Annual Report 2012 - Thecorporatelibrary.net

Annual Report 2012 - Thecorporatelibrary.net

Annual Report 2012 - Thecorporatelibrary.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

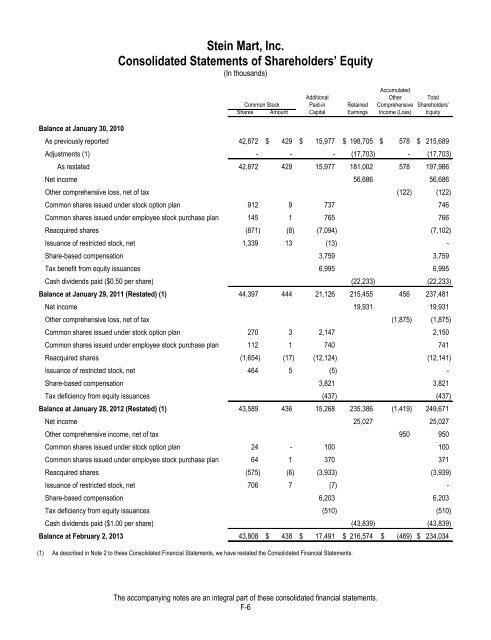

Stein Mart, Inc.<br />

Consolidated Statements of Shareholders’ Equity<br />

(In thousands)<br />

Accumulated<br />

Additional Other Total<br />

Common Stock<br />

Paid-in Retained Comprehensive Shareholders’<br />

Shares Amount Capital Earnings Income (Loss) Equity<br />

Balance at January 30, 2010<br />

As previously reported 42,872 $ 429 $ 15,977 $ 198,705 $ 578 $ 215,689<br />

Adjustments (1) - - - (17,703) - (17,703)<br />

As restated 42,872 429 15,977 181,002 578 197,986<br />

Net income 56,686 56,686<br />

Other comprehensive loss, <strong>net</strong> of tax (122) (122)<br />

Common shares issued under stock option plan 912 9 737 746<br />

Common shares issued under employee stock purchase plan 145 1 765 766<br />

Reacquired shares (871) (8) (7,094) (7,102)<br />

Issuance of restricted stock, <strong>net</strong> 1,339 13 (13) -<br />

Share-based compensation 3,759 3,759<br />

Tax benefit from equity issuances 6,995 6,995<br />

Cash dividends paid ($0.50 per share) (22,233) (22,233)<br />

Balance at January 29, 2011 (Restated) (1) 44,397 444 21,126 215,455 456 237,481<br />

Net income 19,931 19,931<br />

Other comprehensive loss, <strong>net</strong> of tax (1,875) (1,875)<br />

Common shares issued under stock option plan 270 3 2,147 2,150<br />

Common shares issued under employee stock purchase plan 112 1 740 741<br />

Reacquired shares (1,654) (17) (12,124) (12,141)<br />

Issuance of restricted stock, <strong>net</strong> 464 5 (5) -<br />

Share-based compensation 3,821 3,821<br />

Tax deficiency from equity issuances (437) (437)<br />

Balance at January 28, <strong>2012</strong> (Restated) (1) 43,589 436 15,268 235,386 (1,419) 249,671<br />

Net income 25,027 25,027<br />

Other comprehensive income, <strong>net</strong> of tax 950 950<br />

Common shares issued under stock option plan 24 - 100 100<br />

Common shares issued under employee stock purchase plan 64 1 370 371<br />

Reacquired shares (575) (6) (3,933) (3,939)<br />

Issuance of restricted stock, <strong>net</strong> 706 7 (7) -<br />

Share-based compensation 6,203 6,203<br />

Tax deficiency from equity issuances (510) (510)<br />

Cash dividends paid ($1.00 per share) (43,839) (43,839)<br />

Balance at February 2, 2013 43,808 $ 438 $ 17,491 $ 216,574 $ (469) $ 234,034<br />

(1) As described in Note 2 to these Consolidated Financial Statements, we have restated the Consolidated Financial Statements.<br />

The accompanying notes are an integral part of these consolidated financial statements.<br />

F-6