journal of pension planning & compliance - Kluwer Law International

journal of pension planning & compliance - Kluwer Law International

journal of pension planning & compliance - Kluwer Law International

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

4 / JOURNAL OF PENSION PLANNING & COMPLIANCE<br />

THE SIMULATION MODEL<br />

In order to assess the magnitude <strong>of</strong> obligations facing <strong>pension</strong><br />

plans under the prevailing circumstances, a simulation <strong>of</strong> a prototype<br />

<strong>pension</strong> plan was constructed to consider the impact <strong>of</strong> economic conditions<br />

as well as financial factors on the ability <strong>of</strong> a <strong>pension</strong> plan to<br />

meet its obligations.<br />

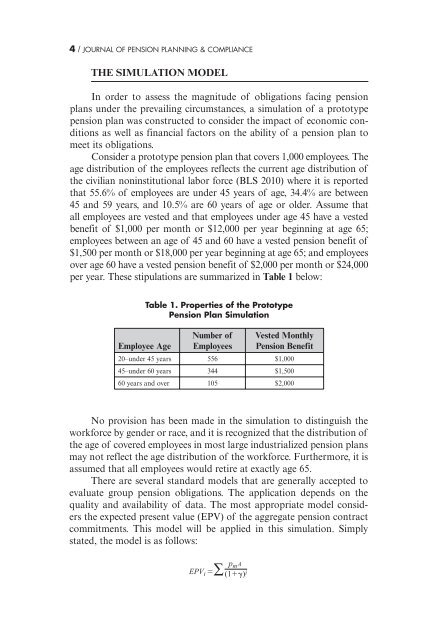

Consider a prototype <strong>pension</strong> plan that covers 1,000 employees. The<br />

age distribution <strong>of</strong> the employees reflects the current age distribution <strong>of</strong><br />

the civilian noninstitutional labor force (BLS 2010) where it is reported<br />

that 55.6% <strong>of</strong> employees are under 45 years <strong>of</strong> age, 34.4% are between<br />

45 and 59 years, and 10.5% are 60 years <strong>of</strong> age or older. Assume that<br />

all employees are vested and that employees under age 45 have a vested<br />

benefit <strong>of</strong> $1,000 per month or $12,000 per year beginning at age 65;<br />

employees between an age <strong>of</strong> 45 and 60 have a vested <strong>pension</strong> benefit <strong>of</strong><br />

$1,500 per month or $18,000 per year beginning at age 65; and employees<br />

over age 60 have a vested <strong>pension</strong> benefit <strong>of</strong> $2,000 per month or $24,000<br />

per year. These stipulations are summarized in Table 1 below:<br />

Table 1. Properties <strong>of</strong> the Prototype<br />

Pension Plan Simulation<br />

Employee Age<br />

Number <strong>of</strong><br />

Employees<br />

Vested Monthly<br />

Pension Benefit<br />

20–under 45 years 556 $1,000<br />

45–under 60 years 344 $1,500<br />

60 years and over 105 $2,000<br />

No provision has been made in the simulation to distinguish the<br />

workforce by gender or race, and it is recognized that the distribution <strong>of</strong><br />

the age <strong>of</strong> covered employees in most large industrialized <strong>pension</strong> plans<br />

may not reflect the age distribution <strong>of</strong> the workforce. Furthermore, it is<br />

assumed that all employees would retire at exactly age 65.<br />

There are several standard models that are generally accepted to<br />

evaluate group <strong>pension</strong> obligations. The application depends on the<br />

quality and availability <strong>of</strong> data. The most appropriate model considers<br />

the expected present value (EPV) <strong>of</strong> the aggregate <strong>pension</strong> contract<br />

commitments. This model will be applied in this simulation. Simply<br />

stated, the model is as follows:<br />

p m A<br />

EPV i ∑ (1) i