Fixed Annuity Lincoln Leader - September 2011 - ECA Marketing

Fixed Annuity Lincoln Leader - September 2011 - ECA Marketing

Fixed Annuity Lincoln Leader - September 2011 - ECA Marketing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Vol. 5, Issue 10, <strong>September</strong> 26, <strong>2011</strong><br />

<strong>Fixed</strong> <strong>Annuity</strong><br />

Recent Product Updates<br />

The following list provides a summary of recent product updates:<br />

<strong>Lincoln</strong> OptiChoice SM <strong>Fixed</strong> Indexed <strong>Annuity</strong><br />

The Performance Triggered indexed account is now available with newly<br />

issued <strong>Lincoln</strong> OptiChoice SM contracts in states where approved.<br />

<strong>Lincoln</strong> Lifetime Income SM Edge<br />

• The minimum election age is 35. Other ages may be considered<br />

with prior approval.<br />

• Minnesota approved the new rider effective with contracts issued<br />

<strong>September</strong> 8, <strong>2011</strong> and later. The last issue day for contracts with<br />

the prior Guaranteed Lifetime Withdrawal Benefit (GLWB) rider<br />

(<strong>Lincoln</strong> Living Income SM Advantage) is November 8, <strong>2011</strong>.<br />

• Massachusetts: The Nursing Home enhancement is now<br />

approved.<br />

<strong>Lincoln</strong> Long-Term Care SM <strong>Fixed</strong> <strong>Annuity</strong><br />

These contracts will now include a Market Value Adjustment (MVA) provision (in<br />

states where approved). The MVA will only apply to withdrawals above the 10%<br />

partial surrender amount allowed per the contract, during the surrender charge<br />

period.<br />

The MVA will not apply to long-term care benefit payments.<br />

Key Headlines<br />

Recent Product Updates<br />

LFIT/Mobility Release<br />

(Current System)<br />

New <strong>Annuity</strong> Illustration<br />

System Coming Soon<br />

<strong>Lincoln</strong> Forms Tool<br />

Enhancements<br />

Book of Business Tools<br />

Which Withdrawal Form?<br />

E-Signatures on Post-Issue<br />

Client Forms<br />

NY Reg 194 Update<br />

NAIC Training Summary<br />

<strong>Lincoln</strong> Living Income SM<br />

Transition Chart<br />

Wyoming has recently approved the addition of the MVA provision to<br />

<strong>Lincoln</strong> Long-Term Care SM <strong>Fixed</strong> <strong>Annuity</strong>.<br />

Guaranteed Minimum Interest Rate Declared for Contracts Issued<br />

<strong>September</strong> 1, <strong>2011</strong> and Later<br />

Contracts issued <strong>September</strong> 1, <strong>2011</strong> or later will reflect a new guaranteed<br />

minimum interest rate / guaranteed minimum fixed interest rate<br />

(collectively, “GMIR”).<br />

The GMIR is 1.00% for new issues and for inforce <strong>Lincoln</strong><br />

contracts with surrender charge schedules ending<br />

between <strong>September</strong> 1, <strong>2011</strong> and August 31, 2012,<br />

(<strong>Lincoln</strong> Classic 5 and <strong>Lincoln</strong> OptiChoice 5 contracts).<br />

Information compiled by Product and<br />

Distribution Support<br />

The <strong>Lincoln</strong> <strong>Leader</strong> contains product and business implementation information for <strong>Lincoln</strong> fixed annuities. Products and features subject<br />

to state availability. Certain products are only available in select distribution channels. Check your selling agreement for availability.<br />

For Agent/Broker Use Only – Not To Be Used With The General Public. Page 1 of 8

LFIT/Mobility Release <strong>Annuity</strong> Illustration System (Current System)<br />

The following list provides highlights of the recent <strong>Annuity</strong> Illustration release (implemented <strong>September</strong> 12, <strong>2011</strong>):<br />

• <strong>Lincoln</strong> OptiChoice SM <strong>Fixed</strong> Indexed <strong>Annuity</strong> Updates:<br />

- The 1-Year Point-to-Point Indexed Account has been replaced with the Performance Triggered<br />

Indexed Account<br />

The 1-Year Point-to-Point Indexed Account will no longer be offered with new contracts.<br />

The Performance Triggered Indexed Account can now be illustrated for <strong>Lincoln</strong> OptiChoice SM fixed<br />

indexed annuities.<br />

• <strong>Lincoln</strong> OptiChoice SM and <strong>Lincoln</strong> New Directions ® <strong>Fixed</strong> Indexed <strong>Annuity</strong> Update:<br />

- The <strong>Lincoln</strong> Lifetime Income SM Edge Rider now reflects an Income Bonus Rate of .50% for completed<br />

rider years 5 through 9 and 1.00% for 10+ completed rider years. The values will be reflected in the<br />

Lifetime Benefit Amounts on the <strong>Lincoln</strong> Lifetime Income SM Edge report and in the table on the <strong>Lincoln</strong><br />

Lifetime Income SM Edge Overview.<br />

• <strong>Lincoln</strong> Long-Term Care SM <strong>Fixed</strong> <strong>Annuity</strong> Updates:<br />

- The Market Value Adjustment (MVA) provision will be included with contracts issued <strong>September</strong> 1, <strong>2011</strong>,<br />

and later (where approved). The MVA provision will now be reflected in the illustration and the<br />

Guaranteed Minimum Cash Value column has been added to the report.<br />

Available in October: <strong>Lincoln</strong> <strong>Annuity</strong> Illustration System Enhancement<br />

<strong>Lincoln</strong> will be launching the new ForeSight annuity illustration system in October <strong>2011</strong>. This new system<br />

replaces the current Mobility 3.0 illustration system and will provide users with faster data input, illustration<br />

output and other features to help improve productivity and ease of use. Some of these improvements include:<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

New technology provides faster navigation capabilities and significantly reduced screen “flash” or time<br />

to move between input screens;<br />

The “quick quote” tool provides immediate real-time quotes based on current data entered;<br />

Ability to run multiple illustrations simultaneously;<br />

Case-sharing available across business lines;<br />

Inputs designed with <strong>Annuity</strong> Sales Desk to help “tell the story”;<br />

Ability to store newly created cases using the Case Management feature so cases can be re-run without<br />

having to re-enter any data (similar to the Case Management feature available today in LFIT/Mobility);<br />

Ability to create more hypothetical illustrations within the same time period; and<br />

Increased update abilities for each release.<br />

Once the new ForeSight illustration system launches in October, the current LFIT/Mobility system will no<br />

longer be available. Keep in mind that the actual reports generated will not change and will continue to look<br />

the same as with the previous system.<br />

Cases DO NOT Carry-Over – Cases stored in the LFIT / Mobility system using the Case Management feature<br />

will NOT automatically transfer to ForeSight. Previous cases will need to be re-created in ForeSight by using<br />

the new data entry process. The saved PDF will serve as a reference if the case needs to be re-created in the<br />

new system.<br />

More Information Available – For more detailed information about how to use the new ForeSight annuity<br />

illustration system, see the ForeSight Reference Guide (available mid-October) on www.lfd.com > <strong>Fixed</strong><br />

Annuities > Illustrations.<br />

For Agent/Broker Use Only – Not To Be Used With The General Public. Page 2 of 8

<strong>Lincoln</strong> Forms Tool Enhancements<br />

On October 3, <strong>2011</strong>, <strong>Lincoln</strong> is introducing an updated Forms Tool with a new look and enhanced search<br />

capabilities to make it easier to find the forms you need quickly and accurately, without losing any of the<br />

previous functionality. The product “radio buttons” have been replaced with dynamic drop down menus,<br />

providing a more efficient method to access needed forms.<br />

The consolidated online Forms Tool can be accessed by the same links currently available from <strong>Lincoln</strong><br />

producer websites, including LFD.com, <strong>Lincoln</strong>FinancialNetwork.com, AmericanLegacy.com and<br />

LFAPlanner.com.<br />

There are now two methods available for finding forms:<br />

<br />

<br />

Search by Criteria<br />

Search by Form Name or Number (Partial or Whole)<br />

Search by Criteria<br />

A new “Line of Business” menu is available to help narrow down<br />

available forms.<br />

1. Select the appropriate Line of Business from the drop down<br />

menu.<br />

2. Select the Purpose Type (Point of Sale, Client Service or<br />

Producer Solutions).<br />

3. Select the State and Product. Selections displayed are only<br />

those products and items that pertain to the line of business<br />

selected.<br />

4. Click on “Find Forms.” The Results Page will appear with the<br />

list of applicable forms. Click on the form number of the<br />

desired form to download the PDF.<br />

Search by Form Name or Number (Partial or Whole)<br />

If the form name or form number is known, type the information directly into the text box and hit “find forms”.<br />

The form will appear on the Results Page. Tip: If only a part of the name or form number is known, the same<br />

process can be used to narrow the results generated.<br />

The list of forms generated and the forms themselves have had minimal changes. Required forms will continue<br />

to be pre-selected in the menu and are available as fill-able forms. Descriptive subheadings have been added<br />

to non-required forms.<br />

A short training video will be available on the forms tool web page to walk you through the new drop down<br />

menu experience. Click on the Tutorial link at the top of the Forms screen to access the training.<br />

Note: LaserApp (available via LFAPlanner.com) and the online Forms Tool for Employer Retirement Plans<br />

have not been updated at this time.<br />

If you have any questions, please contact Forms Management at FormsManagement@lfg.com.<br />

For Agent/Broker Use Only – Not To Be Used With The General Public. Page 3 of 8

Withdrawal Forms Decision Tree Now Available<br />

There are several forms available to facilitate taking withdrawals from deferred fixed annuities. A new tool, the<br />

Withdrawal Forms Decision Tree, is available to help determine which form should be used for each type of<br />

withdrawal. This chart covers the following forms:<br />

• Required Minimum Distribution (RMD) Form AN07119<br />

• Systematic Withdrawals Form AN07099<br />

• <strong>Annuity</strong> Distribution Request Form AN07301<br />

• <strong>Lincoln</strong> Lifetime Income SM Edge Distribution Request Form<br />

AN10100<br />

• Substantially Equal Periodic Payments Form AN07097<br />

- Payments under IRC Section 72(t) or 72(q)<br />

Click Here to view or download the chart.<br />

Book of Business Incorporates Policy Inquiry Tools<br />

The <strong>Annuity</strong> Book of Business Tool will automatically generate a list of all contracts appropriate for that<br />

representative, including those that had been previously accessed via the Policy Inquiry tool.<br />

The Book of Business Tool<br />

can be accessed from the<br />

<strong>Fixed</strong> <strong>Annuity</strong> Home page,<br />

and is the best way to<br />

access annuity contract<br />

information.<br />

The Contract Selection screen will provide the total number and total value of contracts (if available) for a<br />

particular representative and can be sorted by different columns. Specific contracts can be selected from the list.<br />

To access additional tools for Policy Inquiry contracts, select ‘Policy Inquiry Tools’ from the left-side of the page.<br />

For Agent/Broker Use Only – Not To Be Used With The General Public. Page 4 of 8

Pilot Program to Allow e-Signatures on Post-Issue Client Forms<br />

<strong>Lincoln</strong>’s Variable <strong>Annuity</strong> Contact Center is planning to launch a pilot program with iPipeline later this month to<br />

allow e-signatures (for clients only) for three post-issue service forms. The <strong>Fixed</strong> <strong>Annuity</strong> Contact Center will<br />

begin a similar pilot shortly thereafter.<br />

The iPipeline pilot program will include the following three post-issue forms:<br />

1. Change of Ownership form (order code 27725)<br />

2. Change of Beneficiary form (order code 28493)<br />

3. Telephone Transfer Authorization form (order code 23932; this form has been updated, consolidating<br />

the variable and fixed annuity forms to create consistency between the product lines)<br />

A client can request a form directly through a customer service representative, or an agent can request that<br />

<strong>Lincoln</strong> e-mail the form to the client (as long as we can verify a current email address in our records or with the<br />

client on the phone). The client will follow a link, enter some security information and complete the form. The<br />

client cannot submit the form to <strong>Lincoln</strong> unless all required fields are completed. The client can then “e-sign” the<br />

form using DocuSign and send the form directly to <strong>Lincoln</strong>.<br />

The pilot program with iPipeline will begin by October 1, <strong>2011</strong> and end in December <strong>2011</strong>. If the pilot is<br />

successful, <strong>Lincoln</strong> could continue the program into 2012 and possibly add new forms and allow more complex<br />

changes.<br />

New York Provides Clarification on Recent Producer Compensation<br />

Regulation<br />

Effective January 1, <strong>2011</strong>, the New York State Insurance Department (NYSID) issued Regulation 194 (Producer<br />

Compensation Transparency), which began requiring all producers licensed in New York to provide<br />

compensation disclosure to purchasers of insurance and annuity products issued in the state.<br />

The New York State Insurance Department (NYSID) recently provided some additional clarification regarding<br />

the disclosure of entertainment and merchandise provided to producers as compensation, specifically as to<br />

whether this disclosure needed to be itemized, or if a reasonable estimate could be provided.<br />

The NYSID confirmed that, when disclosing compensation for Regulation 194, an insurance producer must<br />

itemize entertainment and merchandise received from an insurer as compensation, if the value of the items is<br />

known at the time disclosure is required. If the value is not known, a producer must instead provide a<br />

reasonable estimate of the value and a description of the circumstances that may help determine the value of<br />

the compensation.<br />

For More Information – See the following:<br />

<br />

<br />

<br />

The complete description of the recently issued clarification is available on the NYSID’s website at<br />

http://www.ins.state.ny.us/ogco<strong>2011</strong>/rg110701.htm<br />

The full text of New York Regulation 194 and corresponding Circular Letter 18 may be found on the<br />

NYSID’s website at:<br />

Regulation: http://www.ins.state.ny.us/r_finala/2010/rf194txt.pdf<br />

Circular Letter 18: http://www.ins.state.ny.us/circltr/2010/cl2010_18.pdf<br />

While producers are responsible for compliance with this regulation, a Frequently Asked Questions<br />

document and other resources are available from www.LFD.com regarding the requirements of the<br />

regulation (Note: This FAQ document does not apply to those registered with <strong>Lincoln</strong> Financial Advisors<br />

Corp., <strong>Lincoln</strong> Financial Securities Corp. or those affiliated with <strong>Lincoln</strong> Financial Network).<br />

These tools are intended to assist with compliance, but producers should first consult with their firm of affiliation<br />

to determine if they require any specific forms or procedures related to this regulation. Please contact your<br />

<strong>Lincoln</strong> representative if you have additional questions.<br />

For Agent/Broker Use Only – Not To Be Used With The General Public. Page 5 of 8

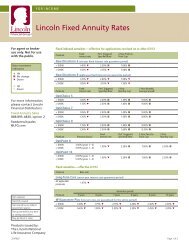

Update: NAIC Suitability in <strong>Annuity</strong> Transactions Model Regulation<br />

Requirements<br />

The NAIC Suitability in <strong>Annuity</strong> Transactions Model Regulation mandates general annuity and product-specific<br />

training requirements.<br />

General <strong>Annuity</strong> Training Requirement – This one-time, four-hour requirement applies to residents and nonresidents.<br />

The deadlines differ, depending on when the producer became licensed; see the chart below for<br />

details. To take the general annuity training, click on the link below. If a state-approved course has already<br />

been taken through another provider, the certificate of completion can be uploaded to the website:<br />

http://naic.pinpointglobal.com/<strong>Lincoln</strong>Financial/Apps/default.aspx<br />

Product-Specific Training Requirement – The product-specific training courses are required by state (see<br />

chart below for details). There are four <strong>Lincoln</strong> annuity training modules; producers can take one or multiple<br />

courses as needed: <strong>Fixed</strong> <strong>Annuity</strong>, <strong>Fixed</strong> Indexed <strong>Annuity</strong>, Variable <strong>Annuity</strong> and SPIA – Single Premium<br />

Immediate <strong>Annuity</strong>.<br />

General Training Course – These courses are provided on the LIMRA website. Please click on the<br />

following link to take the <strong>Lincoln</strong> product-specific course(s):<br />

http://naic.pinpointglobal.com/<strong>Lincoln</strong>Financial/Apps/default.aspx<br />

Addendum Updates – When <strong>Lincoln</strong> introduces new or enhanced products and features, the productspecific<br />

training material must be updated to reflect these changes. Producers who have previously taken<br />

the training will be notified (via email) by LIMRA that an updated training module is available. <strong>Lincoln</strong> has<br />

created an Addendum to the original training, noting changes and providing updated content. Producers<br />

must complete the Addendum training prior to submitting new business in the product lines impacted.<br />

More States Adopt NAIC <strong>Annuity</strong> Training Requirements – Texas has adopted the NAIC Suitability in<br />

<strong>Annuity</strong> Transactions Model Regulation. The following chart lists the states that have approved the new<br />

requirements to date, along with key deadlines for each. This information can also be found online in the <strong>Annuity</strong><br />

Education and Training Chart located in the “Conducting Business” section of the producer websites.<br />

State<br />

Effective Date<br />

General <strong>Annuity</strong><br />

Deadline if licensed<br />

prior to effective date<br />

General <strong>Annuity</strong> Deadline<br />

if NOT licensed prior to<br />

effective date*<br />

Product-Specific<br />

<strong>Annuity</strong> Deadline<br />

(for all producers)<br />

Iowa January 1, <strong>2011</strong> May 1, <strong>2011</strong> January 1, <strong>2011</strong> January 1, <strong>2011</strong><br />

Colorado April 1, <strong>2011</strong> October 1, <strong>2011</strong> April 1, <strong>2011</strong> April 1, <strong>2011</strong><br />

Wisconsin May 1, <strong>2011</strong> November 1, <strong>2011</strong> May 1, <strong>2011</strong> May 1, <strong>2011</strong><br />

Rhode Island June 1, <strong>2011</strong> December 1, <strong>2011</strong> June 1, <strong>2011</strong> June 1, <strong>2011</strong><br />

DC June 24, <strong>2011</strong> December 24, <strong>2011</strong> June 24, <strong>2011</strong> June 24, <strong>2011</strong><br />

New York June 30, <strong>2011</strong> Not required in NY Not required in NY June 30, <strong>2011</strong><br />

Ohio July 1, <strong>2011</strong> January 1, 2012 July 1, <strong>2011</strong> July 1, <strong>2011</strong><br />

Oregon July 1, <strong>2011</strong> January 1, 2012<br />

August 1, <strong>2011</strong><br />

July 1, <strong>2011</strong><br />

(if licensed prior to 8/1/11) (if not licensed by 8/1/11)<br />

West Virginia July 1, <strong>2011</strong> December 31, <strong>2011</strong> July 1, <strong>2011</strong> July 1, <strong>2011</strong><br />

North Dakota August 1, <strong>2011</strong> August 1, 2012 August 1, <strong>2011</strong> August 1, <strong>2011</strong><br />

Texas <strong>September</strong> 1, <strong>2011</strong> March 1, 2012 <strong>September</strong> 1, <strong>2011</strong> <strong>September</strong> 1, <strong>2011</strong><br />

(3/1/12 if licensed by 9/1/11)<br />

South Carolina <strong>September</strong> 25, <strong>2011</strong> March 25, 2012 <strong>September</strong> 25, <strong>2011</strong> <strong>September</strong> 25, <strong>2011</strong><br />

Maryland November 1, <strong>2011</strong> May 1, 2012 November 1, <strong>2011</strong> November 1, <strong>2011</strong><br />

Indiana January 1, 2012 July 1, 2012 January 1, 2012 January 1, 2012<br />

Hawaii January 31, 2012 January 31, 2012 January 31, 2012 January 1, 2012<br />

* Producers licensed on or after the effective date must complete this requirement prior to selling annuities.<br />

Click Here to view the state-specific <strong>Annuity</strong> Education and Training Chart for more information.<br />

For Agent/Broker Use Only – Not To Be Used With The General Public. Page 6 of 8

Transition Information for Guaranteed Lifetime Withdrawal Benefit Riders (as of <strong>September</strong> 19, <strong>2011</strong>)<br />

State<br />

<strong>Lincoln</strong> Lifetime Income SM<br />

Edge<br />

First Available Issue Date<br />

<strong>Lincoln</strong> Living Income SM<br />

Advantage<br />

Last Available Issue Date<br />

Comments<br />

Alabama 06/01/11 08/01/11 Closed<br />

Alaska 06/01/11 08/01/11 Closed<br />

Arizona 06/01/11 08/01/11 Closed<br />

Arkansas 06/01/11 08/01/11 Closed<br />

California<br />

Colorado 06/01/11 08/01/11 Closed<br />

Connecticut 07/01/11 09/01/11 Closed<br />

Delaware 06/22/11 08/22/11 Closed<br />

District Of Columbia 06/01/11 08/01/11 Closed<br />

Florida 07/01/11 09/01/11 Closed<br />

Georgia 06/01/11 08/01/11 Closed<br />

Guam<br />

Hawaii 07/01/11 09/01/11 Closed<br />

Idaho 06/01/11 08/01/11 Closed<br />

Illinois 07/01/11 09/01/11 Closed<br />

Indiana 06/01/11 08/01/11 Closed<br />

Iowa 06/01/11 08/01/11 Closed<br />

Kansas 06/01/11 08/01/11 Closed<br />

Kentucky 06/01/11 08/01/11 Closed<br />

Louisiana 06/01/11 08/01/11 Closed<br />

Maine 06/01/11 08/01/11 Closed<br />

Maryland 06/22/11 08/22/11 Closed No Nursing Home Enhancement<br />

Massachusetts 06/08/11 08/08/11 Closed Nursing Home approved 09/01/11<br />

Michigan 06/01/11 08/01/11 Closed<br />

Minnesota 09/08/11 11/08/11<br />

Mississippi 06/15/11 08/15/11 Closed<br />

Missouri 06/01/11 08/01/11 Closed<br />

Montana 06/01/11 08/01/11 Closed<br />

Nebraska 06/01/11 08/01/11 Closed<br />

Nevada<br />

New Hampshire 06/01/11 08/01/11 Closed<br />

New Jersey 06/01/11 08/01/11 Closed<br />

New Mexico 06/01/11 08/01/11 Closed<br />

New York --- --- Will not file<br />

North Carolina 06/15/11 08/15/11 Closed<br />

North Dakota 06/01/11 08/01/11 Closed<br />

Ohio 06/01/11 08/01/11 Closed<br />

Oklahoma 06/01/11 08/01/11 Closed<br />

Oregon 08/01/11 10/01/11<br />

Pennsylvania 06/01/11 08/01/11 Closed<br />

Puerto Rico 06/15/11 08/15/11 Closed<br />

Rhode Island 06/01/11 08/01/11 Closed<br />

South Carolina 06/01/11 08/01/11 Closed<br />

South Dakota 06/01/11 08/01/11 Closed<br />

Tennessee 06/01/11 08/01/11 Closed<br />

Texas 06/15/11 08/15/11 Closed<br />

Utah 06/01/11 08/01/11 Closed<br />

Vermont 06/01/11 08/01/11 Closed<br />

Virgin Island 06/01/11 08/01/11 Closed<br />

Virginia 06/01/11 08/01/11 Closed<br />

Washington --- --- Disapproved<br />

West Virginia 06/01/11 08/01/11 Closed<br />

Wisconsin 06/01/11 08/01/11 Closed<br />

Wyoming 06/01/11 08/01/11 Closed<br />

For Agent/Broker Use Only – Not To Be Used With The General Public. Page 7 of 8

<strong>Fixed</strong> <strong>Annuity</strong> Contact Information<br />

Reminder<br />

• Enter <strong>Lincoln</strong> Rep/Agent<br />

Number and <strong>Marketing</strong> Firm<br />

Name (if applicable) on all<br />

applications.<br />

• Check the “Direct” or “Other”<br />

box on the Rep page.<br />

• Be sure to enter complete<br />

contact information:<br />

- Telephone number<br />

- Email address<br />

- Fax<br />

• Note the correct business<br />

telephone and address.<br />

Product Availability<br />

Click here to view the<br />

current product availability<br />

chart.<br />

Click here to view the<br />

current bank product<br />

availability chart.<br />

Index to Articles<br />

Click here to view the Index of<br />

Articles for past issues of the<br />

<strong>Fixed</strong> <strong>Annuity</strong> <strong>Lincoln</strong> <strong>Leader</strong>.<br />

Sales Desk<br />

Product questions/ Sales ideas/<br />

Illustrations/ Website training<br />

Producer Solutions<br />

Licensing/ Contracting/<br />

Compensation<br />

New Business<br />

and Post-Issue<br />

Contact Centers<br />

(for Agent/Client use)<br />

<strong>Fixed</strong> <strong>Annuity</strong> Sales Desk<br />

Agent Use Only<br />

Operating hours: 8AM – 7PM ET<br />

Sales Desk: 888-895-4830, Option 2<br />

<strong>Fixed</strong><strong>Annuity</strong>Sales@lfd.com<br />

Licensing/Contracting<br />

Call Center: 800-238-6252, Option 1, Option 2<br />

New Contracting Paperwork Submission:<br />

Contracting@lfg.com<br />

Fax: 603-226-5311<br />

Licensing Status Updates:<br />

LicensingStatus@lfg.com<br />

Compensation<br />

Call Center: 800-238-6252, Option 1, Option 1<br />

Commission questions:<br />

Commissions@lfg.com<br />

FAX Numbers<br />

New business: 260-455-0271(fax)<br />

Post issue: 260-455-0263 (fax)<br />

Overnight Servicing Address<br />

<strong>Lincoln</strong> Financial Group<br />

Individual <strong>Annuity</strong> Operations<br />

1300 South Clinton Street<br />

Fort Wayne, IN 46802-3506<br />

Servicing Address<br />

<strong>Lincoln</strong> Financial Group<br />

P.O. Box 2348<br />

Fort Wayne, IN 46801-2348<br />

<strong>Fixed</strong> and <strong>Fixed</strong> Indexed <strong>Annuity</strong>:<br />

888-916-4900<br />

<strong>Lincoln</strong> SmartIncome SM and <strong>Lincoln</strong> Long-Term<br />

Care SM and annuitization: 877-534-4636<br />

Not a deposit<br />

Not FDIC-insured<br />

Not insured by any<br />

federal government<br />

agency<br />

Not guaranteed by any<br />

bank or savings<br />

association<br />

May go down in value<br />

You must be logged in to one of the producer sites to access the attachments<br />

(LFAplanner/LFD.com/<strong>Lincoln</strong>FinancialNetwork.com). If you are logged in and<br />

are trying to get to a document and are prompted with a new log-in screen, just<br />

hit the “Login Button” and the document will flow through and open.<br />

Products and features subject to state availability. Some of these products are only available in<br />

select distribution channels. Check your selling agreement for availability.<br />

<strong>Lincoln</strong> fixed, fixed indexed and immediate annuities are issued by The <strong>Lincoln</strong> National Life Insurance<br />

Company, Fort Wayne, IN. The <strong>Lincoln</strong> National Life Insurance Company does not solicit business in<br />

the state of New York, nor is it authorized to do so. The "contract" may be referred to as a "certificate" in<br />

certain states. The certificate is a group annuity certificate issued under a group annuity contract issued<br />

by The <strong>Lincoln</strong> National Life Insurance Company to a group annuity trust. Contractual obligations are<br />

backed by the claims-paying ability of The <strong>Lincoln</strong> National Life Insurance Company.<br />

Contracts sold in New York are issued by <strong>Lincoln</strong> Life & <strong>Annuity</strong> Company of New York, Syracuse, NY.<br />

The contractual obligations are backed by the claims-paying ability of <strong>Lincoln</strong> Life & <strong>Annuity</strong><br />

Company of New York.<br />

<strong>Lincoln</strong> Financial Group is the marketing name for <strong>Lincoln</strong> National Corporation and its affiliates.<br />

Affiliates are separately responsible for their own financial and contractual obligations.<br />

© <strong>2011</strong> The <strong>Lincoln</strong> National Life Insurance Company, Fort Wayne, IN 46801<br />

LCN <strong>2011</strong>09-2059112<br />

Newsletter compiled and edited by Ellen Hollis, <strong>Lincoln</strong> Insurance<br />

and Retirement Solutions, Product and Distribution Support.<br />

Please send any comments or suggestions regarding the <strong>Fixed</strong><br />

<strong>Annuity</strong> <strong>Lincoln</strong> <strong>Leader</strong> newsletter to: Ellen.Hollis@LFG.com<br />

For Agent/Broker Use Only – Not To Be Used With The General Public. Page 8 of 8