United Kingdom II - Clearstream

United Kingdom II - Clearstream

United Kingdom II - Clearstream

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

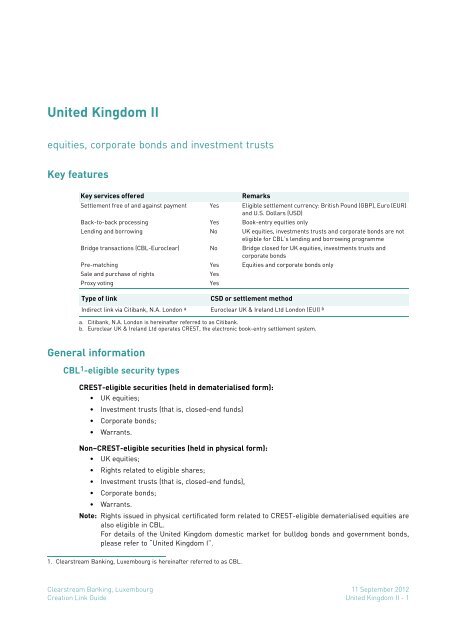

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong><br />

equities, corporate bonds and investment trusts<br />

Key features<br />

Key services offered Remarks<br />

Settlement free of and against payment Yes Eligible settlement currency: British Pound (GBP), Euro (EUR)<br />

and U.S. Dollars (USD)<br />

Back-to-back processing Yes Book-entry equities only<br />

Lending and borrowing No UK equities, investments trusts and corporate bonds are not<br />

eligible for CBL’s lending and borrowing programme<br />

Bridge transactions (CBL-Euroclear) No Bridge closed for UK equities, investments trusts and<br />

corporate bonds<br />

Pre-matching Yes Equities and corporate bonds only<br />

Sale and purchase of rights Yes<br />

Proxy voting Yes<br />

Type of link CSD or settlement method<br />

Indirect link via Citibank, N.A. London a Euroclear UK & Ireland Ltd London (EUI) b<br />

a. Citibank, N.A. London is hereinafter referred to as Citibank.<br />

b. Euroclear UK & Ireland Ltd operates CREST, the electronic book-entry settlement system.<br />

General information<br />

CBL 1 -eligible security types<br />

CREST-eligible securities (held in dematerialised form):<br />

• UK equities;<br />

• Investment trusts (that is, closed-end funds)<br />

• Corporate bonds;<br />

• Warrants.<br />

Non–CREST-eligible securities (held in physical form):<br />

• UK equities;<br />

• Rights related to eligible shares;<br />

• Investment trusts (that is, closed-end funds),<br />

• Corporate bonds;<br />

• Warrants.<br />

Note: Rights issued in physical certificated form related to CREST-eligible dematerialised equities are<br />

also eligible in CBL.<br />

For details of the <strong>United</strong> <strong>Kingdom</strong> domestic market for bulldog bonds and government bonds,<br />

please refer to “<strong>United</strong> <strong>Kingdom</strong> I”.<br />

1. <strong>Clearstream</strong> Banking, Luxembourg is hereinafter referred to as CBL.<br />

<strong>Clearstream</strong> Banking, Luxembourg 11 September 2012<br />

Creation Link Guide <strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 1

Creation Link Guide<br />

Depository<br />

CITIBANK, N.A. LONDON Depository Code: 07<br />

Addresses for physical securities and stock transfer forms<br />

Physical securities address: Unit trust stock transfer forms address:<br />

Attn: Citigroup Residuals<br />

1st Floor<br />

1 North Wall Quay<br />

Dublin 1<br />

Ireland<br />

Cash correspondent details<br />

Pre-matching and settlement services<br />

Attn: Kathryn Lord<br />

Unit Trust Settlements<br />

Citigroup<br />

1st Floor<br />

1 North Wall Quay<br />

Dublin 1<br />

Ireland<br />

Registration name and address:<br />

0.5% SDRT account registration address: 1.5% SDRT account registration address:<br />

Vidacos Nominees Ltd., CLRLUX2 (00XJJ)<br />

Vidacos Nominees Ltd., CLRLUX (14XKL)<br />

Citigroup Centre<br />

Citigroup Centre<br />

Canada Square<br />

Canada Square<br />

Canary Wharf<br />

Canary Wharf<br />

London<br />

London<br />

E14 5LB<br />

E14 5LB<br />

<strong>United</strong> <strong>Kingdom</strong><br />

<strong>United</strong> <strong>Kingdom</strong><br />

Currency: British Pound (GBP) U.S. Dollar (USD<br />

CCB name: Barclays Bank PLC, London JPMorgan Chase Bank, New York<br />

CBL account: GB29 BARC 2032 5350 4088 59 001-1-573714<br />

SWIFT address: BARCGB22 CHASUS33<br />

Currency: Euro (EUR) via CCB Euro (EUR) via TARGET2<br />

CCB name: Barclays Bank PLC, London Banque centrale du Luxembourg<br />

CBL account: GB85 BARC 2032 5388 6774 55 LU84 9990 0012 8904 200E<br />

SWIFT address: BARCGB22 TRGTXEPMXXX<br />

Pre-matching service<br />

The table below summarises CBL's pre-matching service for external settlement instructions, as well<br />

as the pre-matching method and start time in the market. For details of CBL's pre-matching services,<br />

see “Pre-matching services for external settlement instructions”.<br />

Scope Service offered Method employed Start (local time)<br />

Equities and<br />

corporate bonds<br />

Immediate release flag available Automated through CREST On receipt of instructions<br />

Connectivity medium Instruction format<br />

CreationOnline Tick the box to enable the “Immediate Release” option<br />

Creation via SWIFT and CreationDirect Field :22F::STCO/CEDE/IREL<br />

11 September 2012 <strong>Clearstream</strong> Banking, Luxembourg<br />

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 2 Creation Link Guide

Settlement times<br />

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong><br />

All times are given in Central European Time.<br />

The deadlines shown below are valid provided that the customer's instructions are complete, accurate<br />

and eligible for straight-through processing (STP) in CBL and in the local market. Customers must also<br />

ensure that any necessary provision is available. If any of these criteria are not met, CBL cannot<br />

guarantee timely settlement.<br />

CREST-eligible securities<br />

Receipts<br />

Instruction<br />

Deliveries<br />

Matching fines<br />

To minimise the risk of matching fines and in consideration of the fact that the settlement cycle for UK<br />

equities is T+3, all customers are recommended to send their free of payment and against payment<br />

instructions on SD-1 by 14:00.<br />

Non–CREST-eligible / Physical securities<br />

Provisioning Deadline for Expected settlement results<br />

start end<br />

receipt of valid<br />

instruction from to value<br />

AP=Against payment FOP=Free of payment SD=Settlement date<br />

FOP 21:00 SD-2 16:55 SD 16:55a SD 07:00 SD 18:00 SD<br />

AP 21:00 SD-2 14:25 SD 14:25a SD 07:00 SD 18:00 SD SD<br />

FOP 21:00 SD-2 16:55 SD 16:55a SD 07:00 SD 18:00 SD<br />

AP 21:00 SD-2 14:25 SD 14:25a SD 07:00 SD 18:00 SD SD<br />

a. The regular settlement period in CREST is trade date plus three local business days (SD=T+3). The ultimate deadline for an<br />

instruction to be considered for settlement on SD is 16:55 on SD for receipts and deliveries free of payment and 14:25 on SD for<br />

receipts and deliveries against payment. However, matching in CREST for instructions to and from members’ accounts<br />

operated under the 0.5% SDRT regime should be performed at the latest by close of business two local business days after<br />

trade date.<br />

Receipts<br />

Instruction<br />

Deliveries<br />

Provisioning Deadline for Expected settlement results<br />

start end<br />

receipt of valid<br />

instruction from to value<br />

AP=Against payment FOP=Free of payment SD=Settlement date<br />

FOP 11:50 SD-3 11:45 SD-2 11:45 SD-2 22:00 SD-1 18:00 SD<br />

AP 21:00 SD-3 11:45 SD-2 11:45 SD-2 22:00 SD-1 18:00 SD SD<br />

FOP 21:00 SD-3 11:45 SD-2 11:45 SD-2 22:00 SD-1 18:00 SD<br />

AP 21:00 SD-3 11:45 SD-2 11:45 SD-2 22:00 SD-1 18:00 SD SD<br />

<strong>Clearstream</strong> Banking, Luxembourg 11 September 2012<br />

Creation Link Guide <strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 3

Creation Link Guide<br />

Procedures for domestic counterparties<br />

If the<br />

counterparty in<br />

CBL operates an<br />

account under<br />

the standard<br />

rate of duty of<br />

0.5%<br />

If the<br />

counterparty in<br />

CBL operates an<br />

account under<br />

the standard<br />

rate of duty of<br />

1.5%<br />

Allowed countervalue difference<br />

Procedure for the domestic counterparty Deadline<br />

Domestic counterparties must instruct CREST according to the SDRT regime as described<br />

below:<br />

a. In the case of free of and against payment receipt transactions by CBL customers:<br />

- Deliver to: <strong>Clearstream</strong> Banking participant number 00XJJ<br />

- For account of: <strong>Clearstream</strong> Banking, Luxembourg<br />

- In favour of: Account number of CBL customer<br />

b. In case of free of and against payment delivery transactions by CBL customers:<br />

- Receive from: <strong>Clearstream</strong> Banking participant number 00XJJ<br />

- By order of: Account number of CBL customer<br />

a. In the case of free of and against payment receipt transactions by CBL customers:<br />

- Deliver to: <strong>Clearstream</strong> Banking participant number 14XKL<br />

- For account of: <strong>Clearstream</strong> Banking, Luxembourg<br />

- In favour of: Account number of CBL customer<br />

b. In case of free of and against payment delivery transactions by CBL customers:<br />

- Receive from: <strong>Clearstream</strong> Banking participant number 14XKL<br />

- By order of: Account number of CBL customer<br />

A maximum difference in countervalue of GBP 10,00, EUR 15,00 or USD 15 is allowed for matching and<br />

settlement of against payment transactions with domestic counterparties. No difference in<br />

countervalue is allowed for “Own Account Transfer” (OAT) instructions.<br />

Specific settlement rules / settlement restrictions<br />

Market<br />

deadline<br />

Market<br />

deadline<br />

Partial settlement<br />

Market practice is that a counterparty is entitled to deliver as much of its stock as it can according to<br />

stock availability and receive as much stock as it can according to cash availability in its CREST account.<br />

There are no set minimum amounts for partial settlements. A single trade can be partially settled on a<br />

number of different value dates depending on when the delivering party obtains the stock or the<br />

receiving party obtains the cash.<br />

CBL customers are not allowed to initiate splits, whereas CREST counterparties are allowed to initiate<br />

them. Nevertheless, customers’ instructions might be subject to a splitting process initiated by CREST<br />

counterparties, in which case the original customer instruction (parent instruction) will automatically<br />

be reversed and replaced by the corresponding split instructions (sibling instructions): one settled<br />

instruction for the quantity and amount confirmed; and one outstanding instruction for the remaining<br />

quantity and amount, which may settle at a different time.<br />

Nationality Declaration<br />

Some UK equities eligible in CREST are subject to a Nationality Declaration on transfers in the<br />

domestic market.<br />

For holdings of UK securities subject to Nationality Declaration, the registrar must be informed of the<br />

nationality of the beneficial owner. This process allows issuing companies to monitor the level of<br />

ownership by foreigners.<br />

UK equities held in CBL will always be declared to the registrar as held by a Luxembourg national. If a<br />

CBL customer purchases such securities but, at the point of registration, is unable to register them<br />

because the limit of foreign ownership has been reached, CBL’s custodian will contact the counterparty<br />

to arrange for the trade to be cancelled and for any settlement proceeds to be returned. The cash<br />

account of the customer will be debited at the point of settlement and will be re-credited only upon<br />

receipt of the monies from the counterparty. Backvaluation will not be applied to the re-credit of funds.<br />

Note: The breach of the limit does not apply to CBL customer who is a UK national. CBL will advise the<br />

customer to provide a UK Nationality Declaration so that the trade can be re-instructed by CBL’s<br />

custodian.<br />

11 September 2012 <strong>Clearstream</strong> Banking, Luxembourg<br />

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 4 Creation Link Guide

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong><br />

CBL will accept no responsibility with regard to any problems resulting from the registration process<br />

applicable to securities subject to Nationality Declaration.<br />

The following is a non-exhaustive list of issues subject to Nationality Declaration. This list is provided<br />

for information purposes only and is correct according to the best information available to CBL at the<br />

time of publication. However CBL accepts no responsibility for any inaccuracies or omissions.<br />

ISIN Name of Security ISIN Name of Security<br />

ES0177542018 IAG COM STK GB00B06BLB41 MYTRAVEL ORD 30P<br />

GB0000109792 MYTRAVEL GROUP GB00B08HCH30 RAB SPEC SIT ORD 1P<br />

GB0001641991 EASYJET ORD 25P GB00B0WMWD03 QINETIQ GRP ORD 1P<br />

GB0002634946 BAE ORD 2.5P GB00B1VYCH82 THOMS COOK GRP ORD<br />

GB0006648827 FIRST CH ORD 3P GB00B1Z7RQ77 TUI TRAVEL ORD 10P<br />

GB0032836487 ROLLS ROYCE ORD 20P GB00B4QMVR10 FLYBE GRP ORD 1P<br />

GB00B054QP30 MYTRAVEL A ORD 1P GB00B7KR2P84 EASYJET ORD<br />

UK stamp duty reserve tax (SDRT)<br />

Customers will be able to choose either the 0.5% SDRT regime or the 1.5% SDRT regime for the<br />

clearing and settlement of securities for each of their accounts with CBL1 :<br />

In order to operate the two SDRT regimes, CBL will maintain two separate accounts in CREST. If a<br />

customer wants to clear and settle transactions under both SDRT regimes, two separate accounts with<br />

CBL will be required. Internal transfers from a customer’s account under one SDRT regime to an<br />

account of the same customer or another customer under the other SDRT regime will not be possible.<br />

Customer accounts will be subject to the 0.5% SDRT or 1.5% SDRT regimes depending on the<br />

documentation submitted when opening an account in CBL. A request for application of the appropriate<br />

regime (see Appendix A and Appendix B respectively) will have to be completed accordingly.<br />

Customers who want to change the status of existing accounts from the originally defaulted 1.5% SDRT<br />

regime to the 0.5% SDRT regime must also complete Appendix A.<br />

Given the two different SDRT regimes under which UK chargeable securities can be held through<br />

<strong>Clearstream</strong> Banking, customers are requested to verify the status of their account with <strong>Clearstream</strong><br />

Banking for SDRT purposes before transferring UK chargeable securities to <strong>Clearstream</strong> Banking.<br />

Customers should note that a refund of 1.5% SDRT cannot be claimed when securities were received in<br />

error on an account subject to 1.5% SDRT unless a valid exemption reason applies (for example, new<br />

issue or a transfer of securities between two CSP accounts, between two DRS account operators or<br />

between a CSP account and a DRS account operator). Furthermore, no exemption from 1.5% SDRT can<br />

be claimed on the basis of no change of beneficial owner.<br />

Note: If the amount of SDRT due cannot be calculated because no price is available, Citibank N.A. may apply a<br />

default price of GBP 1.00. Customers are therefore recommended to supply a price in all instructions.<br />

Securities subject to SDRT (“chargeable securities”)<br />

Chargeable securities include:<br />

• Shares in UK companies;<br />

• Shares in foreign companies with a registrar in the UK;<br />

• Rights, options or interest related to shares (for example, rights to subscribe for shares and<br />

convertible bonds).<br />

1. Bridge transactions (that is, between a CBL customer and a counterparty in Euroclear Bank) are not allowed.<br />

<strong>Clearstream</strong> Banking, Luxembourg 11 September 2012<br />

Creation Link Guide <strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 5

Creation Link Guide<br />

Overview of the SDRT regimes available through <strong>Clearstream</strong> Banking<br />

Transactions subject to SDRT Transfer of chargeable securities for<br />

consideration in money or money's worth,<br />

for example, a sale.<br />

External transfers Authorised. In principle external receipts<br />

are subject to 0.5% SDRT.<br />

0.5% regime 1.5% regime<br />

Entry of chargeable securities to a<br />

clearance system by way of Transfer or<br />

Issue.<br />

Authorised. In principle external receipts<br />

are subject to 1.5% SDRT.<br />

Internal transfers Not authorised Authorised. No charge to SDRT.<br />

Exemption from SDRT • Issuing house exemption on new issue;<br />

• Exemption on transfers with no change<br />

of beneficial ownership;<br />

• True agency exemption a ;<br />

• Market sale exemption b;<br />

• EU registered charity c.<br />

Certification / documentation<br />

requirements<br />

“Request for application of the 0.5% SDRT<br />

charge”.<br />

Note: Certification is mandatory if the<br />

customer wants to settle transactions<br />

under the 0.5% regime.<br />

Upon request: any further details and/or<br />

documents as requested by <strong>Clearstream</strong><br />

Banking or HM Revenue & Customs<br />

(HMRC).<br />

a. Exemption is claimed by the customer as the SDRT has already been accounted for in the previous transaction.<br />

b. Exemption is claimed by the customer as the SDRT will be accounted for in the future transaction.<br />

c. Exemption is claimed by the customer as the beneficiary entity is a EU registered charity.<br />

• Transfer between two Clearance<br />

Service Providers (CSPs) d;<br />

• Transfer between two Depository<br />

Receipt Systems (DRSs) e ;<br />

• Transfer between a CSP and a DRS;<br />

• Transfer to a 0.5% account where at the<br />

time the agreement is made to transfer<br />

the securities, the said securities are<br />

held in a 1.5% account.<br />

“Request for Application of the 1.5% SDRT<br />

Regime”.<br />

Note: Certification is mandatory if the<br />

customer is claiming an exemption<br />

from 1.5% SDRT.<br />

Upon request: any further details and/or<br />

documents as requested by <strong>Clearstream</strong><br />

Banking or HM Revenue & Customs<br />

(HMRC).<br />

d. A Clearance Service Provider (CSP) operates a system for holding securities and settling transactions on them by book entry.<br />

e. A Depository Receipt System (DRS) is a system for holding securities for an entity whose business includes issuing a depository<br />

receipt for a deposit of securities.<br />

Services offered under the two regimes<br />

1. The customer opts for the 0.5% SDRT regime<br />

- Only external receipts and deliveries can be settled in an account subject to 0.5% SDRT. In<br />

general, CBL will collect SDRT from the purchaser on all external transfers at the standard<br />

rate of 0.5% on the stampable consideration amount unless an exemption applies or the<br />

counterparty is accounting for the SDRT.<br />

- When the delivering customer is - or is acting on behalf of - the accountable person with<br />

respect to the transaction, the SDRT will also be levied on external deliveries of securities. In<br />

such cases, the counterparty in CREST to whom the securities are delivered is not charged<br />

with the SDRT.<br />

- Internal (CBL-CBL) receipts and deliveries are not authorised. Shares can only be transferred<br />

between CBL accounts by means of a domestic instruction, to ensure the correct reporting of<br />

SDRT to HMRC through CREST.<br />

- A customer operating an account subject to the 0.5% rate of SDRT may neither authorise<br />

transfers between accounts in its own books (that is, may not operate a clearance service)<br />

nor operate a depository receipt scheme with respect to securities held under the 0.5% SDRT<br />

regime.<br />

For an account to be subject to the 0.5% SDRT regime, customers must complete the “Request<br />

for Application of the 0.5% SDRT Regime” (see Appendix A) with respect to that account and<br />

return the form to the NCSC Account Administration unit.<br />

11 September 2012 <strong>Clearstream</strong> Banking, Luxembourg<br />

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 6 Creation Link Guide

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong><br />

2. The customer opts for the 1.5% SDRT regime<br />

- On every external receipt of UK securities, <strong>Clearstream</strong> Banking will apply 1.5% SDRT on the<br />

stampable consideration amount unless the delivering party accounts for the SDRT or the<br />

receiving customer claims and is entitled to an exemption from SDRT1. - No SDRT will be due on internal (<strong>Clearstream</strong> Banking - <strong>Clearstream</strong> Banking) receipts and<br />

deliveries.<br />

For an account to be subject to the 1.5% SDRT regime, customers must complete the “Request<br />

for Application of the 1.5% SDRT Regime” (see Appendix B) with respect to that account and<br />

return the form to the NCSC Account Administration unit.<br />

There is a provision in the SDRT legislation that allows for a transfer of stock from one clearance<br />

account to another, from one Depository Receipt System (DRS) operator to another or from one<br />

clearance account to a DRS operator. In such circumstances, the transfer is exempt from 1.5%<br />

SDRT. Customers claiming an exemption are responsible for ensuring that they are entitled to it.<br />

There is a further provision that allows exemption from SDRT for the transfer of securities held<br />

in a clearance service account to an account held with other than a CSP or DRS. Exemption is<br />

applicable when at the time the agreement between the counterparties to make such a transfer<br />

is made, the securities must already be held in the clearance service account.<br />

To benefit from an exemption, customers must complete the “Request for Application of the 1.5%<br />

SDRT Regime” (see Appendix B). Failure to do so will result in the automatic rejection of the<br />

customer's instructions where an exemption is claimed.<br />

Note about the use of the “agency exemption”<br />

The “Agency-exemption” may be used in the following situations:<br />

• True agency exemption: The securities are purchased through a broker/dealer who holds a<br />

custodian type of account and who is not a member of the London Stock Exchange (LSE) or other<br />

regulated UK exchange (for example, LIFFE, Virt-X). The broker/dealer will book the transaction<br />

via a broker that is a member of the LSE or other recognised exchange and the SDRT will be<br />

calculated and accounted for by the broker on the delivery of the securities to the broker/dealer<br />

(first leg).<br />

The broker/dealer will then deliver the securities from his custodian type of account to CBL<br />

(second leg). Such a custodian-to-custodian transaction is in principle subject to SDRT. However,<br />

as the SDRT was already paid on the previous leg by the broker, the Agency-exemption can be<br />

used as Transaction Stamp Status by the CBL customer receiving the securities.<br />

• Market sale: The securities are sold via CBL customer who is acting as an agent. The securities<br />

are first received in the customer's account with CBL (first leg) and then delivered to a broker<br />

(second leg), who will account for the 0.5% SDRT. As the SDRT will be paid by the broker in the<br />

second leg of the transaction, the Agency-exemption can be used as Transaction Stamp Status<br />

by the CBL customer initially receiving securities.<br />

In both cases, for the transaction to be eligible for Agency/market sale-exemption, the trade date<br />

and settlement date of the first and second legs must be the same. Furthermore, the second leg<br />

of the transaction must settle either on the same day as the first leg or later.<br />

Input of UK stamp duty fields<br />

Rules applicable to securities subject to SDRT<br />

The following rules apply to CREST-eligible securities subject to SDRT in order to complete the<br />

appropriate fields of CBL receipt and delivery instructions, as indicated:<br />

1. Exemption can also be achieved in the case of external “Own Account Transfers” (OATs) between two 1.5% CBL accounts (see<br />

“2. The customer opts for the 1.5% SDRT regime” on page 9).<br />

<strong>Clearstream</strong> Banking, Luxembourg 11 September 2012<br />

Creation Link Guide <strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 7

Creation Link Guide<br />

1. The customer opts for the 0.5% SDRT regime<br />

Receipt of a security subject to SDRT CreationOnline<br />

1. An exemption is claimed by the customer because<br />

there is no change of beneficial ownership<br />

throughout the movement of the securities.<br />

2. An exemption is claimed by the customer because<br />

the receipt is the result of a new issue.<br />

3. SDRT is not due from the customer because the<br />

delivering party is accountable for SDRT (as per the<br />

accountable (broker) concept under SI 1997 no. 2430<br />

Reg3 (b)).<br />

4. SDRT is due on the receipt of the securities and no<br />

exemption claimed.<br />

5. An exemption is claimed by the customer because the<br />

SDRT has already been paid on a previous transaction<br />

or the SDRT will be paid in the future transaction (the<br />

counterparty is a custodian). See “Note about the use<br />

of the “agency exemption”” on page 7.<br />

6. The transaction is a “contra” trade, that is, it reverses<br />

a trade that had settled through CREST but that was<br />

not based on a legally valid and enforceable<br />

agreement.<br />

7. Exemption is claimed by the customer as it is a EU<br />

registered charity.<br />

Stamp Duty Status:<br />

UK No change in<br />

beneficial ownership b<br />

Stamp Duty Status:<br />

UK Exemption on new<br />

issue<br />

Stamp Duty Status:<br />

Not used<br />

Repetitive Amount: c<br />

“Trade Amount”<br />

GBP 15d d<br />

Stamp Duty Status:<br />

UK Delivering party<br />

accountable<br />

Stamp Duty Status:<br />

UK transfer between CSP<br />

or ADR accounts<br />

Settlement Processing<br />

Narrative: /GBXX/<br />

coding not available at<br />

present e<br />

Creation via SWIFT<br />

and CreationDirect a<br />

MT540<br />

:19A: not used<br />

:22F::STAM/CRST/GBOXb MT540/541<br />

:19A: not used<br />

:22F::STAM/CRST/GBWX<br />

MT540/541<br />

:19A: not used<br />

:22F: not used<br />

MT540/541 c<br />

:19A::DEAL//GBP15d d<br />

:22F::STAM/CRST/GBPX<br />

MT540/541<br />

:22F::STAM/CRST/GBTX<br />

MT540/541<br />

:19A: not used<br />

:22F::STAM/CRST/GBXX<br />

MT540/541<br />

:19A: not used<br />

:22F::STAM/CRST/GBSX<br />

Meaning<br />

Transaction<br />

exempted from<br />

SDRT<br />

Transaction<br />

exempted from<br />

SDRT<br />

SDRT to be paid<br />

by the delivering<br />

counterparty<br />

SDRT to be paid<br />

by the receiving<br />

customer<br />

Transaction<br />

exempted from<br />

SDRT<br />

Transaction<br />

exempted from<br />

SDRT<br />

Transaction<br />

exempted from<br />

SDRT<br />

a. Customers must ensure that the code words are entered exactly as presented here, including the slash characters. Failure to do so could<br />

result in the instruction not being processed correctly.<br />

b. Mandatory for receipt and delivery.<br />

c. If not used, SDRT will be calculated on the basis of the applicable “midprice” in CREST.<br />

d. This field must contain the ISO currency code (GBP) followed by the total amount of the deal (deal price * quantity of securities) in 1-13<br />

numeric characters (no leading zeroes), the mandatory comma decimal separator and 0-2 decimal positions.<br />

e. Only via Creation via SWIFT and CreationDirect<br />

11 September 2012 <strong>Clearstream</strong> Banking, Luxembourg<br />

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 8 Creation Link Guide

Delivery of a security subject to SDRT CreationOnline<br />

1. The securities are delivered to a CREST counterparty<br />

acting as a CSP or a DRS account operator and the<br />

delivering customer is accountable (as per market<br />

practice).<br />

Repetitive Amount:<br />

“Trade Amount”<br />

GBP 15d b<br />

2. The customer opts for the 1.5% SDRT regime<br />

Stamp Duty Status:<br />

UK delivery to a CSP or<br />

ADR<br />

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong><br />

Creation via SWIFT<br />

and CreationDirect a<br />

MT542/543<br />

:19A::DEAL//GBP15d b<br />

:22F::STAM/CRST/GBRX<br />

2. The securities are delivered to a CBL customer acting Repetitive Amount:<br />

as a CSP or a DRS account operator and the delivering<br />

customer is accountable (as per market practice).<br />

c<br />

“Trade Amount”<br />

GBP 15d b<br />

MT542/543<br />

Stamp Duty Status:<br />

UK delivery to a CSP or ADR<br />

c<br />

:19A::DEAL//GBP15d b<br />

:22F::STAM/CRST/GBRX<br />

3. The delivering customer is accountable for the SDRT<br />

(as per the accountable concept under SI 1997<br />

no. 2430 Reg3 (b)).<br />

4. An exemption is claimed by the customer because<br />

there is no change of beneficial ownership<br />

throughout the movement of the securities.<br />

5. Exemption is claimed by the customer as it is a EU<br />

registered charity<br />

Repetitive Amount:<br />

“Trade Amount”<br />

GBP 15d b<br />

Stamp Duty Status:<br />

UK Delivering party<br />

accountable<br />

Stamp Duty Status:<br />

UK No change in<br />

beneficial ownership<br />

coding not available at<br />

present f<br />

MT542/543<br />

:19A::DEAL//GBP15d b<br />

:22F::STAM/CRST/GBPX<br />

MT540<br />

:19A: not used<br />

:22F::STAM/CRST/GBOX e<br />

MT542/543<br />

:19A: not used<br />

:22F::STAM/CRST/GBSX<br />

Meaning<br />

SDRT to be paid<br />

by the delivering<br />

customer<br />

SDRT to be paid<br />

by the delivering<br />

customer d<br />

SDRT to be paid<br />

by the delivering<br />

customer<br />

Transaction<br />

exempted from<br />

SDRT<br />

Transaction<br />

exempted from<br />

SDRT<br />

a. Customers must ensure that the code words are entered exactly as presented here, including the slash characters. Failure to do so could<br />

result in the instruction not being processed correctly.<br />

b. This field must contain the ISO currency code (GBP) followed by the total amount of the deal (deal price * quantity of securities) in 1-13<br />

numeric characters (no leading zeroes), the mandatory comma decimal separator and 0-2 decimal positions.<br />

c. If not used, SDRT will be calculated on the basis of the applicable “midprice” in CREST.<br />

d. If the SDRT is to be paid by the receiving customer, the receiving customer must input the stampable amount in his instruction (as detailed<br />

in item 3 in the table “2). The customer opts for the 1.5% SDRT regime” on the following page.<br />

e. Mandatory for receipt and delivery.<br />

f. Only via Creation via SWIFT and CreationDirect<br />

Receipt from / delivery to... CreationOnline<br />

1. A DRS account operator Stamp Duty Status:<br />

UK Transfer between CSP or ADR accounts<br />

2. A CSP Stamp Duty Status:<br />

UK Transfer between CSP or ADR accounts<br />

3. A new issue by a company<br />

incorporated in the UK<br />

Stamp Duty Status:<br />

UK Exemption on New Issue<br />

Creation via SWIFT<br />

and CreationDirect a<br />

:19A: not used<br />

:22F::STAM/CRST/GBTX<br />

:19A: not used<br />

:22F::STAM/CRST/GBTX b<br />

:19A: not used<br />

:22F::STAM/CRST/GBWX<br />

Meaning<br />

Transaction exempted<br />

from SDRT<br />

Transaction exempted<br />

from SDRT<br />

Transaction exempted<br />

from SDRT<br />

a. Customers must ensure that the code words are entered exactly as presented here, including the slash characters. Failure to do so could<br />

result in the instruction not being processed correctly.<br />

b. This field may also be included to obtain exemption in the case of external “Own Account Transfers” (OATs) between two 1.5% CBL accounts.<br />

<strong>Clearstream</strong> Banking, Luxembourg 11 September 2012<br />

Creation Link Guide <strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 9

Creation Link Guide<br />

Receipt from... CreationOnline<br />

1. A CBL customer not operating<br />

a DRS or CSP account and the<br />

receiving customer is<br />

accountable<br />

2. A CREST counterparty not<br />

operating a DRS or CSP<br />

account<br />

Repetitive Amount: a<br />

“Trade Amount”<br />

GBP 15d b<br />

Stamp Duty Status:<br />

UK delivery to a CSP or ADR<br />

Repetitive Amount: a<br />

“Trade Amount”<br />

GBP 15d b<br />

Stamp Duty Status:<br />

UK delivery to a CSP or ADR<br />

Creation via SWIFT<br />

and CreationDirect<br />

MT540/541 a<br />

:19A::DEAL//GBP15d b<br />

:22F::STAM/CRST/GBRX<br />

Meaning<br />

a. If not used, SDRT will be calculated on the basis of the applicable “midprice” in CREST.<br />

b. This field must contain the ISO currency code (GBP) followed by the total amount of the deal (deal price * quantity of securities) in 1-13<br />

numeric characters (no leading zeroes), the mandatory comma decimal separator and 0-2 decimal positions.<br />

Delivery to... CreationOnline<br />

1. A counterparty not operating a<br />

DRS or CSP account<br />

Stamp Duty Status:<br />

Not used<br />

MT540/541 a<br />

:19A::DEAL//GBP15d b<br />

:22F::STAM/CRST/GBRX<br />

Creation via SWIFT<br />

and CreationDirect<br />

SDRT to be paid by the<br />

receiving party<br />

SDRT to be paid by the<br />

receiving customer<br />

Meaning<br />

Note: For transfers from a 1.5% SDRT to a 0.5% SDRT account, a 0.5% SDRT will be accounted for<br />

unless NCBO is used.<br />

Rules applicable to securities NOT subject to SDRT<br />

The following rules apply to CREST-eligible securities not subject to SDRT in order to complete the<br />

appropriate fields of CBL receipt and delivery instructions, as indicated:<br />

Receipt / Delivery of a<br />

security NOT subject to SDRT CreationOnline<br />

Stamp Duty Status:<br />

Not used<br />

:19A: not used<br />

:22F: not used<br />

Creation via SWIFT<br />

and CreationDirect<br />

:19A: not used<br />

:22F: not used<br />

SDRT to be paid by the<br />

receiving party<br />

Meaning<br />

Transaction not<br />

subject to SDRT<br />

Input of the stampable consideration amount<br />

Note: Particular attention should be given to the input of the stampable consideration amount, as<br />

penalties may be due if the information subsequently proves to have been incorrect.<br />

The amount of SDRT charged is calculated by multiplying the stampable consideration amount by the<br />

applicable rate (0.5% or 1.5%).<br />

• 0.5% regime:<br />

The stampable consideration amount is the amount or value of the consideration.<br />

• 1.5% regime:<br />

The stampable consideration amount is:<br />

- If the securities are transferred for consideration in money or money's worth: the amount or<br />

value of the consideration;<br />

- If the securities are issued: their price when issued (that is, the unit price multiplied by the<br />

quantity of the security issued);<br />

- In all other cases: the value of the securities.<br />

The amount of the stampable consideration can be up to 15 digits but must always include two decimal<br />

places preceded by a comma separator (not a period). For example:<br />

123456789012,12 and 57,12 are valid amounts;<br />

123456789012 and 123456789012.12 and 57.12 are not valid amounts.<br />

Note: No blank space may be left between the currency and the amount.<br />

11 September 2012 <strong>Clearstream</strong> Banking, Luxembourg<br />

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 10 Creation Link Guide

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong><br />

The stampable consideration amount must always be preceded by the code word DEAL// in Creation via<br />

SWIFT or CreationDirect.<br />

Request for exemption<br />

For transfers of securities between two CSP accounts or between two DRS account operators or<br />

between a CSP account and a DRS account operator, customers must duly complete a “Request for<br />

Application of the 1.5% SDRT Regime” (see Appendix B)). By completing this certificate, the customer<br />

certifies that all transfers for which the customer inputs the appropriate code word (see input of UK<br />

stamp duty fields) in the instruction are eligible for exemption from 1.5% SDRT.<br />

The certificate must be sent, duly completed and signed, to CBL’s Credit and Collateral Management<br />

unit under the customer’s letterhead or via an authenticated communications medium. Failure to<br />

provide CBL’s Credit and Collateral Management unit with a duly completed “Request for Application of<br />

the 1.5% SDRT Regime” will result in automatic rejection of the customer's instruction.<br />

By inputting the appropriate code word in the instruction, the customer is deemed to claim exemption<br />

and to indemnify CBL for any taxes, penalties, interest and other costs that CBL may incur as a result of<br />

CBL’s reliance on the customer’s instruction.<br />

Payment of the stamp duty<br />

When applicable, SDRT (at a rate of 0.5% or 1.5%, as appropriate) will be debited at the latest either two<br />

business days after settlement date (on SD+2) or (if the instruction is matched in CREST) 10 business<br />

days after trade date, whichever is the earlier.<br />

For external receipt instructions under the 0.5% SDRT regime, if the customer is to receive securities<br />

from an external counterparty that is considered a custodian bank or broker and the customer either:<br />

a) does not account for the stamp to be paid in the instruction to CBL; or<br />

b) includes an exemption flag in the instruction to CBL,<br />

CBL and in turn its depository, Citibank, will send a blank input field to CREST, meaning “No Stamp<br />

Status” and “No Stampable consideration”. As a consequence, CREST will not deduct any stamp duty<br />

from the trades.<br />

Later, if the customer finds that it is liable to pay SDRT, then the customer will have to instruct CBL to<br />

make a manual payment to HMRC or alternatively make a direct payment. If the customer is audited<br />

and HMRC finds that SDRT is due, then CBL’s depository and in turn, <strong>Clearstream</strong>, will pass any<br />

obligations due to the customer.<br />

Note: If you are liable to pay SDRT and you do not comply with the delays set forth by HMRC1, you could<br />

be charged a GBP 100 underpayment fee and additional non-refundable interest, penalties and<br />

surcharges. We strongly recommend that you always ensure that you input the appropriate<br />

stampable consideration in your instructions along with the respective codes to avoid the<br />

incorrect calculation of SDRT resulting in under or over payments to HMRC.<br />

A direct payment can be made via CBL through its depository, Citibank.<br />

Alternatively, if the customer wishes to make a direct cash payment the following payment details are<br />

required:<br />

Sort Code: 08-32-10<br />

Account number: 12237210<br />

Account Name: HMRC Stamp Office Shares Unit<br />

1. Please refer to http://www.hmrc.gov.uk/sdrt/index.htm<br />

<strong>Clearstream</strong> Banking, Luxembourg 11 September 2012<br />

Creation Link Guide <strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 11

Creation Link Guide<br />

To pay by cheque, it must be made payable to “Her Majesty's Revenue and Customs” and must be sent<br />

to:<br />

HMRC<br />

Birmingham Stamp Office<br />

9th floor<br />

City Centre House<br />

30 Union Street<br />

Birmingham<br />

B2 4AR<br />

<strong>United</strong> <strong>Kingdom</strong><br />

Payment reference: CREST payment<br />

Payment details: CREST reference<br />

Additionally, for manual payments, credit advices should be sent to HMRC by email to:<br />

nirmala.chauhan@hmrc.gsi.gov.uk<br />

Subject: Credit Advice<br />

This email must include all the specific trade details such as the ISIN, Nominal amount, trade date,<br />

settlement date and CREST reference. This ensures that HMRC can identify the payment and issue a<br />

payment receipt.<br />

For delivery instructions under the 0.5% SDRT regime for which the customer delivering the securities<br />

accounts for the SDRT, the SDRT will be calculated based on the stampable consideration amount input<br />

by the customer.<br />

For deliveries from a non-CSP or non-DRS account operator to a CSP or DRS account operator, the<br />

following rules apply in CREST for charging the 1.5% SDRT due:<br />

1. None of the parties inputs a stampable consideration amount: The receiving CSP/DRS account<br />

operator will be charged with the 1.5% SDRT by default. The SDRT is calculated by CREST, using<br />

the closing mid-price on the trade date of the security * the quantity of shares * the SDRT rate.<br />

2. One of the parties inputs the stampable consideration amount: This party will be charged by<br />

CREST. The 1.5% SDRT is calculated from the stampable consideration amount input.<br />

3. Both parties input stampable consideration amounts: The receiving CSP/DRS will be charged by<br />

default. The 1.5% SDRT is calculated from the stampable consideration amount input.<br />

4. Incorrect or missing values: This may result in underpayments and an HMRC fee of GBP 100.<br />

Customers must send the tax refund request as soon as possible and by no later than the 5th<br />

calendar day following the month of the payment1 .<br />

CBL will bear no responsibility with regard to the stampable consideration amount or other<br />

information mentioned in the customer’s instruction. If HMRC questions or makes inquiries in relation<br />

to the stampable consideration amount mentioned in the instruction or any other details of any of the<br />

customer’s transactions, it is the responsibility of the customer to provide CBL with all required<br />

explanations and/or documentation.<br />

By sending CBL an external receipt or delivery instruction for securities subject to UK SDRT, the<br />

customer is deemed to indemnify CBL for any taxes, penalties, interest thereon and other costs that<br />

CBL may incur as a result of CBL’s reliance on the information included in the customer’s instruction,<br />

including the stampable consideration amount indicated by the customer.<br />

With regard to a delivery from a non-CSP or non-DRS account to CBL’s CSP account when the delivering<br />

party will account for the 1.5% SDRT, the receiving customer must ensure that the delivering party<br />

inputs the appropriate stampable consideration amount in his settlement instruction in CREST in order<br />

for the 1.5% SDRT due to be charged accordingly. Customers are deemed to indemnify CBL for any<br />

taxes, penalties, interest thereon or other costs that CBL may incur as a result of underpayment of<br />

SDRT, should the counterparty instruct the stampable consideration amount incorrectly.<br />

1. The market deadline is no later than the 7th calendar day following the month of the payment.<br />

11 September 2012 <strong>Clearstream</strong> Banking, Luxembourg<br />

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 12 Creation Link Guide

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong><br />

When applicable, the SDRT due on partial receipt(s) will be debited in the same processing of the<br />

consolidated credit of securities with value SD.<br />

The transaction reference that will appear on the debit instruction will be in the format “SDR” followed<br />

by a sequential reference number and most of the details of the original receipt instruction.<br />

Retention and disclosure of documentary evidence<br />

Documentary evidence of details of all transactions and, where applicable, proof of relief from SDRT,<br />

must be retained for a minimum of four years 1 from the settlement date of each transaction and must<br />

be forwarded upon request from CBL or HMRC. By holding UK securities in an account with CBL,<br />

customers will be deemed to have authorised the disclosure to HMRC upon request of all details of<br />

transactions relating to UK securities.<br />

SDRT Reclaim request charges<br />

A charge of GBP 35.00 is made per reclaim item as soon as it has been charged by the HMRC and<br />

forwarded by the depository.<br />

1. Six years, in the case of transactions effected before 1 April 2011.<br />

<strong>Clearstream</strong> Banking, Luxembourg 11 September 2012<br />

Creation Link Guide <strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 13

Creation Link Guide<br />

Procedure for depositing physical securities eligible in Citibank<br />

The procedure<br />

The procedure comprises the following steps:<br />

1. The customer prepares the documents.<br />

2. The customer sends the documents to <strong>Clearstream</strong> Banking for authentication and guarantee.<br />

3. The customer processes the authenticated forms returned from <strong>Clearstream</strong> Banking, delivering<br />

them, with covering letter, to Citibank.<br />

4. Citibank processes the received physical certificates and documentation.<br />

1. The customer prepares the documents<br />

For CREST-eligible physical securities:<br />

a) Download the CREST Transfer Form from the EUI website, www.euroclear.com;<br />

b) Complete the CREST Transfer Form as indicated in Appendix C.<br />

For non–CREST-eligible physical securities:<br />

a) Download the Stock Transfer Form from the CBL website;<br />

b) Complete the Stock Transfer Form as indicated in Appendix D.<br />

Plus, if the holder of the physical securities is a corporation:<br />

• The original Articles of Association; and<br />

• A certified copy (in English) of the Certificate of Registration.<br />

Note: It is of the utmost importance that the customer submits the appropriate transfer form. Citibank,<br />

N.A. will return any securities transferred using inappropriate forms to the contact name and<br />

address provided in the covering letter.<br />

2. The customer sends the documents to <strong>Clearstream</strong> Banking for authentication and guarantee<br />

Customers must send the original CREST Transfer Form or Stock Transfer Form only, duly completed<br />

and signed, by registered mail to <strong>Clearstream</strong> Banking Settlement department in Frankfurt at the<br />

following address:<br />

<strong>Clearstream</strong> Banking AG<br />

Settlement Global<br />

OAA/EA.08.301<br />

60485 Frankfurt am Main<br />

Germany<br />

CBL will:<br />

a) Check that the form is correctly completed;<br />

b) Check and validate the authorised signature(s);<br />

c) Send the authenticated form back to the customer by mail.<br />

N.B.: Physical securities and any additional documentation must not be sent to <strong>Clearstream</strong> Banking.<br />

11 September 2012 <strong>Clearstream</strong> Banking, Luxembourg<br />

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 14 Creation Link Guide

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong><br />

3. The customer processes the authenticated forms returned from <strong>Clearstream</strong> Banking,<br />

delivering them to Citibank.<br />

When customers receive the documents back from CBL, they must do the following:<br />

a) Send to <strong>Clearstream</strong> Banking an appropriate free of payment receipt instruction with the<br />

appropriate stamp duty status, if applicable.<br />

b) Send to Citibank, via a secure courier service, the following documents:<br />

- The original certificate(s);<br />

- The appropriate transfer form; and<br />

- A covering letter, including a contact name and address to enable Citibank to return the<br />

securities if no instruction is received within 5 days or if the securities are not in good order;<br />

Plus, if the holder of the physical securities is a corporation, certified copies (in English) of:<br />

- The Articles of Association (template to be requested directly by the holder from the issuing<br />

company or registrar);<br />

- The Certificate of Registration; and<br />

- The list of authorised signatures.<br />

at the following address:<br />

Attn: Citigroup Residuals<br />

1st Floor<br />

1 North Wall Quay<br />

Dublin 1<br />

Ireland<br />

Note: For reasons of safety, customers are strongly recommended to send the physical certificates and<br />

the documentation separately.<br />

4. Citibank processes the received physical certificates and documentation<br />

For CREST-eligible physical securities:<br />

a) Citibank checks the documentation and the certificates;<br />

b) Citibank arranges for the deposit of shares to be stamped by HMRC or for SDRT to be charged (for<br />

0.5%SDRT regime) or exemption (no change of beneficial ownership) to be applied;<br />

c) Citibank sends to the Registrar the documentation and the certificates for dematerialisation and<br />

re-registration under the name of Citibank nominee (Vidacos nominee);<br />

d) After the completion and confirmation of the re-registration, Citibank credits the securities to<br />

<strong>Clearstream</strong> Banking’s account.<br />

Note: If no instructions are received within five days of receipt of the certificates and/or transfer form,<br />

all documents will be returned to the contact name and address provided in the covering letter.<br />

For non–CREST-eligible physical securities:<br />

a) Citibank checks the documentation and the certificates;<br />

b) Citibank arranges for the form to be stamped by HMRC and (for 0.5% stamp duty regime only) for<br />

the stamp duty to be paid;<br />

c) Citibank sends to the Registrar the documentation and the certificates for re-registration under<br />

the name of Citibank nominee (Vidacos nominee);<br />

d) After the completion and confirmation of the re-registration, Citibank credits the securities to<br />

<strong>Clearstream</strong> Banking’s account.<br />

Note: The re-registration process may require more than two weeks for completion.<br />

If no instructions are received within 5 days of receipt of the certificates and/or transfer form, all<br />

documents will be returned to the contact name and address provided in the covering letter.<br />

<strong>Clearstream</strong> Banking, Luxembourg 11 September 2012<br />

Creation Link Guide <strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 15

Creation Link Guide<br />

Stamp Duty Reserve Tax (SDRT) and Stamp Duty<br />

Stamp Duty Reserve Tax (SDRT) is a duty payable on electronic transfers.<br />

Stamp Duty is a duty payable on paper transfers.<br />

SDRT on dematerialisation for CREST-eligible securities<br />

Where a customer account is subject to the 0.5% stamp duty regime, 0.5% SDRT applies to<br />

dematerialisation of physical securities to be deposited in EUI unless an exemption - No Change in<br />

Beneficial Ownership (NCBO) - is claimed in the settlement instruction.<br />

Dematerialisation of physical securities to a customer account subject to the 1.5% stamp duty regime is<br />

subject to 1.5% SDRT.<br />

Stamp Duty on physical non–CREST-eligible securities<br />

Stamp duty is payable at a rate of either 1.5% or 0.5% ad valorem (for receipts free or against payment,<br />

where no exemption is claimed).<br />

The 0.5% Stamp Duty regime<br />

For 0.5% stamp duty to apply, customers must complete the “Request for Application of the 0.5% SDRT<br />

Regime” (see Appendix A).<br />

Receipt of physical securities into CBL will be subject to 0.5% stamp duty ad valorem unless there is no<br />

change of beneficial ownership.<br />

A customer that deposits physical securities with CBL must indicate in the instruction either the<br />

stampable consideration (when ad valorem duty is payable) or the relevant code word (when fixed duty<br />

is payable - see “1. The customer opts for the 0.5% SDRT regime” on page 8).<br />

Upon receipt of the settlement instruction and the Stock Transfer Form, Citibank will arrange for the<br />

form to be stamped by HMRC and for the stamp duty to be paid.<br />

The 1.5% Stamp Duty regime<br />

If the customer does not submit the “Request for Application of the 0.5% SDRT Regime”, the account<br />

remains subject to 1.5% stamp duty such that every receipt of physical securities in CBL will, unless an<br />

exemption applies, be subject to stamp duty at the rate of 1.5% ad valorem.<br />

It is market practice that stamp duty on receipt of physical securities in a clearance service be paid by<br />

the delivering party, which must complete the Stock Transfer Form and have it stamped by<br />

HM Revenue & Customs prior to delivering the form, together with the securities, to Citibank. If this<br />

procedure is not followed, the securities will not be accepted but will instead be returned to the<br />

delivering party, together with the unstamped form.<br />

Customers must claim any exemption in their settlement instruction by indicating the relevant code<br />

word in accordance with the requirements applicable to CREST-eligible securities (see “2. The<br />

customer opts for the 1.5% SDRT regime” on page 9).<br />

Impact on corporate actions and income collection<br />

CBL will not be responsible for corporate actions and income payments with respect to physical certificates<br />

that have not been re-registered and returned by the transfer agent to the depository (Citibank).<br />

Entitlements will pass to <strong>Clearstream</strong> Banking's depository if the certificates are re-registered not later<br />

than the record date of a corporate action or an income collection event. Corporate actions and income<br />

events will be processed on an “as-received basis”.<br />

“Business as usual” processes will apply as soon as the re-registered securities have been credited to<br />

the <strong>Clearstream</strong> Banking customer's account.<br />

Bilateral securities lending and borrowing<br />

Customers entering into bilateral securities lending and borrowing arrangements in the UK market are<br />

fully responsible and liable to incur SDRT charges or fines linked to such transactions executed via CBL.<br />

11 September 2012 <strong>Clearstream</strong> Banking, Luxembourg<br />

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 16 Creation Link Guide

Key to completing the transfer forms<br />

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong><br />

Appendix C and Appendix D show the CREST and Stock Transfer Forms respectively, with the following<br />

annotations:<br />

1. To be completed by Citibank.<br />

2. The name of the security.<br />

3. The type of the security - for example, equity, unit trust, corporate bond.<br />

4. The number of shares (in words).<br />

5. The number of shares (in figures).<br />

6. The full name(s) and address(es) of the registered certificate holder(s).<br />

7. The signature(s) of the registered holder(s):<br />

- If a corporation: two authorised signatures, stating professional title and name in each case;<br />

- If one individual: the individual’s signature;<br />

- If several persons: each person’s signature.<br />

To avoid confusion, customers must, when validating the signature(s) of registered holder(s),<br />

ensure that their own signature/stamp is to the left of or below the borders of the form content.<br />

8. Customers are responsible for guaranteeing the signatory of the registered owner and, by<br />

signing and stamping the Power of Attorney, customers are deemed to have performed a check<br />

on the signature(s) and the proper power and authority of the registered owner(s).<br />

Note: At the end of this Creation Link Guide (<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong>), a blank Stock Transfer Form is<br />

provided for customers to download, print out and complete for submission.<br />

Back-to-back processing<br />

Back-to-back processing is available for transactions in dematerialised securities eligible in the CREST<br />

system. Customers can increase same-day turnaround of instructions by “linking” one domestic receipt<br />

to one domestic delivery.<br />

The settlement deadline for back-to-back instructions is 15:00 CET on SD-1. Customers must ensure,<br />

together with the respective counterparty, that the receipt and delivery instructions will match on SD-1.<br />

Customers should be aware that where one or other of the transactions to be linked fails to match, the<br />

linking process will not take place.<br />

The CREST system prioritises individual transactions over linked transactions and, therefore, the<br />

linking of two transactions may not guarantee settlement.<br />

CBL will bear no responsibility with regards to failure of a linked transaction. By sending a back-to-back<br />

instruction in the UK market, customers are deemed to indemnify CBL for any costs, penalties or loss that<br />

CBL may incur.<br />

To benefit from this functionality, customers must ensure that their back-to-back instructions are<br />

formatted as follows, according to the connectivity medium used:<br />

Connectivity medium Pool ID format Field(s) to be used Remarks<br />

CreationOnline 16x a<br />

Creation via SWIFT and<br />

CreationDirect<br />

and<br />

Turnaround<br />

:POOL//16x a<br />

and<br />

:SETR//TURN<br />

Pool Reference<br />

Type of Settlement Transaction<br />

Field :20C: sequence A1<br />

Field :22F: sequence E<br />

a. The reference (16x) must neither start nor end with a single slash ’/’ nor must it contain two consecutive slashes ’//’.<br />

<strong>Clearstream</strong> Banking, Luxembourg 11 September 2012<br />

Creation Link Guide <strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 17

Creation Link Guide<br />

Management of failed instructions<br />

Matched receipt and delivery instructions with domestic counterparties that have not settled on SD will<br />

remain pending until they settle or until they are cancelled by both parties in CREST.<br />

• CREST instructions that remain unmatched by the requested settlement date are reported to<br />

CBL as pending.<br />

CBL reserves the right to cancel instructions with domestic counterparties that have not been<br />

matched by the fifth business day after the requested settlement date.<br />

• Non-CREST instructions that remain unmatched by the requested settlement date are reported<br />

to CBL as pending.<br />

CBL reserves the right to cancel such instructions by the 15th business day after the requested<br />

settlement date.<br />

Custody services<br />

Income collection<br />

For both debt securities and equities, <strong>Clearstream</strong> Banking record date is payment date -1 business day<br />

and ex-date equals payment date.<br />

Debt securities<br />

Service offered Remarks<br />

Notification to customers Standard reporting. No specific deviations<br />

Payment of proceeds Income payments are credited to the customer’s account at the<br />

start of RTP with value coupon payment date, based on the<br />

positions at close of business on the record date.<br />

from standard reporting<br />

provided by CBL apply to<br />

the UK market.<br />

Equities<br />

Record dates for equities are determined by the relevant companies according to domestic market<br />

practice and are updated by CBL in accordance with information received from depositories,<br />

newspapers, companies and information suppliers.<br />

Service offered Remarks<br />

Notification to customers Standard reporting. No specific deviations<br />

Payment of proceeds Dividend payments - usually paid four or six weeks after Ex-date -<br />

are credited to the customer’s account at the start of RTP with<br />

value dividend payment date, based on the positions at close of<br />

business on the record date.<br />

from standard reporting<br />

provided by CBL apply to<br />

the UK market.<br />

11 September 2012 <strong>Clearstream</strong> Banking, Luxembourg<br />

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 18 Creation Link Guide

Corporate actions<br />

Sale and purchase of rights<br />

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong><br />

Please refer to the document “Sale and purchase of rights” on the CBL website, www.clearstream.com,<br />

under Information Centre/Market Reference.<br />

Proxy Voting procedures<br />

Proxy voting services are available in CBL for this market. For details about the proxy voting services<br />

offered by CBL, please refer to the CBL Customer Handbook and, for the market specific practices,<br />

please refer to the Market Profile.<br />

Entitlement compensation rules<br />

Please refer to the Securities administration section of the Market Profile (<strong>United</strong> <strong>Kingdom</strong>).<br />

Other services<br />

Securities lending and borrowing<br />

UK equities, investment trusts and corporate bonds are not eligible for CBL’s securities lending and<br />

borrowing programme.<br />

Disclosure requirements<br />

Please refer to the <strong>Clearstream</strong> Banking Guide to Disclosure Requirements, which is an appendix to the<br />

Creation Market Guide.<br />

Holding restrictions<br />

Please refer to the Investment regulation section of the Market Profile (<strong>United</strong> <strong>Kingdom</strong>).<br />

Please also refer to “Specific settlement rules / settlement restrictions” on page 4 for details of<br />

equities subject to a foreign ownership limit.<br />

Foreign exchange<br />

Service offered Remarks<br />

Notification to customers <strong>Clearstream</strong> Banking advises customers of their<br />

entitlement to participate in UK corporate actions<br />

(including, but not limited to, stock dividends, rights<br />

issues, bonuses and takeovers/mergers).<br />

Instruction to CBL Customers may instruct CBL to carry out options<br />

foreseen in the terms and conditions of the<br />

underlying type of security. These options include,<br />

but are not limited to, put options, conversions,<br />

exercises of warrants, exchanges, detachment of<br />

warrants etc.<br />

In addition, CBL informs customers on an “as and if<br />

received” basis of unscheduled securities events<br />

occurring on account holdings, such as rights<br />

offers, reinvestment options, exchange offers,<br />

purchase offers, mergers etc.<br />

No specific deviations from standard<br />

reporting provided by CBL apply to the<br />

UK market.<br />

The issuance of new securities does<br />

not give rise to SDRT under the 0.5%<br />

SDRT regime.<br />

The transfer of securities, albeit newly<br />

issued securities, into a clearance<br />

service under the 1.5% SDRT regime<br />

as a result of a corporate event will<br />

normally give rise to 1.5% SDRT.<br />

Further information on the charge to<br />

SDRT in relation to corporate actions<br />

is available in the respective corporate<br />

action notification.<br />

Foreign exchange services in GBP are automatically available to customers. To complete foreign<br />

exchange conversions for GBP, customers should contact CBL’s Treasury Desk directly by<br />

CreationOnline, via an authenticated communications medium.<br />

<strong>Clearstream</strong> Banking, Luxembourg 11 September 2012<br />

Creation Link Guide <strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 19

Creation Link Guide<br />

Eurex option exercises<br />

<strong>Clearstream</strong> enables CBF International (CBFi) customers, acting as Eurex general clearing member<br />

(GCM), direct clearing member (DCM) or settlement institution, holding their GBP denominated UK<br />

equities and USD denominated ETCs with CBF, to use the holdings to meet settlement delivery<br />

obligations in EUI resulting from their activity in Eurex Clearing AG and to receive these from other<br />

market participants into accounts held with CBF via their CBL accounts (CBFi). This service is not<br />

available for 1.5% SDRT accounts.<br />

Settlement services - Securities<br />

Final settlement will take place in the EUI CREST system.<br />

The CREST system has a static data requirement whereby all GCMs and DCMs must supply a CREST<br />

clearing member ID. CBL has been granted a CREST clearing member ID, which can be used by<br />

customers using the settlement services. Customers who want to use the available CREST clearing ID<br />

should consult their Relationship Officer.<br />

Contrary to current practice, customers must monitor any exercise or assignment allocated to them by<br />

Eurex and instruct accordingly into their CBFi account.<br />

Settlement services - Cash<br />

There will be no impact on the cash leg of settlement for such exercises/assignments taking place on<br />

Eurex designated accounts. All cash movements will take place on the existing cash accounts held by<br />

customers. Settlement of such transactions is available via CBL’s link to Citibank N.A. in the standard<br />

currencies EUR, GBP and USD.<br />

Stamp Duty Reserve Tax (SDRT)<br />

SDRT, currently charged at 0.5% of the stampable consideration of a transaction, is due on all<br />

transactions of chargeable securities. However, in some circumstances, exemption from SDRT or a<br />

relief from SDRT can be applied.<br />

Any realignments between customer accounts are to be managed by the customer as well as ensuring<br />

that the correct stamp flag is included in the settlement transactions. For example, realignments<br />

between customer own 0.5% SDRT accounts and exempt accounts (if exempted for this activity) must be<br />

flagged as “NCBO” to avoid undue taxation.<br />

Non-Application for relief from SDRT<br />

If the customer wants to settle exercises and assignments and have SDRT applied to the<br />

settlement, settlement must take place on an account operated under the 0.5% SDRT regime;<br />

the 1.5% SDRT regime cannot be used for the settlement of such transactions.<br />

Customers holding positions under the 0.5% SDRT regime can use the current process.<br />

Customers not yet holding positions in the 0.5% SDRT regime but only in the 1.5% SDRT regime must<br />

transfer securities into a 0.5% SDRT designated account in order to meet settlement obligations.<br />

For this purpose, customers must submit to their Relationship Officer a duly completed Account<br />

Opening document “Request for Application of the 0.5% SDRT Regime“.<br />

Application for relief from SDRT<br />

If the customer wants to settle exercises and assignments and have full relief applied to the<br />

settlement, settlement must take place on an account operated under an exempt regime.<br />

Customers will have to request the opening of a new account, as well as provide proof of their<br />

exemption status, and must transfer securities into this account in order to meet settlement<br />

obligations.<br />

For this purpose, customers must submit to their Relationship Officer a duly completed Account<br />

Opening document “Request for Application of the 0.5% SDRT Regime" (marked as for a Eurex<br />

services/exempt account).<br />

11 September 2012 <strong>Clearstream</strong> Banking, Luxembourg<br />

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 20 Creation Link Guide

Tax services<br />

<strong>United</strong> <strong>Kingdom</strong> <strong>II</strong><br />

In order to enable the efficient processing of Eurex exercises and/or assignments of UK products,<br />

customers are required to open one or more designated accounts within Creation to correspond with<br />

the account(s) opened in the CREST system.<br />

General technical specifications<br />

So that EUI’s CREST system can recognise incoming instructions for the Eurex market, certain fields in<br />

the instruction are required to contain specific values, as follows:<br />

Connectivity medium/Format Content<br />

CreationOnline<br />

Additional Places Type = Place of Trade<br />

Code = Stock Exchange<br />

Narrative = ECAG<br />

Additional flagging will be required in order to indicate SDRT status for an instruction.<br />

Additional Indicator<br />

Type = Processing Indicator<br />

DSS<br />

CRST Code:<br />

- Axxx = Agency Trade<br />

- PPxx = Purchase Principal<br />

- SPxx = Sale Principal a<br />

For realignments of positions between customer accounts from/to an exempt account to/from their<br />

main 0.5%SDRT account to meet settlement obligations and avoid undue charges:<br />

Stamp Duty Status No change of beneficial ownership<br />

Creation via SWIFT and CreationDirect<br />

:94B::TRAD//EXCH/ECAG Trade System of Origin (TSO) code provided to indicate that<br />

the instruction is for the Eurex market.<br />

Additional flagging will be required in order to indicate SDRT status for an instruction.<br />

:22F::PROC/CRST/Axxx or<br />

- Axxx = Agency Trade<br />

:22F::PROC/CRST/PPxx or<br />

- PPxx = Purchase Principal<br />

:22F::PROC/CRST/SPxx<br />

- SPxx = Sale Principal<br />

:95P::BUYR//customer's BIC or<br />

:95P::SELL//customer's BIC<br />

a<br />

For realignments of positions between customer accounts from/to an exempt account to/from their<br />

main 0.5% SDRT account to meet settlement obligations and avoid undue charges:<br />

:22F::STAM//NCBO - NCBO = No change of beneficial ownership<br />

a. (The field must be completed as shown here, including the “xxx” or “xx” (as the case may be) as required static data.<br />

For information about how to instruct, please refer to “Instruction specifications” on page 22.<br />

Procedures for domestic counterparties<br />

Domestic counterparties must instruct CREST as follows:<br />

All transactions on a 0.5% SDRT account All transactions on an exempt account<br />

Deliver to: CBL participant number 00XJJ CBL participant number nnnnna For account of: <strong>Clearstream</strong> Banking, Luxembourg <strong>Clearstream</strong> Banking, Luxembourg<br />

In favour of: Account number of CBL customer Account number of CBL customer<br />

a. nnnnn = unique CREST participant ID provided by the CBFi customer to the counterparty as appropriate.<br />

Note: For counterparties in CREST, the Trade System of Origin (TSO) code to be used is “U”.<br />

Please refer to the <strong>Clearstream</strong> Banking Market Taxation Guide - <strong>United</strong> <strong>Kingdom</strong>.<br />

<strong>Clearstream</strong> Banking, Luxembourg 11 September 2012<br />

Creation Link Guide <strong>United</strong> <strong>Kingdom</strong> <strong>II</strong> - 21

Creation Link Guide<br />

Instruction specifications<br />

CreationOnline<br />

I. Book-entry<br />

Receive Free Receive Against Payment<br />

M Trade Date M Trade Date<br />

O Deal Price O Deal Price<br />

M Place of Settlement BIC M Place of Settlement BIC<br />

Party CRSTGB22XXX - CREST Party CRSTGB22XXX - CREST<br />

M Delivering Agent CRESTCo M Delivering Agent CRESTCo<br />

Party counterparty's CREST code Party counterparty's CREST code<br />

C Seller BIC a<br />

C Seller BIC a<br />

Party ordering party's BIC a Party ordering party's BIC a<br />

or Seller Name and Address (if BIC does not exist) a or Seller Name and Address (if BIC does not exist) a<br />

Party ordering party's name a Party ordering party's name a<br />

C Account ordering party's account a C Account ordering party's account a<br />

C Stamp Duty Status b<br />

C Stamp Duty Status b<br />

C Trade Amount b C Trade Amount b<br />

Deliver Free Deliver Against Payment<br />

M Trade Date M Trade Date<br />

O Deal Price O Deal Price<br />

M Place of Settlement BIC M Place of Settlement BIC<br />

Party CRSTGB22XXX - CREST Party CRSTGB22XXX - CREST<br />

M Receiving Agent CRESTCo M Receiving Agent CRESTCo<br />

Party counterparty's CREST code Party counterparty's CREST code<br />

C Buyer BIC C Buyer BIC<br />

Party beneficiary's BIC a Party beneficiary's BIC a<br />

or Buyer Name and Address (if BIC does not exist) or Buyer Name and Address (if BIC does not exist)<br />

Party beneficiary's name a Party beneficiary's name a<br />

C Account beneficiary's account a C Account beneficiary's account a<br />

C Stamp Duty Status b C Stamp Duty Status b<br />

C Trade Amount b C Trade Amount b<br />

a. This field must be left blank for transfers between accounts of the same CREST participant.<br />

b. The use of these fields is dependent on whether the transaction is subject to or exempt from stamp duty and on the appropriate<br />

accountability. For details, please refer to “Input of UK stamp duty fields” on page 7.<br />