Due Diligence Review: M&A Behind the Scenes - King & Spalding

Due Diligence Review: M&A Behind the Scenes - King & Spalding

Due Diligence Review: M&A Behind the Scenes - King & Spalding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

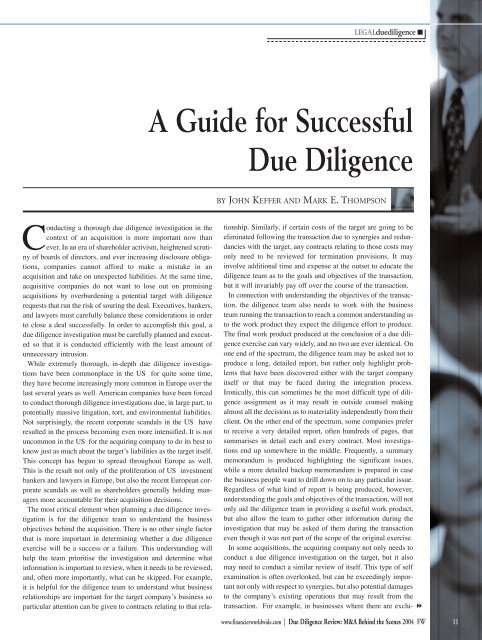

LEGALduediligence<br />

A Guide for Successful<br />

<strong>Due</strong> <strong>Diligence</strong><br />

BY JOHN KEFFER AND MARK E. THOMPSON<br />

Conducting a thorough due diligence investigation in <strong>the</strong><br />

context of an acquisition is more important now than<br />

ever. In an era of shareholder activism, heightened scrutiny<br />

of boards of directors, and ever increasing disclosure obligations,<br />

companies cannot afford to make a mistake in an<br />

acquisition and take on unexpected liabilities. At <strong>the</strong> same time,<br />

acquisitive companies do not want to lose out on promising<br />

acquisitions by overburdening a potential target with diligence<br />

requests that run <strong>the</strong> risk of souring <strong>the</strong> deal. Executives, bankers,<br />

and lawyers must carefully balance <strong>the</strong>se considerations in order<br />

to close a deal successfully. In order to accomplish this goal, a<br />

due diligence investigation must be carefully planned and executed<br />

so that it is conducted efficiently with <strong>the</strong> least amount of<br />

unnecessary intrusion.<br />

While extremely thorough, in-depth due diligence investigations<br />

have been commonplace in <strong>the</strong> US for quite some time,<br />

<strong>the</strong>y have become increasingly more common in Europe over <strong>the</strong><br />

last several years as well. American companies have been forced<br />

to conduct thorough diligence investigations due, in large part, to<br />

potentially massive litigation, tort, and environmental liabilities.<br />

Not surprisingly, <strong>the</strong> recent corporate scandals in <strong>the</strong> US have<br />

resulted in <strong>the</strong> process becoming even more intensified. It is not<br />

uncommon in <strong>the</strong> US for <strong>the</strong> acquiring company to do its best to<br />

know just as much about <strong>the</strong> target’s liabilities as <strong>the</strong> target itself.<br />

This concept has begun to spread throughout Europe as well.<br />

This is <strong>the</strong> result not only of <strong>the</strong> proliferation of US investment<br />

bankers and lawyers in Europe, but also <strong>the</strong> recent European corporate<br />

scandals as well as shareholders generally holding managers<br />

more accountable for <strong>the</strong>ir acquisition decisions.<br />

The most critical element when planning a due diligence investigation<br />

is for <strong>the</strong> diligence team to understand <strong>the</strong> business<br />

objectives behind <strong>the</strong> acquisition. There is no o<strong>the</strong>r single factor<br />

that is more important in determining whe<strong>the</strong>r a due diligence<br />

exercise will be a success or a failure. This understanding will<br />

help <strong>the</strong> team prioritise <strong>the</strong> investigation and determine what<br />

information is important to review, when it needs to be reviewed,<br />

and, often more importantly, what can be skipped. For example,<br />

it is helpful for <strong>the</strong> diligence team to understand what business<br />

relationships are important for <strong>the</strong> target company’s business so<br />

particular attention can be given to contracts relating to that relationship.<br />

Similarly, if certain costs of <strong>the</strong> target are going to be<br />

eliminated following <strong>the</strong> transaction due to synergies and redundancies<br />

with <strong>the</strong> target, any contracts relating to those costs may<br />

only need to be reviewed for termination provisions. It may<br />

involve additional time and expense at <strong>the</strong> outset to educate <strong>the</strong><br />

diligence team as to <strong>the</strong> goals and objectives of <strong>the</strong> transaction,<br />

but it will invariably pay off over <strong>the</strong> course of <strong>the</strong> transaction.<br />

In connection with understanding <strong>the</strong> objectives of <strong>the</strong> transaction,<br />

<strong>the</strong> diligence team also needs to work with <strong>the</strong> business<br />

team running <strong>the</strong> transaction to reach a common understanding as<br />

to <strong>the</strong> work product <strong>the</strong>y expect <strong>the</strong> diligence effort to produce.<br />

The final work product produced at <strong>the</strong> conclusion of a due diligence<br />

exercise can vary widely, and no two are ever identical. On<br />

one end of <strong>the</strong> spectrum, <strong>the</strong> diligence team may be asked not to<br />

produce a long, detailed report, but ra<strong>the</strong>r only highlight problems<br />

that have been discovered ei<strong>the</strong>r with <strong>the</strong> target company<br />

itself or that may be faced during <strong>the</strong> integration process.<br />

Ironically, this can sometimes be <strong>the</strong> most difficult type of diligence<br />

assignment as it may result in outside counsel making<br />

almost all <strong>the</strong> decisions as to materiality independently from <strong>the</strong>ir<br />

client. On <strong>the</strong> o<strong>the</strong>r end of <strong>the</strong> spectrum, some companies prefer<br />

to receive a very detailed report, often hundreds of pages, that<br />

summarises in detail each and every contract. Most investigations<br />

end up somewhere in <strong>the</strong> middle. Frequently, a summary<br />

memorandum is produced highlighting <strong>the</strong> significant issues,<br />

while a more detailed backup memorandum is prepared in case<br />

<strong>the</strong> business people want to drill down on to any particular issue.<br />

Regardless of what kind of report is being produced, however,<br />

understanding <strong>the</strong> goals and objectives of <strong>the</strong> transaction, will not<br />

only aid <strong>the</strong> diligence team in providing a useful work product,<br />

but also allow <strong>the</strong> team to ga<strong>the</strong>r o<strong>the</strong>r information during <strong>the</strong><br />

investigation that may be asked of <strong>the</strong>m during <strong>the</strong> transaction<br />

even though it was not part of <strong>the</strong> scope of <strong>the</strong> original exercise.<br />

In some acquisitions, <strong>the</strong> acquiring company not only needs to<br />

conduct a due diligence investigation on <strong>the</strong> target, but it also<br />

may need to conduct a similar review of itself. This type of self<br />

examination is often overlooked, but can be exceedingly important<br />

not only with respect to synergies, but also potential damages<br />

to <strong>the</strong> company’s existing operations that may result from <strong>the</strong><br />

transaction. For example, in businesses where <strong>the</strong>re are exclu- <br />

www.financierworldwide.com | <strong>Due</strong> <strong>Diligence</strong> <strong>Review</strong>: M&A <strong>Behind</strong> <strong>the</strong> <strong>Scenes</strong> 2004 FW 11