SBI Gold Fund - Finapolis

SBI Gold Fund - Finapolis

SBI Gold Fund - Finapolis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

✄<br />

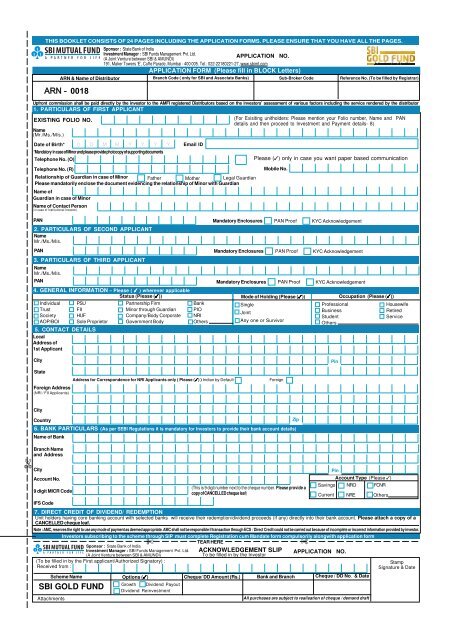

Sponsor : State Bank of India<br />

Investment Manager : <strong>SBI</strong> <strong>Fund</strong>s Management Pvt. Ltd.<br />

APPLICATION NO.<br />

(A Joint Venture between <strong>SBI</strong> & AMUNDI)<br />

191, Maker Towers ‘E’, Cuffe Parade, Mumbai - 400 005. Tel.: 022-22180221-27, www.sbimf.com<br />

APPLICATION FORM (Please fill in BLOCK Letters)<br />

ARN & Name of Distributor Branch Code ( only for <strong>SBI</strong> and Associate Banks) Sub-Broker Code<br />

Reference No. (To be filled by Registrar)<br />

Upfront commission shall be paid directly by the investor to the AMFI registered Distributors based on the investors’ assessment of various factors including the service rendered by the distributor<br />

1. PARTICULARS OF FIRST APPLICANT<br />

EXISTING FOLIO NO.<br />

Name<br />

(Mr./Ms./M/s.)<br />

Date of Birth* D D M M Y Y Y Y<br />

*Mandatory in case of Minor and please provide photocopy of supporting documents<br />

Name of<br />

Guardian in case of Minor<br />

Name of Contact Person<br />

(in case of Institutional Investor)<br />

PAN<br />

2. PARTICULARS OF SECOND APPLICANT<br />

Name<br />

Mr./Ms./M/s.<br />

PAN<br />

3. PARTICULARS OF THIRD APPLICANT<br />

Name<br />

Mr./Ms./M/s.<br />

PAN<br />

THIS BOOKLET CONSISTS OF 24 PAGES INCLUDING THE APPLICATION FORMS. PLEASE ENSURE THAT YOU HAVE ALL THE PAGES.<br />

ARN - 0018<br />

Telephone No. (O)<br />

Telephone No. (R)<br />

Email ID<br />

Relationship of Guardian in case of Minor Father Mother Legal Guardian<br />

Please mandatorily enclose the document evidencing the relationship of Minor with Guardian<br />

(For Exisiting unitholders: Please mention your Folio number, Name and PAN<br />

details and then proceed to Investment and Payment details- 8)<br />

Please (✓) only in case you want paper based communication<br />

Mobile No.<br />

Mandatory Enclosures PAN Proof KYC Acknowledgement<br />

Mandatory Enclosures PAN Proof KYC Acknowledgement<br />

Mandatory Enclosures PAN Proof KYC Acknowledgement<br />

4. GENERAL INFORMATION – Please ( ✓ ) wherever applicable<br />

Status (Please (✓)) Mode of Holding (Please (✓)) Occupation (Please (✓))<br />

(SEE NOTE 2)<br />

Individual PSU Partnership Firm Bank<br />

Single<br />

Professional<br />

Housewife<br />

Trust FII Minor through Guardian PIO<br />

Joint<br />

Business<br />

Retired<br />

Society HUF Company/Body Corporate NRI<br />

Student<br />

Service<br />

AOP/BOI Sole Proprietor Government Body Others<br />

Any one or Survivor<br />

Others<br />

5. CONTACT DETAILS<br />

Local<br />

Address of<br />

1st Applicant<br />

City<br />

Pin<br />

State<br />

Foreign Address<br />

(NRI / FII Applicants)<br />

Address for Correspondence for NRI Applicants only ( Please (✓) ) Indian by Default<br />

Foreign<br />

City<br />

Country<br />

6. BANK PARTICULARS (As per SEBI Regulations it is mandatory for Investors to provide their bank account details)<br />

Name of Bank<br />

Branch Name<br />

and Address<br />

City<br />

Account No.<br />

9 digit MICR Code<br />

IFS Code<br />

7. DIRECT CREDIT OF DIVIDEND/ REDEMPTION<br />

Unit holders having core banking account with selected banks will receive their redemption/dividend proceeds (if any) directly into their bank account. Please attach a copy of a<br />

CANCELLED cheque leaf.<br />

Note : AMC, reserves the right to use any mode of payment as deemed appropriate. AMC shall not be responsible if transaction through ECS / Direct Credit could not be carried out because of incomplete or incorrect information provided by investor.<br />

Investors subscribing to the scheme through SIP must complete Registration cum Mandate form compulsorily alongwith application form<br />

✄<br />

TEAR HERE<br />

Sponsor : State Bank of India<br />

Investment Manager : <strong>SBI</strong> <strong>Fund</strong>s Management Pvt. Ltd. ACKNOWLEDGEMENT SLIP APPLICATION NO.<br />

(A Joint Venture between <strong>SBI</strong> & AMUNDI)<br />

To be filled in by the Investor<br />

(To be filled in by the First applicant/Authorized Signatory) :<br />

Received from :<br />

Scheme Name Options (✓)<br />

Cheque/ DD Amount (Rs.) Bank and Branch Cheque / DD No. & Date<br />

<strong>SBI</strong> GOLD FUND<br />

Attachments<br />

Growth Dividend Payout<br />

Dividend Reinvestment<br />

Zip<br />

(This is 9 digit number next to the cheque number. Please provide a<br />

copy of CANCELLED cheque leaf)<br />

All purchases are subject to realisation of cheque / demand draft<br />

✄<br />

Savings<br />

Current<br />

Pin<br />

Account Type (Please ✓)<br />

NRO<br />

NRE<br />

FCNR<br />

Others<br />

Stamp<br />

Signature & Date

8. INVESTMENT AND PAYMENT DETAILS : I/We would like to invest in the following Scheme of <strong>SBI</strong> Mutual <strong>Fund</strong><br />

One time Investment<br />

Systematic Investment Plan (SIP)<br />

( Please fill in your investment details below)<br />

(Please complete enclosed SIP ECS/Direct Debit Facility Registration cum Mandate Form)<br />

Scheme Name<br />

Options (Please ✓ )<br />

<strong>SBI</strong> GOLD FUND<br />

Growth Dividend Payout Dividend Reinvestment<br />

Cheque / DD Amount (Rs.)<br />

Drawn on Bank and Branch<br />

Cheque / D.D. No. & Date<br />

Investment Amount (Rs. in Figures) Investment Amount (Rs. in Words)<br />

For third party cheques, please see point 3 vii of Bank particulars mentioned in the guidelines.<br />

9. DEMAT ACCOUNT DETAILS –( Please ensure that the sequence of names as mentioned in the application form matches with that of the account held with the Depository Participant).<br />

Do you want Units in Demat Form (Please (✓)) Yes No If Yes, please provide the below details<br />

Depository<br />

Participant Name<br />

DP ID No.<br />

National Securities Depository Limited (NSDL)<br />

Beneficiary Account No.<br />

Depository<br />

Participant Name<br />

I N Target ID No.<br />

Central Depository Services (India) Limited (CDSL)<br />

10A. NOMINATION : I wish to nominate the following person to receive the proceeds in the event of my death. (With effect from 01/04/2011, for individual investors applying<br />

with single holding, Nomination is mandatory. However, in case you do not wish to nominate please sign point 10 B.)<br />

Name of the Nominee<br />

Percentage<br />

Name of the Guardian*<br />

Relationship<br />

Address of Nominee/<br />

Guardian*<br />

Name of the Nominee<br />

Date of Birth*<br />

D D M M Y Y Y Y<br />

Percentage<br />

⊗<br />

Signature of Guardian*<br />

(*Mandatory in case of Minor nominee)<br />

Name of the Guardian*<br />

Relationship<br />

Address of Nominee/<br />

Guardian*<br />

Name of the Nominee<br />

Date of Birth*<br />

D D M M Y Y Y Y<br />

Percentage<br />

⊗<br />

Signature of Guardian*<br />

(*Mandatory in case of Minor nominee)<br />

Name of the Guardian*<br />

Relationship<br />

Address of Nominee/<br />

Guardian*<br />

Date of Birth*<br />

10B. NOMINATION : I do not wish to nominate any person at the time of making the investment.<br />

D D M M Y Y Y Y<br />

⊗<br />

Signature of Guardian*<br />

(*Mandatory in case of Minor nominee)<br />

Signature<br />

11. DECLARATION & SIGNATURE : "I/We have read and understood the contents of the Scheme Information Document and the details of the scheme and I/We have<br />

not received or been induced by any rebate or gifts, directly or indirectly, in making this investment." "I/We hereby declare that the amount invested/to be invested by me/us in<br />

the scheme(s) of <strong>SBI</strong> Mutual <strong>Fund</strong> is derived through legitimate sources and is not held or designed for the purpose of contravention of any act, rules, regulations or any statute<br />

or legislation or any other applicable laws or any notifications, directions issued by any governmental or statutory authority from time to time." * I/We certify that as per the<br />

Memorandum and Articles of Association of the Company, Bye laws, Trust Deed or Partnership Deed and resolutions passed by the Company / Firm / Trust. I/We are authorised<br />

to enter into this transactions for and on behalf of the Company/Firm/Trust. ** I/We confirm that I am/we are Non Resident of Indian Nationality/Origin and I/We hereby confirm<br />

that the funds for the subscriptions have been remitted from abroad through approved banking channels or from my/our Non Resident External/Ordinary account/FCNR Account<br />

. * Applicable to other than Individuals / HUF; ** Applicable to NRI; I/We do not have any existing SIP/Micro SIPs which together with the current Micro SIP application will result<br />

in aggregate investments exceeding Rs. 50,000 in a year (applicable to Micro SIP investors only). The ARN holder has disclosed to me/us all the commissions (in the form of trail<br />

commission or any other mode), payable to him for the different competing Schemes of various Mutual <strong>Fund</strong>s from amongst which the Scheme is being recommended to me/us<br />

SIGNATURE(S)<br />

Applicants must<br />

sign as per mode<br />

of holding<br />

Date<br />

⊗ ⊗ ⊗<br />

1st Applicant / Guardian / Authorised Signatory<br />

2nd Applicant / Authorised Signatory<br />

TEAR HERE<br />

Place<br />

3rd Applicant / Authorised Signatory<br />

All future communication in connection with this application should be addressed to the Registrars to the scheme or <strong>SBI</strong>MF Corporate Office.<br />

Investment Manager :<br />

<strong>SBI</strong> <strong>Fund</strong>s Management Pvt. Ltd.<br />

(A Joint Venture between <strong>SBI</strong> & AMUNDI)<br />

191, Maker Towers ‘E’, Cuffe Parade,<br />

Mumbai - 400 005.<br />

Tel.: 022-22180244/22180221, Fax : 022 -22180244<br />

E-mail :customer.delight@sbimf.com,<br />

Website : www.sbimf.com<br />

Registrar:<br />

Computer Age Management Services Pvt. Ltd.,<br />

SEBI Registration No. : INR000002813)<br />

148, Old Mahabalipuram Road, Okkiyam Thuraipakkan,<br />

Adjacent to Hotel Fortune, Chennai 600097, Tamil Nadu<br />

Tel: 044-30407000 & 24587000, Fax: 044-24580982<br />

Email: enq_L@camsonline.com, Website : www.camsonline.com

Sponsor : State Bank of India<br />

Investment Manager : <strong>SBI</strong> <strong>Fund</strong>s Management Pvt. Ltd.<br />

(A Joint Venture between <strong>SBI</strong> & AMUNDI)<br />

191, Maker Towers ‘E’, Cuffe Parade, Mumbai - 400 005. Tel.: 022-22180221-27, www.sbimf.com<br />

SIP ECS/DIRECT DEBIT FACILITY : REGISTRATION CUM MANDATE FORM<br />

Investors subscribing to the scheme through SIP ECS/Direct Debit Facility must complete this form compulsorily alongwith Application Form<br />

ARN & Name of Distributor Branch Code ( only for <strong>SBI</strong> and Associate Banks) Sub-Broker Code<br />

Reference No. (To be filled by Registrar)<br />

ARN - 0018<br />

Upfront commission shall be paid directly by the investor to the AMFI registered Distributors based on the investors’ assessment of various factors including the service rendered by the distributor<br />

Please<br />

SIP Registration - by New Investor<br />

( ✓)<br />

SIP<br />

MICRO SIP<br />

SIP Registration - by Existing Investor<br />

INVESTOR DETAILS<br />

Folio No./Application No.<br />

(For Existing Investor please mention Folio Number / For New Applicants please mention the<br />

Application Form Number)<br />

Name of 1st Applicant<br />

(Mr/Ms/M/s)<br />

Name of Father/Guardian<br />

in case of Minor<br />

PAN DETAILS (Furnishing of PAN together with an attested copy of PAN Card is mandatory)<br />

First Applicant / Guardian Second Applicant Third Applicant<br />

PAN Proof<br />

Scheme Name<br />

Mandatory Enclosures<br />

Mandatory Enclosures<br />

KYC Acknowledgement<br />

PAN Proof<br />

KYC Acknowledgement<br />

SIP DETAILS (ECS in select cities or Direct Debit in select banks only)<br />

Options (Please ✓ ) Growth Dividend Payout Dividend Reinvestment<br />

First SIP Cheque No.<br />

Each SIP Amount (Rs.)<br />

(Note : Cheque should be drawn on bank account mentioned below)<br />

SIP Date 5 th 10 th 15 th 20 th 25 th 30 h (For February, last business day) No of SIP<br />

Frequency Monthly SIP Quarterly SIP<br />

Installments<br />

DECLARATION : I / We hereby , authorize the AMC and their authorised service providers , to debit my / our following bank account directly or by ECS for collection of payments.<br />

BANK PARTICULARS (as per bank records)<br />

Name of 1st Holder<br />

Name of 2nd Holder<br />

Name of 3rd Holder<br />

Name of Bank<br />

Branch Name<br />

and Address<br />

SIP with Cheque<br />

DOCUMENT DETAILS<br />

(in case of Micro SIP)<br />

Document Description<br />

Document Number (if any)<br />

SIP without Cheque<br />

S B I G O L D F U N D<br />

PAN Proof<br />

SIP Period From* D D M M Y Y Y Y To (Please ✓ ) D D M M Y Y Y Y<br />

* The earliest date for first SIP debit through ECS/Direct Debit is 15 th October 2011 (for the applications submitted during NFO).<br />

Mandatory Enclosures<br />

KYC Acknowledgement<br />

Till further notice#<br />

# Please refer point no. xi overleaf<br />

City<br />

Account No.<br />

Account Type (Please ✓)<br />

Savings NRO FCNR<br />

9 digit MICR Code<br />

(This is 9 digit number next to the cheque number. Please<br />

provide a copy of CANCELLED cheque leaf)<br />

Current NRE Others<br />

IFS Code<br />

DECLARATION & SIGNATURE : I/We hereby declare that the particulars given above are correct and express my willingness to make payments referred above to debit my/our account directly or through participation in ECS. If the transaction is delayed<br />

or not effected for reasons of incomplete or incorrect information, I / We would not hold the user institution responsible. I / We will also inform AMC, about any changes in my/our bank account. I/We do not have any existing SIP/Micro SIPs which together<br />

with the current Micro SIP application will result in aggregate investments exceeding Rs. 50,000 in a year (applicable to Micro SIP investors only). The ARN holder has disclosed to me/us all the commissions (in the form of trail commission or any other mode),<br />

payable to him for the different competing Schemes of various Mutual <strong>Fund</strong>s from amongst which the Scheme is being recommended to me/usI/We have read and agreed to the terms and conditions mentioned in SID/KIM.<br />

SIGNATURE(S)<br />

Applicants must<br />

sign as per mode<br />

<br />

of holding 1st Account Holder/ Guardian / Authorised Signatory<br />

2nd Account Holder<br />

3rd Account Holder<br />

BANKER’S ATTESTATION<br />

Certified that the signature of account holder and the Details of Bank account are correct as per our records.<br />

Signature of authorised Official from Bank (Bank stamp and date)<br />

Signature of authorised Official from Bank (Bank stamp and date)<br />

Pin<br />

The Branch Manager<br />

Bank<br />

Branch<br />

Date<br />

D D M M Y Y Y Y<br />

Sub : Mandate verification for A/c. No.<br />

This is to inform you that I/We have registered for making payment towards my investments in <strong>SBI</strong>MF by debit to my /our above account directly or through ECS. I/We hereby authorize you<br />

to honour such payments for which I/We have signed and endorsed the Mandate Form.<br />

Further, I authorize my representative (the bearer of this request) to get the above Mandate verified. Mandate verification charges, if any, may be charged to my/our account.<br />

Thanking you,<br />

Yours sincerely<br />

<br />

1st Account Holder/ Guardian / Authorised Signatory<br />

<br />

2nd Account Holder<br />

<br />

3rd Account Holder<br />

A C K N O W L E D G E M E N T S L I P<br />

To be filled in by the Investor<br />

(To be filled in by the First applicant/Authorized Signatory) :<br />

Received from<br />

an application for Purchase of Units alongwith<br />

1st Cheque Number<br />

All purchases are subject to realisation of cheques.<br />

Folio No. /<br />

Application No.<br />

For Rs.<br />

Acknowledgement Stamp

TERMS AND CONDITIONS FOR SYSTEMATIC INVESTMENT PLAN (SIP) THROUGH ECS/DIRECT DEBIT<br />

List of Cities for SIP ECS Facility :Agra, Ahmedabad, Allahabad, Amritsar, Anand, Asansol, Aurangabad, Bangalore, Bardhaman, Baroda,<br />

Belgaum, Bhavnagar, Bhilwara, Bhopal, Bhubaneshwar, Bijapur, Bikaner, Calicut, Chandigarh, Chennai, Cochin, Coimbatore, Cuttack,<br />

Davangere, Dehradun, Dhanbad, Durgapur, Erode,Gadag, Gangtok, Goa, Gorakhpur, Gulbarga, Guwahati, Gwalior, Haldia, Hasan, Hubli,<br />

Hyderabad, Indore, Imphal, Jabalpur, Jaipur, Jalandhar, Jammu, Jamnagar, Jamshedpur, Jodhpur, Kakinada, Kanpur, Kolhapur, Kolkata, Kota,<br />

Lucknow, Ludhiana, Madurai, Mandya, Mangalore, Mumbai, Mysore, Nagpur, Nasik, Nellore, New Delhi, Patna, Pondicherry, Pune, Raichur,<br />

Raipur, Rajkot, Ranchi, Salem, Shillong, Shimla , Shimoga, Sholapur, Siliguri, Surat, Thirupur, Tirunelveli, Tirupati, Trichur, Trichy, Trivandrum,<br />

Tumkur, Udaipur, Udipi, Varanasi, Vijayawada and Vizag<br />

List of Direct Debit Banks (All core branches): Axis Bank, Bank of Baroda, Bank of India, Citibank, HDFC Bank, IDBI Bank, IndusInd Bank,<br />

Kotak Mahindra Bank, Punjab National Bank, State Bank of Bikaner & Jaipur, State Bank of Hyderabad, State Bank of India (including SBS &<br />

SB Indore), State Bank of Mysore, State Bank of Patiala, State Bank of Travancore and Union Bank of India<br />

The AMC may alter the list of banks participating in direct debit arrangement from time to time / withdraw direct debit facility from banks,<br />

based on its experience of dealing with any such bank or add/withdraw the name of the bank with whom direct debit facility arrangement can<br />

be introduced/ discontinued as the case may be.<br />

i. The SIP ECS facility is offered to investors having bank account in select cities mentioned above. The debit to the bank account would<br />

be processed directly or through the RBI ECS (Debit Clearing).<br />

ii. Investors can start a SIP without any initial investment during the NFO Period and such investors are required to submit the application<br />

form along with SIP ECS / Direct Debit Form. Investor has to select SIP cycle of 5 th / 10 th / 15 th / 20 th /25 th /30 th (for February last business<br />

day). The earliest date for first SIP debit through ECS/Direct Debit is 15 th October 2011 (for the applications submitted during NFO).<br />

.Incase the condition is not met, the SIP would start on the same date from the next month. If the date on the application is a non-Business<br />

Day for the scheme, then the units shall be allotted on the next Business Day.<br />

iii. Completed Application Form for Cancellation/Change of Bank Mandate for SIP debit can be submitted on any date of the month and the<br />

same would be processed subject to the condition that there would be a minimum of 30 days period between the submission of the<br />

application and the SIP date.<br />

iv.<br />

The cities in the list may be modified / updated / changed / removed at any time in future entirely at the discretion of <strong>SBI</strong> <strong>Fund</strong>s<br />

Management Pvt. Ltd without assigning any reasons or prior notice. If any city is removed, SIP instructions for investors in such cities<br />

via ECS facility route will be discontinued without prior notice.<br />

v. The bank account provided for ECS facility should participate in local MICR clearing.<br />

vi. SIP facility is available only on specific dates of the month viz. 5 th /10 th /15 th /20 th /25 th /30 th (For February, last business day). In case 5 th /10 th /<br />

15 th /20 th /25 th /30 th (For February, last business day) is a holiday then next business day.<br />

vii. The investor agrees to abide by the terms and conditions of ECS facility of Reserve Bank of India (RBI).<br />

viii. Investor will not hold <strong>SBI</strong> <strong>Fund</strong>s Management Pvt. Ltd , its registrars and other service providers responsible if the transaction is delayed<br />

or not effected or the investor bank account is debited in advance or after the specific SIP date due to various clearing cycles of ECS.<br />

ix.<br />

<strong>SBI</strong> <strong>Fund</strong>s Management Pvt Ltd., its registrars and other service providers shall not be responsible and liable for any damages/compensation<br />

for any loss, damage etc. incurred by the investor. The investor assumes the entire risk of using this facility and takes full responsibility.<br />

x. <strong>SBI</strong> <strong>Fund</strong>s Management Pvt Ltd. reserves the right to reject any application without assigning any reason thereof.<br />

xi.<br />

Investors can opt for the facility of perpetual SIP (Till further notice) through ECS/Direct Debit by ticking appropriate box in SIP ECS/<br />

Direct Debit facility registration cum mandate form. Investor can choose to discontinue the facility of perpetual SIP (Till further notice) by<br />

giving 30 days written notice at any of our Investor secvice centres.

Sponsor : State Bank of India<br />

Investment Manager : <strong>SBI</strong> <strong>Fund</strong>s Management Pvt. Ltd.<br />

(A Joint Venture between <strong>SBI</strong> & AMUNDI)<br />

191, Maker Towers ‘E’, Cuffe Parade, Mumbai - 400 005.<br />

Tel.: 022-22180221-27, www.sbimf.com<br />

ASBA Application No. Date D D M M Y Y Y Y<br />

APPLICATION SUPPORTED BY BLOCKED AMOUNT (ASBA) FORM<br />

BROKER/AGENT INFORMATION<br />

Name and AMFI Regn. No. Sub Broker Name & Code SCSB SCSB IFSC Code Syndicate Member Code SL No.<br />

7. DETAILS OF BANK ACCOUNT FOR BLOCKING OF FUNDS<br />

Bank Account Number<br />

Bank Name<br />

Branch Name<br />

IFS Code<br />

Total Amount to be blocked<br />

(Rs. In figures)<br />

Rs. in words<br />

Note : AMC, reserves the right to use any mode of payment as deemed appropriate. AMC shall not be responsible if transaction through ECS / Direct Credit could not be carried out because of incomplete or incorrect information provided by investor.<br />

<strong>SBI</strong> GOLD FUND<br />

Received from :<br />

INVESTORS MUST READ THE SCHEME INFORMATION DOCUMENT/KEY INFORMATION MEMORANDUM AND INSTRUCTIONS BEFORE COMPLETING THIS FORM.<br />

ASBA Application Number<br />

Address<br />

SCSB Account details:<br />

✄<br />

Sponsor : State Bank of India<br />

Investment Manager : <strong>SBI</strong> <strong>Fund</strong>s Management Pvt. Ltd.<br />

(A Joint Venture between <strong>SBI</strong> & AMUNDI)<br />

TEAR HERE<br />

ACKNOWLEDGEMENT SLIP<br />

To be filled in by the Investor<br />

FOR OFFICE USE ONLY<br />

ARN [Name & Code] [11 digit code] [Name & Code]<br />

ARN - 0018<br />

Upfront commission shall be paid directly by the investor to the AMFI registered Distributors based on the investors’ assessment of various factors including the service rendered by the distributor<br />

1. PARTICULARS OF FIRST APPLICANT<br />

Name<br />

Mr./Ms./M/s.<br />

PAN<br />

2. PARTICULARS OF SECOND APPLICANT<br />

Name<br />

Mr./Ms./M/s.<br />

PAN<br />

3. PARTICULARS OF THIRD APPLICANT<br />

Name<br />

Mr./Ms./M/s.<br />

PAN<br />

(Name should be as available in Demat Account )<br />

4. EXISTING FOLIO No. (If you have an existing folio number, please mention here)<br />

Folio No.<br />

5. DEMAT ACCOUNT DETAILS<br />

Depository (Please ✓) National Securities Depository Limited Central Depository Services [India] Limited<br />

Depository Participant Name<br />

DP - ID<br />

Beneficiary Account Number<br />

6. INVESTMENT DETAILS<br />

Scheme Name<br />

Options (Please ✓ )<br />

<strong>SBI</strong> GOLD FUND<br />

Growth Dividend Payout Dividend Reinvestment<br />

✄<br />

Date : _____/_____/___________<br />

A/c No. _______________________________________ Bank Name ________________________________________________ Branch Name ___________________________________<br />

Total Amount to be Blocked:<br />

SCSB Stamp, Signature<br />

Rs. In figures ______________________Rs. In words _______________________________________________________________________<br />

___________________________________________________________________________________________________________________<br />

Date & time of receipt ________________________________________________________________________________________________

8. DECLARATION & SIGNATURE<br />

1) l/We hereby undertake that l/We am/are an ASBA lnvestor as per the applicable provisions of the SEBl (lssue of Capital and Disclosure Requirements), Regulations 2009 (‘SEBl Regulations’) as amended from time to<br />

time. 2) ln accordance with ASBA process provided in the SEBl Regulations and as disclosed in this application, l/We authorize (a) the SCSB to do all necessary acts including blocking of application money towards the<br />

Subscription of Units of the Scheme, to the extent mentioned above in the “SCSB / ASBA Account details” or unblocking of funds in the bank account maintained with the SCSB specified in this application form, transfer of<br />

funds to the Bank account of the Scheme/<strong>SBI</strong> Mutual <strong>Fund</strong> on receipt of instructions from the Registrar and Transfer Agent after the allotment of the Units entitling me/us to receive Units on such transfer of funds, etc. (b)<br />

Registrar and Transfer Agent to issue instructions to the SCSB to remove the block on the funds in the bank account specified in the application, upon allotment of Units and to transfer the requisite money to the Scheme’s<br />

account / Bank account of <strong>SBI</strong> Mutual <strong>Fund</strong>. 3) ln case the amount available in the bank account specified in the application is insufficient for blocking the amount equivalent to the application money towards the Subscription<br />

of Units, the SCSB shall reject the application 4) lf the DP lD, Beneficiary Account No. or PAN furnished by me/us in the application is incorrect or incomplete or not matching with the depository records, the application<br />

shall be rejected and the <strong>SBI</strong> Mutual <strong>Fund</strong> or SCSBs shall not be liable for losses, if any. All future communication in connection with NFO should be addressed to the SCSB/RTA/AMC quoting the full name of the Sole/<br />

First Applicant, NFO Application Number, ASBA Application Number, Despository Account details [if it has been provided], Amount applied for and the accpunt number from where NFO amount was blocked.<br />

"I/We have read and understood the contents of the Scheme Information Document and the details of the scheme and I/We have not received or been induced by any rebate or gifts, directly or indirectly, in making this investment."<br />

"I/We hereby declare that the amount invested/to be invested by me/us in the scheme(s) of <strong>SBI</strong> Mutual <strong>Fund</strong> is derived through legitimate sources and is not held or designed for the purpose of contravention of any act, rules,<br />

regulations or any statute or legislation or any other applicable laws or any notifications, directions issued by any governmental or statutory authority from time to time." * I/We certify that as per the Memorandum and Articles<br />

of Association of the Company, Bye laws, Trust Deed or Partnership Deed and resolutions passed by the Company / Firm / Trust. I/We are authorised to enter into this transactions for and on behalf of the Company/Firm/Trust.<br />

** I/We confirm that I am/we are Non Resident of Indian Nationality/Origin and I/We hereby confirm that the funds for the subscriptions have been remitted from abroad through approved banking channels or from my/our Non<br />

Resident External/Ordinary account/FCNR Account . * Applicable to other than Individuals / HUF; ** Applicable to NRI; The ARN holder has disclosed to me/us all the commissions (in the form of trail commission or any other<br />

mode), payable to him for the different competing Schemes of various Mutual <strong>Fund</strong>s from amongst which the Scheme is being recommended to me/us<br />

SIGNATURE(S)<br />

All applicants<br />

must sign here<br />

Date<br />

⊗ ⊗ ⊗<br />

1st Applicant / Guardian / Authorised Signatory 2nd Applicant / Authorised Signatory<br />

Place<br />

3rd Applicant / Authorised Signatory<br />

INSTRUCTIONS FOR FILLING ASBA APPLICATION FORM<br />

1. An Application Supported by Blocked Amount (ASBA) investor shall submit a duly filled up ASBA Application form, physically or<br />

electronically, to the Self Certified Syndicate Bank (SCSB) with whom the bank account to be blocked, is maintained.<br />

●<br />

●<br />

In case of ASBA application form in physical mode, the investor shall submit the ASBA Application Form at the Bank branch of<br />

SCSB, which is designated for the purpose and the investor must be holding a bank account with such SCSB.<br />

In case of ASBA application form in electronic form, the investor shall submit the ASBA Application Form either through the<br />

internet banking facility available with the SCSB, or such other electronically enabled mechanism for subscribing to units of Mutual<br />

<strong>Fund</strong> scheme authorising SCSB to block the subscription money in a bank account.<br />

2. Investors shall correctly mention the Bank Account number in the ASBA Application Form and ensure that funds equal to the subscription<br />

amount are available in the bank account maintained with the SCSB before submitting the same to the designated branch.<br />

3. Upon submission of an ASBA Application Form with the SCSB, whether in physical or electronic mode, investor shall be deemed to<br />

have agreed to block the entire subscription amount specified and authorized the Designated Branch to block such amount in the Bank<br />

Account.<br />

4. On the basis of an authorisation given by the account holder in the ASBA Application Form, the SCSB shall block the subscription<br />

money in the Bank Account specified in the ASBA Application Form. The subscription money shall remain blocked in the Bank Account<br />

till allotment of units under the scheme or till rejection of the application, as the case may be.<br />

5. If the Bank Account specified in the ASBA Application Form does not have sufficient credit balance to meet the subscription money, the<br />

ASBA application shall be rejected by the SCSB.<br />

6. The ASBA Application Form should not be accompanied by cheque, demand draft or any mode of payment other than authorisation to<br />

block subscription amount in the Bank Account.<br />

7. All grievances relating to the ASBA facility may be addressed to the BANK/AMC / RTA to the Issue, with a copy to the SCSB, giving full<br />

details such as name, address of the applicant, subscription amount blocked on application, bank account number and the Designated<br />

Branch or the collection centre of the SCSB where the ASBA Application Form was submitted by the Investor.<br />

8. ASBA facility extended to investors shall operate in accordance with the SEBI guidelines in force from time to time.