IPO Sales Memo - SMS Pharmaceuticals Limited - Finapolis

IPO Sales Memo - SMS Pharmaceuticals Limited - Finapolis

IPO Sales Memo - SMS Pharmaceuticals Limited - Finapolis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

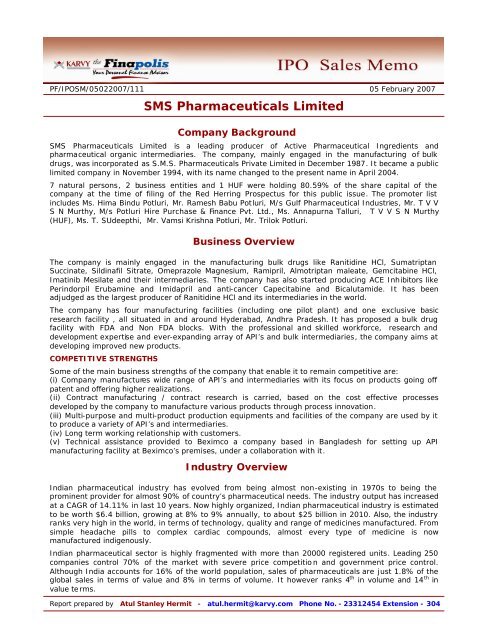

PF/<strong>IPO</strong>SM/05022007/111 05 February 2007<br />

<strong>SMS</strong> <strong>Pharmaceuticals</strong> <strong>Limited</strong><br />

Company Background<br />

<strong>SMS</strong> <strong>Pharmaceuticals</strong> <strong>Limited</strong> is a leading producer of Active Pharmaceutical Ingredients and<br />

pharmaceutical organic intermediaries. The company, mainly engaged in the manufacturing of bulk<br />

drugs, was incorporated as S.M.S. <strong>Pharmaceuticals</strong> Private <strong>Limited</strong> in December 1987. It became a public<br />

limited company in November 1994, with its name changed to the present name in April 2004.<br />

7 natural persons, 2 business entities and 1 HUF were holding 80.59% of the share capital of the<br />

company at the time of filing of the Red Herring Prospectus for this public issue. The promoter list<br />

includes Ms. Hima Bindu Potluri, Mr. Ramesh Babu Potluri, M/s Gulf Pharmaceutical Industries, Mr. T V V<br />

S N Murthy, M/s Potluri Hire Purchase & Finance Pvt. Ltd., Ms. Annapurna Talluri, T V V S N Murthy<br />

(HUF), Ms. T. SUdeepthi, Mr. Vamsi Krishna Potluri, Mr. Trilok Potluri.<br />

The company is mainly engaged in the manufacturing bulk drugs like Ranitidine HCl, Sumatriptan<br />

Succinate, Sildinafil Sitrate, Omeprazole Magnesium, Ramipril, Almotriptan maleate, Gemcitabine HCl,<br />

Imatinib Mesilate and their intermediaries. The company has also started producing ACE Inhibitors like<br />

Perindorpil Erubamine and Imidapril and anti-cancer Capecitabine and Bicalutamide. It has been<br />

adjudged as the largest producer of Ranitidine HCl and its intermediaries in the world.<br />

The company has four manufacturing facilities (including one pilot plant) and one exclusive basic<br />

research facility , all situated in and around Hyderabad, Andhra Pradesh. It has proposed a bulk drug<br />

facility with FDA and Non FDA blocks. With the professional and skilled workforce, research and<br />

development expertise and ever-expanding array of API’s and bulk intermediaries, the company aims at<br />

developing improved new products.<br />

COMPETITIVE STRENGTHS<br />

Business Overview<br />

Some of the main business strengths of the company that enable it to remain competitive are:<br />

(i) Company manufactures wide range of API’s and intermediaries with its focus on products going off<br />

patent and offering higher realizations.<br />

(ii) Contract manufacturing / contract research is carried, based on the cost effective processes<br />

developed by the company to manufacture various products through process innovation.<br />

(iii) Multi-purpose and multi-product production equipments and facilities of the company are used by it<br />

to produce a variety of API’s and intermediaries.<br />

(iv) Long term working relationship with customers.<br />

(v) Technical assistance provided to Beximco a company based in Bangladesh for setting up API<br />

manufacturing facility at Beximco’s premises, under a collaboration with it.<br />

Industry Overview<br />

Indian pharmaceutical industry has evolved from being almost non-existing in 1970s to being the<br />

prominent provider for almost 90% of country’s pharmaceutical needs. The industry output has increased<br />

at a CAGR of 14.11% in last 10 years. Now highly organized, Indian pharmaceutical industry is estimated<br />

to be worth $6.4 billion, growing at 8% to 9% annually, to about $25 billion in 2010. Also, the industry<br />

ranks very high in the world, in terms of technology, quality and range of medicines manufactured. From<br />

simple headache pills to complex cardiac compounds, almost every type of medicine is now<br />

manufactured indigenously.<br />

Indian pharmaceutical sector is highly fragmented with more than 20000 registered units. Leading 250<br />

companies control 70% of the market with severe price competition and government price control.<br />

Although India accounts for 16% of the world population, sales of pharmaceuticals are just 1.8% of the<br />

global sales in terms of value and 8% in terms of volume. It however ranks 4 th in volume and 14 th in<br />

value terms.<br />

Report prepared by Atul Stanley Hermit - atul.hermit@karvy.com Phone No. - 23312454 Extension - 304

Management Organizational Structure<br />

Board of Directors<br />

Chairman & Managing Director<br />

Vice Chairman & Joint Managing Director<br />

GM Marketing<br />

GM Purchase & HR<br />

VP Technical & Operations<br />

GM Finance<br />

GM Research Centre<br />

Manager<br />

Marketing USA,<br />

Canada, & Latin<br />

America<br />

Manager<br />

Marketing<br />

Europe<br />

Asst. GM<br />

Administration<br />

Senior Manager<br />

Raw Materials<br />

Senior Manager<br />

Projects<br />

GM Unit I<br />

– Khazipally<br />

Asst. GM Unit II<br />

– Bachupally<br />

GM Unit III<br />

– Jeedimetla<br />

Manager Finance<br />

Manager<br />

Secretarial<br />

Manager<br />

Accounts<br />

Manager<br />

Analytical<br />

Development<br />

Manager<br />

Product<br />

Development<br />

Manager<br />

Marketing India,<br />

Bangladesh, &<br />

Documentation<br />

Manager<br />

Marketing Rest<br />

of World<br />

Mr. Ramesh Babu Potluri,<br />

Managing Director<br />

Asst. GM<br />

Miscellaneous<br />

Purchase<br />

Senior Manager<br />

Job Works<br />

Board of Directors of Company<br />

Chairman and<br />

Mr. T V V S N Murthy, Vice Chairman and<br />

Joint Managing Director<br />

Mr. A. P. Rao, Non Executive and Independent<br />

Director<br />

The Competition & Clientele<br />

Dr. Mihir K. Chaudhuri, Non Executive and<br />

Independent Director<br />

Dr. B. Manoranjan Choudary, Non Executive<br />

and Independent Director<br />

Mr. K. Subramanyeswar Rao, Non Executive<br />

and Independent Director<br />

Mr. Vinod Goel, Nominee Director (EXIM Bank)<br />

The major competitors of the company, with respect to particular product segments, are:<br />

• Saraca Laboratories<br />

• Dr. Reddy’s Laboratories<br />

• Neuland Laboratories<br />

• Natco Pharma<br />

• Aarthi Drugs<br />

• Shipa Medicare<br />

• Benzochem<br />

• Rakshit Drugs<br />

• DSM<br />

• Matrix Laboratories<br />

• Cipla<br />

• Cadila Pharma<br />

• Hetero Drugs<br />

THE CLIENTELE<br />

International<br />

• Scino Pharma Kushan Biochemical Ltd.<br />

• Spanchem S. L.<br />

• Helm De Mexico S. A.<br />

• Chemo S. A.<br />

• Tektrade Ltd.<br />

• Albion Laboratories Ltd.<br />

• Beximco <strong>Pharmaceuticals</strong> Ltd.<br />

• Mione Trading Ltd. – Bulgaria<br />

• Ap Dept. Teva Pharm USA<br />

• PKK Chemical Marketing WLL<br />

Domestic<br />

• Ranbaxy Laboratories Ltd.<br />

• Cadila <strong>Pharmaceuticals</strong> Ltd.<br />

• Orchev Pharma Pvt. Ltd.<br />

• Disha Enterprises<br />

• Dabur Pharma Ltd.<br />

• Nueland Laboratories Ltd.<br />

• Torrent <strong>Pharmaceuticals</strong> Ltd.<br />

• Shilpa Medicare Ltd.<br />

• Unimed Technologies Ltd.<br />

• Unique Pharma Labs

.<br />

The key performance figures for <strong>SMS</strong> <strong>Pharmaceuticals</strong> <strong>Limited</strong> are as follows (in Rs. Crore):<br />

6 months<br />

ended 30th<br />

Sep. 2006<br />

Year ended<br />

31st March<br />

2006<br />

Year ended<br />

31st March<br />

2005<br />

Year ended<br />

31st March<br />

2004<br />

9 months<br />

ended 31st<br />

March 2003<br />

12 months<br />

ended 30th<br />

June 2002<br />

Total Income 97.63 133.48 121.21 118.36 51.95 79.69<br />

EBIDT 21.11 24.14 19.77 18.72 8.84 12.65<br />

PAT 10.6 8.51 8.45 7.49 2.33 5.92<br />

Total Assets 170.13 159.27 147.44 123.41 96.16 93.33<br />

Total<br />

Liabilities 108.35 110.41 105.69 87.53 64.44 54.18<br />

Net Worth 61.78 48.86 41.75 35.88 31.72 39.15<br />

Dividend (in<br />

%) 20.00% 20.00% 20.00% 20.00% 20.00% 20.00%<br />

Adjusted EPS 16.12 * 20.75 20.6 18.28<br />

RONW (in %) 17.16% 17.41% 20.23% 20.88%<br />

* Non Annualized<br />

Company Financials<br />

Capital Structure<br />

Details<br />

Nominal Value (in Rs.)<br />

Existing Equity Capital (7,423,000 shares @ Rs. 10 / share) 74,230,000<br />

Present Issue (2,577,000 shares @ Rs. 10 / share) 25,770,000<br />

Equity shares after the issue (10,000,000 shares @ Rs.10 / share) 100,000,000<br />

Corporate Strategy<br />

Key elements of the business growth strategy for <strong>SMS</strong> <strong>Pharmaceuticals</strong> <strong>Limited</strong> are:<br />

Proposed marketing set-up – The company intends to focus on increasing its sales in regulated<br />

markets such as those in US and other European countries. Also, it will continue to look for opportunities<br />

for supply of its advanced intermediates to large companies, on a mutually beneficial proposition.<br />

Upgrade existing manufacturing facilities – Company aims at upgrading its existing facilities to<br />

make these compliant with international regulations like US FDA. This would assist in greater<br />

acceptability of the company’s products in foreign markets.<br />

Establishment of new facilities – Company aims at establishment of new facilities to enhance the<br />

existing manufacturing capabilities while also adding to the production capacity.<br />

Reduction of operational costs – Company wants to remain a cost competitive entity, and will be<br />

focusing on the reduction of its operational costs to increase its competitiveness.<br />

Improving manufacturing technology – Company aims at achieving best productivity, energy<br />

efficiency and cost effectiveness by improving its process technology that has been developed in-house.<br />

Enhancing employee skills & efficiencies – Company conducts periodic training for all its technical<br />

staff to upgrade and hone their skills. Further, the management provides good working conditions and<br />

encouragement to innovative ideas to spurs the employees to excel in their work area.<br />

Reducing environmental pollution – Company is committed to providing a safe, clean and healthy<br />

environment and continuously strives to minimize generation of waste water and air emissions thereby<br />

preventing pollution. The company does this by using cleaner technologies, reducing use of natural<br />

resources, and reusing & recycling wastes.<br />

More focus on research and development – Research and development being the key to the future of<br />

the pharmaceutical industry, as well as the basis for the increase in life expectancy and health all over<br />

the world, the company plans to: develop non-infringing synthesizer for its API’s and intermediaries;<br />

conduct basic research for new chemical entities; customize synthesis (where synthesis route is<br />

developed by it) & otherwise contract synthesis; and synthesis of special chemicals.

Objective of the Public Issue<br />

<strong>SMS</strong> <strong>Pharmaceuticals</strong> <strong>Limited</strong> intends to utilize the proceeds of this public issue for:<br />

(i) Setting up of facilities for manufacturing Active <strong>Pharmaceuticals</strong> Ingredients (APIs). (ii) Meeting<br />

requirements of additional working capital. (iii) Meeting the expenses of this issue.<br />

<strong>IPO</strong> Snapshot<br />

Type of issue<br />

100% Book Building Issue<br />

Price<br />

Rs.360 – Rs.380<br />

No. of shares 2,577,000<br />

Issue Size<br />

Rs.92.77 Crore – Rs.97.93<br />

Issue Opening 05, February 2007<br />

Issue Closing 08, February 2007<br />

Face Value<br />

Rs.10<br />

Application Size<br />

15 equity shares and in multiples of 15 equity shares each<br />

Book Running Lead Managers<br />

UTI Securities <strong>Limited</strong><br />

Registrar To The Issue<br />

Aarthi Consultants Private <strong>Limited</strong><br />

Allotment Basis<br />

Retail Investors<br />

Not less than 901,950 Equity shares<br />

Non-Institutional Investors<br />

Not less than 386,550 Equity Shares<br />

Qualified Institutional Buyers<br />

Not more than 1,288,500 Equity Shares<br />

Disclaimer<br />

Risk Factors<br />

Some of the risk factors that need to be taken into account are: (i) All manufacturing units of company<br />

are based within one geographical area, and hence exposed to the social, natural, economic, risks<br />

localized in this area. (ii) Certain licenses / approvals relating to the issue have either not been received<br />

or not applied for. (iii) Several outstanding litigations if decided against the company could adversely<br />

effect its operations and financials. (iv) More than 45% of the company’s revenue is from sale of a single<br />

product, while a few of the customers account for almost half of its sales. (v) Company’s business is not<br />

covered by any business interruption policy. (vi) Pending utilization of the objects of issue, company<br />

intends to temporarily invest the funds in high quality / dividend bearing liquid instruments. (vii)<br />

Company is subject to restrictive covenants in certain debt facilities provided to its by its lenders. (viii)<br />

Risks associated with group companies in the same line of business. (x) ON January 8, 2007, 400000<br />

equity shares of the company have been placed with Gulf Pharmaceutical Industries at a price little lower<br />

than the floor price of this issue. (xi) Sufficient insurance coverage may not be available for certain<br />

losses that the company may incur. (xi) Company has filed applications for registration of non-infringing<br />

process patents for some of its new products in developed markets. Processing of such applications is a<br />

lengthy process and the outcome is unascertainable. (xii) Some of the external risk factors are terrorist<br />

attacks, civil disturbances, political instability, economic recession, interest rate fluctuations, natural<br />

calamities, adverse change in government policies and regulations, etc.<br />

The information and views presented in this report are prepared by Karvy Stock Broking <strong>Limited</strong>. The information<br />

contained herein is based on our analysis and upon sources that we consider reliable. We, however, do not vouch for<br />

the accuracy or the completeness thereof. This material is for personal information and we are not responsible for any<br />

loss incurred based upon it. The investments discussed or recommended in this report may not be suitable for all<br />

investors. Investors must make their own investment decisions based on their specific investment objectives and<br />

financial position and using such independent advice, as they believe necessary. While acting upon any information or<br />

analysis mentioned in this report, investors may please note that neither Karvy nor Karvy Stock Broking nor any<br />

person connected with any associate companies of Karvy accepts any liability arising from the use of this information<br />

and views mentioned in this document.