Oaks is<br />

entered into, the cost of the bungalow is rest<strong>at</strong>ed <strong>at</strong> the Fully Refundable Residence Fee, or<br />

equivalent sum, included in the le<strong>as</strong>e for th<strong>at</strong> bungalow.<br />

6

(e)<br />

Depreci<strong>at</strong>ion<br />

(i)<br />

Land and Buildings<br />

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

No depreci<strong>at</strong>ion is provided on freehold land. Depreci<strong>at</strong>ion on buildings is provided, on a<br />

straight line b<strong>as</strong>is, so <strong>as</strong> to write down the net book value of the buildings to their estim<strong>at</strong>ed<br />

residual value over their estim<strong>at</strong>ed useful economic lives. The depreciable amount is b<strong>as</strong>ed<br />

on the original cost, less Social Housing Grant and other grants applicable to the buildings.<br />

Depreci<strong>at</strong>ion is calcul<strong>at</strong>ed <strong>at</strong> the following r<strong>at</strong>es:-<br />

Housing Properties built since 1 January 2000: over 100 years<br />

Housing Properties built prior to 1 January 2000:-<br />

Housing Properties built before 1950: over 50 years from 1 January 2000<br />

Housing Properties built since 1950: over the balance of 100 years from<br />

1 January 2000<br />

Hartrigg Oaks Care Centre and Communal Facilities: over the balance of 100 years<br />

from 1 January 2000<br />

Other Buildings built since 1950: over the balance of 50 years from 1 January 2000<br />

Other Buildings more than 50 years old <strong>at</strong> 1 January 2000 and those from which the Trust<br />

receives no financial benefit have been fully depreci<strong>at</strong>ed.<br />

(ii)<br />

Vehicles, Furniture and Equipment<br />

Vehicles, Furniture and Equipment are written off over five years by a straight line method.<br />

Computer Equipment and Software is written off over three and five years respectively by a<br />

straight line method.<br />

(f)<br />

(g)<br />

Social Housing Grant<br />

Certain Housing Land and Buildings of the Trust have been developed with the benefit of Social<br />

Housing Grant. This Grant, which is paid by the Homes and Communities Agency (previously the<br />

Housing Corpor<strong>at</strong>ion) or the Local Authority in which the housing is developed, is deducted from<br />

the Cost of Housing Land and Buildings to which it rel<strong>at</strong>es. Social Housing Grant may be<br />

repayable in certain circumstances such <strong>as</strong> when a property is sold or if the development of a<br />

property is not completed.<br />

Other Grants<br />

Other Grants, which includes grants from other public bodies, legacies and other don<strong>at</strong>ions<br />

received for the development of specific capital projects are deducted from the cost of Housing<br />

Land and Buildings.<br />

(h)<br />

Homebuy<br />

Under the Homebuy loan arrangements the Trust h<strong>as</strong> made loans to individuals to enable them to<br />

purch<strong>as</strong>e a property. The loan is equivalent to a specified percentage, ranging from 12½% to 30%<br />

of the market value of the property. No interest is charged on the loan but the Trust is entitled to<br />

receive the specified percentage of the market value of the property which is credited in full to<br />

interest receivable in the Income and Expenditure Account when it is sold. The loans are<br />

secured on the properties to which they rel<strong>at</strong>e. This scheme is supported by the Homes and<br />

Communities Agency (previously the Housing Corpor<strong>at</strong>ion) through the provision of Social<br />

Housing Grant.<br />

7

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

(i)<br />

Stock<br />

Stock, which comprises m<strong>at</strong>erials, loose tools and other building supplies for use by the Direct<br />

Labour Organis<strong>at</strong>ion, and food and drink for use in the restaurant/coffee shop <strong>at</strong> Hartrigg Oaks, is<br />

st<strong>at</strong>ed <strong>at</strong> the lower of cost and net realisable value.<br />

(j)<br />

Deferred Income - Amounts Received in Advance<br />

(i)<br />

Le<strong>as</strong>eholders<br />

The Trust h<strong>as</strong> entered into Le<strong>as</strong>es in which it is required to defer income to m<strong>at</strong>ch against<br />

future expenditure on maintenance and repairs and equipment from sums collected via the<br />

service charge. Interest is added to the sums set <strong>as</strong>ide <strong>at</strong> the Trust's overdraft r<strong>at</strong>e.<br />

(ii)<br />

Residential Care Homes<br />

The Trust h<strong>as</strong> deferred income to m<strong>at</strong>ch against future expenditure on furnishings and<br />

equipment <strong>at</strong> its Residential Care Homes from fees received from residents. Interest is<br />

added to the sums set <strong>as</strong>ide <strong>at</strong> the Trust's overdraft r<strong>at</strong>e.<br />

(iii)<br />

Rents Received in Advance<br />

The Trust h<strong>as</strong> received rental income in advance on Office Accommod<strong>at</strong>ion which is<br />

rele<strong>as</strong>ed to the Income and Expenditure Account over the length of the le<strong>as</strong>e.<br />

(k)<br />

Hartrigg Oaks Capitalised Community Fees<br />

Hartrigg Oaks Capitalised Community Fees represent sums paid in advance by residents <strong>at</strong><br />

Hartrigg Oaks towards the Community Fee. Capitalised Community Fees are not refundable<br />

when a resident leaves Hartrigg Oaks on a permanent b<strong>as</strong>is, except partial repayments, on a<br />

decre<strong>as</strong>ing b<strong>as</strong>is, are made over the first 56 months of residence. Capitalised Community Fees<br />

are amortised in the Accounts over the anticip<strong>at</strong>ed lives of the residents <strong>at</strong> a r<strong>at</strong>e b<strong>as</strong>ed on advice<br />

from the Trust's actuaries.<br />

(l)<br />

Recycled Capital Grant Fund<br />

Following the full sale of a rented property (other than under the Voluntary Purch<strong>as</strong>e Grant or<br />

Social Homebuy programmes), the partial sale of a shared ownership property or upon a<br />

Homebuy redemption, the Social Housing Grant <strong>at</strong>tributable to th<strong>at</strong> property is transferred to the<br />

Recycled Capital Grant Fund. Sums in th<strong>at</strong> Fund must be applied in accordance with criteria<br />

established by the Homes and Communities Agency.<br />

(m)<br />

Disposal Proceeds Fund<br />

Following the sale of a rented property under the Government's Voluntary Purch<strong>as</strong>e Grant<br />

programme or Social Homebuy Programme, the Social Housing Grant <strong>at</strong>tributable to th<strong>at</strong> property<br />

is transferred to the Disposal Proceeds Fund. The surplus on sale over book cost is transferred to<br />

the Sales Re-investment Fund. Sums in the Disposal Proceeds Fund must be applied in<br />

accordance with criteria established by the Homes and Communities Agency, principally in the<br />

provision of replacement property for rent.<br />

8

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

(n)<br />

Hartrigg Oaks Residence Fees<br />

Hartrigg Oaks Residence Fees represents sums received from residents under the Le<strong>as</strong>e and<br />

Care Agreements <strong>at</strong> Hartrigg Oaks. Fully Refundable Residence Fees are refundable in the<br />

original sum within 14 days of a resident leaving Hartrigg Oaks on a permanent b<strong>as</strong>is. No interest<br />

is payable by the Trust on the sums received. Non-refundable Residence Fees are not<br />

refundable when a resident leaves Hartrigg Oaks on a permanent b<strong>as</strong>is except partial<br />

repayments, on a decre<strong>as</strong>ing b<strong>as</strong>is, are made over the first 56 months of residence. Nonrefundable<br />

Residence Fees are amortised in the Accounts over the anticip<strong>at</strong>ed lives of the<br />

residents <strong>at</strong> a r<strong>at</strong>e b<strong>as</strong>ed on advice from the Trust's actuaries.<br />

(o)<br />

Bonds and Loan Stock<br />

The Trust h<strong>as</strong> issued Bonds and Loan Stock <strong>at</strong> its Residential Care Homes. Residents who take<br />

up Bonds or Loan Stock are entitled to a reb<strong>at</strong>e on their fee. Any interest which is earned on the<br />

Bonds or Stock in excess of the reb<strong>at</strong>es given is available to provide Bursary Support to those<br />

residents in the Homes who are unable to meet the full fee. Repayments are made when a<br />

resident ce<strong>as</strong>es to be in occup<strong>at</strong>ion or following a re-<strong>as</strong>sessment of a resident's financial position.<br />

(p)<br />

Design<strong>at</strong>ed Reserves<br />

(i)<br />

Hartrigg Oaks Reserve<br />

The Trustees have earmarked sums from the surplus on Hartrigg Oaks oper<strong>at</strong>ions to meet<br />

the future care needs of the residents of Hartrigg Oaks and Major Repairs/Improvements to<br />

the property.<br />

(ii)<br />

Hartrigg Oaks Bursary Reserve<br />

The Trustees have earmarked sums to provide Bursary Support to residents of the Trust to<br />

enable them to join Hartrigg Oaks.<br />

(q)<br />

Restricted Reserves: Sales Re-investment Fund<br />

The surplus on sale over book cost arising from sales of property under the Government's<br />

Voluntary Purch<strong>as</strong>e Grant and Social Homebuy programmes have been transferred to the Sales<br />

Re-investment Fund. Sums in the Fund will be rele<strong>as</strong>ed when they have been applied to provide<br />

replacement housing property.<br />

(r)<br />

Sales of Housing Land and Buildings<br />

Sales of Housing Land and Buildings are included in the Accounts with effect from the d<strong>at</strong>e of the<br />

legal completion of the sale. The proceeds of sale of the first tranche of shared ownership<br />

properties are st<strong>at</strong>ed net of any contribution required to cross subsidise other elements of the<br />

scheme concerned and are included in turnover.<br />

Surpluses on subsequent tranches and from other Sales are recognised in their entirety in the<br />

Income and Expenditure Account (Note 20) after the Oper<strong>at</strong>ing Surplus. At the Trust's Extra Care<br />

schemes the Trust is committed to buying back property on the termin<strong>at</strong>ion of the le<strong>as</strong>e. The<br />

price paid to the outgoing resident is the original price paid plus a percentage of the equity<br />

appreci<strong>at</strong>ion. The remaining equity appreci<strong>at</strong>ion is retained by the Trust.<br />

9

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

(s)<br />

Major Repairs and Cyclical Maintenance<br />

Expenditure on Major Repairs, including reimprovements, and Cyclical Maintenance on general<br />

needs housing accommod<strong>at</strong>ion and Residential Care Homes is charged to the Income and<br />

Expenditure Account in the year in which it is incurred unless it results in an enhancement of<br />

economic benefit. Major Repair Social Housing Grant which is received is offset against<br />

expenditure incurred.<br />

(t)<br />

Impairment<br />

For all properties with a remaining useful economic life of more than fifty years, impairment<br />

reviews are carried out on an annual b<strong>as</strong>is in accordance with Financial Reporting Standard 11.<br />

(u)<br />

<strong>Joseph</strong> <strong>Rowntree</strong> Found<strong>at</strong>ion<br />

The <strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust (JRHT) h<strong>as</strong> the same Trustees <strong>as</strong> the <strong>Joseph</strong> <strong>Rowntree</strong><br />

Found<strong>at</strong>ion (JRF). The JRF funds a programme of Research and Development in Social Policy<br />

and Practice.<br />

Directors and staff are employed by the JRF and certain Administr<strong>at</strong>ion Costs are shared between<br />

JRHT and JRF. Those costs which are solely <strong>at</strong>tributable to one of the Organis<strong>at</strong>ions are charged<br />

to th<strong>at</strong> Organis<strong>at</strong>ion. Shared costs are apportioned between JRHT and JRF on the b<strong>as</strong>is of an<br />

estim<strong>at</strong>ed division of staff time.<br />

(v)<br />

Pensions<br />

The pensions costs charged in the accounts are calcul<strong>at</strong>ed so <strong>as</strong> to spread the cost of pensions<br />

over the service lives of employees in the Social Housing Pension Scheme.<br />

(w)<br />

VAT<br />

The Trust is registered for VAT. Expenditure is included gross of VAT and any recoveries made<br />

are netted off other oper<strong>at</strong>ing costs (Note 18a).<br />

10

2 Housing Land and Buildings<br />

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

Cost<br />

Other<br />

Housing<br />

Property<br />

£'000 £'000 £'000<br />

At 1 January 55,102 9,762 1,211 21,530<br />

Additions 1,769 - - 2,517<br />

Sales (Note 20) (414) - - -<br />

Transfer to housing stock held for<br />

resale (608) - - -<br />

Recl<strong>as</strong>sific<strong>at</strong>ion - (329) - 329<br />

Completions 17,953 132 - (18,085)<br />

At <strong>31</strong> <strong>December</strong> 73,802 9,565 1,211 6,291<br />

Social Housing Grant<br />

At 1 January 23,056 2,029 1,177 1,676<br />

Received in Year - - - 170<br />

Transferred from the Recycled<br />

Capital Grant Fund (Note 10)<br />

143 - - 60<br />

Transferred to the Recycled<br />

Capital Grant Fund (Note 10)<br />

(80) - - -<br />

Ab<strong>at</strong>ement (7) - - -<br />

Recl<strong>as</strong>sific<strong>at</strong>ion - (<strong>31</strong>4) - <strong>31</strong>4<br />

Completions 1,094 - - (1,094)<br />

At <strong>31</strong> <strong>December</strong> 24,206 1,715 1,177 1,126<br />

Other Grants<br />

At 1 January 2,500 990 - 9,855<br />

Completions 9,855 - - (9,855)<br />

At <strong>31</strong> <strong>December</strong> 12,355 990 - -<br />

Depreci<strong>at</strong>ion<br />

At 1 January 2,486 387 3 -<br />

Transfer to Housing Stock held for<br />

resale (10) - - -<br />

Recl<strong>as</strong>sific<strong>at</strong>ion - (2) - 2<br />

Charge for the year 435 54 - -<br />

Disposals (Note 20) (13) - - -<br />

At <strong>31</strong> <strong>December</strong> 2,898 439 3 2<br />

Net Book Value<br />

At 1 January 27,060 6,356 <strong>31</strong> 9,999<br />

At <strong>31</strong> <strong>December</strong> 34,343 6,421 <strong>31</strong> 5,163<br />

Represented by:<br />

Housing<br />

Property<br />

held for<br />

letting<br />

Residential<br />

Care Homes<br />

Property<br />

in the<br />

Course of<br />

Construction<br />

£'000<br />

Freehold Land and Buildings 28,971 6,421 <strong>31</strong> 5,163<br />

Long Le<strong>as</strong>ehold Land and<br />

Buildings 5,372 - - -<br />

34,343 6,421 <strong>31</strong> 5,163<br />

11

tree Housing Trust<br />

Registered Charity<br />

Total<br />

£'000<br />

87,605<br />

4,286<br />

(414)<br />

(608)<br />

-<br />

-<br />

90,869<br />

27,938<br />

170<br />

203<br />

(80)<br />

(7)<br />

-<br />

-<br />

28,224<br />

13,345<br />

-<br />

13,345<br />

2,876<br />

(10)<br />

-<br />

489<br />

(13)<br />

3,342<br />

43,446<br />

45,958<br />

40,586<br />

5,372<br />

45,958<br />

12

2 Housing Land and Buildings (continued)<br />

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

(i)<br />

(ii)<br />

(iii)<br />

(iv)<br />

(v)<br />

Included within the net book value of £34,343,000 (2008: £27,060,000) of Housing Properties held<br />

for letting are Shared Ownership properties with a net book value of £7,060,000 (2008:<br />

£5,756,000).<br />

Additions in the year include £245,740 (2008: £362,745) in respect of Development Administr<strong>at</strong>ion<br />

and £191,933 (2008: £1,380,277) in respect of bridging interest. The average r<strong>at</strong>e of interest w<strong>as</strong><br />

1.64% (2008: 5.69%).<br />

Expenditure on existing housing properties during the year totalled £949,000 (2008: £1,020,000).<br />

Of this amount £467,000 (2008: £379,000) w<strong>as</strong> capitalised and £482,000 (2008: £641,000) w<strong>as</strong><br />

cl<strong>as</strong>sified <strong>as</strong> major repairs and charged to the Income and Expenditure Account.<br />

Recl<strong>as</strong>sific<strong>at</strong>ion refers to care units which were transferred to work in progress during the year<br />

pending reconfigur<strong>at</strong>ion.<br />

The total accumul<strong>at</strong>ed Social Housing Grant received by the Trust up to <strong>31</strong> <strong>December</strong> <strong>2009</strong>,<br />

including Major Repairs Grant, w<strong>as</strong> £<strong>31</strong>,451,212 (2008: £<strong>31</strong>,281,212).<br />

3 Hartrigg Oaks<br />

Cost<br />

<strong>2009</strong> <strong>2009</strong><br />

£'000<br />

£'000<br />

At 1 January 22,508<br />

Expenditure in the year 33<br />

Current Residence Fees on bungalows re-sold in the year<br />

Less: previous Residence Fees on bungalows re-sold in the year<br />

2,599<br />

(945)<br />

Incre<strong>as</strong>e in Residence Fees on bungalows re-sold in the year<br />

1,654<br />

At <strong>31</strong> <strong>December</strong> 24,195<br />

Depreci<strong>at</strong>ion<br />

At 1 January <strong>31</strong>3<br />

Charged in the year 45<br />

At <strong>31</strong> <strong>December</strong> 358<br />

Net Book Value<br />

At 1 January 22,195<br />

At <strong>31</strong> <strong>December</strong> 23,837<br />

Hartrigg Oaks is a Continuing Care Retirement Community built on land in the Trust's ownership in<br />

New Earswick. It consists of 152 bungalows, a 42 room Care Centre, together with communal<br />

facilities.<br />

4 Homebuy<br />

<strong>2009</strong><br />

£'000<br />

Loans<br />

At 1 January 4,458<br />

Additions -<br />

Repayments (56)<br />

At <strong>31</strong> <strong>December</strong> 4,402<br />

12

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

4 Homebuy (continued)<br />

Grants<br />

<strong>2009</strong><br />

£'000<br />

At 1 January 4,442<br />

Received in the year -<br />

Applied to Recycled Capital Grant Fund (Note 10) (36)<br />

Grant Ab<strong>at</strong>ed (20)<br />

At <strong>31</strong> <strong>December</strong> 4,386<br />

Net Book Value<br />

At 1 January 16<br />

At <strong>31</strong> <strong>December</strong> 16<br />

5 Other Fixed Assets<br />

Cost<br />

£'000 £'000 £'000<br />

At 1 January 12,398 1,077 13,475<br />

Additions 345 18 363<br />

Disposals/Repayments (187) (62) (249)<br />

At <strong>31</strong> <strong>December</strong> 12,556 1,033 13,589<br />

Depreci<strong>at</strong>ion<br />

Other<br />

Freehold<br />

Land and<br />

Buildings<br />

Vehicles,<br />

Furniture and<br />

Equipment<br />

At 1 January 871 775 1,646<br />

Charge for the year 200 87 287<br />

Disposals/Repayments (8) (48) (56)<br />

At <strong>31</strong> <strong>December</strong> 1,063 814 1,877<br />

Net Book Value<br />

At 1 January 11,527 302 11,829<br />

At <strong>31</strong> <strong>December</strong> 11,493 219 11,712<br />

Other Freehold Land and Buildings consists of the Trust's farm holdings, business and office<br />

premises, communal are<strong>as</strong> <strong>at</strong> Extra Care schemes, other non-housing property in New Earswick<br />

and an outdoor activity school <strong>at</strong> Stape on the North Yorkshire Moors.<br />

Total<br />

6 Debtors<br />

<strong>2009</strong> 2008<br />

£'000 £'000 £'000 £'000<br />

Housing Stock held for re-sale 8,477 13,216<br />

Loans 16 29<br />

Stock 129 139<br />

Rent Arrears<br />

Gross 395 377<br />

Bad Debt Provision (80) (52)<br />

<strong>31</strong>5 325<br />

Other Debtors 878 744<br />

9,815 14,453<br />

13

6 Debtors (continued)<br />

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

Loans represent sums advanced to New Earswick Sports and Social Club and New Earswick<br />

N<strong>at</strong>ure Reserve. The loan to the Club <strong>at</strong>tracts interest <strong>at</strong> the Trust's overdraft r<strong>at</strong>e and h<strong>as</strong> a final<br />

repayment d<strong>at</strong>e of April 2010. The loan to the N<strong>at</strong>ure Reserve is interest free and h<strong>as</strong> a final<br />

repayment d<strong>at</strong>e of September 2014.<br />

7 C<strong>as</strong>h <strong>at</strong> Bank and Short Term Deposit<br />

C<strong>as</strong>h <strong>at</strong> Bank and in-hand<br />

8 Creditors: Amounts falling due within one year<br />

<strong>2009</strong> 2008<br />

£'000<br />

£'000<br />

4,548 5,968<br />

4,548 5,968<br />

<strong>2009</strong> 2008<br />

£'000<br />

£'000<br />

Bridging Loan 1,241 5,871<br />

Housing Loans (Note 12) 296 280<br />

Hartrigg Oaks Loans (Note 12) 76 79<br />

Rent in Advance 171 78<br />

Recycled Capital Grant Fund (Note 10) 69 272<br />

Disposal Proceeds Fund (Note 11) 114 107<br />

Other Creditors 1,660 2,442<br />

9 Creditors: Amounts falling due after one year<br />

3,627 9,129<br />

The Bridging Loan h<strong>as</strong> been provided by the <strong>Joseph</strong> <strong>Rowntree</strong> Found<strong>at</strong>ion. Interest is charged <strong>at</strong><br />

the Found<strong>at</strong>ion's overdraft r<strong>at</strong>e.<br />

<strong>2009</strong><br />

2008<br />

£'000 £'000 £'000 £'000<br />

Deferred Income - amounts received in advance:<br />

Rents received in advance 683 733<br />

Le<strong>as</strong>eholders 1,267 1,266<br />

Residential Care Homes and Extra Care 720 650<br />

Hartrigg Oaks 281 272<br />

2,951 2,921<br />

Capitalised Community Fees:<br />

At 1 January 1,247 1,291<br />

Received in the year 293 54<br />

Repaid in the year - -<br />

Amortis<strong>at</strong>ion in the year (106) (98)<br />

At <strong>31</strong> <strong>December</strong> 1,434 1,247<br />

Recycled Capital Grant Fund (Note 10) 570 453<br />

4,955 4,621<br />

14

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

10 Recycled Capital Grant Fund (RCGF)<br />

<strong>2009</strong> 2008<br />

£'000<br />

£'000<br />

At 1 January 725 721<br />

Transfer in the year (Note 2) 80 26<br />

Applied in the year (Note 2) (203) (95)<br />

Homebuy Grant repaid (Note 4) 36 43<br />

Interest added to the Fund (Note 24) 1 30<br />

At <strong>31</strong> <strong>December</strong> 639 725<br />

RCGF is applicable in the following periods:-<br />

<strong>2009</strong> 2008<br />

£'000<br />

£'000<br />

Within one year (Note 8) 69 272<br />

More than one year (Note 9) 570 453<br />

639 725<br />

11 Disposal Proceeds Fund (DPF)<br />

<strong>2009</strong> 2008<br />

£'000<br />

£'000<br />

At 1 January 107 57<br />

Transfer in the year (Note 2) - 172<br />

Applied in the year (Note 2) - (130)<br />

Social Homebuy Grant Repaid 6 -<br />

Interest added to the Fund (Note 24) 1 8<br />

At <strong>31</strong> <strong>December</strong> 114 107<br />

All of the DPF balance <strong>at</strong> <strong>31</strong> <strong>December</strong> <strong>2009</strong> is applicable within one year.<br />

12 Loans due after one year<br />

<strong>2009</strong> 2008<br />

£'000<br />

£'000<br />

Housing Loans (Note i) 22,<strong>31</strong>4 14,611<br />

Hartrigg Oaks loans (Note ii) 828 904<br />

Revolving Credit (Note iii) 14,000 22,000<br />

37,142 37,515<br />

15

12 Loans due after one year (continued)<br />

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

Note i<br />

The Housing Loans comprise:-<br />

<strong>2009</strong> 2008<br />

£'000<br />

£'000<br />

Orchardbrook Ltd 1,200 1,276<br />

Lloyds TSB plc Loan 1 3,114 3,335<br />

Lloyds TSB plc Loan 2 10,000 10,000<br />

Lloyds TSB plc Loan 3 8,000 -<br />

22,<strong>31</strong>4 14,611<br />

(a)<br />

(b)<br />

(c)<br />

(d)<br />

The loans from Orchardbrook Ltd are settled by equal half-yearly instalments of capital and interest<br />

over the estim<strong>at</strong>ed life of the scheme for which the loan w<strong>as</strong> provided. The final instalments fall to<br />

be repaid in the period 2010 to 2047. The r<strong>at</strong>es of interest are fixed and range from 9.25% to<br />

15.875%. The loans are secured against 156 of the Trust's properties.<br />

Loan 1 from Lloyds TSB plc is for a 25 year term <strong>at</strong> a fixed r<strong>at</strong>e of interest of 4.89% with the final<br />

instalment being due in 2021. The loan is secured against 67 of the Trust's properties and h<strong>as</strong><br />

been guaranteed by the <strong>Joseph</strong> <strong>Rowntree</strong> Found<strong>at</strong>ion.<br />

Loan 2 from Lloyds TSB is for a 30 year term with a bullet repayment. Interest is fixed <strong>at</strong> 4.74%<br />

until September 2013. The margins incre<strong>as</strong>e over the life of the loan so th<strong>at</strong> from September 2030<br />

the r<strong>at</strong>e, including margins, is 4.84%. The average r<strong>at</strong>e charged during the year w<strong>as</strong> 4.74%. The<br />

loan is secured against 147 of the Trust's properties.<br />

Loan 3 from Lloyds TSB is for a 28 year term with a bullet repayment. It w<strong>as</strong> converted from the<br />

Lloyds TSB revolving facility (note iii below) on 1 May <strong>2009</strong>. Interest is fixed <strong>at</strong> 4.26% up to 24<br />

March 2010. The margins incre<strong>as</strong>e over the life of the loan, so th<strong>at</strong> from 24 March 2028 the r<strong>at</strong>e,<br />

including margins, is 4.39%. The loan is secured against 80 of the Trust's properties.<br />

The Housing Loans are repayable in the following periods:-<br />

<strong>2009</strong><br />

2008<br />

£'000 £'000 £'000 £'000<br />

In one year or less (Note 8) 296 280<br />

Between one and two years <strong>31</strong>2 297<br />

Between two and five years 934 948<br />

In five years or more 21,068 13,366<br />

Note ii<br />

The Hartrigg Oaks Loans comprise:-<br />

22,<strong>31</strong>4 14,611<br />

22,610 14,891<br />

<strong>2009</strong> 2008<br />

£'000<br />

£'000<br />

<strong>Joseph</strong> <strong>Rowntree</strong> Found<strong>at</strong>ion<br />

Fixed 828 904<br />

Interest is charged on this fixed loan <strong>at</strong> an interest r<strong>at</strong>e of 6.75%. The loan is due to be repaid in<br />

2023.<br />

16

12 Loans due after one year (continued)<br />

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

The Hartrigg Oaks Loans are repayable in the following periods:-<br />

13 Hartrigg Oaks Residence Fees<br />

<strong>2009</strong><br />

2008<br />

£'000 £'000 £'000 £'000<br />

In one year or less (Note 8) 76 79<br />

Between one and two years 73 76<br />

Between two and five years 207 213<br />

In five years or more 548 615<br />

828 904<br />

904 983<br />

Note iii<br />

The Revolving Credit represents a drawdown from a facility of £32m with Lloyds TSB. Interest is<br />

charged <strong>at</strong> a variable r<strong>at</strong>e linked to LIBOR: the average r<strong>at</strong>e charged during the year w<strong>as</strong> 1.<strong>31</strong>%. The<br />

Facility is secured against 320 of the Trust's properties. During the year, £8m of the initial facility of<br />

£40m w<strong>as</strong> converted to a term loan (note i).<br />

At 1 January 13,119 2,072 15,191<br />

Received in the year 1,884 341 2,225<br />

Repaid in the year (622) - (622)<br />

Amortised in the year - (245) (245)<br />

At <strong>31</strong> <strong>December</strong> 14,381 2,168 16,549<br />

14 Bonds and Loan Stock<br />

<strong>2009</strong> 2008<br />

£'000<br />

£'000<br />

At 1 January 5,453 5,819<br />

Bonds and Loan Stock received in the year 1,780 1,273<br />

Bonds and Loan Stock repaid in the year (1,109) (1,743)<br />

Index<strong>at</strong>ion (50) 104<br />

At <strong>31</strong> <strong>December</strong> 6,074 5,453<br />

15 Reserves<br />

Fully Nonrefundable<br />

Refundable<br />

Fees Fees Total<br />

£'000 £'000 £'000<br />

Index<strong>at</strong>ion represents a decre<strong>as</strong>e in sums due to Bedford Court bond holders, following the reduction<br />

in RPI during the year.<br />

(a) Revenue Reserves £'000<br />

At 1 January 22,061<br />

Surplus for the year 1,541<br />

23,602<br />

Transfers:<br />

To Restricted Reserves (10)<br />

To Design<strong>at</strong>ed Reserves (848)<br />

At <strong>31</strong> <strong>December</strong> 22,744<br />

17

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

15 Reserves (continued)<br />

(b) Restricted Reserves<br />

£'000<br />

Sales Reinvestment<br />

Fund<br />

£'000<br />

At 1 January 1,575<br />

Transfer from Revenue Reserves<br />

10<br />

At <strong>31</strong> <strong>December</strong> 1,585<br />

The transfer to the Sales Re-investment Fund represents notional interest applied during the year.<br />

(c) Design<strong>at</strong>ed Reserves<br />

Hartrigg<br />

Oaks<br />

Reserve<br />

Hartrigg<br />

Oaks<br />

Bursary<br />

Reserve<br />

Total<br />

£'000 £'000 £'000<br />

At 1 January 2,182 180 2,362<br />

Transfers from Revenue Reserves 843 5 848<br />

At <strong>31</strong> <strong>December</strong> 3,025 185 3,210<br />

16 Capital Commitments<br />

<strong>2009</strong> 2008<br />

£'000<br />

£'000<br />

Expenditure authorised not contracted 1,438 500<br />

Expenditure contracted less certified 7,497 14,417<br />

8,935 14,917<br />

Included within "Expenditure contracted less certified" is £1.57m rel<strong>at</strong>ing to land purch<strong>as</strong>ed on deferred<br />

consider<strong>at</strong>ion terms. Payment falls due between the years 2026 and 2044 or, if earlier, <strong>at</strong> the time of<br />

freehold sales of the dwellings developed on the land.<br />

17 Housing Stock<br />

Housing Properties<br />

Rent<br />

Shared<br />

Ownership<br />

Extra<br />

Care<br />

Le<strong>as</strong>ehold<br />

Le<strong>as</strong>ehold<br />

Scheme<br />

for Elderly<br />

Residential<br />

Care Homes<br />

(Bedspaces)<br />

Hartrigg<br />

Oaks<br />

Total<br />

At 1 January 1,278 386 14 156 182 194 2,210<br />

Additions 106 51 34 - 2 - 193<br />

Reconfigur<strong>at</strong>ion - - - - (13) - (13)<br />

Net switches in tenure (1) 1 - - - - -<br />

Sales (3) (3) - - - - (6)<br />

Disposals - - - - (1) - (1)<br />

At <strong>31</strong> <strong>December</strong> 1,380 435 48 156 170 194 2,383<br />

18

17 Housing Stock (continued)<br />

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

In addition, the Trust manages 42 units within two le<strong>as</strong>ehold schemes and owns 14 shops and two<br />

farm holdings in New Earswick. There are also 9 units used <strong>as</strong> accommod<strong>at</strong>ion by scheme managers.<br />

Reconfigur<strong>at</strong>ion rel<strong>at</strong>es to units which were transferred to work in progress during the year prior to<br />

remodelling. The disposal of the Residential Care Unit during the year rel<strong>at</strong>es to the decommissioning<br />

of one unit for use <strong>as</strong> a communal facility.<br />

18 Turnover, Oper<strong>at</strong>ing Surplus and Surplus for the Year<br />

(a) By cl<strong>as</strong>s of business<br />

Social Housing<br />

Activities:<br />

Cost<br />

of<br />

Sales<br />

Surplus/<br />

(Deficit)<br />

for the<br />

year<br />

£'000 £'000 £'000 £'000 £'000<br />

Housing for Rent 5,053 (3,641) - 1,412 1,342<br />

Shared Ownership 920 (582) - 338 306<br />

Service Charges<br />

eligible for housing benefit<br />

393 (829) - (436) (92)<br />

Care and Support Charges<br />

Residential Care Homes<br />

1,209 (1,189) - 20 (2)<br />

3,956 (4,485) - (529) (445)<br />

First tranche sales 5,911 - (5,911) - (85)<br />

Other Social Housing<br />

Activities:<br />

Community Services and<br />

Special Initi<strong>at</strong>ives (Note 19)<br />

Management Services<br />

17,442 (10,726) (5,911) 805 1,024<br />

253 (532) - (279) (302)<br />

101 (80) - 21 32<br />

Property Services 180 (228) - (48) (45)<br />

VAT - 6 - 6 6<br />

Notes 18(b) & 18(c)<br />

Non-Social Housing<br />

Activities:<br />

Oper<strong>at</strong>ing<br />

Costs<br />

534 (834) - (300) (309)<br />

17,976 (11,560) (5,911) 505 715<br />

Hartrigg Oaks 2,385 (2,334) - 51 99<br />

Business Properties<br />

and Farms<br />

Turnover<br />

2008<br />

Surplus/<br />

(Deficit) for<br />

the year<br />

340 (229) - 111 74<br />

2,725 (2,563) - 162 173<br />

Oper<strong>at</strong>ing Surplus 20,701 (14,123) (5,911) 667 888<br />

Interest Receivable 136 249<br />

Interest Payable (Note 24)<br />

Surplus on Sales (Note 20)<br />

(1,<strong>31</strong>1) (1,167)<br />

2,049 1,203<br />

Surplus for the year 1,541 1,173<br />

First tranche sales includes outright sales <strong>at</strong> Extra Care schemes, Hartfields and Plaxton Court.<br />

19

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

18 Turnover, Oper<strong>at</strong>ing Surplus and Surplus for the Year (continued)<br />

(b) Turnover from Social Housing Activities<br />

<strong>2009</strong><br />

2008<br />

£'000 £'000 £'000 £'000<br />

Rents and service charges from Housing Properties 6,502 5,469<br />

Charges for Care and Support Services from<br />

Housing Properties<br />

1,209 149<br />

Income from Residential Care Homes<br />

Fees 4,020 4,022<br />

Supporting People Grant 49 47<br />

4,069 4,069<br />

Proceeds from first tranche sales 5,911 7,120<br />

Other Social Housing Activities 534 936<br />

18,225 17,743<br />

Less: Voids on Housing Properties (136) (24)<br />

Voids on Residential Care Homes (113) (93)<br />

(249) (117)<br />

17,976 17,626<br />

(c) Oper<strong>at</strong>ing Costs of Social Housing Activities<br />

Housing<br />

for Rent<br />

Shared<br />

Ownership<br />

Total<br />

<strong>2009</strong><br />

Total<br />

2008<br />

£'000 £'000 £'000 £'000<br />

Direct Property Management:<br />

Management Expenses 1,537 365 1,902 1,245<br />

Repairs and Maintenance 1,049 59 1,108 1,121<br />

Major Repairs 418 64 482 641<br />

Depreci<strong>at</strong>ion 358 77 435 371<br />

Est<strong>at</strong>e Maintenance 260 11 271 263<br />

Bad Debts 19 6 25 23<br />

3,641 582 4,223 3,664<br />

Other Oper<strong>at</strong>ing Costs:<br />

Service Costs 829 225<br />

Costs of Care and Support Services to Housing Properties 1,189 151<br />

Residential Care Homes Expenditure 4,485 4,421<br />

Community Services and Other Special Initi<strong>at</strong>ives 532 543<br />

Management Services 80 302<br />

Property Services 228 406<br />

VAT (6) (6)<br />

11,560 9,706<br />

20

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

19 Community and Special Initi<strong>at</strong>ives<br />

<strong>2009</strong> 2008<br />

£'000<br />

£'000<br />

Special Initi<strong>at</strong>ives - Care 22 (9)<br />

Contribution to New Earswick Schools 41 39<br />

New Earswick Community Associ<strong>at</strong>ion 55 53<br />

Net Cost of Swimming Pool 54 33<br />

Hartrigg Oaks Bursary Support 25 24<br />

New Earswick Community Grants 22 32<br />

Repairs to New Earswick Folk Hall 7 16<br />

Remodelling of New Earswick Primary School (21) 35<br />

New Earswick Community Development Trust 20 -<br />

Community Facilities Audit - 22<br />

Major Repairs to Stape School - 24<br />

Other 23 33<br />

248 302<br />

Special Initi<strong>at</strong>ives-Care represents specialist posts including a Person-Centred Planning Co-ordin<strong>at</strong>or<br />

and Specialist Mental Health Nurse, net of income received from the Training function.<br />

20 Surplus on Sales<br />

Housing<br />

Properties<br />

£'000<br />

Hartrigg<br />

Oaks<br />

<strong>2009</strong><br />

Total<br />

2008<br />

Total<br />

£'000 £'000 £'000<br />

Sales proceeds 836 2,599 3,435 1,555<br />

Less: Cost of properties sold<br />

(Notes 2 and 3)<br />

(414) (945) (1,359) (304)<br />

Depreci<strong>at</strong>ion (Note 2) 13 - 13 4<br />

Direct Costs (26) (21) (47) (52)<br />

Social Housing Grant Ab<strong>at</strong>ed (Note 2) 7 - 7 -<br />

(420) (966) (1,386) (352)<br />

Surplus on sales 416 1,633 2,049 1,203<br />

21 Trustees' and Directors' Emoluments<br />

No Trustee received any emoluments or benefits in kind in respect of their services.<br />

The Executive Directors of the Trust are employed by the <strong>Joseph</strong> <strong>Rowntree</strong> Found<strong>at</strong>ion (JRF) and<br />

costs of employment are apportioned to the Trust on the b<strong>as</strong>is of an estim<strong>at</strong>ed division of time.<br />

The remuner<strong>at</strong>ion paid by the Found<strong>at</strong>ion to the Executive Directors, and the amounts apportioned to<br />

JRHT, were <strong>as</strong> follows:-<br />

<strong>2009</strong> 2008<br />

Highest Paid Director (excluding pension<br />

contributions, but including benefits in kind)<br />

Total Directors' Emoluments (including pension<br />

contributions and benefits in kind)<br />

Total<br />

Total<br />

£ £ £ £<br />

151,500<br />

582,338<br />

Apportioned<br />

JRHT<br />

Apportioned<br />

JRHT<br />

18,180 147,500 17,700<br />

363,977 629,851 344,737<br />

21

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

21 Trustees' and Directors' Emoluments (continued)<br />

All of the Directors are ordinary members of the pension scheme.<br />

Staff are employed by the <strong>Joseph</strong> <strong>Rowntree</strong> Found<strong>at</strong>ion (JRF). Costs are apportioned between JRF<br />

and the Trust on the b<strong>as</strong>is of an estim<strong>at</strong>ed division of time. Total staff costs, including those shared<br />

with JRF, during the year, were:-<br />

The number of Directors of the JRF for whom a percentage of emoluments (excluding pension<br />

contributions but including benefits in kind) w<strong>as</strong> apportioned to the Trust fell in the following ranges<br />

w<strong>as</strong>:-<br />

<strong>2009</strong> 2008<br />

£55,001 - £60,000 - 1<br />

£65,001 - £70,000 2 -<br />

£70,001 - £75,000 2 2<br />

£85,001 - £90,000 1 -<br />

£90,001 - £95,000 - 1<br />

£115,001 - £120,000 - 1<br />

£145,001 - £150,000 - 1<br />

£150,001 - £155,000 1 -<br />

A loan to one of the Directors for a car required for business purposes w<strong>as</strong> outstanding <strong>at</strong> the<br />

beginning and end of the year. The details of the loan, for which a commercial r<strong>at</strong>e of interest is being<br />

charged are:-<br />

Sum advanced 4,865<br />

Repayments (2,820)<br />

Balance <strong>at</strong> <strong>31</strong> <strong>December</strong> <strong>2009</strong><br />

2,045<br />

£<br />

22 Staff Costs<br />

<strong>2009</strong> 2008<br />

£'000<br />

£'000<br />

Wages and salaries 10,620 9,229<br />

N<strong>at</strong>ional Insurance contributions 760 674<br />

Other pension costs (Note 23) 663 666<br />

12,043 10,569<br />

The average weekly number of persons, including part time staff, employed by JRF in conjunction with<br />

the Trust during the year w<strong>as</strong> 590 (2008: 494). £9,553,000 (2008: £8,116,000) of the staff costs w<strong>as</strong><br />

apportioned to the Trust.<br />

The average number of full time equivalent employees, b<strong>as</strong>ed on a working week of 35 hours, w<strong>as</strong> 446<br />

(2008: 396).<br />

23 Pension Costs<br />

The Trust particip<strong>at</strong>es in the Social Housing Pension Scheme (SHPS). SHPS is a multi-employer<br />

defined benefit scheme where the share of <strong>as</strong>sets and liabilities applicable to each employer is not<br />

identified. Accordingly, the Trust accounts for its pension costs on a defined contribution b<strong>as</strong>is in<br />

accordance with Financial Reporting Standard 17.<br />

22

23 Pension Costs (continued)<br />

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

Contributions to the scheme are b<strong>as</strong>ed on applicable pension costs across the particip<strong>at</strong>ing<br />

organis<strong>at</strong>ions taken <strong>as</strong> a whole and are charged to the Income and Expenditure Account so <strong>as</strong> to<br />

spread the costs over the members' working lives. The pensions charge recorded by the Trust during<br />

the account period w<strong>as</strong> equal to the contributions payable.<br />

The results and <strong>as</strong>sumptions of the most recent valu<strong>at</strong>ion of the scheme are <strong>as</strong> follows:-<br />

Valu<strong>at</strong>ion d<strong>at</strong>e 30 September 2008<br />

Valu<strong>at</strong>ion method<br />

Projected Unit Credit<br />

Value of <strong>as</strong>sets<br />

£1,527m<br />

Value of liabilities<br />

Funding level for accrued benefits<br />

£2,190m<br />

70%<br />

Investment return on future contributions per annum:-<br />

Pre-Retirement 7.8%<br />

Non-Pensioner Post-Retirement 6.2%<br />

Pensioner Post-Retirement 4.7%<br />

Pensionable Earnings Growth 5.6%<br />

Pension incre<strong>as</strong>es per annum:-<br />

Pre-1988 Guaranteed Minimum Pension 0.0%<br />

Post-1988 Guaranteed Minimum Pension 2.8%<br />

R<strong>at</strong>e of Price infl<strong>at</strong>ion 3.2%<br />

As a result of this valu<strong>at</strong>ion, the Trust h<strong>as</strong> elected to maintain the following benefit structure. Staff who<br />

were employed before 1 April 2007 have the option of remaining in the final salary arrangement, where<br />

the average employee contribution r<strong>at</strong>e will be incre<strong>as</strong>ed from 9.1% to 11.3% from 1 April 2010, or to<br />

transfer to a Career Average Revalued Earnings (CARE) arrangement, where the average employee<br />

contribution r<strong>at</strong>e will incre<strong>as</strong>e from 5.6% to 7.8%. From 1 April 2010, all staff regardless of their d<strong>at</strong>e of<br />

employment, are only entitled to join the CARE arrangement.<br />

The Trust's standard contribution r<strong>at</strong>e will be incre<strong>as</strong>ed from 1 April 2010 from 12.9% to 14.0% for the<br />

final salary arrangement and from 12.9% to 14.6% for the CARE arrangement.<br />

24<br />

Interest Payable and Similar Charges<br />

<strong>2009</strong> 2008<br />

£'000<br />

£'000<br />

Interest Paid:<br />

Orchardbrook Ltd 141 149<br />

<strong>Joseph</strong> <strong>Rowntree</strong> Found<strong>at</strong>ion 117 334<br />

Lloyds TSB plc 1,118 1,721<br />

Bank Overdraft - 45<br />

1,376 2,249<br />

Interest Applied to:<br />

Income received in advance 36 101<br />

Bonds and Loan Stock 90 306<br />

Recycled Capital Grant Fund (Note 10) 1 29<br />

Disposal Proceeds Fund (Note 11) 1 8<br />

Other - 19<br />

1,504 2,712<br />

Less Capitalised:<br />

Housing Land and Buildings (Note 2) (192) (1,380)<br />

Other Freehold Land and Buildings (Note 5) (1) (154)<br />

Hartrigg Oaks (Note 3) - (11)<br />

1,<strong>31</strong>1 1,167<br />

23

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

25 Surplus for the Year<br />

Surplus for the year is st<strong>at</strong>ed after charging:<br />

<strong>2009</strong> 2008<br />

£'000<br />

£'000<br />

Depreci<strong>at</strong>ion<br />

Recurring 821 626<br />

Auditors' Remuner<strong>at</strong>ion<br />

In their capacity <strong>as</strong> Auditors 21 17<br />

Other Services 12 -<br />

26 <strong>Joseph</strong> <strong>Rowntree</strong> Found<strong>at</strong>ion (JRF) - Rel<strong>at</strong>ed Party Transactions<br />

(a) Guarantee<br />

The JRF h<strong>as</strong> provided a guarantee to Lloyds TSB against a loan to the JRHT. At <strong>31</strong> <strong>December</strong> <strong>2009</strong><br />

the balance outstanding on the loan w<strong>as</strong> £3,335,180 (2008: £3,547,000). The loan is <strong>at</strong> a fixed r<strong>at</strong>e of<br />

interest of 4.89% and is due to m<strong>at</strong>ure on 28 February 2021. See also Note 12.<br />

(b) Outstanding Loans<br />

Outstanding loans from JRF <strong>at</strong> <strong>31</strong> <strong>December</strong> <strong>2009</strong> amounted to £2,144,399 (2008: £6,853,786).<br />

Loans made during the year amounted to £4,675,516, and loan repayments amounted to £9,384,903<br />

Interest charged on these loans during the year w<strong>as</strong> £117,000 (2008: £334,000). Further details of<br />

these loans can be found in Notes 8 and 12.<br />

24

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

STATEMENT OF TRUSTEES' RESPONSIBILITIES IN RESPECT OF THE<br />

TRUSTEES' ANNUAL REPORT AND THE FINANCIAL STATEMENTS<br />

Under the Trust Deed of the Trust and charity law, the Trustees are responsible for preparing the<br />

Trustees' Annual Report and the Financial St<strong>at</strong>ements in accordance with applicable law and<br />

regul<strong>at</strong>ions.<br />

The Financial St<strong>at</strong>ements are required by law to give a true and fair view of the st<strong>at</strong>e of affairs of<br />

the Trust and of the surplus or deficit for th<strong>at</strong> period.<br />

In preparing these Financial St<strong>at</strong>ements, the Trustees are required to:-<br />

- select suitable accounting policies and then apply them consistently;<br />

- make judgements and estim<strong>at</strong>es th<strong>at</strong> are re<strong>as</strong>onable and prudent;<br />

-<br />

-<br />

-<br />

st<strong>at</strong>e whether applicable UK Accounting Standards and the St<strong>at</strong>ement of Recommended<br />

Practice have been followed, subject to any m<strong>at</strong>erial departures disclosed and explained in the<br />

Financial St<strong>at</strong>ements;<br />

st<strong>at</strong>e whether the Financial St<strong>at</strong>ements comply with the Trust Deed, subject to any m<strong>at</strong>erial<br />

departures disclosed and explained in the Financial St<strong>at</strong>ements; and<br />

prepare the Financial St<strong>at</strong>ements on the going concern b<strong>as</strong>is unless it is inappropri<strong>at</strong>e to<br />

presume th<strong>at</strong> the Trust will continue in business.<br />

The Trustees are required to act in accordance with the Trust Deed of the Trust, within the<br />

framework of trust law. The Trustees are responsible for keeping proper accounting records,<br />

sufficient to disclose <strong>at</strong> any time, with re<strong>as</strong>onable accuracy, the financial position of the Trust <strong>at</strong><br />

th<strong>at</strong> time and enable Trustees to ensure th<strong>at</strong> its Financial St<strong>at</strong>ements comply with the Charities<br />

Act 1993, the Housing Act 1996 and the Accounting Requirements for Registered Social<br />

Landlords General Determin<strong>at</strong>ion 2006. The Trustees have general responsibility for taking such<br />

steps <strong>as</strong> are re<strong>as</strong>onably open to them to safeguard the <strong>as</strong>sets of the Trust and to prevent and<br />

detect fraud and other irregularities.<br />

The Trustees are responsible for the maintenance and integrity of the corpor<strong>at</strong>e and financial<br />

inform<strong>at</strong>ion included on the Trust's website. Legisl<strong>at</strong>ion in the UK governing the prepar<strong>at</strong>ion and<br />

dissemin<strong>at</strong>ion of Financial St<strong>at</strong>ements may differ from legisl<strong>at</strong>ion in other jurisdictions.<br />

25

INDEPENDENT AUDITORS' REPORT TO THE TRUSTEES OF JOSEPH<br />

ROWNTREE HOUSING TRUST<br />

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

We have audited the Financial St<strong>at</strong>ements of <strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust for the year ended <strong>31</strong><br />

<strong>December</strong> <strong>2009</strong> which comprise the Income and Expenditure Account, the Balance Sheet and the C<strong>as</strong>h<br />

Flow St<strong>at</strong>ement and the rel<strong>at</strong>ed notes. These Financial St<strong>at</strong>ements have been prepared under the<br />

accounting policies set out therein.<br />

This report is made solely to the Trustees, <strong>as</strong> a body, in accordance with Schedule 1 paragraph 16 to the<br />

Housing Act 1996, section 43 of the Charities Act 1993 and regul<strong>at</strong>ions made under section 44 of th<strong>at</strong><br />

Act. Our audit work h<strong>as</strong> been undertaken so th<strong>at</strong> we might st<strong>at</strong>e to the Trustees those m<strong>at</strong>ters we are<br />

required to st<strong>at</strong>e to them in an auditor's report and for no other purpose. To the fullest extent permitted by<br />

law, we do not accept or <strong>as</strong>sume responsibility to anyone other than the Trust and the Trustees, <strong>as</strong> a<br />

body, for our audit work, for this report, or for the opinions we have formed.<br />

Respective responsibilities of the Trustees and auditors<br />

The responsibilities of the Trustees for the prepar<strong>at</strong>ion of the Trustees' Annual Report, and the<br />

prepar<strong>at</strong>ion of Financial St<strong>at</strong>ements in accordance with applicable United Kingdom law and UK<br />

accounting standards (UK Generally Accepted Accounting Practice) are set out in the St<strong>at</strong>ement of<br />

Trustees' Responsibilities on page 25.<br />

Our responsibility is to audit the Financial St<strong>at</strong>ements in accordance with relevant legal and regul<strong>at</strong>ory<br />

requirements and Intern<strong>at</strong>ional Standards on Auditing (UK and Ireland).<br />

We report to you our opinion <strong>as</strong> to whether the Financial St<strong>at</strong>ements give a true and fair view and are<br />

properly prepared in accordance with the Charities Act 1993, the Housing Act 1996 and the Accounting<br />

Requirements for Registered Social Landlords General Determin<strong>at</strong>ion 2006. We also report to you if, in<br />

our opinion, the Trustees' Annual Report is not consistent with the Financial St<strong>at</strong>ements, if a s<strong>at</strong>isfactory<br />

system of control over transactions h<strong>as</strong> not been maintained, if the Trust h<strong>as</strong> not kept proper accounting<br />

records or if we have not received all the inform<strong>at</strong>ion and explan<strong>at</strong>ions we require for our audit.<br />

We read the Trustees' Annual Report and consider the implic<strong>at</strong>ions for our report if we become aware of<br />

any apparent misst<strong>at</strong>ements within it. We read the other inform<strong>at</strong>ion accompanying the Financial<br />

St<strong>at</strong>ements and consider whether it is consistent with those st<strong>at</strong>ements. We consider the implic<strong>at</strong>ions for<br />

our report if we become aware of any apparent misst<strong>at</strong>ements within it. Our responsibilities do not extend<br />

to any other inform<strong>at</strong>ion.<br />

B<strong>as</strong>is of audit opinion<br />

We conducted our audit in accordance with Intern<strong>at</strong>ional Standards on Auditing (UK and Ireland) issued<br />

by the Auditing Practices Board. An audit includes examin<strong>at</strong>ion, on a test b<strong>as</strong>is, of evidence relevant to<br />

the amounts and disclosures in the financial st<strong>at</strong>ements. It also includes an <strong>as</strong>sessment of the significant<br />

estim<strong>at</strong>es and judgements made by the Trustees in the prepar<strong>at</strong>ion of the financial St<strong>at</strong>ements, and of<br />

whether the accounting policies are appropri<strong>at</strong>e to the Trust's circumstances, consistently applied and<br />

adequ<strong>at</strong>ely disclosed.<br />

We planned and performed our audit so <strong>as</strong> to obtain all the inform<strong>at</strong>ion and explan<strong>at</strong>ions which we<br />

considered necessary in order to provide us with sufficient evidence to give re<strong>as</strong>onable <strong>as</strong>surance th<strong>at</strong><br />

the Financial St<strong>at</strong>ements are free from m<strong>at</strong>erial misst<strong>at</strong>ement, whether caused by fraud or other<br />

irregularity or error. In forming our opinion we also evalu<strong>at</strong>ed the overall adequacy of the present<strong>at</strong>ion of<br />

inform<strong>at</strong>ion in the Financial St<strong>at</strong>ements.<br />

26

<strong>Joseph</strong> <strong>Rowntree</strong> Housing Trust<br />

Registered Charity<br />

INDEPENDENT AUDITORS' REPORT TO THE TRUSTEES OF JOSEPH<br />

ROWNTREE HOUSING TRUST (continued)<br />

Opinion<br />

In our opinion the Financial St<strong>at</strong>ements:<br />

-<br />

-<br />

give a true and fair view, in accordance with UK Generally Accepted Accounting Practice, of the st<strong>at</strong>e<br />

of affairs of the Trust <strong>as</strong> <strong>at</strong> <strong>31</strong> <strong>December</strong> <strong>2009</strong> and of its surplus for the year then ended; and<br />

have been properly prepared in accordance with the Charities Act 1993, the Housing Act 1996 and<br />

the Accounting Requirements for Registered Social Landlords General Determin<strong>at</strong>ion 2006.<br />

Chris Wilson<br />

for and on behalf of KPMG LLP, St<strong>at</strong>utory Auditor<br />

Chartered Accountants<br />

Leeds<br />

27

tree Housing Trust<br />

Registered Charity<br />

r the year ended <strong>31</strong><br />

Sheet and the C<strong>as</strong>h<br />

prepared under the<br />

paragraph 16 to the<br />

er section 44 of th<strong>at</strong><br />

ose m<strong>at</strong>ters we are<br />

t extent permitted by<br />

the Trustees, <strong>as</strong> a<br />

al Report, and the<br />

gdom law and UK<br />

in the St<strong>at</strong>ement of<br />

legal and regul<strong>at</strong>ory<br />

nd fair view and are<br />

and the Accounting<br />

o report to you if, in<br />

ents, if a s<strong>at</strong>isfactory<br />

pt proper accounting<br />

our audit.<br />

e become aware of<br />

nying the Financial<br />

r the implic<strong>at</strong>ions for<br />

bilities do not extend<br />

and Ireland) issued<br />

evidence relevant to<br />

ent of the significant<br />

l St<strong>at</strong>ements, and of<br />

istently applied and<br />

lan<strong>at</strong>ions which we<br />

able <strong>as</strong>surance th<strong>at</strong><br />

by fraud or other<br />

f the present<strong>at</strong>ion of<br />

28

tree Housing Trust<br />

Registered Charity<br />

Practice, of the st<strong>at</strong>e<br />

ended; and<br />

using Act 1996 and<br />

tion 2006.<br />

29