IPO Sales Memo - SMS Pharmaceuticals Limited - Finapolis

IPO Sales Memo - SMS Pharmaceuticals Limited - Finapolis

IPO Sales Memo - SMS Pharmaceuticals Limited - Finapolis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

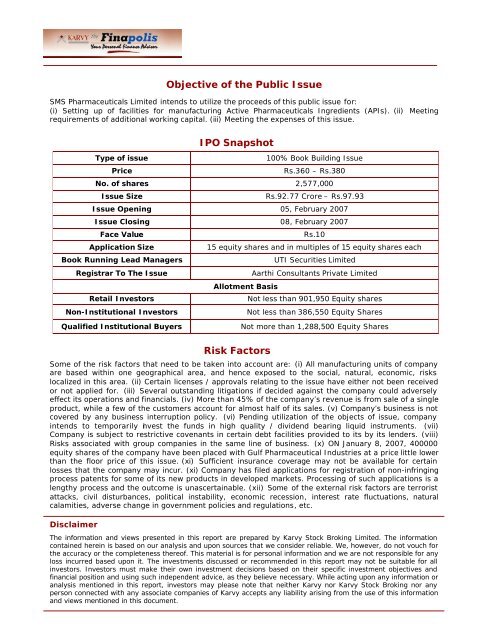

Objective of the Public Issue<br />

<strong>SMS</strong> <strong>Pharmaceuticals</strong> <strong>Limited</strong> intends to utilize the proceeds of this public issue for:<br />

(i) Setting up of facilities for manufacturing Active <strong>Pharmaceuticals</strong> Ingredients (APIs). (ii) Meeting<br />

requirements of additional working capital. (iii) Meeting the expenses of this issue.<br />

<strong>IPO</strong> Snapshot<br />

Type of issue<br />

100% Book Building Issue<br />

Price<br />

Rs.360 – Rs.380<br />

No. of shares 2,577,000<br />

Issue Size<br />

Rs.92.77 Crore – Rs.97.93<br />

Issue Opening 05, February 2007<br />

Issue Closing 08, February 2007<br />

Face Value<br />

Rs.10<br />

Application Size<br />

15 equity shares and in multiples of 15 equity shares each<br />

Book Running Lead Managers<br />

UTI Securities <strong>Limited</strong><br />

Registrar To The Issue<br />

Aarthi Consultants Private <strong>Limited</strong><br />

Allotment Basis<br />

Retail Investors<br />

Not less than 901,950 Equity shares<br />

Non-Institutional Investors<br />

Not less than 386,550 Equity Shares<br />

Qualified Institutional Buyers<br />

Not more than 1,288,500 Equity Shares<br />

Disclaimer<br />

Risk Factors<br />

Some of the risk factors that need to be taken into account are: (i) All manufacturing units of company<br />

are based within one geographical area, and hence exposed to the social, natural, economic, risks<br />

localized in this area. (ii) Certain licenses / approvals relating to the issue have either not been received<br />

or not applied for. (iii) Several outstanding litigations if decided against the company could adversely<br />

effect its operations and financials. (iv) More than 45% of the company’s revenue is from sale of a single<br />

product, while a few of the customers account for almost half of its sales. (v) Company’s business is not<br />

covered by any business interruption policy. (vi) Pending utilization of the objects of issue, company<br />

intends to temporarily invest the funds in high quality / dividend bearing liquid instruments. (vii)<br />

Company is subject to restrictive covenants in certain debt facilities provided to its by its lenders. (viii)<br />

Risks associated with group companies in the same line of business. (x) ON January 8, 2007, 400000<br />

equity shares of the company have been placed with Gulf Pharmaceutical Industries at a price little lower<br />

than the floor price of this issue. (xi) Sufficient insurance coverage may not be available for certain<br />

losses that the company may incur. (xi) Company has filed applications for registration of non-infringing<br />

process patents for some of its new products in developed markets. Processing of such applications is a<br />

lengthy process and the outcome is unascertainable. (xii) Some of the external risk factors are terrorist<br />

attacks, civil disturbances, political instability, economic recession, interest rate fluctuations, natural<br />

calamities, adverse change in government policies and regulations, etc.<br />

The information and views presented in this report are prepared by Karvy Stock Broking <strong>Limited</strong>. The information<br />

contained herein is based on our analysis and upon sources that we consider reliable. We, however, do not vouch for<br />

the accuracy or the completeness thereof. This material is for personal information and we are not responsible for any<br />

loss incurred based upon it. The investments discussed or recommended in this report may not be suitable for all<br />

investors. Investors must make their own investment decisions based on their specific investment objectives and<br />

financial position and using such independent advice, as they believe necessary. While acting upon any information or<br />

analysis mentioned in this report, investors may please note that neither Karvy nor Karvy Stock Broking nor any<br />

person connected with any associate companies of Karvy accepts any liability arising from the use of this information<br />

and views mentioned in this document.