Untitled - David Kronemyer

Untitled - David Kronemyer

Untitled - David Kronemyer

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Tirrnover lrom continuing operations<br />

Depreciation<br />

Profi1 belbre finance charges<br />

Finance charges<br />

Profit befbre taxation<br />

Prolit alier taxation<br />

Capital expenditure - property, plant, ct(j<br />

- rental equipment<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

F)arnings per Ordinary Share<br />

Dividends per Ordinary Share<br />

<br />

<br />

<br />

<br />

<br />

<br />

urnover by Seclor (Contnuing Busrnesses)<br />

I Renla ancl Belai 38qo<br />

lTechno ogy 26%<br />

a Mrs c22ED<br />

I Cons!mer a.d Commercait4%

Last year's results are a reflcction o{ the cnvironment lbr<br />

success created bY our nc$ oPerating sqle. ln particular"<br />

our perforrnance is a measure oI the growing stature and<br />

qualitl of the managcment in our hrrsiness. And it is a<br />

commentary on the commitment and supgrrt given b1<br />

our employees at all levels in all the countries lhere the<br />

(iroup operates. My Board colleagues joirr me in paving<br />

tribute to thcir continuing efforts.

THORN EMI is a rad :ally duutgerl business. Last<br />

yeot mrnked, afind,amental shift au;ay frorn the<br />

past.Three yea.rs of tough restructuing harse mndc<br />

our compargr leon, strong and itemational in<br />

outlnok. We htu;e inrreased. profi,ts - and more<br />

importo,nt profitahility - and, will continue to dn so.<br />

THORN EMI is intent onfurther grozoth.<br />

Our results show t}tat our strategy is working; we<br />

are sharpening our focus, concentrating our<br />

resources, competing globally. The detailed<br />

performance of our rnajor businesses - Rental and<br />

Retail. Music. Lighting and our tluee main<br />

Technology activities, Software, Security and<br />

Elechonics - is reviewed in the pages that follow.<br />

Each set ambitious targets for t}le year; each met<br />

or exceeded thern. Through organic grovth<br />

acquisition or alliance, each strengthened its<br />

international position.<br />

THORN EMI has becorne the world's leading<br />

renter/retailer. We achieved our position of global<br />

strength with the carefi ly targeted acquisition of<br />

the US market leader Rent-A-Center; the<br />

opportunity to acquire six more European rental<br />

operations; and by expansion in record retailing as<br />

far afield as New Zealand and Canada.<br />

Music is another o{ our truly global businesses.<br />

EMI Music is one of the world's 'Big Five' music<br />

companies. The breadth of its international<br />

presence is formidable - operations in 35<br />

countries and a worldwide distribution network -<br />

and for the third consecutive year, the company<br />

successfully increased volume and profit,<br />

generating high levels of cash with excellent<br />

returns on capital ernployed, As part of our bid to<br />

move frrther towards world leadership, Jirn Fifield<br />

was appointed President and Chief Operating<br />

OfEcer o{ EMI Music Worldwide, reporting to<br />

Bhaskar Menon.<br />

Our Lighting business is well on the way to<br />

joining the front rank of truly multinational<br />

companies. This year it further increased the<br />

proportion of its sales outside the UK to<br />

Colin Southgate (pictured leli)

54 per ccnt. S'e have unique strengths among<br />

PBIT/Turnove(%)<br />

world manufacturers in sut:cessfully targeting both<br />

the fittings and light sources markets. Acquisition<br />

of the littings rnanufacturer Jdmkonst, in Sweden,<br />

reinlbrces our position in the important Nordic<br />

markets and strengthens our international product<br />

range. Our bid to acquire the French group<br />

Holophane and its subsidiary Europhane is one<br />

example of our determination to build on THORN<br />

Lighting"s international position and further<br />

strengthen our move toward thc single market in<br />

Uurope in lQo2.<br />

The improving lrend in<br />

THORN EMI'S reiurn on sa es<br />

rellecls lhe success ol our<br />

resirucluring programrne,<br />

whrch was based on a core<br />

stralegy execlied under slr ct<br />

iinancia dlsciplines,a!med<br />

firmlyal improv ng prolilab ly<br />

as distincl lrom pure y groMh<br />

rn lurnover achieved al lhe<br />

expense ol adequale marg ns.<br />

The activities of Thorn Ericsson have been<br />

restricted to the llK telecommunications market.<br />

This does not fit with our international gronth<br />

strategy and we have reached agreement with our<br />

partners, Ericsson o{ Sweden, to sell them our 5l<br />

per cent interest. \le believe that this will also he to<br />

the long-term benefit of Thom Ericsson, which is<br />

dependent on Ericsson's technology in this lield.<br />

Our principal tchnology businesses, already at<br />

the forefront of their markets in the UK. are now<br />

winning major overseas contracts against strong<br />

competition. S'ith these succcsses they have<br />

PBIT perEmployee (t)<br />

established important international niche positions<br />

and helped boost the overall profit of Technology<br />

by 34 per cent last year.<br />

\ measure of THOR\ E\'ll's grouing<br />

international status is the increasing proportion of<br />

our employees uorking outside the UK. One-third<br />

of our 64,000 cmployccs nor lork in Noth and<br />

South America, continental Europe and the<br />

countries of the Pacific Basin. Our commitment to<br />

the UK continues, houever, as shovn in the<br />

Ths rnpo anl measlre<br />

ol ernployee producl vily<br />

shows slrong and conl nlous<br />

progress s nce 1985/6.<br />

Alhough lhe loial n!mber ol<br />

ernployees lras decreased by<br />

busrnesses we lrave ncreased<br />

mPodanllylhe r prodlclvrly<br />

investment of over 940 million in worldcornpetitive<br />

manulacturing lacilities in Britain for<br />

our Lighting, Music and Technology businesses.<br />

Thcse are being integrated into our international<br />

manufacturing networh in line with our global<br />

strategy.<br />

This pattern of global behaviour shapes our<br />

buying policies as well. Our Rental and Retail<br />

operations make us one of the world's biggest

single purchasers of consumer electronics<br />

products, spend;ng a commanding !500 million a<br />

year.<br />

Restructuring has enabled us to promote or<br />

recruit new managers throughout our company,<br />

who are infusing each business with a {resh sense<br />

o1 competitive urgency and drive. One of our<br />

highest priorities is to keep all our rrranagers<br />

adaptive and contemporary by providing<br />

. onlinuous opporlunitl lor innurative<br />

development and training. New prograrlrnes,<br />

designed in conjunction with INSEAD in France,<br />

the University of Hong Kong and the Australian<br />

Graduate School of Management, are heiping us<br />

develop the pace-setting leaders our business<br />

needs.<br />

THORN EMI is increasingly decentralised in its<br />

management style. Responsibility and'ownership'<br />

of the business are being pushed down the line,<br />

giving each operation the agility to respond laster<br />

and more decisively to market opportunities.<br />

The corporate centre's job is to provide the<br />

businesses with clear strategic direction, with<br />

accurate, relevant and sophisticated inlbrmation<br />

resources and with financial strength. A team of<br />

senior corporate and operations managers enEures<br />

that corporale strateg;r and business objectives are<br />

based in competitive reality. Key performance<br />

indicators for each business and its competitors are<br />

monitored constantly and precisely at Group<br />

Headquafiers using new interactive management<br />

information systems.<br />

(Jur results are reflecting a vitality at THORN<br />

lnteresl Cover (x)<br />

r98t6 198d.7 1987/8<br />

Th slesl used by bankersto<br />

asess lhe salely margin for<br />

interesl on oans not only<br />

reliecls Ilre comb nation of<br />

improvinq absolule leve s oi<br />

profil coupied with decreasing<br />

leve s ol borowings, bulatso<br />

demonstrates thal TH oBN Et\,11<br />

ex ts lhe I98718 linancial lear<br />

rn a slrong postion lrom wh ch<br />

to plrsle tlreexpansron of ts<br />

organ cally and byacqulsition<br />

EMI lew would have thought possible just a short<br />

time ago. The momentum unleashed by our<br />

restructuring shows we can maintain high retums<br />

while growing, not just while pruning. During 1987<br />

THORN EMI disposed of businesses with a<br />

combined tumover of over 5500 million - a total<br />

more than offset by the growth achieved by our<br />

core businesses at constant exchange rates.<br />

Even more significant was the 4l per cent<br />

increase in Group profit before tax. In facl as can

e seen, all key measures of performance<br />

improved significantly last year.<br />

We are proud of the gains we have achieved<br />

but by no means satisfied; we are aware of the<br />

scale of our task. Last October's turrnoil in world<br />

Enancial markets affected con$dence in many<br />

intemationally operating businesses. Ve know that<br />

currency fluchrations will continue to impact on<br />

future earnings and the cost o{ future acquisitions.<br />

There is no shelter however in depending heavily<br />

on a single geographic rnarket or economy'<br />

THORN EMI's operational style and structure<br />

are now fiily geared to intemational opportunities.<br />

Our pordolio of companies today provides us with<br />

a remarkable set of businesses. Their diversity<br />

greatly reduces our exposure to any significant<br />

downtum. We intend not only to increase our<br />

worldwide earnings but to improve the balance in<br />

our earnings mix, which will cushion still further<br />

the adverse impact o{ economic uncertainty. We<br />

will do this by continuing controlled expansion of<br />

our activities in world markets, by both acquisition<br />

and organic growth<br />

Reassuringly, the year's upheavals demonstrated<br />

the resilience of our main international operations,<br />

notably Music, Lighting, and International Rentals.<br />

The profits of Rent-A-Center in the US, for<br />

example, stayed on target.<br />

Enthusiasm and optimism are growing at<br />

THORN EMI. We have profoundly changed the<br />

Group's culture. Ve have reinvested in our core<br />

businesses, strengthened their competitiveness<br />

and improved their world market positions. And<br />

we have streamlined our organisation and<br />

strengthened line management. People throughout<br />

THORN EMI are operating with less bureaucracy<br />

and more openness.<br />

The results are encouraging for everyone<br />

concemed with THORN EMI - for customers,<br />

employees and above all shareholders. They<br />

reaffrrm our confidence in the growth strategy we<br />

are pursuing. Today, at THORN EMI, our plans are<br />

amlitious - and realistic. We have our sights set<br />

firmly on an even more prosperous future.<br />

<br />

Bob Nellist (pictured right)

e seen, all key measures of performance<br />

improved significantly last year.<br />

We are proud of the gains we have achieved<br />

but by no means satisfied; we are aware of the<br />

scale of our task. Last October's turrnoil in world<br />

Enancial markets affected con$dence in many<br />

intemationally operating businesses. Ve know that<br />

currency fluchrations will continue to impact on<br />

future earnings and the cost o{ future acquisitions.<br />

There is no shelter however in depending heavily<br />

on a single geographic rnarket or economy'<br />

THORN EMI's operational style and structure<br />

are now fiily geared to intemational opportunities.<br />

Our pordolio of companies today provides us with<br />

a remarkable set of businesses. Their diversity<br />

greatly reduces our exposure to any significant<br />

downtum. We intend not only to increase our<br />

worldwide earnings but to improve the balance in<br />

our earnings mix, which will cushion still further<br />

the adverse impact o{ economic uncertainty. We<br />

will do this by continuing controlled expansion of<br />

our activities in world markets, by both acquisition<br />

and organic growth<br />

Reassuringly, the year's upheavals demonstrated<br />

the resilience of our main international operations,<br />

notably Music, Lighting, and International Rentals.<br />

The profits of Rent-A-Center in the US, for<br />

example, stayed on target.<br />

Enthusiasm and optimism are growing at<br />

THORN EMI. We have profoundly changed the<br />

Group's culture. Ve have reinvested in our core<br />

businesses, strengthened their competitiveness<br />

and improved their world market positions. And<br />

we have streamlined our organisation and<br />

strengthened line management. People throughout<br />

THORN EMI are operating with less bureaucracy<br />

and more openness.<br />

The results are encouraging for everyone<br />

concemed with THORN EMI - for customers,<br />

employees and above all shareholders. They<br />

reaffrrm our confidence in the growth strategy we<br />

are pursuing. Today, at THORN EMI, our plans are<br />

amlitious - and realistic. We have our sights set<br />

firmly on an even more prosperous future.<br />

<br />

Bob Nellist (pictured right)

INNOVATIVf, MARKETING GIVING GLOBAL CAPABILITY<br />

in the rentaVretail o{ consumer electronics and<br />

consumer durables, and the retailing of recorded<br />

music.<br />

'Exponsion continues in all our businesses: we ore<br />

consta.ntly looking for grcwth or arquisition<br />

opportunities utorldu:ide.In the nnxt fne years wv<br />

are aimingfor at least half our eamings to comn<br />

from outsid.e the UK. Already, uith neorly 3,000<br />

stores a,round. the world,we a.rc the world\ Leoninq<br />

renter/retailer. Rentol operatiorc now extentJ to<br />

17 counties. Acquiing Rent-A-C,enter brought the<br />

soug!.ttfter brealtthrough in Ameica and. its<br />

strong performanrc will hclp w to meet our growth<br />

objectioes.<br />

'We uirnally doublcil profx sirce 1984 $,<br />

applying professional marketing te dtniEtes<br />

th.roughnut our businesses, b1, explniting oul<br />

world.wide purdusi;ng pu:er, and lry rigid cost<br />

controls.These measures, together with our<br />

simplif.ed, mntagement structures and, d.ecentralised.<br />

field<br />

oper atinrc responding imagirntiuely<br />

to laca.l. market uaiation,Iune ennbled us n mnke<br />

th* mnst of our world strength and bing about 1<br />

big improuem.ens in our proftability.' I<br />

::Hil::'JilLi'",0,,o"*wasmadein J u^ .[*"***<br />

<br />

the UK market. All the UK rental companies again<br />

reported increases in market share and<br />

significandy improved levels of customer retentiono<br />

so that the UK rental assets showed marginal<br />

grorth {or the first time in recent years. A major<br />

decentralisation programme to improve the<br />

operating companies' responses to the marketplace<br />

and customer requirements has eliminated<br />

duplication o{ functions, shortened lines o{<br />

communication and given staff at local level<br />

greater job satisfaction through greater<br />

responsibility. High levels of investment in new<br />

rental assets and shops continued with over<br />

9180 million invested in 1987/8.<br />

"

Fadio Benla s a.d the DER,<br />

MultiBroadcasl and Foc!s<br />

chains give THOBN EMI prc<br />

eminen.e in lhe ( lK renlels<br />

markel. Togelher wilh the<br />

THOFN hlernalional Fenlals<br />

companles, ihey lom the<br />

wond s mosl exlensive<br />

and successlul business in<br />

The h ghly ellective HMV<br />

concepls n €cord relarling<br />

are be ng appried w h<br />

considerab e slccess in a<br />

growing nLrmber oi olher<br />

markels around lhe world<br />

as lar alield as Canada and<br />

UK RETAIL! The Rumbelows refurbishment<br />

programme extended the stylish 'grey look' to<br />

almost all oudets. Without exception this increased<br />

sales dramatically, in some cases by more than<br />

30 per cent. In very competitive market conditions,<br />

Rumbelows<br />

increased<br />

overall<br />

market share.<br />

Yorkshirebased<br />

Vallances, acquired for t10 million, was<br />

successfully integrated into the Rumbelows system.<br />

Trinity House Finance continued to groq with<br />

outstanding balances increasing by 32 per cent.<br />

Major investment in new management, personnel<br />

and systems ensures that future grovth can be<br />

handled successfully. A SI00 million multi-option<br />

facility and a S50 million commercial<br />

paper funding operation were arranged.<br />

THORN INTERNATIONAI RENTALS (TIR): This business<br />

had an extremely sur-r-essful year. overr"oming<br />

adverse trading conditions in Denmark and New<br />

Zealand. Units on rent increased by 6 per cent<br />

before allowing for the acquisitions in continental<br />

Europe and lreland. These will make a major<br />

contribution to achier ing the strategic expansion<br />

of this business, bringing its units on rent to over<br />

l.l million and adding substantially to profitability.<br />

The near\ completed integration in Denmark,<br />

France and Spain is already producing substantial<br />

economies of scale and organic grov{h: Italy and<br />

Switzerland take TIR into two new markets,<br />

bringing to 15 the total number of countries<br />

served. In lreland, Murphy Telerent purchased<br />

from the Jefferson Smurfit group added 20,000<br />

customers and has been integrated successfully<br />

into the existing operation, giving clear market<br />

leadership. FONA in Denmark performed well in a<br />

diffr cult economic environment.<br />

Sork continued on lhe neu TliRllS management<br />

information system. Already used in almost<br />

half ofTIR's markets, by the end o{ this fiscal year<br />

it will be in full use, providing a powerful<br />

marketing and management tool.

HMv INTERNATIONAI, The worldwide expansion<br />

programme continued, adding EMI retailing<br />

operations in Canada and New Zealand and<br />

making substantial progress in both countries. A<br />

new superstore is scheduled to open in 'loronto in<br />

September 1988. A 4,000 sq ft superstore was<br />

successfully opened in Christchurch and the Music<br />

Studio chain in the Auckland area was acquired.<br />

There are active plans to develop the HMV concept<br />

lurther internationally. HMV UK had another<br />

successful year; turnover increased by 33 per cent<br />

with trading profit and market share at record<br />

levels. The new Ox{ord Circus store made<br />

outstanding progress.<br />

RENT-A-CENTER (RAC), The most significant development<br />

in the rental business was the purchase<br />

in August of Rent-A-Center. US rental<br />

market leader, RAC operates in 46 states.<br />

Since acquisition its narket<br />

share has grown from l0 per<br />

cent 10 over 12 per cent.<br />

Its highly professional senior<br />

management team, excellent control systems<br />

and its rent-to-own marketing concept are<br />

ideally suited to the US market. The total rent-toown<br />

market - estimated at 92.5 to $3-0 billion a<br />

year - has been growing at 20 per cent annually.<br />

RAC has been smoothly integrated into THORN<br />

EMI's Rental and Retail operations: 106 stores, of<br />

which about 40 per cent were franchised, have<br />

been added into its system, bringing the total to<br />

575 at lear end compared to 4oQ at ar"quisirion.<br />

Aggressive expansion will be sustained, with over<br />

I75 store openings planned system-wide in l9B8/9<br />

and more than 1,100 operating units targeted by<br />

I99ll2. This makes major new staff training<br />

and management development programrrres<br />

critically important: computer-based distance<br />

learning programmes are now in use. The<br />

company has enjoyed local support from a strong<br />

and pro{essional body of fianchisees. New<br />

fianchise opportunities are being actively sought<br />

outside the USA, with negotiations completed<br />

The acquistion of RentA<br />

Cenler,lhe eader n the<br />

rapidly g rowing 'renl-to<br />

n THOBN EMls renta<br />

business asl year RAC<br />

is ma nlain ng an aggress ve<br />

growlh prosramme, includ ng<br />

expansion nlo markets

successfully in the Ottawa and Toronto areas as<br />

well as westem Canada. Opportunities are being<br />

explored in South America, the Pacific Basin and<br />

Japan. Early studies show the intemational appeal<br />

and potential of the RAC concePt.<br />

Overall, there was substantial progress towards<br />

achieving the business goals and objectives. Today<br />

the Rental and Retail activities cover 18 countries<br />

and employ 25,000 people. They are the first truly<br />

global player - no other consumer electronics<br />

distributor in the world has the same spread o{<br />

markets. The challenge ahead is to create from this<br />

base an even more robust business offering<br />

outstanding levels of service to all its customers<br />

worldwide.<br />

^<br />

'I gtess I am a pretty competitiae gty,'says Bob<br />

Murphy, uoted Store Manoger of the Year at Rent-A-<br />

C,enter.Th.e title bings a sportyTians-Am car and a<br />

tip to see THORN EMls IJK store operations. He<br />

won it for adricuing h@h prorttability aloryide<br />

sucress in dmeloping the people working for him -<br />

lour houe gone on to become store manngers in<br />

their own right.This kind oJ performance ako<br />

brought him promotion to Zonn Mano6er<br />

responsible for eight stores in Neu; Jersey. Bob,28,<br />

says Rent-A-Center thittes on competition, and<br />

peoptn titte him thiue within il' RAC's phenomennl<br />

grtnuth mmes from malting artomer sentice the<br />

absolute toudxtone.'We get dl th'e bark-up ue<br />

needfor razor-keen fficienty,ThntJrees us up to<br />

conxerltrale on ensuing customcr sQtisfa'ctinn out<br />

Jront.' He recalls hottt RAC people feh, learning th'ey<br />

had. been bought by THORN EMI.As the best in our<br />

felil,'he<br />

V7/r^*4-<br />

says, ufiat diil we nced' with onother<br />

company?'Now diuing a.round his new territory,<br />

h.e reJleas on the benefits.'There's eaen greater<br />

emphnsis on training and' people deuelopment,'<br />

./ savs Bob.'qnd thp buying poner of thr<br />

,iud" l*g", g,rup k very good news"<br />

/ 7/<br />

Ho^" 1o, Bob. his wife Susan Qnd two sons is<br />

in Skkleruill.e, NJ. where he rela-res ... by competing<br />

at golf, and. rat:i.ng his 110 mph four whceler dirt4ike.

successfully in the Ottawa and Toronto areas as<br />

well as westem Canada. Opportunities are being<br />

explored in South America, the Pacific Basin and<br />

Japan. Early studies show the intemational appeal<br />

and potential of the RAC concePt.<br />

Overall, there was substantial progress towards<br />

achieving the business goals and objectives. Today<br />

the Rental and Retail activities cover 18 countries<br />

and employ 25,000 people. They are the first truly<br />

global player - no other consumer electronics<br />

distributor in the world has the same spread o{<br />

markets. The challenge ahead is to create from this<br />

base an even more robust business offering<br />

outstanding levels of service to all its customers<br />

worldwide.<br />

^<br />

'I gtess I am a pretty competitiae gty,'says Bob<br />

Murphy, uoted Store Manoger of the Year at Rent-A-<br />

C,enter.Th.e title bings a sportyTians-Am car and a<br />

tip to see THORN EMls IJK store operations. He<br />

won it for adricuing h@h prorttability aloryide<br />

sucress in dmeloping the people working for him -<br />

lour houe gone on to become store manngers in<br />

their own right.This kind oJ performance ako<br />

brought him promotion to Zonn Mano6er<br />

responsible for eight stores in Neu; Jersey. Bob,28,<br />

says Rent-A-Center thittes on competition, and<br />

peoptn titte him thiue within il' RAC's phenomennl<br />

grtnuth mmes from malting artomer sentice the<br />

absolute toudxtone.'We get dl th'e bark-up ue<br />

needfor razor-keen fficienty,ThntJrees us up to<br />

conxerltrale on ensuing customcr sQtisfa'ctinn out<br />

Jront.' He recalls hottt RAC people feh, learning th'ey<br />

had. been bought by THORN EMI.As the best in our<br />

felil,'he<br />

V7/r^*4-<br />

says, ufiat diil we nced' with onother<br />

company?'Now diuing a.round his new territory,<br />

h.e reJleas on the benefits.'There's eaen greater<br />

emphnsis on training and' people deuelopment,'<br />

./ savs Bob.'qnd thp buying poner of thr<br />

,iud" l*g", g,rup k very good news"<br />

/ 7/<br />

Ho^" 1o, Bob. his wife Susan Qnd two sons is<br />

in Skkleruill.e, NJ. where he rela-res ... by competing<br />

at golf, and. rat:i.ng his 110 mph four whceler dirt4ike.

successfully in the Ottawa and Toronto areas as<br />

well as westem Canada. Opportunities are being<br />

explored in South America, the Pacific Basin and<br />

Japan. Early studies show the intemational appeal<br />

and potential of the RAC concePt.<br />

Overall, there was substantial progress towards<br />

achieving the business goals and objectives. Today<br />

the Rental and Retail activities cover 18 countries<br />

and employ 25,000 people. They are the first truly<br />

global player - no other consumer electronics<br />

distributor in the world has the same spread o{<br />

markets. The challenge ahead is to create from this<br />

base an even more robust business offering<br />

outstanding levels of service to all its customers<br />

worldwide.<br />

^<br />

'I gtess I am a pretty competitiae gty,'says Bob<br />

Murphy, uoted Store Manoger of the Year at Rent-A-<br />

C,enter.Th.e title bings a sportyTians-Am car and a<br />

tip to see THORN EMls IJK store operations. He<br />

won it for adricuing h@h prorttability aloryide<br />

sucress in dmeloping the people working for him -<br />

lour houe gone on to become store manngers in<br />

their own right.This kind oJ performance ako<br />

brought him promotion to Zonn Mano6er<br />

responsible for eight stores in Neu; Jersey. Bob,28,<br />

says Rent-A-Center thittes on competition, and<br />

peoptn titte him thiue within il' RAC's phenomennl<br />

grtnuth mmes from malting artomer sentice the<br />

absolute toudxtone.'We get dl th'e bark-up ue<br />

needfor razor-keen fficienty,ThntJrees us up to<br />

conxerltrale on ensuing customcr sQtisfa'ctinn out<br />

Jront.' He recalls hottt RAC people feh, learning th'ey<br />

had. been bought by THORN EMI.As the best in our<br />

felil,'he<br />

V7/r^*4-<br />

says, ufiat diil we nced' with onother<br />

company?'Now diuing a.round his new territory,<br />

h.e reJleas on the benefits.'There's eaen greater<br />

emphnsis on training and' people deuelopment,'<br />

./ savs Bob.'qnd thp buying poner of thr<br />

,iud" l*g", g,rup k very good news"<br />

/ 7/<br />

Ho^" 1o, Bob. his wife Susan Qnd two sons is<br />

in Skkleruill.e, NJ. where he rela-res ... by competing<br />

at golf, and. rat:i.ng his 110 mph four whceler dirt4ike.

TARGETING INTERNATIONAI OPPORTUNITIES IN<br />

Electronics, Software, and Security, through<br />

operations with in-depth technological shen$hs.<br />

'Our Te chnologt businesses-pincipally comprising<br />

SeuiSt Electronics, and, Sofnaare-had. a good.<br />

year and. are utell positioned. to do euen better.We<br />

are intent on expa.nsion lry both intemal growth<br />

and. ocquisition.We belieue that from its strong UK<br />

position Secuity hos the potential to be o truIy<br />

ir*ruetional businzss: its capabilities attil prod.utts<br />

haue worl&nid.e applicatiorc. Some of our Software<br />

businesses hnae simikr potential: our Finanrial<br />

'Iiading Systems,for example, suit markets ds<br />

far<br />

apolt os Smnilind,aia and Japan.<br />

'In a world defenre market that is at best sto;tic,<br />

our Electronics business has irnreased prof,tability.<br />

Thk results [rom ou stratcgt of inucsting in piuat?<br />

x)enture projects: our Hand HelilThermal Imaging<br />

equipm.ent - already sold. to nine counties - is ct<br />

case in point.The Electronics ordcr book is close lo<br />

the f 1/z billion mark and ute intend ta contirute<br />

deueloping inremntiornl nidn ma*et$' __--<br />

\su^-- \r.q*.oC-.<br />

REVIEV OF ACTMTIES<br />

The Gchnology Group continued its progress<br />

during the year, with tumover increasing by<br />

15 per cent and an improvement in profitability<br />

of 34 per cent. The lbrmulation of plans for<br />

expanding the intemational activities of the group,<br />

in electronics, software and security also advanced<br />

substantially.<br />

Among the important developments affecting<br />

the Security business have been the acquisition of<br />

JEL Energy Conservation Services in October, 1987<br />

and of Kidde Automated Systems Inc in the USA in<br />

June, 1988. The Elechonics business has made<br />

further moves to strengthen its hand internationally<br />

in its specialised market sectors. Fufiher steps were<br />

taken by the Software business to establish<br />

activities in key markets outside the UK.<br />

.o. r"u", S<br />

pictuled in Loodon

THoRN EMI ELECTRONICS, With divisions based in<br />

the UK and the USA, this company had a most<br />

successlul year, gaining key contracts which<br />

reinlbrced its position in exacting international<br />

markets and contribuled lo a q pcr cent in, rea"e in<br />

its forward order book. Its Defence Systems<br />

Division won a major programme - the FITOIT/<br />

(Further Improved Tube-launched Opticallyrracked<br />

Wire-guided) system - to update the<br />

British Army's existing TOW anti-tank missile<br />

systems. Among the sub-conhactors on this project<br />

are Royal Ordnance, Hughes Aircraft of the US<br />

and Westland Helicopters. The 500,000<br />

'fOWs in service in over 30 countnes<br />

provide promising export prospects<br />

in the 1990s.<br />

THOFN EM Elecko<br />

ncs n lhe UKand the llSA<br />

make im porlanl contnbu<br />

llons lo lhe armed serv ces<br />

ot many nal ons. The company<br />

is also a key s!ppl€r to<br />

industrial, screnl rc, aerospace<br />

and comrnunicalions markels<br />

imaging products.<br />

Significant contracts lrom a<br />

number of countries, including<br />

Denmark and the Netherlands, were<br />

gained by Electro Optics<br />

Division. Its thermal<br />

imaging equipment is being<br />

evaluated by the US Marines<br />

and other agencies in the<br />

USA. To date 15 organisations in<br />

nine countries have adopted the<br />

division's advanced thermal<br />

Securing the high value contract to develop and<br />

manufacture the Air Defence Alerting Device<br />

"ysrem (+D+D) againsl tough competition r.ras a<br />

substantial achievement. Ordered in quantity for<br />

the British Army, AIIAD represents a novel solution<br />

to warning ground lbrces of approaching aircraft. It<br />

is considerably ahead of similar developments in<br />

Europe and the USA.<br />

Radar Division, the only European supplier of<br />

operational Airbome Early Warning (AEW) radar<br />

systems, reported successful completion of the<br />

initial llight trials of Skymaster. This innovative<br />

AEW radar - the result of private venture<br />

investment by THORN EMI - has proved its<br />

capabilities in detecting low llying aircrall over<br />

land and sea. Its,'onvinr"ing perlbrmanr-e is

expected to stimulate major overseas sales during<br />

the current year.<br />

The division also won the UK Minist{, o{<br />

Delence (NIoD) competition to supply both of the<br />

Airborne Stand-Ofl Radar (ASTOR) demonstrators.<br />

The primary purposc o[ lhi. programme is to<br />

prove the ability of airborne radars to detect<br />

moving vehicles, giving battlefi eld commanders<br />

early warning of attack. One demonstrator will be a<br />

modified Shl.rnaster aboard a PBN De{ender<br />

aircraft; the other will be a synthetic apefiure radar<br />

installed in an Moll Canberra aircralt.<br />

California-based Systron l)onner, a noted<br />

supplier o{ components and sub-systems for<br />

delence and aerospace projects, maintained its<br />

dominance of the intemational market for aircralt<br />

engine fire/overheat detection. A key contract was<br />

to supply the total fire protection system - both<br />

detection and extinguishing - for the new V22<br />

Osprey Tilt Rotor aircraft. This safeguards not only<br />

the main engines but also the auxiliary power unit<br />

and wing dry bay areas. The development of a<br />

unique lire suppression system will serve to<br />

expand Systron Donner's position in the aerospace<br />

and industrial marketplace.<br />

'Ihe Computer Systems Division, with a range of<br />

activitics in .pe,.ialised r.omputing. r.ommunir.arion<br />

and revenue control systems, won an important<br />

contract lrom British Rail to supply over 2,000<br />

upgraded versions of the extremely successful<br />

PORTIS (PORtable Ticket Issuing System)<br />

developed by THORN ENll. It is used on pay trains,<br />

to read and store data from magnetically encoded<br />

travel tickets and credit cards, as well as to issue<br />

tickets and capture related revenue<br />

data. Deliveries of the new<br />

SPORTIS version will<br />

extend over the next<br />

two years, while<br />

BR's existing<br />

1,750 machines<br />

will he retrolitted<br />

to the<br />

same standard.<br />

Malor p.otecls lo meel lhe<br />

needs ol lhe Br tish Army<br />

aso have valuable potentia<br />

These rnciude lhe rnnova|ve<br />

At Defence Ae ng Device<br />

(ADAD), lo warn groLrnd forces<br />

ol approaclring ancraft, and<br />

the rn provernenls to the<br />

exislrnq TOW ant rank<br />

Success in specialised iieds<br />

conr nues. As wellas ds<br />

ach evemenls w th Searchwater<br />

Radars lor a rbome<br />

eary warning and marit me<br />

aenal reconnaissance lhe<br />

comPanY recenl y won the<br />

UK \4oD competilon lo<br />

supplyboln A 6orne Sland-<br />

Ofi Radar (ASTOR) dernonslralors<br />

to prove eifectiveness<br />

vehicles. rn Electro Optics<br />

com pany's the.mal rmagers<br />

rncludethe US lvlar ne Corps.

Before the year-end, THORN EMI Electronics<br />

announced the formation of Electronic Systems<br />

Division to harness the capabilities of all its<br />

husiness units in the UK and the USA and to lead<br />

major programmes for integrated systems. It will<br />

act as prime contractor on multi-divisional project<br />

opportunities arising around the world'<br />

Naval Systems Division, THORN EMI Varian<br />

and THORN EMI Elechon Tirbes also made<br />

considerable headway. particularly in overseas<br />

markets. Satisfactory first year results were<br />

produced by Babcock Thom, the company's joint<br />

venture with FKI Babcock, which is responsible for<br />

the managernent of the Royal Roryth Dockyard.<br />

You coul.d sin1le out CliueTrapmore as'Dod'to<br />

ADAD, an Air Deferce Alerting Deuice uhidt wams<br />

ground forces of approodring aircraft. His 60*trong<br />

team of physirists, electronics and software<br />

angineers recently gaue birth to this remnrkable<br />

new passiue infra-red canrept, considrerably aheod<br />

of ileuelopmenx in Europe or the USA, ADAD won<br />

the UK Min;shy of Defew contrart for seueral<br />

hundreil sets of equipment for the Bitish Army,<br />

uith exporl orders in thc offing.<br />

'Crodting the problem was madc eosinr by our<br />

being nanber one in thermal imaging,'Clive<br />

commcnts El,ectro Optia supplies this tednnlctgr'<br />

a uial part oJ the ADAD system - to arm.edforces<br />

arund. the worlil. Cliue,46, h,as pimcered infra-red<br />

surueillanre deuelopments for ten of his 2B years<br />

with THORN EMl. He liues just south of LoruJan,<br />

uith his photo-journalist wife Alison and two<br />

drildren.'h's tnt only tedmologr that has &tmged<br />

the ilnfence electronia businnss ouer the years,'hn<br />

says:'In the days of'cost-plus'contracts you worked'<br />

your utay towatds a solution.'Ioilay's much tougher<br />

comtnercial realities mean you just haue to get it<br />

rightfrxst timp.'

Before the year-end, THORN EMI Electronics<br />

announced the formation of Electronic Systems<br />

Division to harness the capabilities of all its<br />

husiness units in the UK and the USA and to lead<br />

major programmes for integrated systems. It will<br />

act as prime contractor on multi-divisional project<br />

opportunities arising around the world'<br />

Naval Systems Division, THORN EMI Varian<br />

and THORN EMI Elechon Tirbes also made<br />

considerable headway. particularly in overseas<br />

markets. Satisfactory first year results were<br />

produced by Babcock Thom, the company's joint<br />

venture with FKI Babcock, which is responsible for<br />

the managernent of the Royal Roryth Dockyard.<br />

You coul.d sin1le out CliueTrapmore as'Dod'to<br />

ADAD, an Air Deferce Alerting Deuice uhidt wams<br />

ground forces of approodring aircraft. His 60*trong<br />

team of physirists, electronics and software<br />

angineers recently gaue birth to this remnrkable<br />

new passiue infra-red canrept, considrerably aheod<br />

of ileuelopmenx in Europe or the USA, ADAD won<br />

the UK Min;shy of Defew contrart for seueral<br />

hundreil sets of equipment for the Bitish Army,<br />

uith exporl orders in thc offing.<br />

'Crodting the problem was madc eosinr by our<br />

being nanber one in thermal imaging,'Clive<br />

commcnts El,ectro Optia supplies this tednnlctgr'<br />

a uial part oJ the ADAD system - to arm.edforces<br />

arund. the worlil. Cliue,46, h,as pimcered infra-red<br />

surueillanre deuelopments for ten of his 2B years<br />

with THORN EMl. He liues just south of LoruJan,<br />

uith his photo-journalist wife Alison and two<br />

drildren.'h's tnt only tedmologr that has &tmged<br />

the ilnfence electronia businnss ouer the years,'hn<br />

says:'In the days of'cost-plus'contracts you worked'<br />

your utay towatds a solution.'Ioilay's much tougher<br />

comtnercial realities mean you just haue to get it<br />

rightfrxst timp.'

Before the year-end, THORN EMI Electronics<br />

announced the formation of Electronic Systems<br />

Division to harness the capabilities of all its<br />

husiness units in the UK and the USA and to lead<br />

major programmes for integrated systems. It will<br />

act as prime contractor on multi-divisional project<br />

opportunities arising around the world'<br />

Naval Systems Division, THORN EMI Varian<br />

and THORN EMI Elechon Tirbes also made<br />

considerable headway. particularly in overseas<br />

markets. Satisfactory first year results were<br />

produced by Babcock Thom, the company's joint<br />

venture with FKI Babcock, which is responsible for<br />

the managernent of the Royal Roryth Dockyard.<br />

You coul.d sin1le out CliueTrapmore as'Dod'to<br />

ADAD, an Air Deferce Alerting Deuice uhidt wams<br />

ground forces of approodring aircraft. His 60*trong<br />

team of physirists, electronics and software<br />

angineers recently gaue birth to this remnrkable<br />

new passiue infra-red canrept, considrerably aheod<br />

of ileuelopmenx in Europe or the USA, ADAD won<br />

the UK Min;shy of Defew contrart for seueral<br />

hundreil sets of equipment for the Bitish Army,<br />

uith exporl orders in thc offing.<br />

'Crodting the problem was madc eosinr by our<br />

being nanber one in thermal imaging,'Clive<br />

commcnts El,ectro Optia supplies this tednnlctgr'<br />

a uial part oJ the ADAD system - to arm.edforces<br />

arund. the worlil. Cliue,46, h,as pimcered infra-red<br />

surueillanre deuelopments for ten of his 2B years<br />

with THORN EMl. He liues just south of LoruJan,<br />

uith his photo-journalist wife Alison and two<br />

drildren.'h's tnt only tedmologr that has &tmged<br />

the ilnfence electronia businnss ouer the years,'hn<br />

says:'In the days of'cost-plus'contracts you worked'<br />

your utay towatds a solution.'Ioilay's much tougher<br />

comtnercial realities mean you just haue to get it<br />

rightfrxst timp.'

THORN SOFIVARE: This major computing services<br />

business had an excellent year, reporting revenue<br />

grolr'th o{ around 20 per cent and a record year<br />

end order book.<br />

Software Sciences' 40 per cent revenue grou,th<br />

reflected a good all round performance,<br />

highlighted by its Commercial and Financial<br />

Division and its Retail activities in Electronic<br />

Point-O{-Sale (EPOS) systems.<br />

Key UK contracts included the SI5 million pilot<br />

phase in tJre national plan to automate Post Office<br />

counter operations, and two substantial further<br />

orders for the Automobile Association's vehicle<br />

breakdown seruice r:entres-<br />

Retail sector development was demonstrated by<br />

completion o{ signilicant conhacts for Marks and<br />

Spencer and the Burton Group for a variety of<br />

computer systems. Demand for the Continuous<br />

On-Line Tiading system, COLI - by Salomon<br />

Brothers in London and by overseas customers -<br />

led to operations being established in Denmark<br />

and Japan. In the fast expanding EFTPOS<br />

Bob Bnnen hus taken another upheaaal in his<br />

stride. Norlr bosed. in Tokyo - uhere he mwed Jrom<br />

Copenha6en - Bob,42, is putsuing opportu;nities in<br />

Japan and Hong Kongfor thc COLT (Continuous<br />

On-Line Trad.in6) integratnd deal entry system. Bob<br />

belieues it ideal for the mnrqt Japonese banks<br />

planning to inuest in tedtrnlogt portiatlarly to<br />

supporT their copitol markets operatiorc. Alreody in<br />

Japan, ouer 500 ma nngers haae seen it<br />

d.emomtrate d. A compuling systems pr ofessiona)<br />

uith 25 years' erpeience, Bob says,'COIII operates<br />

at the uery heart of a counny's banking and,<br />

fnaneial infrostructure- lou (an't expect to u in<br />

anstomnrs for this sort of product unless you ere on<br />

the spot - especial\r in Japan . You haue to be<br />

prepared. to go uhere the business is.'While Bob<br />

seeks that flrst or.l,er that could, he belieues, start o;n<br />

avalanche, his uife, Maureen, is learning lapanese.<br />

Although, *^ith the internotional potential of COLT,<br />

learnhg yet rnother langunge may be on the utrds<br />

before no long.

to seclrily syslems and<br />

spe. a sed compLrtrrg<br />

rfslallal ons cornpan es<br />

(Elcctronic liunds Trans{cr at Point-Ol:<br />

Sale) systems market. So{tware Sciences<br />

Nederland won lbur orders. Another.<br />

from Shcll International, is to control its garage<br />

lbrcururt rctailing actirities torldride.<br />

Thc Datasolvc group extended its leading<br />

position in thc UK rith<br />

outstanding rcvenue and profit<br />

perlbrmance and thc acquisition<br />

of two hardwarc maintenancc<br />

companies and LA Computer<br />

Senices - an IBM mainlrame<br />

processing operation.<br />

Contracts rith Hertz, Bird's Eye Shlls and<br />

'I hanre. Ti'l"visitrn exemplified the er.iting<br />

THORN EM Technoogy<br />

Gro!p are seMnq many oi<br />

the wor d's eading names<br />

n bankng and I nance<br />

r€larlrfg and other areas ol<br />

Producls ano setu ces lrom<br />

THOFN Sorlware setuing<br />

firany aspecls ot the rela<br />

seclor nc lde advanced<br />

EPOS (Eeclron c Po nl 01<br />

Sa e)l€,m nas lsed by<br />

malor organ salro.s ke<br />

possibilities in the'lacilities management' market.<br />

Signilicant processing sen'ices contracts were<br />

signed with companies including Britric Corona;<br />

major trrntracts with the Daily Telegraph and tslCC<br />

marked further high grovth in partoll and<br />

personnel services.<br />

The microcomputer equipment maintenance<br />

operation Computeraid Services doubled its size,<br />

expanding its network throughout the UI{. It<br />

undertook maintenance responsibility lbr thc<br />

entire British Rail inventory o{ ticket-issuing<br />

machines supplied bv THOR\ E\II Eler:tronics.<br />

Thc international position o{ TI{ORN E\II<br />

Conrput.r S,,ltuare {TLt.S) in d,'cision "upport<br />

packages was rcinforced by an exclusive European<br />

diitributi,'n agrecmcnl lor PlLuT. an .'\rculi\e<br />

inlbrmation systcm.<br />

PILOT joins the FCS<br />

product liamily<br />

which has achievcd<br />

40 per cent<br />

penetration of<br />

the European<br />

market lbr<br />

these<br />

products.

THORN SECURITY: 'Ihis company last year<br />

consolidated its UK market leadership and<br />

reorganised to target new opportunities in UK<br />

and international markets. lls preeminent<br />

place in fire detection in the<br />

UK was coupled with substantial<br />

grorth in lire extinguishing, while<br />

its intruder detection and related<br />

operations also flourished- Revenue<br />

growth of 14 per cent reflected a<br />

positive improvement with the<br />

forward order book at record levels.<br />

The acquisition ofJEL Energy<br />

Conservation Services in October combined<br />

that company's capabilities with those of THORN<br />

Security to create the largest UK company<br />

pioneering developments in systems integrating<br />

fire protection, security, environmental control and<br />

energy management technologies - a lundamental<br />

trend in the design of services for commercial and<br />

industrial properties.<br />

A typical project for such multi-capability<br />

supporl is Glasgow's huge St Enoch Square glazed,<br />

city centre shopping precinct development. The<br />

internal environment control scheme - a 91.3<br />

million package of services including an advanced<br />

communications systern - will play a crucial role.<br />

Other key technical developments in THORN<br />

Security's accelerating market drive ircluded the<br />

launch of an innovative analogue addressable fire<br />

detection system incorporating cost-saving false<br />

alarm reduction features. A new domestic early<br />

waming fire detection product met enthusiastic<br />

response in a new sector for the company: other<br />

ventures targeting new market areas are planned.<br />

The acquisition of the I S ser"uritl compan;<br />

Kidde Automated Systems Inc, in June 1988, has<br />

given the company a valuable lbothold in<br />

complementary areas of the US market.<br />

In the tiS, THORN EMI Malco the market leader<br />

in plastic transaction cards and verilication<br />

sy6tems, had an excellent year with significant<br />

productivity improvements and revenue<br />

TheCistinctive<br />

cover on ils alarm<br />

sounders s an ambassador<br />

and lncreasingly inlernationa,<br />

acllvilies of THOBN Secufity<br />

rn fire prolecl on, security,<br />

env ronmenlal conlro and<br />

energy managernenl and n<br />

systerns integraling all these

increase of I per cent.<br />

THORN EMI Gchnology also has continuing<br />

activities in semiconductors and flow measurement.<br />

INMOS has manufactured all its semiconductor<br />

products in Newport" South Wales, for over a year<br />

and all technology development has now fiansfer<br />

red there fiom the US. Due to growing worldwide<br />

interest, transputer products now account {or half<br />

total revenues and significandy aided last year's<br />

overall 35 per cent reyenue grou,lh' Its US<br />

marketing cenhe has been relocated following the<br />

recent sale of the Colorado Springs facility.<br />

THORN EMI Flow Measurement had an excellent<br />

year, supplying record volumes of gas meters to<br />

British Gas. Demand outlook is buoyant. The<br />

Poll.mer Components activity also performed well,<br />

increasing its output of synthetic meter diaphragns.<br />

An agreement to sell THORN EMI's 5I per cent<br />

interest in the UK telecommunications company'<br />

Thom Ericsson, to its partner in the joint<br />

venture, Ericsson of Sweden, was announced on<br />

9 June 1988.<br />

<br />

<br />

<br />

<br />

<br />

Hong <br />

<br />

Kong to Beijing to sell THORN Secuity\ fwe<br />

proltfii.bn systems and serurily equipmcnl Lo rhc<br />

People's Republic of Chirn - potentiolly the world's<br />

largest market. Alfred. is 31, recently mnnicd. and<br />

speal* both Mand.ain anl, Contonese, as weII as<br />

the Chnnzhou d,ial.ect of the coastal region. ulhke a<br />

recent project like the nan Xinhua Neus Agen'q,<br />

hzad. ofi.ce,'Alfteil says.'It's importurt to talk<br />

tedmical.ities in th,e atstomcr's lnnguage. We<br />

alread,y haae af,ne reputation in Chirut,'he adds.<br />

'Our auxessful tedmologt-transfer otrangemnnt for<br />

the proifu.ction offire detection equipm.ent in<br />

Beijing olso hclps.'Alfed hos the tort,<br />

persuasiveness and, Jlexibility e ssential for<br />

tronsaainns in China- But euen h.e gets the odd.<br />

surprise. Like being obliged to ilrinh a near-lethal<br />

mia of beer, white uine m.d Mqa Thi - afi.ery spirit<br />

- before closing a recent deal.'I still ltrvw exa.ctly<br />

whnre to sign,' he says,proudly.

increase of I per cent.<br />

THORN EMI Gchnology also has continuing<br />

activities in semiconductors and flow measurement.<br />

INMOS has manufactured all its semiconductor<br />

products in Newport" South Wales, for over a year<br />

and all technology development has now fiansfer<br />

red there fiom the US. Due to growing worldwide<br />

interest, transputer products now account {or half<br />

total revenues and significandy aided last year's<br />

overall 35 per cent reyenue grou,lh' Its US<br />

marketing cenhe has been relocated following the<br />

recent sale of the Colorado Springs facility.<br />

THORN EMI Flow Measurement had an excellent<br />

year, supplying record volumes of gas meters to<br />

British Gas. Demand outlook is buoyant. The<br />

Poll.mer Components activity also performed well,<br />

increasing its output of synthetic meter diaphragns.<br />

An agreement to sell THORN EMI's 5I per cent<br />

interest in the UK telecommunications company'<br />

Thom Ericsson, to its partner in the joint<br />

venture, Ericsson of Sweden, was announced on<br />

9 June 1988.<br />

<br />

<br />

<br />

<br />

<br />

Hong <br />

<br />

Kong to Beijing to sell THORN Secuity\ fwe<br />

proltfii.bn systems and serurily equipmcnl Lo rhc<br />

People's Republic of Chirn - potentiolly the world's<br />

largest market. Alfred. is 31, recently mnnicd. and<br />

speal* both Mand.ain anl, Contonese, as weII as<br />

the Chnnzhou d,ial.ect of the coastal region. ulhke a<br />

recent project like the nan Xinhua Neus Agen'q,<br />

hzad. ofi.ce,'Alfteil says.'It's importurt to talk<br />

tedmical.ities in th,e atstomcr's lnnguage. We<br />

alread,y haae af,ne reputation in Chirut,'he adds.<br />

'Our auxessful tedmologt-transfer otrangemnnt for<br />

the proifu.ction offire detection equipm.ent in<br />

Beijing olso hclps.'Alfed hos the tort,<br />

persuasiveness and, Jlexibility e ssential for<br />

tronsaainns in China- But euen h.e gets the odd.<br />

surprise. Like being obliged to ilrinh a near-lethal<br />

mia of beer, white uine m.d Mqa Thi - afi.ery spirit<br />

- before closing a recent deal.'I still ltrvw exa.ctly<br />

whnre to sign,' he says,proudly.

ARTISTS, STUDIOS. RECORD MANUFACTUR[.<br />

distribution and marheting music publishing and<br />

music videos: worldwide operations serving the<br />

whole world of recorded mrrsic-<br />

'We aim to increase our share of world marltet sales<br />

unsiderably. In this, the truly global nature of the<br />

music business is a particular asset<br />

for us. Duing<br />

90 years of pioneeing e"-ery uspect of record,ed,<br />

music, EMI Mustc has buih up a powerlil<br />

w orldutir)e or gonis ation. Our international<br />

presenre. with rompanips in 35 countrivs. $ues us u<br />

Jormid,oble position. h protid.es our neu:<br />

international manogement structure uith an extra<br />

Itqr resource.for athiexing global impact for our<br />

aflists. addin{ to the beneft of our major<br />

inuestmenl in neut and superstar talent oround the<br />

w orld, in stre amlining w orldwid,e manufactuing<br />

and d.istibution, and. in the latest te

process of extensive top management changes.<br />

EMI[/usics rosler ol mator<br />

nlernal ona arl sls who have<br />

achiev€d successaround lhe<br />

wor d inc ldesthe PetShoP<br />

Boys, Paul Mccartney, Hean,<br />

Dav d Aowe,TinaTurnei C It<br />

R chard, Bob Seger, Pink Floyd<br />

uNITED KINGDOM: EMI Records (UK) reported<br />

improved sales and profits. The signing of major<br />

talent such as Robert Palmer (in partnership with<br />

EMI-Manhattan) underlined its commitment to<br />

attraot superstars as well as discover and develop<br />

neu artists with international appeal. The<br />

highly successful "Now" series of 'fVpromoted<br />

hit compilations<br />

continues to dominate<br />

its segment of the<br />

market. IIK-based<br />

music video<br />

producer, Picture<br />

Music<br />

International,<br />

maintained its<br />

market lead.<br />

NORTH AMERICA: Pop<br />

talent acquisition and<br />

marketing nas lbcused more<br />

competitively on the Siest Coast liagship<br />

Capitol label and the strengthened New<br />

York-based EMI-Manhattan label<br />

following the closure of the EMl-America<br />

label. The commitment to Black Music.<br />

Country Jazz and Classical recordings was<br />

maintained. Trading results improved but<br />

continued to reflect repertoire<br />

investment to support EMI Music's<br />

strategic grorth plans in North<br />

America.<br />

em€rg ng lal€nl rncludes<br />

C m e Fshe( Crowded House<br />

Richard [.4arx, Grear White and<br />

EURopta: Operations in continental<br />

Europe had an outstanding year,<br />

producing re, urd levels of sales and<br />

prolits. A1l territories showed healthy<br />

improvements in perlbrmance, notably Germany,<br />

France, Italy and Spain. Outstanding success with<br />

Anglo-American repeftoire and improved CD<br />

supplies added to the drive to exploit national<br />

artists like Herbert Griinemeyer, Jeanne Mas, EAV,<br />

Juan Pardo, Alicia, Roxette and Guesch Patti<br />

across Europe.

INTERNATIoNAL, EMI Australia's substantial<br />

improvement in profitability was a highlight.<br />

Several South East Asian countries registered<br />

rapid improvement in profitabiliry with the<br />

introduction o{ more effective copp'iglit<br />

legislation. Latin America's worsening economic<br />

environment and currency devaluations depressed<br />

sterling profits from the region. However, steady<br />

progress was made in the exploitation of Hispanic<br />

repertoire from both Latin America and Spain. A<br />

new Venezuelan company was established in<br />

collaboration with a prominent local entertainment<br />

group.<br />

JAPAN: After the US this is the world's second<br />

largest market for pre-recorded music. The<br />

Toshiba-EMl joint venture again posted impressive<br />

increases in sales and profits, successfully<br />

exploiting American, British, European and<br />

classical recordings and substantially increasing i1s<br />

share of the vital Japanese repertoire 6egment. Its<br />

Tokyo recording studios were relocated and now<br />

have state-of-the-art recording equipment.<br />

EMI Music's contin ! ng<br />

nveshenl in three Compact<br />

Disc planls ,esulled in<br />

rncreased capacily permtlrng<br />

t!rther exploilalion ol ils<br />

enormous repedoire base lt<br />

aided lhe launch on CD ol<br />

EL4l's classical and pop music<br />

cala oqu€s - the ater<br />

spearh$ded by lhe Beatles.<br />

cLAssIcAL, EMI's International Classical Division<br />

guided several major recordings, featuring such<br />

distinguished musicians as Riccardo Muti, Itzhak<br />

Perlman, Kathleen Batde and Placido Domingo, as<br />

well as exciting new international performers like<br />

Simon Ratde, Nigel Kennedy and Roger<br />

Norrington. Considerable success was achieved<br />

with ocrossover' recordings of classical artists<br />

performing popular music.<br />

opERATIoNs: New investment in CD plant in the<br />

UII USA, and Japan increased capacity and<br />

facilitated the major launch on CD of EMI Music's<br />

classical and pop catalogues, the latter<br />

spearheaded by the Beatles. Considerable progress<br />

was made towards central coordination o{ the main<br />

manu{acturing and distribution resources in the<br />

UK and continental Europe.<br />

PUBLISHING: The appointment of a worldwide<br />

President of EMI Music Publishing heralded a new<br />

intemational structure for its operations in 24

countries. This important business again achieved<br />

impressive levels of income and profits.<br />

RESTRUCTURTNG: capitol Magnetic Products<br />

Division and a UK sulsidiary, mainly magnetic<br />

base tape suppliers for audio duplicators, were<br />

closed. This allowed consolidation of all Capitol's<br />

music cassette duplicating activities into the<br />

complex in Jacksonville, Illinois. Distribution<br />

of third party videos in North America was also<br />

discontinued. Adverse conditions in New Zealand<br />

led to the disposal o{ the Record Clu} operations,<br />

withdrawal from manufacturing and the relocation<br />

of marketing and distribution activities. In<br />

Mexico, in-house manufacture and dishibution<br />

was replaced by collaboration with a major<br />

Mexican entertainment company.<br />

In its 90th year EMI Music now operates direcdy<br />

in 35 countries and serves a firrther 60 countries<br />

tlrough licensees and exclusive distributors. It is<br />

continually exploring new opportunities for<br />

expansion in the worldwide music market.<br />

Last year Br n Harris, his Managing Direaor<br />

Daoid Sncll ond their colleagrcs at EIVII Australin<br />

twned, a $A1 millinn loss into o profit of $A2<br />

million.'This year,' predias Brinn,'that profit uill<br />

be tuire os bi6.'Brinn gradualed in Econnmics,<br />

went to toork for Australin's lorgest biscuit malrcr<br />

onil only lnter johwd EMl. He then left n nm his<br />

own business. Lured, bo.dt by Daai.d Sncll in 1986<br />

he immciliately got to grips uith e.rcessiue<br />

overheads and rationalising lhe artists roster.<br />

Another key prinrity -'I'm a marketing gty.I<br />

belieue I am onllt as strong as the peopb uho work<br />

uith mc. So I set about buil.ding a winning team'.<br />

'Ioday,Atutralia's number onn band. Crowded<br />

Howe is an inlernntional success for EMI. Bian<br />

enjoys being uith his tu;o sons aboard their 28-foot<br />

monr ouiser. But his leisure thne is spdrse.'You<br />

coul.d say mtcit is a business like arry other,but it<br />

can become a way of life.'Th.en he le[t for his next<br />

appointm.ent - presenting a plntinum d,isc to Cliff<br />

Ridnril marking 70,000 albuns sol.d furi.ng Cffis<br />

four monlh Australian tour.

A MAJOR INTERNATIONAL FORCE PROVIDING TOTAL<br />

lighting solutions through exceptional skills in<br />

marketing, design, engineering, R&D, and<br />

production of light sources and fittings.<br />

'The d.etermination arul commitment b1r all in<br />

THORN Lighting shuts in our strong performance,<br />

and profitability impro..-ement of 51 per cent.We<br />

are expanding our international business.from a<br />

Europeo n pl a t<br />

for m. Th e st ra tegi r o rqu i si ti on<br />

programme, begun u;ith Jibnkonst in Sueden,is a<br />

continuing priori$r.<br />

'Neu proclucts hare been introduced. at a higher<br />

rotp than prcr bphre. Our S, qndinorion omenitl<br />

anrl decoratit e lighting, Cerman commercial<br />

lighting anrl Italianfittings are being sold.<br />

rorldrrirJe.We hare reduced. orcrall costs rhile<br />

enhancing customer seruice . Quality in both product<br />

and, seruice is our conlinuingfocw. A neu'<br />

m qnegpmen I I ce m. ex tensit'c t ra in ing to increase<br />

proJessionalism at all leuek, plus substantial<br />

inuestment in rlistilution, u,arehousing and<br />

systems support ore key elem.ents oJ our<br />

programme .The spirit of enthusiosm, enterprise<br />

<br />

<br />

REVIEW OF ACTIVITIES<br />

THORN Lighting has unique strengths in design,<br />

manufacture and marketing. lts capabilities centre<br />

on two distinct, but closely related, product areas -<br />

lamps and littings. Currently THORN Lighting has<br />

subsidiaries in 17 countries. in l0 ofwhich it has<br />

manufacturing facilities. Its activities serve 140<br />

markets worldwide.<br />

piclLrred n Soest, near THORN<br />

PERFoRUA\CE: The lear sau signilir-ant<br />

improvement in perfornance r,ith sales up by 12<br />

per cent and profit increased by over 50 per cent<br />

rellecting thc more lbcused business strategy,<br />

accelerated introduction of new products and the<br />

continuing restructuring programme. Thc S15.9<br />

million acquisition of Jdrnkonst last year

Theacqu silior oi Jarnkonsl<br />

was asign ficanl step lasi year<br />

It slrenglhened THORN<br />

L ghling's Europ€an posil on<br />

and ils rapd nlegralion gave<br />

leadership in the impo anl<br />

Nord c rcglon Overa ,lhere<br />

was a signil cant ncrease in<br />

lhe proporrion of THOFN<br />

Lighting s sales outs delhe UK<br />

contributed to the strong advance in the results.<br />

Encouraging progress was made throughout<br />

Westem Europe, notably in Austria, Italy and West<br />

Germany.<br />

<br />

Des gn, serv ce and lnnovation<br />

halharks ol THORN Lqhling<br />

- arc conlibuling a qrowing<br />

range oi producb wnh a malor<br />

mpaclon lhe way lighlls used.<br />

Low-vollage Lghrsrream's<br />

compacr size and qoaliry ol<br />

Lghl are providing excting new<br />

solulions lo lradilional ighling<br />

problerns. As w€ I as allowing<br />

cr$live lighling scheme<br />

des€ns, bringing brqhhess lo<br />

displays in boul ques and slores,<br />

ts skilluluse ol modern coaling<br />

lechnoloqy d ramalicaily reduces<br />

rhe amounr ol hear hirherro<br />

Improved robustness showed in the proportion<br />

of sales outside the UK. This increased to 54 per<br />

cenl despile dilliculties in Canada, New Zealand<br />

and Ausralia and inlcnse competition in many<br />

markets for light sources and off-the-sheH littings.<br />

INTERNATIONAT cRowTH, The Jernkonst acquisition<br />

is a signilicant step in strengthening the company's<br />

European position. Jdrnkonst's important products<br />

and design skills have already been led through<br />

into other territories, while Jdrnkonst has<br />

benelited from access to a much wider range of<br />

fittings and high technology light sources. The bid<br />

for the French group Holophane, and its<br />

subsidiary Europhane, is relerred to in the Chief<br />

Executive's Statement.<br />

CUSTOMER SUPPORT: Customer support and product<br />

availability are continuing priorities. This year, {or<br />

example, service to UK customers will be<br />

streamlined by means of an Sll million investment<br />

in two strategically located depots using modern<br />

on-line ordering systems and rapid radial delivery<br />

seruices. More advanced computer aided design<br />

and manufacture (CAII/CAM) processes, and Just<br />

In Time produr-tion terhniqucs. are improving<br />

competitiveness through improved delivery<br />

timescales, speed of response and more tlexible<br />

manufacturing.<br />

INSTALLATIONS: Prestigious lighting schemes<br />

around the world again showed the company's<br />

ability to offer customers total lighting solutions.<br />

Most notable were the lloodlighting of Sydney<br />

<br />

Opera House, lighting<br />

ice-skating arenas lbr<br />

the Winter Olympic<br />

Games at Calgary and<br />

the new North<br />

Terminal complex at<br />

Gatwick Jnternalional<br />

Airport in the UK.

PRoDUCTS: A threefold increase in<br />

the launch of new products, exploiting<br />

the company's intemational design skills,<br />

significandy improved the established product<br />

strength, fucstream, a l50W metal halide lamp for<br />

commercial interiors and exterior lloodlighting is<br />

stimulating a new generation of stylish fittings.<br />

Other key light source developments include new<br />

35mm diameter low voltage tungsten halogen<br />

display lamps, H.tlocltN HEAT lamps for spaceheating,<br />

and larger compact fluorescents - 2D<br />

38W and 2L 40W - for offices and stores. The<br />

comprehensive'Cityscape' exterior amenity and<br />

security fittings meet increasing requirements for<br />

improved urban lighting programmes.<br />

Appreciation of the worldwide commercial<br />

lighting market inspired Modulight and Quattro -<br />

high performance fluorescent luminaires witJr<br />

sophisticated optical attachments - together with<br />

tJre new Legato range o{ uplights.<br />

The innovali\,€ design oi the<br />

Thorn 2-D lamp has opened<br />

up new avenues for desiqners<br />

imaginalive use ol lighr 10<br />

environmenls by means of<br />

uplighlerq downliqhterc, wall<br />

iightsand bulkheads.<br />

Advanced lechnologies<br />

in control ge€i and sources<br />

and olher energy eliiciency<br />

improvemenls make cost<br />

elfecliveness an imporlant<br />

t€lure oi new lighiing<br />

solLnions based on THORN<br />

Lighting's expedise and<br />

DESIGN: Growing demand for well des{ned, energy<br />

efficient, high technology products continues to<br />

stimulate research and product development.<br />

In lighting, leadership in interreF<br />

ating design, technological and<br />

engineering skills is increasingly<br />

important in tackling intemational market<br />

opportunities. Advances in electronics, as well as<br />

in lamps and fittings, are a major spur to progress.<br />

THOR\ Lighting's expertise in rhis area is<br />

illustrated by its high frequency control gear for<br />

fluorescent tubes and by electronic transformers<br />

for low voltage display lighting.<br />

QUALITTY: The new management team has had a<br />

fundamental influence on quality standards<br />

throughout the company - vital to the policy of<br />

improving the commitment to customers,<br />

Continuous progress in the grolth of the<br />

business is anticipated. Good intemational<br />

prospects, clear objectives and continuing focus on<br />

<br />

<br />

Kenwood - a hous€hold name<br />

in smallappliances in markets<br />

around lhe world - is alsd<br />

rcPorted under li'e Consumer<br />

and Commercia| heading in

market, product and operational developments<br />

reinforce the company's confidence in its future<br />

per{orman ce.<br />

Kf,NS OOD<br />

Kenwood had a year of mixed lbfunes. UK<br />

markets for several food preparation products<br />

contracted. Operations in New Zealand were<br />

rationalised in line uith husiness opponunities.<br />

Good progress for the luture of the hrrsiness<br />

included launching several ne'w products including<br />

the innovative System K rechargeable appliances,<br />

and substantial investment in research and<br />

development. Signilicant additions to the product<br />

range over the next two years and new<br />

manufacturing plant will further improve<br />

productivity. New Kenwood businesses were<br />

established in Australia and the USA.<br />

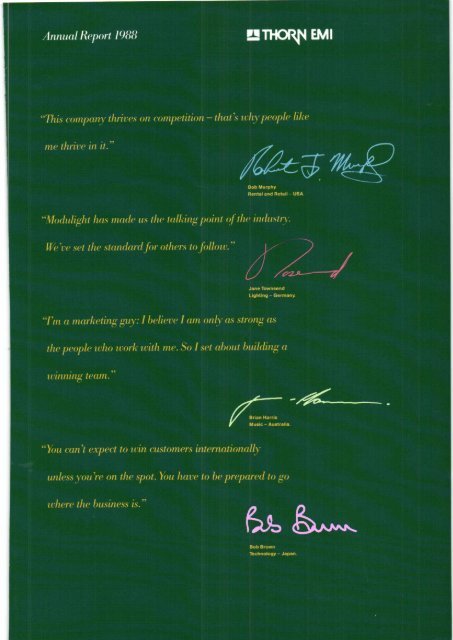

aa fl-,tt1 ffi"##".-:i:!;ffi:*,<br />

lighting, u'as absolute . Incorporating the latest<br />

p,oducl Deve opmeni and<br />

i;ilffi::.YHT:,,",", y:;:;:":"_3;'::,,ytr:"y,;""i:::;#:<br />

others to follut.It<br />

uos odopted enthusiastically by<br />

THORN Lighting companies around the u;orld', arul<br />

by customers, ar

The Directors submit their annual report and statement of accounts for eonsideration at<br />

the Annual Ceneral Meeting on B September 1988.<br />

ACCOUNTS AND DIVIDENDS<br />

Ti.rrnover 1br the year to 3I March 1988 amounted to S3,054.0m compared with<br />

S3,203.2m lbr the previous year. Prolit belbre finance charges amounted to S243.7m (last<br />

year 9l9l.Brn) and profit before taxation was 9225.3m (S159.5m). Eamings per share were<br />

53.Ip (43.9p).<br />

Flxtraordinary items o{sl4.2m (924.7m) net of tax vere charged, mainly for the<br />

restructuring o{ the Music business in Nodh America.<br />

An inte m dividend of 6.0p per share (5.0p) was paid in March 1988. The Board is<br />

recommending a linal dividend o{ t6.0p per share (13.5p), payable on 7 October 1988 to<br />

Ordinary Shareholders on the register as at 14 July 19B8, making a total of 22.0p (18.5p)<br />

for the full year.<br />

Investment in tangible fixed assets during the year amounted to S39B.6m (S326.8m)<br />

comprising rental equipment 5272.2m (S208.9m) and other lixed assets $P6.4m<br />

(slr7.9m).<br />

PRINCIPAL ACTIVITIES<br />

The principal activities are Rental and Retail, Technology, Music and Lighting.<br />

A review of these activities and indications ol likely future developmerts is set out on<br />

pages ll to 38. A li6t of operating subsidiaries is available, on application, {iom the<br />

Company.<br />

DISPOSALS AND ACQUISITIONS<br />

During the year under review disposals included the completion of the sale ol the Major<br />

Domestic and Commercial Appliance division for an aggregate consideration of 943.8m.<br />

This sale was accounted for in the year to 3l March 1987. The sale of the Ferguson<br />

Division was also completed lbr an aggregate consideration of s90m.<br />

The Company made several acquisitions during the year uhich included the entire<br />

issued share capital of Rent-A-Center, Inc. in the United States lbr a consideration of<br />

$594m (S37lm). The consideration was satisfied by the issue ol53.4m Ordinary Shares<br />

which in the lirst instance were made available to existing shareholders by way o{ an<br />

Open Olier.<br />

'lhis and other acquisitions are referred to in the review of the principal activities.<br />

POST BALANCE SHEET EVENTS<br />