Annuity Product Grid 2-15-10 - ECA Marketing

Annuity Product Grid 2-15-10 - ECA Marketing

Annuity Product Grid 2-15-10 - ECA Marketing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

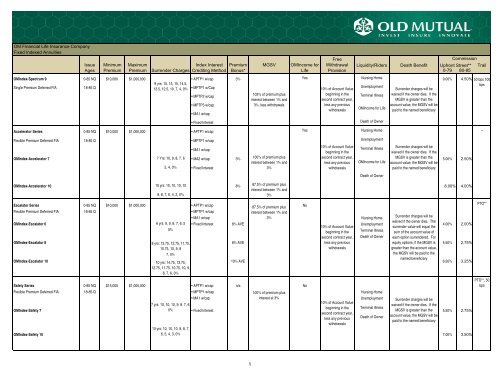

OM Financial Life Insurance Company<br />

Fixed Indexed Annuities<br />

Free<br />

Commission<br />

Issue Minimum Maximum<br />

Index Interest Premium MGSV OMIncome for Withdrawal Liquidity/Riders Death Benefit Upfront Street** Trail<br />

Ages Premium Premium Surrender Charges Crediting Method Bonus*<br />

Life Provision<br />

0-79 80-85<br />

OMIndex-Spectrum 9 0-85 NQ $<strong>10</strong>,000 $1,000,000 • APTP1 w/cap 3% Yes Nursing Home 9.00% 4.50% 50 bps <strong>10</strong>0<br />

Single Premium Deferred FIA 18-85 Q<br />

9 yrs: <strong>15</strong>, <strong>15</strong>, <strong>15</strong>, 14.5,<br />

• MPTP1 w/Cap Unemployment<br />

13.5, 12.5, <strong>10</strong>, 7, 4, 0%<br />

<strong>10</strong>% of Account Value<br />

Surrender charges will be<br />

bps<br />

• MPTP2 w/cap<br />

<strong>10</strong>3% of premium plus<br />

beginning in the Terminal Illness waived if the owner dies. If the<br />

interest between 1% and<br />

second contract year,<br />

MGSV is greater than the<br />

• MPTP3 w/cap<br />

3%, less withdrawals<br />

less any previous<br />

account value, the MGSV will be<br />

withdrawals<br />

OMIncome for Life<br />

paid to the named beneficiary<br />

• MA1 w/cap<br />

• Fixed Interest<br />

Death of Owner<br />

Accelerator Series 0-85 NQ $<strong>10</strong>,000 $1,000,000 • APTP1 w/cap Yes Nursing Home --<br />

Flexible Premium Deferred FIA 18-85 Q • MPTP1 w/cap Unemployment<br />

• MA1 w/cap<br />

<strong>10</strong>% of Account Value<br />

Terminal Illness<br />

Surrender charges will be<br />

beginning in the<br />

waived if the owner dies. If the<br />

OMIndex-Accelerator 7 7 Yrs: <strong>10</strong>, 9, 8, 7, 6 • MA2 w/cap 3%<br />

<strong>10</strong>0% of premium plus<br />

second contract year,<br />

MGSV is greater than the<br />

interest between 1% and<br />

less any previous OMIncome for Life account value, the MGSV will be<br />

5.00% 2.50%<br />

5, 4, 0% • Fixed Interest<br />

3%<br />

withdrawals<br />

paid to the named beneficiary<br />

Death of Owner<br />

OMIndex-Accelerator <strong>10</strong> <strong>10</strong> yrs: <strong>10</strong>, <strong>10</strong>, <strong>10</strong>, <strong>10</strong> 8%<br />

87.5% of premium plus<br />

8.00% 4.00%<br />

interest between 1% and<br />

9, 8, 7, 6, 4, 2, 0%<br />

3%<br />

Escalator Series 0-85 NQ $<strong>10</strong>,000 $1,000,000 • APTP1 w/cap<br />

87.5% of premium plus<br />

No<br />

Flexible Premium Deferred FIA 18-85 Q • MPTP1 w/cap<br />

interest between 1% and<br />

OMIndex-Escalator 6<br />

• MA1 w/cap<br />

3%<br />

Nursing Home<br />

Surrender charges will be<br />

waived if the owner dies. The<br />

6 yrs: 9, 9, 8, 7, 6, 5 • Fixed Interest 6% AVE Unemployment<br />

<strong>10</strong>% of Account Value<br />

surrender value will equal the<br />

0%<br />

beginning in the Terminal Illness sum of the account value of<br />

4.00% 2.00%<br />

second contract year, Death of Owner each option surrendered. For<br />

OMIndex-Escalator 8 8 yrs: 13.75, 12.75, 11.75,<br />

8% AVE less any previous<br />

equity options, if the MGSV is 5.50% 2.75%<br />

<strong>10</strong>.75, <strong>10</strong>, 9, 8<br />

withdrawals<br />

greater than the account value,<br />

7, 0%<br />

the MGSV will be paid to the<br />

OMIndex-Escalator <strong>10</strong> <strong>10</strong> yrs: 14.75, 13.75,<br />

<strong>10</strong>% AVE<br />

named beneficiary<br />

6.50% 3.25%<br />

12.75, 11.75, <strong>10</strong>.75, <strong>10</strong>, 9,<br />

8, 7, 6, 0%<br />

Safety Series 0-85 NQ $<strong>15</strong>,000 $1,000,000 • APTP1 w/cap n/a No<br />

Flexible Premium Deferred FIA 18-85 Q • MPTP1 w/cap <strong>10</strong>0% of premium plus<br />

Nursing Home<br />

• MA1 w/cap<br />

interest at 3%<br />

Unemployment<br />

<strong>10</strong>% of Account Value<br />

7 yrs: <strong>10</strong>, <strong>10</strong>, <strong>10</strong>, 9, 8, 7, 6,<br />

beginning in the<br />

OMIndex-Safety 7<br />

0% • Fixed Interest<br />

second contract year,<br />

Terminal Illness<br />

less any previous Death of Owner<br />

withdrawals<br />

OMIndex-Safety <strong>10</strong><br />

Surrender charges will be<br />

waived if the owner dies. If the<br />

MGSV is greater than the<br />

account value, the MGSV will be<br />

paid to the named beneficiary<br />

5.50% 2.75%<br />

<strong>10</strong> yrs: <strong>10</strong>, <strong>10</strong>, <strong>10</strong>, 9, 8, 7,<br />

6, 5, 4, 3, 0% 7.00% 3.50%<br />

PTO**<br />

PTO**, 50<br />

bps<br />

1

OM Financial Life Insurance Company<br />

Traditional Annuities<br />

Free<br />

Commission<br />

Issue Minimum Maximum<br />

Index Interest Premium MGIR OMIncome for Withdrawal Liquidity/Riders Death Benefit Upfront Street** Trail<br />

Ages Premium Premium Surrender Charges Crediting Method Bonus*<br />

Life Provision<br />

0-79 80-90<br />

Guarantee Series 0-90 NQ $5,000 NQ $600,000 n/a n/a Between 1% and 3% No Account value. --<br />

$2,000 Q Nursing Home<br />

OMGuarantee-Platinum 3 3 yrs: 9, 8, 7% Unemployment 1.50% 0.75%<br />

Up to the amount of Terminal Illness<br />

the accumulated<br />

OMGuarantee-Platinum 5 5 yrs: 9, 8, 7, 6, 5% interest without<br />

2.50% 1.25%<br />

surrender charges.<br />

OMGuarantee-Platinum 7 7 yrs: 9, 8, 7, 6, 5, 4 3.25% 1.625%<br />

3%<br />

Guarantee Plus Series 0-90 NQ $5,000 NQ $600,000 n/a 1% Between 1% and 3% No None Surrender value. --<br />

$2,000 Q<br />

OMGuarantee-Plus 3 3 yrs: 9, 8, 7% 1.50% 0.75%<br />

Up to the amount of<br />

the accumulated<br />

OMGuarantee-Plus 5 5 yrs: 9, 8, 7, 6, 5% interest without<br />

2.50% 1.25%<br />

surrender charges.<br />

OMGuarantee-Plus 7 7 yrs: 9, 8, 7, 6, 5, 4 3.25% 1.625%<br />

3%'<br />

Index Options Abbreviations Explained<br />

<strong>Annuity</strong> Payment Options for all traditional and indexed annuities<br />

APTP1 w/cap 1-Year S&P 500® Annual Point-to-Point w/ Cap • Income for a fixed period<br />

MPTP1 w/cap 1-Year S&P 500® Monthly Point-to-Point w/ Cap • Life Income with a Guaranteed Period<br />

MPTP2 w/cap 2-Year S&P 500® Monthly Point-to-Point w/ Cap • Life Income<br />

MPTP3 w/cap 3-Year S&P 500® Monthly Point-to-Point w/ Cap • Joint and Contingent Life Income<br />

MA1 w/cap 1-Year S&P 500® Monthly Average w/ Cap • Joint and Survivor Life Income with a Guaranteed Period<br />

MA2 w/cap 2-Year S&P 500® Monthly Average w/ Cap • Joint and Survivor Life Income<br />

• Life Income with a Lump Sum Refund at Death<br />

Contracts issued by OM Financial Life Insurance Company, Baltimore, MD. Optional provisions and riders may have limitations, restrictions and additional charges. Subject to state availability. Certain restrictions may apply.<br />

“S&P 500® ” is a trademarks of The McGraw-Hill Companies, Inc. and has been licensed for use by OM Financial Life Insurance Company. Standard & Poor’s does not sponsor, endorse, promote, or make any representation<br />

regarding the advisability of purchasing the contracts.<br />

*Subject to change.<br />

**Performance Trail Option (PTO) pays <strong>10</strong>% of each crediting method interest as compensation.<br />

All fixed indexed annuities have a <strong>10</strong>0% participation rate in the indexing formula. 2/<strong>15</strong>/<strong>10</strong> FOR PRODUCER USE ONLY - NOT FOR USE WITH THE GENERAL PUBLIC<br />

09-171<br />

2