Cyprus - Clearstream

Cyprus - Clearstream

Cyprus - Clearstream

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Cyprus</strong><br />

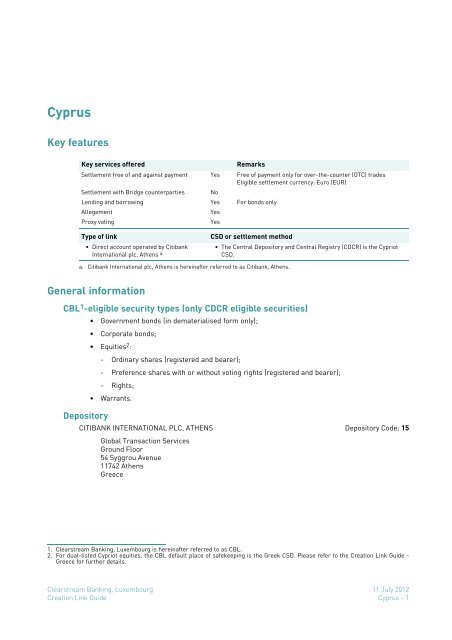

Key features<br />

Key services offered Remarks<br />

Settlement free of and against payment Yes Free of payment only for over-the-counter (OTC) trades<br />

Eligible settlement currency: Euro (EUR)<br />

Settlement with Bridge counterparties No<br />

Lending and borrowing Yes For bonds only<br />

Allegement Yes<br />

Proxy voting Yes<br />

Type of link CSD or settlement method<br />

• Direct account operated by Citibank<br />

International plc, Athens a<br />

a. Citibank International plc, Athens is hereinafter referred to as Citibank, Athens.<br />

General information<br />

CBL 1 -eligible security types (only CDCR eligible securities)<br />

Depository<br />

• The Central Depository and Central Registry (CDCR) is the Cypriot<br />

CSD.<br />

• Government bonds (in dematerialised form only);<br />

• Corporate bonds;<br />

• Equities2 :<br />

- Ordinary shares (registered and bearer);<br />

- Preference shares with or without voting rights (registered and bearer);<br />

- Rights;<br />

• Warrants.<br />

CITIBANK INTERNATIONAL PLC, ATHENS Depository Code: 15<br />

Global Transaction Services<br />

Ground Floor<br />

54 Syggrou Avenue<br />

11742 Athens<br />

Greece<br />

1. <strong>Clearstream</strong> Banking, Luxembourg is hereinafter referred to as CBL.<br />

2. For dual-listed Cypriot equities, the CBL default place of safekeeping is the Greek CSD. Please refer to the Creation Link Guide -<br />

Greece for further details.<br />

<strong>Clearstream</strong> Banking, Luxembourg 11 July 2012<br />

Creation Link Guide <strong>Cyprus</strong> - 1

Creation Link Guide<br />

Cash correspondent details<br />

Currency: Euro (EUR) via CCB Euro (EUR) via TARGET2<br />

CCB name: Deutsche Bank AG, Frankfurt Banque centrale du Luxembourg<br />

CBL account: 9382250 LU84 9990 0012 8904 200E<br />

SWIFT address: DEUTDEFFXXX TRGTXEPMXXX<br />

Pre-matching and settlement services<br />

Pre-matching service<br />

The table below summarises CBL’s pre-matching service for external settlement instructions, as well<br />

as the pre-matching method and start time in the market. For details of CBL’s pre-matching services,<br />

see “Pre-matching services for external settlement instructions” in the Introduction.<br />

Scope Service offered Method employed Start (local time)<br />

All securities Immediate release flag available Manual via telephone or fax<br />

(“best effort” basis)<br />

Connectivity medium Instruction format<br />

CreationOnline Tick the box to enable the “Immediate Release” option<br />

Creation via SWIFT and CreationDirect Field :22F::STCO/CEDE/IREL<br />

Local pre-matching, which is market practice, starts, subject to counterparty availability, on receipt of<br />

instructions and continues until settlement date (SD).<br />

Domestic allegement matching service<br />

On receipt of instructions<br />

As a complement to the pre-matching services offered for this market and where no pre-matching<br />

instruction has been sent to the market, CBL accepts allegements via its depository from domestic<br />

market counterparties. It will then use these allegement messages to search for the best matching<br />

customer instruction.<br />

If no matching customer instruction is found, the allegement is reported to the customer provided that<br />

its <strong>Clearstream</strong> Banking account number is present.<br />

For details of CBL’s domestic allegement service, see “Domestic allegement matching service” in the<br />

Introduction.<br />

11 July 2012 <strong>Clearstream</strong> Banking, Luxembourg<br />

<strong>Cyprus</strong> - 2 Creation Link Guide

Settlement times<br />

<strong>Cyprus</strong><br />

The deadlines shown below are valid provided that the customer’s instructions are complete, accurate<br />

and eligible for straight-through processing (STP) in CBL and in the local market. Customers must also<br />

ensure that any necessary provision is available. If any of these criteria are not met, CBL cannot<br />

guarantee timely settlement.<br />

Note: All times are CET.<br />

Instruction<br />

CBL-eligible securities<br />

Receipts<br />

Deliveries<br />

For dual-listed Cypriot equities for settlement in <strong>Cyprus</strong>, the Immediate Release flag must be set on<br />

all settlement instructions, in order to allow provisioning early on SD-1.<br />

When it is a business holiday in Greece, instructions will be released to the market only on the next<br />

business day. If there is insufficient provision in <strong>Cyprus</strong> at the CBL account with Citibank, Athens,<br />

positions may need to be realigned from Greece to <strong>Cyprus</strong>. This usually takes 2 or 3 business days and,<br />

consequently, settlement in <strong>Cyprus</strong> may be delayed.<br />

Procedures for domestic counterparties<br />

All securities listed on the CSE and eligible in <strong>Clearstream</strong> Banking<br />

Linkage of trading codes (OASIS codes) with accounts in CSD<br />

When the customer/end-investor has an execution agreement with a local broker who is a direct<br />

member of CSE (that is, no remote or international broker-dealer is involved), the customer is<br />

requested to advise the local broker that the linkage between OASIS code (trading code in CSE) and the<br />

CSD account into which the trade settles is not applicable to trades that settle on CBL’s account at the<br />

CSD.<br />

Allowed countervalue difference<br />

Provisioning Deadline for Expected settlement results<br />

start end<br />

receipt of valid<br />

instruction from to value<br />

AP=Against payment FOP=Free of payment SD=Settlement date<br />

FOPa 11:00 SD-1 10:55 SD 10:55 SD 09:30 SD 18:00 SD<br />

AP 11:00 SD-1 10:55 SD 10:55 SD 09:30 SD 18:00 SD SD<br />

FOPa 11:00 SD-1 10:55 SD 10:55 SD 09:30 SD 18:00 SD<br />

AP 11:00 SD-1 10:55 SD 10:55 SD 09:30 SD 18:00 SD SD<br />

a. Only OTC trades can be made free of payment.<br />

Receipt in CBL /<br />

Delivery from CBL<br />

Procedure for the domestic counterparty Deadline<br />

Citibank, Athens operates the following segregated account for<br />

<strong>Clearstream</strong> Banking Luxembourg at the CSD:<br />

SAT a Code: 2004765061-6<br />

SAT Account: CY06980067-7<br />

Operator code (Citibank, Athens): 5000000002<br />

a. SAT is the Dematerialised Securities System and also the clearing system for <strong>Cyprus</strong>.<br />

Market deadline<br />

A maximum difference in countervalue of EUR 18.00 is allowed for matching and settlement of against<br />

payment transactions with domestic counterparties.<br />

<strong>Clearstream</strong> Banking, Luxembourg 11 July 2012<br />

Creation Link Guide <strong>Cyprus</strong> - 3

Creation Link Guide<br />

Specific settlement rules / settlement restrictions<br />

Equities<br />

1. Settlement of Stock Exchange (SE) trades<br />

The equities market has a beneficial ownership structure and registration, which is part of the<br />

settlement process, that occurs simultaneously with settlement in SAT on T+3.<br />

Following the implementation of unbundling of clearing and settlement in the Cypriot market,<br />

processing in the CSD on behalf of CBL customers takes place as follows:<br />

- On T+3 Client Settlement1: transfer of securities from/to the intermediary's principal account<br />

to/from CBL's account at CSD;<br />

- After T+3 OTC Rectification Trade (used if Client Settlement failed): transfer of securities<br />

from/to the intermediary's proprietary account to/from CBL's account at the CSD.<br />

2. Settlement of OTC trades (off exchange)<br />

OTC transactions are allowed free of or against payment.<br />

For the settlement deadlines on OTC trades in CBL, please refer to “Settlement times” on page 3.<br />

Late instructions should be cancelled and re-instructed by the customer with a new SD.<br />

However, matched trades can only be cancelled if both parties send cancellation instructions.<br />

In order to benefit from straight-through processing, customers must complete fields as follows<br />

to specify the type of OTC transaction that will apply:<br />

OTC transaction Creation via SWIFT and CreationDirect CreationOnline<br />

Type of Settlement Transaction field / Additional Indicators field<br />

Normal trade :22F::SETR//TRAD (Sequence B) Trade Settlement<br />

Re-registration :22F::SETR//TRAD (Sequence B) Trade Settlement<br />

:22F::REGT//YREG (Sequence E) Additional Indicators:<br />

Type: Registration Indicator<br />

Code: Register<br />

OTC rectification trade :22F::SETR//TRAD<br />

:22F::STCO/HCSD/RCTF<br />

Rectification<br />

Place of Trade field / Additional Places field<br />

All OTC transactions :94B::TRAD//OTCO/OTC Additional Places:<br />

Type: Place of Trade<br />

Code: OTC Trade<br />

Narrative: OTC<br />

Fees and charges2 The following fees and charges are applied by CSE in the settlement process to OTC trades:<br />

• Equities - normal OTC trade for equities listed in the main market: 3.5 bps per side and for<br />

equities listed in the other markets 8.5 bps. Minimum EUR 20.00 (plus EUR 1.00 for against<br />

payment transactions, per side);<br />

• Fixed income - normal OTC trades: 1.5 bps per side with minimum EUR 20.00 (plus EUR 1.00 for<br />

against payment transactions, per side)<br />

• Re-registration: EUR 5.00.<br />

1. The cycle of T+3 is mandatory in CSE for Client Settlement instructions; no other cycle is accepted by the CSE for these instructions.<br />

Customers can however instruct Client Settlement on any date including SD. For CBL deadlines please refer to Settlement times<br />

2. These fees are given as an indication only.<br />

11 July 2012 <strong>Clearstream</strong> Banking, Luxembourg<br />

<strong>Cyprus</strong> - 4 Creation Link Guide

<strong>Cyprus</strong><br />

In addition, 0.15% sales tax is imposed by the CSE on normal OTC trades. For free of payment normal<br />

OTC trades, the tax on sale is calculated on the amount that derives from the closing price of the<br />

securities on trade date multiplied by the quantity of the securities.<br />

From settlement date 9 July 2012, transfers of securities from <strong>Cyprus</strong> to Greece are subject to EUR 5 or<br />

0.1% of the transferable amount if the value of the transferred securities exceeds EUR 5,000. Please<br />

refer to the Market Profile (<strong>Cyprus</strong>).<br />

All charges incurred by CBL in the trading and settlement processes will be passed on to the relevant<br />

customer on an “upon receipt” basis.<br />

Dual-listed Cypriot equities<br />

Customer instructions on dual-listed Cypriot equities will be settled in CBL according to the Greek<br />

settlement rules as detailed in the Creation Link Guide (Greece).<br />

Customers must inform their counterparty accordingly and ensure that this is in accordance with the<br />

trades agreed in the market.<br />

The default settlement setup will not prevent customers from trading and settling their transactions in<br />

<strong>Cyprus</strong> except during business holidays in the Greek and/or Cypriot markets, in which cases the<br />

instructions will only be released to the market on the next business day.<br />

Currently only the following issues are affected:<br />

• CC 018724855 ISIN CY0000100111 - SHS BANK OF CYPRUS PUBLIC COMPANY LTD<br />

• CC 026989256 ISIN CY0000200119 - SHS MARFIN POPULAR BANK PUBLIC CO LTD<br />

Realignment between <strong>Cyprus</strong> and Greece<br />

For equities listed on both the Greek and the Cypriot Stock Exchanges, customers have the right to<br />

move securities from one CSD to the other. The transfer is performed by CBL’s local depository based<br />

on the settlement instructions through the CSD system of the country in which the shares are currently<br />

held. At the end of the day, the holding CSD releases all requests for the transfer of shares to the<br />

receiving CSD. The transfer usually takes two or three business days.<br />

To transfer shares from the Greek CSD directly to the Cypriot CSD, customers should send deliver<br />

free instructions with details as follows:<br />

Connectivity<br />

medium<br />

Counterparty -<br />

Delivering Agent<br />

CreationOnline CITIGRAAXXX<br />

Creation via SWIFT and<br />

CreationDirect<br />

Settlement<br />

Processing<br />

Narrative<br />

Transfer due to<br />

dual listing<br />

:95P::DEAG//CITIGRAA :70E::SPRO//Transfer<br />

due to dual listing<br />

Receive free instructions should also be sent, with the following details:<br />

Connectivity<br />

medium<br />

Counterparty -<br />

Receiving Agent<br />

CreationOnline CITIGRAAXXX<br />

Creation via SWIFT and<br />

CreationDirect<br />

a. <strong>Clearstream</strong> Banking’s account number in Citibank, Athens.<br />

Settlement<br />

Processing<br />

Narrative<br />

Transfer due to<br />

dual listing<br />

:95P::REAG//CITIGRAA :70E::SPRO//Transfer<br />

due to dual listing<br />

Settlement Party -<br />

Place of Settlement<br />

- HCSDGRAAXXX<br />

- :95P::PSET//HCSDGRAA<br />

Safekeeping<br />

Account a<br />

Settlement Party -<br />

Place of Settlement<br />

986312 XCYSCY2NXXX<br />

:97A::SAFE//986312 :95P::PSET//XCYSCY2N<br />

<strong>Clearstream</strong> Banking, Luxembourg 11 July 2012<br />

Creation Link Guide <strong>Cyprus</strong> - 5

Creation Link Guide<br />

To transfer shares from the Cypriot CSD directly to the Greek CSD, customers should send deliver<br />

free instructions with details as follows:<br />

Connectivity<br />

medium<br />

Management of failed instructions<br />

Stock exchange instructions that are not settled by 14:30 - 14:45 on SD (T+3) local time are no longer<br />

valid in the market and, if not cancelled by the customer, will be cancelled by CBL 30 days after the<br />

requested SD.<br />

Other unmatched instructions with domestic counterparties are cancelled 30 calendar days after the<br />

requested SD.<br />

However, CBL reserves the right to cancel receipt instructions with domestic counterparties that have<br />

not settled on the fifth business day after the expected settlement date (SD+5) and have not been<br />

reconfirmed by the customer.<br />

New issues settlement<br />

Counterparty -<br />

Delivering Agent<br />

CreationOnline CITIGRAAXXX<br />

Creation via SWIFT and<br />

CreationDirect<br />

Not applicable in the Cypriot market.<br />

Settlement<br />

Processing<br />

Narrative<br />

Transfer due to<br />

dual listing<br />

:95P::DEAG//CITIGRAA :70E::SPRO//Transfer<br />

due to dual listing<br />

Receive free instructions should also be sent, with the following details:<br />

Connectivity<br />

medium<br />

Counterparty -<br />

Receiving Agent<br />

CreationOnline CITIGRAAXXX<br />

Creation via SWIFT and<br />

CreationDirect<br />

a. <strong>Clearstream</strong> Banking’s account number in Citibank, Athens.<br />

Settlement<br />

Processing<br />

Narrative<br />

Transfer due to<br />

dual listing<br />

:95P::REAG//CITIGRAA :70E::SPRO//Transfer<br />

due to dual listing<br />

Settlement Party -<br />

Place of Settlement<br />

- XCYSCY2NXXX<br />

- :95P::PSET//XCYSCY2N<br />

Safekeeping<br />

Account a<br />

Settlement Party -<br />

Place of Settlement<br />

986312 HCSDGRAAXXX<br />

:97A::SAFE//986312 :95P::PSET//HCSDGRAA<br />

11 July 2012 <strong>Clearstream</strong> Banking, Luxembourg<br />

<strong>Cyprus</strong> - 6 Creation Link Guide

Custody services<br />

Income collection<br />

Debt securities<br />

Equities<br />

Corporate actions<br />

Mandatory events<br />

Security proceeds are credited on an “upon receipt” basis.<br />

Sale and purchase of rights<br />

<strong>Cyprus</strong><br />

Sale and purchase of rights are not applicable to corporate actions in the Cypriot market. Customers<br />

can only trade rights via settlement instructions.<br />

Proxy Voting procedures<br />

Proxy voting services are available in CBL for this market.<br />

The nominee concept is not recognised under Cypriot law and so securities deposited with Citibank,<br />

Athens are registered in <strong>Clearstream</strong> Banking’s name. Customers that want to exercise voting rights<br />

can do so only via proxy voting through <strong>Clearstream</strong> Banking.<br />

For details about the proxy voting services offered by CBL, please refer to the CBL Customer Handbook<br />

and, for the market specific practices, please refer to the Market Profile.<br />

Entitlement compensation rules<br />

Service offered Remarks<br />

Notification to customers Standard reporting. No specific deviations from standard<br />

Payment of proceeds Interests on bonds will be credited in EUR to the<br />

customer's account upon receipt of funds with<br />

value collection date, based on the positions<br />

recorded at market record date.<br />

Please refer to the Entitlement Compensation Rules Guide.<br />

reporting provided by CBL apply to the<br />

Cypriot market.<br />

Service offered Remarks<br />

Notification to customers Standard reporting. No specific deviations from standard<br />

reporting provided by CBL apply to the<br />

Cypriot market.<br />

Payment of proceeds Market record date = Ex-date +2 business days.<br />

Dividend payments are credited to the customer’s<br />

account upon receipt of funds, with value actual<br />

payment date.<br />

Ownership is transferred on settlement<br />

date.<br />

Service offered Remarks<br />

Notification to customers Standard reporting. No specific deviations from standard<br />

reporting provided by CBL apply to the<br />

Cypriot market.<br />

Instruction to CBL Customers can instruct CBL to carry out options<br />

foreseen in the terms and conditions of the<br />

underlying security type.<br />

In addition, CBL informs customers on an “as and<br />

if received” basis of unscheduled securities<br />

events occurring on account holdings, such as<br />

rights offers, reinvestment options, exchange<br />

offers, purchase offers etc.<br />

Ownership is transferred on settlement<br />

date.<br />

<strong>Clearstream</strong> Banking, Luxembourg 11 July 2012<br />

Creation Link Guide <strong>Cyprus</strong> - 7

Creation Link Guide<br />

Other services<br />

Bridge settlement<br />

Cypriot securities are not eligible for settlement through the Bridge with Euroclear Bank.<br />

Securities lending and borrowing<br />

All Cypriot government debt securities eligible in CBL qualify for CBL’s securities lending and<br />

borrowing programme.<br />

Equities are not eligible for CBL’s securities lending and borrowing programme.<br />

Disclosure requirements<br />

Please refer to the <strong>Clearstream</strong> Banking Guide to Disclosure Requirements, which is an appendix to the<br />

Creation Market Guide.<br />

Holding restrictions<br />

Due to Cypriot restrictions, customers are not allowed to hold Cypriot financial instruments in<br />

<strong>Clearstream</strong> Banking for underlying beneficial owners that are Cypriot residents or legal entities that<br />

are incorporated in <strong>Cyprus</strong>.<br />

For details of other local holding restrictions, please refer to the Market Profile (<strong>Cyprus</strong>).<br />

Tax services<br />

For non-residents, tax, duty and capital gains tax are not charged in <strong>Cyprus</strong>. However, for interest<br />

income payments, the Special Contribution for Defence (SDC) applies at a rate of 10%.<br />

11 July 2012 <strong>Clearstream</strong> Banking, Luxembourg<br />

<strong>Cyprus</strong> - 8 Creation Link Guide

Instruction specifications<br />

CreationOnline<br />

Receive Free a<br />

Receive Against Payment<br />

M Trade Date M Trade Date<br />

O Deal Price O Deal Price<br />

M Place of Settlement BIC M Place of Settlement BIC<br />

Party XCYSCY2NXXX Party XCYSCY2NXXX<br />

M Delivering Agent b BIC c<br />

M Delivering Agent b BIC c<br />

Party counterparty’s BIC Party counterparty’s BIC<br />

Cd Seller b BIC Cd Seller b BIC<br />

Party ordering party’s BIC Party ordering party’s BIC<br />

Ce Account ordering party’s account Ce Account ordering party’s account<br />

C f<br />

Additional Indicators:<br />

Type:<br />

Code<br />

C f Additional Places:<br />

Type<br />

Code<br />

Narrative<br />

Registration Indicator g<br />

Register g<br />

Place of Trade<br />

OTC Trade<br />

OTC<br />

C f Additional Indicators:<br />

Type:<br />

<strong>Cyprus</strong><br />

a. Allowed for OTC transactions only.<br />

b. If no BIC exists for the Delivering/Receiving Agent or for the Seller/Buyer, you can use the Name and Address option instead in each case.<br />

If the appropriate BIC does exist but you do not provide it, STP cannot be guaranteed and you run the risk of incurring eventual charges.<br />

c. For settlement with a counterparty outside Citibank, this must be the BIC of the counterparty. For settlement with a counterparty within<br />

Citibank, this must be the BIC of Citibank, Athens, CITIGRAA.<br />

d. Mandatory when delivering/receiving agent is <strong>Clearstream</strong> Banking’s depository Citibank, Athens.<br />

e. Mandatory for securities transfers between accounts of different customers at Citibank, Athens.<br />

f. Mandatory for OTC trades; otherwise, not applicable.<br />

g. Please refer to “Specific settlement rules / settlement restrictions” on page 4.<br />

<strong>Clearstream</strong> Banking, Luxembourg 11 July 2012<br />

Creation Link Guide <strong>Cyprus</strong> - 9<br />

Code<br />

C f Additional Places:<br />

Type<br />

Code<br />

Narrative<br />

Deliver Free a Deliver Against Payment<br />

Registration Indicator g<br />

Register g<br />

Place of Trade<br />

OTC Trade<br />

OTC<br />

M Trade Date M Trade Date<br />

O Deal Price O Deal Price<br />

M Place of Settlement BIC M Place of Settlement BIC<br />

Party XCYSCY2NXXX Party XCYSCY2NXXX<br />

M Receiving Agent b BIC c M Receiving Agent b BIC c<br />

Party counterparty's BIC c Party counterparty's BIC c<br />

Cd Buyer b BIC Cd Buyer b BIC<br />

Party beneficiary’s BIC Party beneficiary’s BIC<br />

Ce Account beneficiary’s account Ce Account beneficiary’s account<br />

C f Additional Indicators:<br />

Type:<br />

Code<br />

C f Additional Places:<br />

Type<br />

Code<br />

Narrative<br />

Registration Indicator g<br />

Register g<br />

Place of Trade<br />

OTC Trade<br />

OTC<br />

C f Additional Indicators:<br />

Type:<br />

Code<br />

C f Additional Places:<br />

Type<br />

Code<br />

Narrative<br />

Registration Indicator g<br />

Register g<br />

Place of Trade<br />

OTC Trade<br />

OTC

Creation Link Guide<br />

Creation via SWIFT and CreationDirect<br />

MT540 Receive Free a<br />

Seq MT541 Receive Against Payment<br />

Cb :94B: :TRAD //OTCO/OTC B Cb :94B: :TRAD //OTCO/OTC<br />

M :98a: :TRAD //Trade date/time M :98a: :TRAD //Trade date/time<br />

O :90a: :DEAL //Deal price O :90a: :DEAL //Deal price<br />

O :70E: :SPRO c<br />

O :70E: :SPRO c<br />

C :22F: :REGT //YREG c E C :22F: :REGT //YREG c<br />

M :95P: :PSET //XCYSCY2N(XXX) E1 M :95P: :PSET //XCYSCY2N(XXX)<br />

M :95P: :DEAG //Counterparty’s BIC d<br />

M :95P: :DEAG //Counterparty’s BIC d<br />

Ce :95P: :SELL //Ordering party’s BIC, if different from DEAG d Ce :95P: :SELL //Ordering party’s BIC, if different from DEAG d<br />

Cf :97A: :SAFE //Ordering party’s account Cf :97A: :SAFE //Ordering party’s account<br />

MT542 Deliver Free a MT543 Deliver Against Payment<br />

C b :94B: :TRAD //OTCO/OTC B C b :94B: :TRAD //OTCO/OTC<br />

M :98a: :TRAD //Trade date/time M :98a: :TRAD //Trade date/time<br />

O :90a: :DEAL //Deal price O :90a: :DEAL //Deal price<br />

O :70E: :SPRO c O :70E: :SPRO c<br />

C :22F: :REGT //YREG c E C :22F: :REGT //YREG c<br />

M :95P: :PSET //XCYSCY2N(XXX) E1 M :95P: :PSET //XCYSCY2N(XXX)<br />

M :95P: :REAG //Counterparty’s BIC d M :95P: :REAG //Counterparty’s BIC d<br />

C e :95P: :BUYR //Beneficiary’s BIC, if different from REAG d C e :95P: :BUYR //Beneficiary’s BIC, if different from REAG d<br />

C f :97A: :SAFE //Beneficiary’s account C f :97A: :SAFE //Beneficiary’s account<br />

a. Allowed for OTC transactions only.<br />

b. Mandatory for OTC trades; otherwise, not applicable.<br />

c. Please refer to “Specific settlement rules / settlement restrictions” on page 4.<br />

d. If no BIC exists for the Delivering/Receiving Agent or for the Seller/Buyer, you can use the Name and Address option instead in each case.<br />

If the appropriate BIC does exist but you do not provide it, STP cannot be guaranteed and you run the risk of incurring eventual charges.<br />

e. Mandatory when delivering/receiving agent is <strong>Clearstream</strong> Banking’s agent Citibank, Athens.<br />

f. Mandatory for securities transfers between accounts of different customers at Citibank, Athens.<br />

11 July 2012 <strong>Clearstream</strong> Banking, Luxembourg<br />

<strong>Cyprus</strong> - 10 Creation Link Guide

List of domestic counterparties<br />

<strong>Cyprus</strong><br />

Note: This is an indicative list, valid at November 2009. For up-to-date information, please consult the<br />

SWIFT website at www.swift.com<br />

Counterparty name BIC address<br />

ARTION SECURITIES ARSIGRA1<br />

AXIA VENTURES GROUP LTD AXVCCY21<br />

BANK OF CYPRUS PUBLIC COMPANY LIMITED (NICOSIA) BCYPCY2N<br />

BETA SECURITIES S.A. BETEGRA1<br />

CYPRUS POPULAR BANK LTD, THE LIKICY2N<br />

EFG EUROBANK SECURITIES S.A. EFESGRA1<br />

EUROCORP SECURITIES S.A. ABXEGRA1XXX<br />

EUROXX SECURITIES SA EUSSGRA1XXX<br />

HELLENIC BANK LTD (NICOSIA) HEBACY2NXXX<br />

HSBC PANTELAKIS SECURITIES S.A. MDPSGRA1XXX<br />

INVESTMENT BANK OF GREECE SA (SECS) IBOGGRAA<br />

NATIONAL P AND K SECURITIES CO SA NASOGRA1<br />

PIREAUS A.E.P.E.Y. SIGSGRA1<br />

PROTON BANK S.A. PRTNGRAA<br />

SHARELINK SECURITIES AND FINANCIAL SERVICES LTD SSFVCY21<br />

SOLIDUS SECURITIES AEPEY SOSXGRA1<br />

<strong>Clearstream</strong> Banking, Luxembourg 11 July 2012<br />

Creation Link Guide <strong>Cyprus</strong> - 11

Creation Link Guide<br />

This page has intentionally been left blank.<br />

11 July 2012 <strong>Clearstream</strong> Banking, Luxembourg<br />

<strong>Cyprus</strong> - 12 Creation Link Guide