Annual Report - EFG Bank Group

Annual Report - EFG Bank Group

Annual Report - EFG Bank Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

20<br />

Notes to the Consolidated Financial Statements (continued)<br />

and any goodwill identified on acquisition net of<br />

any accumulated impairment losses. If the<br />

<strong>Group</strong>’s share of losses of an associate equals or<br />

exceeds its interest in the associate, the <strong>Group</strong><br />

discontinues recognising its share of further<br />

losses, unless it has incurred obligations or made<br />

payments on behalf of the associate. Where<br />

necessary, the accounting policies used by the<br />

associate have been changed to ensure<br />

consistency with the policies of the <strong>Group</strong>.<br />

A listing of the <strong>Group</strong>’s associated undertakings,<br />

which are accounted for using the equity method,<br />

is shown in note 25.<br />

(d) Joint ventures<br />

The <strong>Group</strong>’s interest in jointly controlled entities<br />

are accounted for by the equity method of<br />

accounting in the consolidated financial<br />

statements and are treated as associates.<br />

A listing of the <strong>Group</strong>’s joint ventures, is shown<br />

in note 25.<br />

(e) Foreign currencies<br />

i) Functional and presentation currency<br />

Items included in the financial statements of each<br />

of the <strong>Group</strong>’s entities are measured using the<br />

currency of the primary economic environment in<br />

which the entity operates. The consolidated<br />

financial statements are presented in CHF which<br />

is the <strong>Group</strong>’s functional and presentation<br />

currency.<br />

Assets and liabilities of foreign subsidiaries are<br />

translated using the closing exchange rate and<br />

statement of income items at the average<br />

exchange rate for the period reported. All<br />

resulting exchange differences are recognised as a<br />

separate component of equity (cumulative<br />

translation adjustment).<br />

Exchange differences arising from the<br />

retranslation of the net investment in foreign<br />

subsidiaries are taken to shareholders’ equity<br />

until disposal of net investments and then<br />

released to the statement of income.<br />

(ii) Transactions and balances<br />

Foreign currency transactions are translated into<br />

the functional currency using the exchange rates<br />

prevailing at the dates of the transactions.<br />

Foreign exchange gains and losses resulting from<br />

the settlement of such transactions and from the<br />

translation at year-end exchange rates of<br />

monetary assets and liabilities denominated in<br />

foreign currencies are recognised in the statement<br />

of income, except when deferred in equity as<br />

qualifying cash flow hedges and qualifying net<br />

investment hedges.<br />

Translation differences on non-monetary items,<br />

such as other financial assets held at fair-valuethrough-profit-<br />

or-loss, are reported as part of the<br />

fair value gain or loss. Translation differences on<br />

non-monetary items, such as other financial<br />

assets classified as available-for-sale financial<br />

assets, are included in the fair value reserve in<br />

equity.<br />

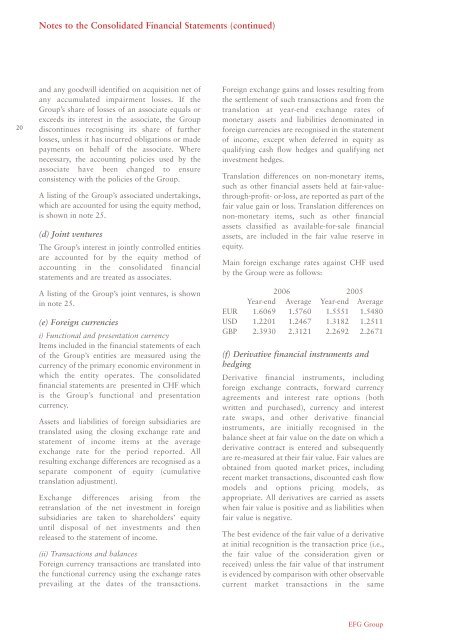

Main foreign exchange rates against CHF used<br />

by the <strong>Group</strong> were as follows:<br />

2006 2005<br />

Year-end Average Year-end Average<br />

EUR 1.6069 1.5760 1.5551 1.5480<br />

USD 1.2201 1.2467 1.3182 1.2511<br />

GBP 2.3930 2.3121 2.2692 2.2671<br />

(f) Derivative financial instruments and<br />

hedging<br />

Derivative financial instruments, including<br />

foreign exchange contracts, forward currency<br />

agreements and interest rate options (both<br />

written and purchased), currency and interest<br />

rate swaps, and other derivative financial<br />

instruments, are initially recognised in the<br />

balance sheet at fair value on the date on which a<br />

derivative contract is entered and subsequently<br />

are re-measured at their fair value. Fair values are<br />

obtained from quoted market prices, including<br />

recent market transactions, discounted cash flow<br />

models and options pricing models, as<br />

appropriate. All derivatives are carried as assets<br />

when fair value is positive and as liabilities when<br />

fair value is negative.<br />

The best evidence of the fair value of a derivative<br />

at initial recognition is the transaction price (i.e.,<br />

the fair value of the consideration given or<br />

received) unless the fair value of that instrument<br />

is evidenced by comparison with other observable<br />

current market transactions in the same<br />

<strong>EFG</strong> <strong>Group</strong>