Annual Report - EFG Bank Group

Annual Report - EFG Bank Group

Annual Report - EFG Bank Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

70<br />

Notes to the Consolidated Financial Statements (continued)<br />

45. Acquisition of subsidiaries<br />

Details of acquisitions of subsidiaries during the year ended December 31, 2006 that gave rise to goodwill and<br />

intangible assets are as follows:<br />

DZI <strong>Bank</strong> AD<br />

In December 2006, the <strong>Group</strong>, through its subsidiary <strong>EFG</strong> Eurobank Ergasias SA, acquired 91.29% of the share<br />

capital of DZI <strong>Bank</strong> AD, which operates in Bulgaria.<br />

Global Fund Management SA<br />

In March 2006, the <strong>Group</strong>, through its subsidiary <strong>EFG</strong> Eurobank Ergasias SA, increased its shareholding in Global<br />

Fund Management SA, Athens, to 72% from 44.44%; as a result the company has been transferred from investments<br />

in associated undertakings to subsidiary undertakings and is consolidated using the full consolidation method.<br />

Best Direct SA<br />

In March 2006, the <strong>Group</strong>, through its subsidiary <strong>EFG</strong> Eurobank Ergasias SA (through its 100% subsidiary Open 24<br />

SA), acquired 100% of the share capital of Best Direct SA, a company providing sundry services.<br />

C.M.Advisors Limited<br />

On February 13, 2006, the <strong>Group</strong>, through its subsidiary <strong>EFG</strong> International, acquired 100% of the issued share<br />

capital of C.M.Advisors Limited (CMA). Bermuda-based CMA focuses on both managing fund-of-hedge-funds and<br />

research of hedge funds. The transaction gave rise to an estimated goodwill of CHF 263.6 million, taking into account<br />

the estimated deferred consideration and to the recognition of intangible assets for CHF 65.2 million. The intangible<br />

assets are amortised over 4 to 14 year periods depending on their nature.<br />

Harris Allday<br />

On August 18, 2006, the <strong>Group</strong>, through its subsidiary <strong>EFG</strong> International, acquired 100% of the business and assets<br />

of Harris Allday Stockbrokers (a partnership), a United Kingdom Birmingham-based private client stockbroker. The<br />

transaction gave rise to goodwill of CHF 54.8 million and to the recognition of intangible assets of CHF 49.3 million.<br />

The intangible assets related to client relationships are amortised over a 10 to 20 year period and the intangible<br />

related to the trademark is amortised over 25 years.<br />

Banque Monégasque de Gestion<br />

On November 1, 2006, the <strong>Group</strong>, through its subsidiary <strong>EFG</strong> International, acquired 100% of the issued share<br />

capital of the Monaco-based private banking organisation. The transaction gave rise to goodwill of CHF 30.9 million<br />

and to the recognition of intangible assets of CHF 11.1 million. The intangible assets are amortised over a 15 year<br />

period.<br />

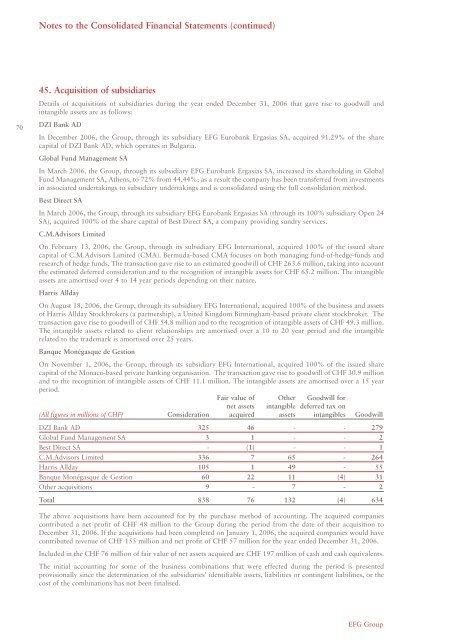

Fair value of Other Goodwill for<br />

net assets intangible deferred tax on<br />

(All figures in millions of CHF) Consideration acquired assets intangibles Goodwill<br />

DZI <strong>Bank</strong> AD 325 46 - - 279<br />

Global Fund Management SA 3 1 - - 2<br />

Best Direct SA - (1) - - 1<br />

C.M.Advisors Limited 336 7 65 - 264<br />

Harris Allday 105 1 49 - 55<br />

Banque Monégasque de Gestion 60 22 11 (4) 31<br />

Other acquisitions 9 - 7 - 2<br />

Total 838 76 132 (4) 634<br />

The above acquisitions have been accounted for by the purchase method of accounting. The acquired companies<br />

contributed a net profit of CHF 48 million to the <strong>Group</strong> during the period from the date of their acquisition to<br />

December 31, 2006. If the acquisitions had been completed on January 1, 2006, the acquired companies would have<br />

contributed revenue of CHF 155 million and net profit of CHF 57 million for the year ended December 31, 2006.<br />

Included in the CHF 76 million of fair value of net assets acquired are CHF 197 million of cash and cash equivalents.<br />

The initial accounting for some of the business combinations that were effected during the period is presented<br />

provisionally since the determination of the subsidiaries' identifiable assets, liabilities or contingent liabilities, or the<br />

cost of the combinations has not been finalised.<br />

<strong>EFG</strong> <strong>Group</strong>