Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Vol. 15 No. 08 June 2008<br />

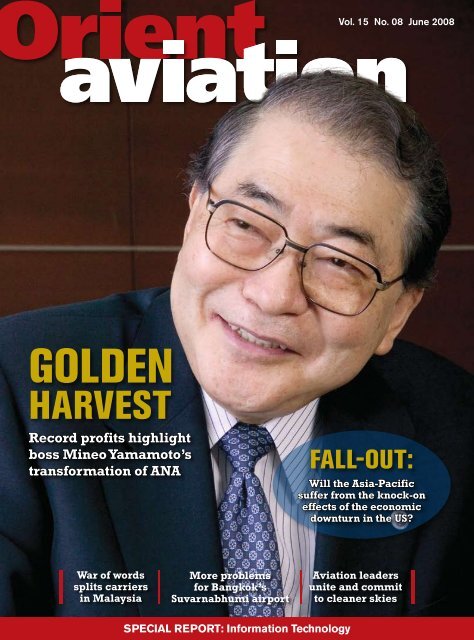

GOLDEN<br />

HARVEST<br />

Record profits highlight<br />

boss Mineo Yamamoto’s<br />

transformation of ANA<br />

FALL-OUT:<br />

Will the Asia-Pacific<br />

suffer from the knock-on<br />

effects of the economic<br />

downturn in the US?<br />

War of words<br />

splits carriers<br />

in Malaysia<br />

More problems<br />

for Bangkok’s<br />

Suvarnabhumi airport<br />

<strong>Aviation</strong> leaders<br />

unite and commit<br />

to cleaner skies<br />

SPECIAL REPORT: Information Technology

comment<br />

The region holds its breath<br />

In the past, when U.S. stock markets plunged and<br />

recession set in there was an inevitability about what<br />

followed, espoused in that old adage: when the U.S.<br />

sneezes, the rest of the world catches a cold.<br />

If the U.S. is not already in recession, it is as close<br />

as it can be without being there. Most of its airlines have only<br />

just emerged from bankruptcy, but they are in a perilous state<br />

once again.<br />

Huge losses were recorded on their balance sheets in the<br />

first quarter of this year. Planes are being grounded as eroding<br />

consumer confidence sees customers tighten their belts and stay<br />

on the ground. Desperate operators are looking at mergers to<br />

rationalize operations.<br />

Analysts say Europe is showing signs of the U.S. pattern<br />

as banks report huge losses and a credit squeeze tightens.<br />

Global air traffic, which has been growing strongly for several<br />

years, began to slide in December. The latest figures from the<br />

International Air Transport Association, for March, show the<br />

trend continuing.<br />

So let us hope the experts quoted in our main story in this<br />

issue (Fall-out P.16) are correct. Their opinion is there is now<br />

a disconnect between the U.S. economy and the economies<br />

of the Asia-Pacific and that our region is capable of surviving<br />

any spill-over from a severe economic slowdown in the U.S.<br />

and Europe.<br />

As IATA chief economist, Brian Pearce, puts it, much of the<br />

extraordinary growth in <strong>China</strong>, India and elsewhere in the Asia-<br />

Pacific is not closely linked to the economic coat tails of the<br />

U.S. It has been domestically generated and should continue,<br />

maintaining the underlying demand for air travel.<br />

Nevertheless, one way or another there is bound to be some<br />

knock-on effects from the U.S.’s economic woes. Long-haul<br />

travel between the Asia-Pacific and the rest of the world may<br />

be impacted as big corporate firms reduce their travel budgets.<br />

There are some signs of a dip in consumer confidence in Korea<br />

and Japan and that is a threat to the region.<br />

There is also the issue of over-capacity, with large numbers<br />

of new aircraft arriving in the Asia-Pacific at a time traffic<br />

is slowing. This situation means more competition, pricing<br />

pressures and dipping yields. To cap it all record fuel prices<br />

are showing no sign of easing. At press time they had reached<br />

$126 a barrel.<br />

While there will be continuing growth in Asia-Pacific<br />

markets, it is undoubtedly a time for caution and for<br />

airline managers to keep a very close watch on economic<br />

developments. ■<br />

TOM BALLANTYNE<br />

Chief Correspondent<br />

The Association of Asia Pacific <strong>Airlines</strong>’ members and contact list<br />

Air New Zealand<br />

Chief Executive, Mr Rob Fyfe<br />

VP Public Affairs and Group Communications,<br />

Mr Mike Tod<br />

Tel: (64 9) 336 2770 Fax: (64 9) 336 2759<br />

All Nippon Airways<br />

President and CEO, Mr Mineo Yamamoto<br />

Dep. Director, Public Relations, Mr Kaz Iwakata<br />

Tel: (81 3) 6735 1111<br />

Fax: (81 3) 6735 1115<br />

Asiana <strong>Airlines</strong><br />

Vice Chairman & CEO,<br />

Mr. C.B. Park<br />

Managing Director, PR, Mr Hong Lae Kim<br />

Tel: (822) 2669 5300 Fax: (822) 2669 3111<br />

Cathay Pacific Airways<br />

Chief Executive Officer, Mr Tony Tyler<br />

Corporate Communications General Manager,<br />

Mr Dane Cheng<br />

Tel: (852) 2747 8868 Fax: (852) 2810 6563<br />

<strong>China</strong> <strong>Airlines</strong><br />

Chairman & President, Mr Ringo Chao<br />

VP, Corp Comms & Customer Relations,<br />

Mr. Bruce Chen<br />

Tel: (8862) 2514 5750 Fax: (8862) 2514 5754<br />

Dragonair<br />

Chief Executive Officer, Mr Kenny Tang<br />

Head of Corp. Communications<br />

Ms May Lam-Kobayashi<br />

Tel: (852) 3193 3193 Fax: (852) 3193 3194<br />

EVA Air<br />

Chairman, Mr Steve Lin<br />

Executive VP, Group Public Relations,<br />

Mr K. W. Nieh<br />

Tel: (8862) 2500 1122 Fax: (8862) 2500 1523<br />

Garuda Indonesia<br />

President & CEO, Mr Emirsyah Satar<br />

VP Corporate Communications, Mr Pujobroto<br />

Tel: (6221) 231 2612<br />

Fax: (6221) 381 1486<br />

Japan <strong>Airlines</strong><br />

President, Mr Haruka Nishimatsu<br />

Executive Officer, Public Relations,<br />

Mr Toshinari Oshima<br />

Tel: (813) 5460 3109 Fax: (813) 5460 5910<br />

Korean Air<br />

Chairman and CEO, Mr Yang Ho Cho<br />

Managing VP, Corporate Communications,<br />

Mr Nam Il Park<br />

Tel: (822) 2656 7065 Fax: (822) 2656 7288/89<br />

Malaysia <strong>Airlines</strong><br />

Managing Director, Mr Idris Jala<br />

Gen Mgr, Int’l Affairs, Mr Germal Singh Khera<br />

Tel: (603) 2165 5137<br />

Fax: (603) 2161 0558<br />

Philippine <strong>Airlines</strong><br />

President, Mr Jaime Bautista<br />

VP Corporate Communications,<br />

Mr Rolando Estabilio<br />

Tel: (632) 817 1234 Fax: (632) 817 8689<br />

Qantas Airways<br />

Managing Director and CEO, Mr Geoff Dixon<br />

Head of Corporate Communications,<br />

Ms Belinda de Rome<br />

Tel: (612) 9691 4773 Fax: (612) 9691 4187<br />

Royal Brunei <strong>Airlines</strong><br />

Chairman, Pengiran Dato Hj Abu Bakar Ismail<br />

CEO, Mr Ray Sayer<br />

Tel: (673 2) 229 799<br />

Fax: (673 2) 221 230<br />

Singapore <strong>Airlines</strong><br />

Chief Executive Officer,<br />

Mr Chew Choon Seng<br />

VP Public Affairs, Mr Stephen Forshaw<br />

Tel: (65) 6541 5880 Fax: (65) 6545 6083<br />

Thai Airways International<br />

President, Flying Officer Apinan Sumanaseni<br />

Director, Corporate Communications<br />

M.L. Ajcharaporn Na Songkhla<br />

Tel: (662) 513 3364 Fax: (662) 545 3891<br />

Vietnam <strong>Airlines</strong><br />

President & CEO, Mr Pham Ngoc Minh<br />

Dep Director, Corp Affairs,<br />

Mr Nguyen Huy Hieu<br />

Tel: (84-4) 873 0928 Fax: (84-4) 872 1161<br />

june 2008 ORIENT AVIATION

Air Canada<br />

Air France Cargo<br />

Air Transport Int'l<br />

Airborne Express<br />

AirTran<br />

Alaska <strong>Airlines</strong><br />

America West<br />

American<br />

American Eagle<br />

ATA<br />

British Airways<br />

Cathay Pacific Cargo<br />

<strong>China</strong> <strong>Airlines</strong> Cargo<br />

<strong>China</strong> Cargo<br />

Continental<br />

Delta<br />

EVA Air Cargo<br />

FedEx<br />

Frontier<br />

KLM<br />

Korean Air<br />

Lufthansa<br />

Martinaire<br />

Mesa<br />

Mexicana<br />

Midwest <strong>Airlines</strong><br />

Northwest<br />

Singapore Cargo<br />

TACA<br />

United<br />

UPS<br />

US Airways

Being the office genius has its perks. And it all starts with a flight into DFW.<br />

Want what it takes to make an airline successful? How about an $11 billion travel market. And a region that’s<br />

home to 24 Fortune 500 company headquarters. Add to that our amazing new International Terminal D and<br />

Skylink high-speed airport train. It’s what’s made DFW the airport where nearly 1 out of 10 connecting U.S.<br />

passengers makes their connection. Now, it’s your turn to succeed. Find out more at dfwairport.com/genius.

june 2008<br />

CONTENTS<br />

O r i e n t A v i at i o n V o l u m e 1 5 , I s s u e 0 8<br />

COVER STORY<br />

30 GOLDEN<br />

HARVEST<br />

In three years, president and chief<br />

executive, Mineo Yamamoto’s<br />

transformation of ANA has culminated<br />

in record profits. Along the way he has<br />

upgraded the inflight product, taken cargo<br />

to a new level and introduced IT innovation<br />

MAIN STORY<br />

16 FALL-OUT: Will Asia-Pacific airlines<br />

suffer knock-on effects from the U. S.<br />

economic downturn?<br />

AIRPORTS<br />

23 More protests expected as Bangkok’s<br />

Suvarnabhumi Airport granted fast<br />

track expansion<br />

NEWS BACKGROUNDER<br />

22 War of words. MAS and AirAsia no<br />

longer ‘flying together’<br />

40 Airbus called<br />

to account<br />

again about<br />

latest A380<br />

delay<br />

COMMUTER AVIATION<br />

26 Korean Air prepares to launch new<br />

carrier<br />

ENVIRONMENT<br />

36 <strong>Aviation</strong> leaders<br />

unite as never<br />

before<br />

38 US Air Force<br />

chief a man on a<br />

‘green’ mission<br />

ORIENT AVIATION june 2008

SPECIAL REPORT<br />

Information Technology<br />

42 IT spending soars<br />

44 When is an LCC not an<br />

LCC?<br />

46 Trying to come to grips<br />

with lost baggage<br />

48 Electronic flight bags the way ahead<br />

NEWS<br />

10 Cross strait flights to hit <strong>China</strong> <strong>Airlines</strong>’ Hong Kong route<br />

10 <strong>China</strong> unveils jumbo jet company<br />

10 New airport for Taipei<br />

10 LCC terminals open in <strong>China</strong><br />

10 <strong>China</strong> Southern, Air France/KLM in cargo joint venture<br />

11 Record profit for Singapore <strong>Airlines</strong><br />

11 <strong>China</strong> Eastern seeks international loans<br />

11 JAL exceeds income forecast<br />

12 <strong>China</strong> Southern benefits from stronger yuan<br />

12 Jet fuel tops 40% of THAI’s operating costs<br />

51 Busy times ahead – preview of IATA’s annual meeting<br />

REGULAR FEATURES<br />

3 Comment: The region holds its breath<br />

49 ARINC’s new arrival<br />

management system<br />

proves timely<br />

50 Hi-tech experience for<br />

ANA passengers at<br />

Haneda<br />

52 Business Digest: Capacity growth hits Vietnam <strong>Airlines</strong><br />

Association of Asia Pacific <strong>Airlines</strong> Secretariat<br />

PublisheD BY<br />

Wilson Press HK Ltd<br />

GPO Box 11435 Hong Kong<br />

Tel: Editorial (852) 2865 1013<br />

Fax: Editorial (852) 2865 3966<br />

E-mail: orientav@netvigator.com<br />

Website: www.orientaviation.com<br />

Chief Executive<br />

Barry Grindrod<br />

E-mail: orientav@netvigator.com<br />

Publisher<br />

Christine McGee<br />

E-mail: cmcgee@netvigator.com<br />

Chief Correspondent<br />

Tom Ballantyne<br />

Tel: (612) 9638 6895<br />

Fax: (612) 9684 2776<br />

E-mail: tomball@orientaviation.com<br />

Special Correspondent<br />

Charles Anderson<br />

Tel: (852) 2809 2209<br />

E-mail: charlesanderson@orientaviation.com<br />

Japan & Korea<br />

Julian Ryall<br />

Tel/Fax: (81) 45 663 2501<br />

Email: jmryall@orientaviation.com<br />

Photographers<br />

Rob Finlayson, Colin Parker, Andrew Hunt<br />

Design & Production<br />

Chan Ping Kwan<br />

Colour Separations<br />

The Best Compugraphic & Output Co.<br />

Printing<br />

Hop Sze Printing Company Ltd.<br />

advertising<br />

South East Asia and Pacific<br />

Tan Kay Hui<br />

Tel: (65) 9790 6090<br />

E-mail: tankayhui@tankayhuimedia.com<br />

The Americas / Canada<br />

Barnes Media Associates<br />

Ray Barnes<br />

Tel: (1 434) 927 5122<br />

Fax: (1 434) 927 5101<br />

E-mail: barnesrv@gmail.com<br />

Europe & the Middle East<br />

REM International<br />

Stephane de Rémusat<br />

Tel: (33 5) 34 27 01 30<br />

Fax: (33 5) 34 27 01 31<br />

E-mail: sremusat@aol.com<br />

© All rights reserved<br />

Wilson Press HK Ltd., Hong Kong, 2008<br />

Suite 9.01, 9/F, Kompleks Antarabangsa<br />

Jalan Sultan Ismail, 50250 Kuala Lumpur, Malaysia<br />

Tel: (603) 2145 5600 Fax: (603) 2145 2500<br />

E-mail: info@aapa.org.my<br />

Director General: Andrew Herdman<br />

Commercial Director: Beatrice Lim<br />

Technical Director: Martin Eran-Tasker<br />

The views expressed in this magazine are not necessarily<br />

those of the Association of Asia Pacific <strong>Airlines</strong>.<br />

june 2008 ORIENT AVIATION

Trent Family<br />

Wide-chord titanium fan blade<br />

The Trent philosophy of continuous evolution and intelligent innovation delivers decisive business benefits.

The<br />

real<br />

beauty<br />

is<br />

it’s quieter,<br />

lighter,<br />

and more<br />

fuel efficient.

egional round-up<br />

Cross strait flights to hit<br />

CAL’s Hong Kong route<br />

Taiwan flag carrier, <strong>China</strong> <strong>Airlines</strong>’<br />

(CAL), Taiwan-Hong Kong network<br />

would be reduced by up to 20% if, as<br />

expected, weekend direct flights to <strong>China</strong> are<br />

introduced on July 4, said the airline.<br />

The 90-minute cross strait chartered<br />

flights would compare at present with a<br />

journey of up to half day, via either Hong<br />

Kong or Macau, for Taiwanese travellers to<br />

the Mainland. CAL’s general manager in<br />

Hong Kong, Michael Wu, told the South<br />

<strong>China</strong> Morning Post: “Its pretty obvious<br />

people would prefer to travel directly to the<br />

Mainland instead of spending half a day<br />

transiting in Hong Kong.”<br />

Wu said CAL planned to re-deploy some<br />

of its A330-300s to the chartered services,<br />

which are expected to operate to Beijing,<br />

Shanghai, Guangzhou and Xiamen from<br />

Taiwan’s Taipei, Taichung and Kaohsiung.<br />

CAL, which flies 270,000 passengers<br />

between Hong Kong and Taiwan each month,<br />

is one of five airlines providing 3,000 flights<br />

monthly from Hong Kong to Taiwan’s three<br />

major cities.<br />

Separately, both CAL and Cathay Pacific<br />

Airways have said relaxing the direct cross<br />

strait flight ban would bring long-term<br />

benefits to the route, as the market would<br />

become bigger.<br />

<strong>China</strong> unveils<br />

jumbo jet company<br />

In May, Mainland <strong>China</strong> aviation regulators<br />

officially unveiled the company<br />

which they hope will produce the<br />

nation’s own jumbo jets. The Commercial<br />

Aircraft Corp. of <strong>China</strong> based in Shanghai,<br />

has been set the task of designing a large<br />

<strong>China</strong> Southern sets date for cargo joint venture<br />

<strong>China</strong> Southern <strong>Airlines</strong> (CSA) chairman, Liu Shaoyong, said at its annual<br />

results media conference in Guangzhou that the airline would launch a joint<br />

venture cargo airline with Air France/KLM by year-end.<br />

However, he said, the partners had not decided if the so far un-named cargo carrier<br />

would be based in Guangzhou or in Shenzhen, on the Hong Kong border.<br />

The European carrier has long courted CSA in the hope the cargo airline would come<br />

to fruition.<br />

Jade Cargo, a joint venture cargo carrier majority-owned by Shenzhen <strong>Airlines</strong> and<br />

Lufthansa, has been operating from Shenzhen since 2007. ■<br />

commercial jet airliner and provided with<br />

start-up capital of US$2.72 billion.<br />

Among the shareholders are the<br />

Assets Supervision and Administration<br />

Commission (32%), AVIC I and the builder<br />

of the ARJ21 commuter jet, AVIC II.<br />

At the media launch, company chairman,<br />

Zhang Qingwei, was encouraged by vicepremier<br />

Zhang Dejiang, to “let <strong>China</strong>’s large<br />

plane fly into the sky at an early date”.<br />

But analysts continue to insist it will be<br />

at least a decade before <strong>China</strong> can produce<br />

the jumbo jet of its dreams.<br />

Air Deccan founder<br />

to set up cargo airline<br />

Indian low-cost carrier pioneer, Capt. G.<br />

R. Gopinath, has set up a cargo carrier<br />

following the sale of his airline company,<br />

Deccan <strong>Aviation</strong>, to the Kingfisher<br />

<strong>Airlines</strong>’ parent company, the UB Group.<br />

Deccan Cargo, which its owner has<br />

initially equipped with nine leased A310s,<br />

provided by his own investment funds, will<br />

be run by former Federal Express executive,<br />

Jude Fonseka, from a network of bases<br />

across India.<br />

Gopinath started his domestic airline,<br />

Bangalore-based Air Deccan, in 2003.<br />

He defied naysayers who said India’s overregulated<br />

market would defeat him and<br />

quickly established a niche – and a brand<br />

– for his airline with his low-fare promotions<br />

and ebullient leadership.<br />

But as Indian aviation was deregulated<br />

intense competition from other airline startups,<br />

with deeper pockets than Air Deccan,<br />

forced it into the red and resulted in the sale<br />

of the LCC. ■<br />

AIRPORTS<br />

LCC terminals in <strong>China</strong><br />

Two Chinese cities, Zhengzhou and Xiamen, have followed the<br />

lead of Malaysia and Singapore by providing separate terminal<br />

facilities for budget carriers.<br />

Zhengzhou airport in Henan has converted an unused airport hall<br />

into a low-cost carrier (LCC) terminal, which now provides services for<br />

its first customer, Shanghai-based LCC, Spring <strong>Airlines</strong>.<br />

In coastal Fujian, Xiamen’s city fathers are upgrading a former cargo<br />

terminal to a dedicated LCC facility for domestic and international<br />

budget airlines, which analysts see as a good investment once cross<br />

strait flights between <strong>China</strong> and Taiwan are approved.<br />

Taipei plans new airport<br />

Taiwan’s new president, Ma Ying-jeou, is committed<br />

to rebuilding Taoyaun International Airport and<br />

establishing a satellite town around the upgraded<br />

facility, which is much closer to Taipei than the present<br />

international airport.<br />

Ma said the US$40 million project, which will include<br />

a new terminal, another runway and ground handling and<br />

maintenance centres, will be serviced by a new satellite<br />

town of hotels, shopping centres, exhibition facilities and<br />

residential precincts. ■<br />

10 ORIENT AVIATION june 2008

usiness round-up<br />

JAL beats<br />

income forecast<br />

Japan <strong>Airlines</strong> (JAL) reported a better<br />

than expected profit of Y16.9 billion<br />

(US$164 million) for the 12 months<br />

to March 31, after the group doubled its<br />

forecast weeks before announcing its annual<br />

results.<br />

JAL said the profit, up from a predicted<br />

Y7 billion for the 12 months, was based on<br />

healthy business traffic, an effective costcutting<br />

programme as well as the absorption<br />

of a US$110 million fine for pleading guilty<br />

to participating in an air cargo price cartel<br />

in the U.S.<br />

The airline said it would continue its cost<br />

rationalisation strategy and sharpen its focus<br />

on premium strategies intended to attract<br />

greater international business traffic to the<br />

carrier. It forecast a 44% increase in operating<br />

costs due to rising jet fuel prices and<br />

capacity constraints for the coming year.<br />

JAL’s revenue increased by Y25.1<br />

billion to Y1.827 billion, with international<br />

passenger revenue up 4% to Y754.3<br />

billion. Operating costs for the 12 months<br />

were reduced by Y138.5 billion to Y2.140<br />

billion.<br />

Record profits, but a<br />

challenging 2008 - SIA<br />

The Singapore <strong>Airlines</strong> Group<br />

announced higher than predicted<br />

earnings for its final quarter and<br />

reported a group operating profit of S$2.125<br />

billion (US$1.36 billion) for the full fiscal<br />

year.<br />

The aviation group, made up of<br />

Singapore <strong>Airlines</strong>, SIA Cargo, SATS, SIA<br />

Engineering and SilkAir, said annual group<br />

CEA seeks international loans<br />

<strong>China</strong> Eastern <strong>Airlines</strong><br />

(CEA) is in negotiations<br />

to raise up to 15<br />

billion yuan (US$2.145 billion)<br />

as part of an ambitious plan<br />

believed to include a re-submission<br />

of the Singapore <strong>Airlines</strong><br />

(SIA)/Temasek offer to buy<br />

24.8% in the struggling carrier.<br />

CEA, which is the weakest<br />

of the “big three” Mainland<br />

airlines, had hoped to have SIA<br />

as an investor from this year,<br />

but the Singapore offer was<br />

operating profit improved by 61.6% for the<br />

12 months to March 31, but the coming year<br />

would be “more challenging” for airlines.<br />

The company said Singapore <strong>Airlines</strong><br />

(SIA) recorded a 60.1% rise in operating<br />

profit, to S$1.644 billion and SIA Cargo<br />

turned around a loss of S$32 million last<br />

year to an operating profit of S$132 million<br />

for the latest 12 months.<br />

Net profit for the fourth quarter to March<br />

31 was S$528 million (US$387 million)<br />

compared with S$671 million 12 months<br />

earlier - when results included the sale<br />

<strong>China</strong> Eastern <strong>Airlines</strong>: pilot protests cost<br />

airline dear<br />

scuppered by minority shareholders who were promised a higher price per share by Air<br />

<strong>China</strong> investors. CEA said the funds would be largely used to pay for new aircraft.<br />

CEA’s problems are not just about cash. In April, 18 CEA pilots turned back on<br />

domestic flights from Kunming to Dali and Xinxiang in an organised protest about<br />

salaries and conditions, with another 78 CEA pilots reported to have resigned since the<br />

incidents. Hundreds of passengers were inconvenienced by the industrial action.<br />

The Civil <strong>Aviation</strong> Administration of <strong>China</strong> subsequently fined CEA 1.5 million<br />

yuan (US$214,500) and withdrew the routes from the carrier. The Shanghai airline<br />

has calculated the suspension of the lucrative services will reduce income by up to 400<br />

million yuan this year. ■<br />

of a Singapore central business district<br />

property.<br />

“The group benefited from a strong business<br />

environment for the year,” said SIA.<br />

“However, the current turmoil in global<br />

financial markets has clouded the outlook<br />

for discretionary air travel.<br />

“In addition, jet fuel prices, in step with<br />

crude oil prices, look set to stay well above<br />

US$100 a barrel this year. The combination<br />

of a global economic slowdown and record<br />

high fuel prices will make this a more<br />

challenging year for airlines.”<br />

june 2008 ORIENT AVIATION 11

usiness round-up<br />

<strong>China</strong> Southern benefits<br />

from stronger yuan<br />

<strong>China</strong> Southern <strong>Airlines</strong> (CSA),<br />

the Mainland’s largest carrier, has<br />

reported a net profit of 1.85 billion<br />

yuan (US$264.5 million) for the 2007 year.<br />

Revenue increased by 18% to 55.87 billion<br />

yuan, benefiting from an appreciation<br />

in the national currency. However, the<br />

airline missed its profit forecast, a result<br />

it attributed to rising jet fuel prices and<br />

increased international competition.<br />

CSA also announced its majority-owned<br />

subsidiary, Xiamen <strong>Airlines</strong>, would buy 20<br />

B737s from Boeing, which are scheduled for<br />

delivery from the second quarter of 2014 to<br />

October 2015.<br />

Air <strong>China</strong> reports<br />

147% profit rise in Q1<br />

Beijing-based Air <strong>China</strong> has<br />

announced a 147% profit increase<br />

for its first quarter, to March 31,<br />

based on a 4% increase in the yuan and<br />

strong passenger demand. Net income was<br />

1.04 billion yuan (US$148.9 million) for<br />

the three months, with analysts predicting<br />

the full-year profit for the airline could<br />

be as high as 29%, as spectators, tourists<br />

and participants gather in Beijing for the<br />

Olympic Games in August.<br />

The carrier said average passenger<br />

capacity had increased to 77.1%, with 8.3<br />

million travellers flying on Air <strong>China</strong> in the<br />

reported three months.<br />

Jet fuel tops 40% of<br />

THAI’s operating costs<br />

Thai Airways International’s<br />

(THAI) first quarter profit was<br />

almost halved, to 2.22 billion baht<br />

(US$68.71 million), from 4.23 billion baht a<br />

year earlier, the carrier said in May.<br />

THAI said foreign exchange charges<br />

were incurred when some loans were<br />

transferred to baht and a 40% increase in<br />

fuel costs had produced the 48% profit drop<br />

over the same months a year ago.<br />

The carrier, which has ordered the<br />

A380, announced a foreign exchange gain<br />

of 1.47 billion baht in the 2007 first quarter<br />

compared with a 664.2 billion baht loss<br />

for the same period this year. THAI said it<br />

would need to produce savings, including<br />

a possible review of its fleet purchases, as<br />

its jet fuel was now averaging above 40%<br />

of operating costs at the carrier.<br />

Taiwan carriers’<br />

record Q1 losses<br />

Both <strong>China</strong> <strong>Airlines</strong> (CAL) and<br />

EVA Air blamed hefty first<br />

quarter losses of NT$2.97 billion<br />

(US$98 million) and NT$2.29 billion<br />

respectively on rising jet fuel prices. Both<br />

carriers said operating costs from fuel had<br />

risen from between 38% to 40% in the final<br />

three months of last year to 46% for the<br />

three months to March 31. CAL said it has<br />

increased its fuel hedging to 70% of total<br />

fuel needs for the second quarter.<br />

All Nippon Airways results: Cover story,<br />

Golden Harvest. Page 30. ■<br />

shorttakes<br />

AIRPORTS>> Australia’s Queensland<br />

government will sell its equity in Cairns,<br />

Mackay and Brisbane airports to raise<br />

funds for hospital investment in the northern<br />

Australian state. Kunming International<br />

Airport is in the market for up to US$400<br />

million from foreign investors to fund expansion<br />

plans and become <strong>China</strong>’s fourth largest<br />

airport after Beijing, Shanghai and<br />

Guangzhou.<br />

ATM>> A <strong>China</strong> Eastern <strong>Airlines</strong> (CEA)<br />

B737-700, equipped with Jeppesen’s<br />

new Required Navigation Performa (RNP)<br />

system successfully completed a trial of<br />

the new technology at <strong>China</strong>’s Lijiang<br />

Airport. CEA, Jeppesen, Boeing and the<br />

Civil <strong>Aviation</strong> Administration of <strong>China</strong><br />

(CAAC) are working together to expand air<br />

routes across <strong>China</strong>.<br />

CARGO>> Cathay Pacific Airways<br />

plans to add a three-times-a-week service<br />

between Hong Kong and Houston and<br />

Miami from September 2. Hong Kong Air<br />

Cargo Terminals (HACTL) will build three<br />

new canopies to provide all weather protection<br />

for clients’ cargo, at a cost of $2.7<br />

million. Completion is scheduled for mid-<br />

2009.<br />

CODE-SHARES>> Thai Airways<br />

International and Royal Brunei <strong>Airlines</strong><br />

will code-share on the Bangkok to Bandar<br />

Seri Begawan route.<br />

ENGINES>> SilkAir, based in Singapore,<br />

has ordered IAE V2500 Select engines for<br />

up to 20 of its A320s.<br />

FLEET>> Asiana <strong>Airlines</strong>, based in<br />

Seoul, has finalised an order for two B777-<br />

200ERs, with the option of converting the<br />

order to the B777-300ER if required. Biman<br />

Bangladesh <strong>Airlines</strong> has ordered four<br />

B777-300ERs and four B787-8 Dreamliners<br />

with purchase rights for eight aircraft: four<br />

B777s and four B787s. Dragonair has<br />

leased two new A320-200s from CIT, with<br />

deliveries scheduled for 2009 & 2010.<br />

MRO>> Qantas Airways has awarded<br />

Lufthansa Technik AG a 10-year contract<br />

to service its GE and CFM56-7 engines for<br />

its B737, B767, B747 and A330 airliners,<br />

in a deal that requires Lufthansa Technik to<br />

buy a 50% interest in Qantas’s MRO company,<br />

Jet Turbine Services in Melbourne.<br />

Overhaul and repair of the engines will be<br />

shared between the Australian facility and<br />

Lufthansa Technik’s Hamburg plant.<br />

ROUTES>> AirAsia X will launch a<br />

six-times-a-week service between Kuala<br />

Lumpur and Perth, Australia in November, its<br />

third route after Queensland and Hangzhou,<br />

since its launch in late 2007. Hong Kong<br />

Express has added Kagoshima to its first<br />

Japanese route - Okinawa – from its Hong<br />

Kong base. Singapore <strong>Airlines</strong> (SIA)<br />

started its daily, 100-seat, all-business class<br />

flights between Singapore and New York,<br />

with a re-configured A340-500, on May<br />

15. SIA will use one of its A380 aircraft on<br />

services between Singapore and Beijing<br />

during the Olympic Games this August.<br />

Viva Macau will double its flights between<br />

the Asian gambling enclave and Tokyo to<br />

four-times-a-week, to Jakarta to five-timesa-week<br />

and to Sydney to four-times-a-week,<br />

all from July. It also plans to launch a twice<br />

a week charter service, subject to government<br />

approval, between Macau and<br />

Okinawa. ■<br />

12 ORIENT AVIATION june 2008

600 parts = $100,000 in savings<br />

Can you afford not to talk to your lessor<br />

about using HEICO parts?<br />

Whether you are looking for savings on just one part, need someone to<br />

look at product improvement or want a full scale PMA Management and<br />

Development Program, HEICO has the perfect solution tailor made for your<br />

company’s needs. In addition to our 5,000 PMA parts, HEICO offers state of<br />

the art component repair and distribution facilities to help meet your cost<br />

containment goals. With a 50-year track record that speaks for itself, it’s easy<br />

to see why HEICO is the number one choice of the world’s largest airlines.<br />

So, if you need a partner that’s trusted in the air to keep prices on the ground,<br />

contact HEICO at (954) 744-7500 or visit www.heico.com<br />

S I N C E 1 9 5 7<br />

Y E A R S

Security, made by

EADS.<br />

At EADS, we help provide security against the threats no-one wants to think<br />

about. Eurofighter Typhoon, the world‘s leading high performance multi-role<br />

combat aircraft is guarding borders across Europe and beyond. Early-warning and<br />

air defence technologies monitor and manage threats from the sky. Sensor technologies<br />

are protecting our airports. Security systems keep us safe in the crowd<br />

at large sporting events. At EADS, we‘re here to make the world a rather more<br />

secure place to be. | www.eads.com/madebyeads<br />

AIRBUS A380 EUROCOPTER EC135 A400M EUROFIGHTER<br />

METEOR GALILEO ARIANE 5

main STORY<br />

FALL-OUT<br />

Will Asia-Pacific airlines suffer from the knock-on effects of<br />

the U. S. economic downturn as North American airlines deal with<br />

the double blow of escalating jet fuel prices and negative cash flows?<br />

Tom Ballantyne reports.<br />

The good news is that most airline<br />

industry experts believe<br />

Asia-Pacific economies are<br />

strong enough to withstand<br />

the worst of the fall-out from<br />

America’s economic woes. The region’s<br />

airlines will continue to experience air traffic<br />

growth, it is predicted.<br />

The bad news is that while Tokyo,<br />

Singapore or Sydney may be a long way<br />

from the U.S., there will almost certainly<br />

be a slowdown in the region’s industry<br />

and other factors, including the potential<br />

for over-capacity, may threaten yields and<br />

profitability as the confidence crisis reaches<br />

beyond the shores of North America.<br />

That is the prognosis for the region’s<br />

operators as they emerge from a surprisingly<br />

bumper period of profitability. In 2007,<br />

despite a tough competitive environment<br />

and soaring fuel prices, the region’s major<br />

carriers were in the money.<br />

Now, they are bracing themselves “for<br />

some turbulence in the remainder of the<br />

year”, according to Andrew Herdman,<br />

director general of the Association of Asia<br />

Pacific <strong>Airlines</strong> (AAPA).<br />

Last year, the 17 AAPA member carriers<br />

reported combined revenue of US$103 billion,<br />

11% higher than the previous year , and<br />

announced US$5.2 billion in profits. But as<br />

global markets reel under the impact of U.S.<br />

economic woes and consumer confidence<br />

16 ORIENT AVIATION june 2008

takes a battering, there is growing industry<br />

uncertainty about the reach and depth a U.S.<br />

recession will have on other markets around<br />

the world.<br />

“Clearly, the U.S. economy is weakening<br />

and it’s already evident that is effecting<br />

demand in the U.S. domestic market ...<br />

the question is to what extent it is going to<br />

spread to other parts of the world, including<br />

the Asia-Pacific,” Herdman told <strong>Orient</strong><br />

<strong>Aviation</strong>.<br />

“The IMF (International Monetary Fund)<br />

has revised its forecasts for global growth<br />

downwards, but in Asia that means you<br />

are simply going from low double-digit to<br />

around 9% or 10% for countries like <strong>China</strong>,<br />

and perhaps 1% to 1.5% slower growth in<br />

other countries.<br />

“How big an impact is that going to have?<br />

I think it means we will still see growth in<br />

travel demand, but it is not going to be as<br />

good as what we’ve seen.”<br />

There is a footnote. Herdman warned<br />

other factors, including the additional capacity<br />

planned to arrive in the region this year,<br />

pose a threat. With slower growth and more<br />

seats, load factors, which peaked at around<br />

77% last year, could start to decline.<br />

“If load factors come down a little that<br />

changes the complexion of the pricing<br />

environment. Couple that with oil prices<br />

pushing $126 a barrel and it is a toxic<br />

combination from the point of view of<br />

airlines this year. So carriers are bracing<br />

themselves for turbulence in the year ahead,”<br />

said Herdman.<br />

The contention the Asia-Pacific can<br />

weather the U.S. economic storm better than<br />

other regions receives support in a report<br />

released by Standard & Poor’s in May. Titled<br />

“Asian Resilience Amid Global Turbulence”<br />

it was prepared by the company’s chief<br />

economist for the Asia-Pacific, Dr. Subir<br />

Gokarn.<br />

“Strong regional drivers will help insulate<br />

the Asia-Pacific from the adverse impact of<br />

a moderate U.S. recession,” he said. While<br />

growth in the region would slow down,<br />

it would nevertheless remain positive, he<br />

added.<br />

“The ability of the region’s economies to<br />

insulate themselves against a U.S. recession<br />

is enhanced by their ability to exploit the<br />

opportunities in the region through greater<br />

economic integration ... Asia does have the<br />

ability to continue to grow quite strongly<br />

even when the rest of the global economy<br />

finds itself in some trouble,” he said.<br />

The worsening U.S. situation is taking<br />

‘A lot of the growth that we<br />

have seen, certainly in places<br />

like <strong>China</strong> and India, is not so<br />

much linked to the coat tails<br />

of the U.S.’<br />

Brian Pearce<br />

Chief Economist<br />

IATA<br />

its toll on global airline profitability. The<br />

International Air Transport Association<br />

(IATA) is revising the industry’s profit forecast<br />

for the third time, its chief economist,<br />

Brian Pearce, told <strong>Orient</strong> <strong>Aviation</strong>.<br />

The new forecast will be announced at<br />

IATA’s annual general meeting in Istanbul<br />

on June 2. Originally forecasting $7.6 billion<br />

in combined profits this year, IATA lowered<br />

this to $5 billion in December last year and<br />

to $4.5 billion in March.<br />

But there remains some doubt that the<br />

record fuel prices of $126 a barrel of crude<br />

(a barrel of jet fuel neared $150 last month)<br />

would allow airlines to make any profit at<br />

all.<br />

Asked if there would still be some<br />

income, Pearce said: “Since that March<br />

forecast oil prices have gone even higher<br />

and the economic situation has, if anything,<br />

deteriorated even further ... Who knows?<br />

We’ll have a close look at the numbers.”<br />

Last year, the world’s airlines paid $156<br />

‘Asia-Pacific airlines are<br />

bracing themselves for<br />

some turbulence in the<br />

remainder of the year’<br />

Andrew Herdman<br />

Director General<br />

AAPA<br />

‘Chaotic conditions in the U.S.<br />

won’t necessarily translate to<br />

Europe and the Asia-Pacific’<br />

Geoff Dixon<br />

Chief Executive<br />

Qantas Airways<br />

billion for their fuel (an average of $86 a<br />

barrel), which was 32% of operating costs.<br />

AAPA airlines paid $27 billion, representing<br />

almost 30% of their costs.<br />

“Right now, at today’s oil prices, it must<br />

be 40% of operating costs,” said Herdman.<br />

“So it has to be passed on to the customers<br />

and that is another factor in a weakening<br />

economy where people are looking to make<br />

economies in terms of expenditure. If prices<br />

are going up, it will probably undermine<br />

demand,” he said.<br />

His concern comes despite a relatively<br />

good start to 2008 for Asia-Pacific operators.<br />

In March, according to the AAPA, its<br />

members carried 12.7 million international<br />

passengers, up 3.9% on the same month in<br />

2007, keeping average passenger load factors<br />

unchanged at 78.5%.<br />

Nevertheless, Herdman said the outlook<br />

for the remainder of the year “is decidedly<br />

less optimistic, given clear evidence of<br />

a slowing global economy coupled with<br />

cripplingly high fuel prices. The doubling<br />

of the oil price compared to a year ago has<br />

already triggered the collapse of several<br />

carriers around the world and even wellcapitalised<br />

and well-run airlines are bracing<br />

themselves for further turbulence in the<br />

months ahead”.<br />

The casualties have mostly been in<br />

the U.S., where Aloha <strong>Airlines</strong>, Frontier<br />

<strong>Airlines</strong>, Champion Air, ATA <strong>Airlines</strong>,<br />

june 2008 ORIENT AVIATION 17

main STORY<br />

Oasis Hong Kong <strong>Airlines</strong>: a recent casualty<br />

Skybus <strong>Airlines</strong> and all-business class<br />

carrier, Eos <strong>Airlines</strong>, were among the airlines<br />

to stop operating.<br />

In Asia, two operators, Indonesia’s<br />

Adam Air and Oasis Hong Kong <strong>Airlines</strong><br />

also ceased business. Massive losses<br />

amounting to hundreds of millions of dollars<br />

among U.S. majors in the first quarter of<br />

this year have also sparked moves towards<br />

what are being tagged “shotgun mergers”<br />

between such legacy operators as American,<br />

Continental, United, Southwest <strong>Airlines</strong><br />

and US Air.<br />

The latest statistics from IATA, released<br />

last month, confirmed a sharp downward<br />

trend in global air traffic growth that began<br />

last December is continuing. On the surface,<br />

the latest figures, for March, looked good,<br />

with international passenger demand<br />

increasing 5.8% and load factors at 77.7%.<br />

But the devil was in the detail. IATA<br />

pointed out the result was “skewed” by<br />

the Easter holiday period, which in 2007<br />

was in April, but in March this year. When<br />

adjusted to take into account artificially high<br />

utilisation over the Easter period, the March<br />

load factor was 76.1%.<br />

While still high, this is 1.7 percentage<br />

points lower than the 77.8% recorded for<br />

the same month in 2007. This fall indicated<br />

reduced demand occurred faster than<br />

airlines could cut capacity. Adjusting for<br />

this distortion, real traffic growth in March<br />

was only 4%.<br />

“Traffic only tells a part of the story,” said<br />

IATA director general, Giovanni Bisignani.<br />

“Astronomical oil prices are hitting hard.<br />

And the buffer of an expanding economy<br />

has disappeared. The fortunes of the industry<br />

have taken a major turn for the worse.”<br />

He said a slowdown in Asia-Pacific<br />

carrier traffic to 4.3% is significant (this<br />

figure is different from the AAPA March statistic<br />

because IATA’s numbers include many<br />

non-AAPA airlines) because the region’s<br />

economies were expected to immunise them<br />

from the U.S.’s problems.<br />

Even in the Middle East, where carriers<br />

saw a double-digit increase of 15.4%, reflecting<br />

the expanding economies in that region,<br />

this was a “significant downward step” from<br />

the 20.4% in growth recorded in 2007.<br />

“In the face of such dramatic shifts in the<br />

global economy, consolidation is critical,”<br />

said Bisignani. “The proposed consolidation<br />

in the U.S. is good news. But it makes<br />

no sense that consolidation is limited to<br />

domestic partners. This is a global industry<br />

that needs to be run like a global business.”<br />

A mixed picture is emerging in Asia-<br />

Pacific aviation markets. For example,<br />

despite the gloomy landscape, Qantas chief<br />

executive, Geoff Dixon, said the airline<br />

is sticking to it’s profit guidance that the<br />

airline’s pre-tax profits in the current year<br />

(ending June 30) will be at least 40% higher<br />

than last year’s US$933.8 million. Local<br />

rivals Virgin Blue and Air New Zealand have<br />

both signalled forecast downgrades.<br />

Dixon thinks the impact on the industry<br />

of U.S. problems is not uniform and “chaotic<br />

conditions in the U.S. won’t necessarily<br />

translate to Europe and the Asia-Pacific”,<br />

although he does expect more airlines to fall<br />

by the wayside.<br />

He also believed fuel prices will start to<br />

fall within about six months.<br />

“There is one thing this industry has<br />

shown in recent times and that is it comes to<br />

‘Strong regional drivers<br />

will help insulate the Asia-<br />

Pacific from the adverse<br />

impact of a moderate U.S.<br />

recession’<br />

Dr Subir Gokarn<br />

Chief Economist, Asia-Pacific<br />

Standard & Poor’s<br />

its own equilibrium at some stage or another<br />

... the industry is more robust that it was seven<br />

or eight years ago and even governmentowned<br />

airlines have been forced to get their<br />

house in order,” said the Qantas chief.<br />

“People are going to continue to travel.<br />

Now that there’s an economic problem,<br />

people are still out there trying to get new<br />

business.”<br />

Malaysia <strong>Airlines</strong> chief executive, Idris<br />

Jala, has disclosed the carrier is not ignoring<br />

the possibility of consolidation and has<br />

given some thought to a merger with another<br />

airline.<br />

He said MAS would look at potential<br />

partners worldwide, but stressed the carrier<br />

was merely considering opportunities. No<br />

talks are underway with potential partners.<br />

Idris believes the industry does face a serious<br />

over-capacity issue.<br />

While business confidence in major<br />

industrial economies such as Japan and Korea<br />

is showing signs of weakening, it appears to<br />

be holding up strongly elsewhere, including<br />

<strong>China</strong>, Southeast Asia and Australia.<br />

<strong>China</strong>’s major airlines – Air <strong>China</strong>,<br />

<strong>China</strong> Southern <strong>Airlines</strong> and <strong>China</strong> Eastern<br />

<strong>Airlines</strong> - are all back in profit, reporting<br />

double-digit rises in passenger numbers and<br />

an 11.9% growth in the country’s economy<br />

through 2007.<br />

Air <strong>China</strong> reported a 30.37% rise in net<br />

profit last year to US$555.7 million. <strong>China</strong><br />

Eastern had a net profit of $83.9 million in<br />

2007, compared with a loss of $428.2 million<br />

in 2006. <strong>China</strong> Southern saw income rise<br />

from $29.9 million in 2006 to $264.9 million<br />

last year. However, much of the income was<br />

generated by foreign exchange gains as the<br />

yuan strengthened against a weakening<br />

U.S. dollar.<br />

In the low-cost carrier sector (LCC), the<br />

chief executive of Singapore-based Tiger<br />

Airways, Tony Davis, sees a silver lining in<br />

the economic gloom.<br />

Speaking at a May airline distribution<br />

conference in Kuala Lumpur, he suggested<br />

passengers will “downturn” in a recession,<br />

opting to fly on budget airlines as they tighten<br />

their belts.<br />

“Generally, well-run, efficient, low-cost<br />

carriers weather these storms better than full<br />

service carriers. If the U.S. sneezes, Asia<br />

won’t catch a cold,” he said.<br />

Nevertheless, budget operators are<br />

feeling the pinch. Speaking at the same<br />

event, AirAsia group chief executive,<br />

Tony Fernandes, said he has put a brake on<br />

expansion.<br />

18 ORIENT AVIATION june 2008

CFM.<br />

ONE OF THE WORLD’S<br />

STRONGEST CURRENCIES.<br />

Amongst shrewd investors no other engine has greater currency<br />

than CFM * . In Airfinance Journal’s 2007 Investors’ Poll, CFM is<br />

number one in Residual Value, in Remarketing Potential, in Value<br />

for Money and in Investor Appeal. And there’s more. Leading<br />

independent appraisers are unanimous in giving CFM the highest<br />

residual values within the narrow body sector. In a fluctuating world<br />

see how exchanging dollars, euros or yuan for CFM engines is a<br />

valuable investment that holds its value. Visit www.cfm56.com now.<br />

*CFM, CFM56 and the CFM logo are all trademarks of CFM International, a 50/50 joint company of Snecma and General Electric Co.

main STORY<br />

Elsewhere, there is also a belief that<br />

booming economic regions such as Asia and<br />

the Middle East will escape the worst of the<br />

fall-out. In Dubai, the chairman and chief<br />

executive of the Emirates Airline group,<br />

Sheikh Ahmad Bin Saeed Al Maktoum, said<br />

his airline would continue to achieve strong<br />

passenger and revenue growth in the current<br />

financial year despite the challenges of rising<br />

fuel prices and economic slowdown in some<br />

parts of the world.<br />

“We do not anticipate a drop in the number<br />

of passengers ... a slowdown may be happening<br />

in places like the U.S., but we do not see<br />

this trend here,” he said.<br />

“Emirates is fortunate to be located in<br />

Dubai in the middle of the East-West route<br />

and the threat of a global economic downturn<br />

will be offset by the economic boom in the<br />

Middle East.”<br />

What is the likely scenario for the Asia-<br />

Pacific’s aviation markets? IATA’s Pearce<br />

explained the region had experienced four<br />

years of the strongest global economic growth<br />

in 30 years.<br />

“Up to 2007 the industry was benefiting<br />

from exceptionally strong growth and<br />

therefore exceptionally strong travel growth<br />

and revenues. The tough period ahead of us is<br />

because that seems to be dropping away while<br />

fuel prices are rocketing,” said Pearce.<br />

“The economic cycle seems to have<br />

changed quite abruptly because of the<br />

bursting of the housing bubble in the U.S.,<br />

sub-prime markets and all the problems the<br />

banks have faced.”<br />

In the U.S., consumer confidence has<br />

declined to levels not seen since the early<br />

1990s. “The question for the rest of the<br />

world is: what are the knock-on effects of the<br />

confidence crisis?” he said.<br />

Pearce believed there will be an impact on<br />

Europe, but considered the Asia-Pacific was<br />

in a different situation.<br />

“A lot of the growth that we have seen,<br />

certainly in places like <strong>China</strong> and India, is<br />

not so much linked to the coat tails of the<br />

U.S. There has been a big investment boom<br />

and there’s been liberalization of economies,”<br />

he said.<br />

“A lot of expansion is domestically<br />

generated. So there has been underlying<br />

demand for travel. Are the economies [of<br />

Asia] exposed to the U.S. slow down? The<br />

U.S. is still an important export market so<br />

some companies will be exposed. But it<br />

appears there is still a lot of growth potential<br />

there because of regional investment and the<br />

opening up of new markets that have taken<br />

‘Generally, well-run efficient<br />

low-cost carriers weather<br />

these storms better than full<br />

service carriers’<br />

Tony Davis<br />

Chief Executive<br />

Tiger Airways<br />

place, which should support air travel.”<br />

A worry that high yield corporate travel<br />

could begin to slow as big companies reduce<br />

travel has yet to materialize, although it<br />

remains a threat if economic conditions<br />

worsen.<br />

“Corporate travel seems to be holding<br />

up extremely well and that is a reminder the<br />

economies are still in good shape in Asia,”<br />

said Herdman. “Having said that, if you look<br />

at the troubles afflicting the financial services<br />

industry, who are big customers of corporate<br />

travel, they are talking about job losses.<br />

“That’s a global business and some of<br />

the big centres in Asia are plugged into that<br />

global financial services network. We know<br />

from previous experience these people fly a<br />

lot, but when they need to tighten their belts<br />

they do so. They don’t stop flying, but they<br />

downgrade. That could mean some weakness<br />

in business travel. But we are not seeing it<br />

right now in Asia.”<br />

Pearce agreed, and warned front-end<br />

traffic on long-haul routes between Asia and<br />

Massive losses<br />

amounting to hundreds<br />

of millions of dollars<br />

among U.S. majors in the<br />

first quarter of this year<br />

have also sparked moves<br />

towards what are being<br />

tagged “shotgun mergers”<br />

Europe and Asia and North America could<br />

be affected.<br />

“There has been a lot of M & A [merger<br />

and acquisition] activity and direct investment<br />

and outsourcing, with many businesses<br />

in North America and Europe outsourcing<br />

to Asia. So there has been a lot of travel,”<br />

he said.<br />

“Much of that travel between long-haul<br />

markets could be hit, but I’d say travel within<br />

Asia is much more insulated than in past<br />

cycles.<br />

“I suspect the domestic markets of <strong>China</strong><br />

and India and perhaps even Australia, being<br />

supported by the commodity boom from<br />

<strong>China</strong>, are going to be more driven by the<br />

capacity of the businesses in those markets.<br />

“On the longer haul routes, for those<br />

businesses investing in the region or export<br />

business, there clearly will be some knock-on<br />

effect from the weakness in the U.S.”<br />

Along with the credit crunch and oil<br />

prices, one other key element poses a serious<br />

threat to airline financial viability. The<br />

downturn in demand is coinciding with an<br />

increase in aircraft deliveries - from 1,041<br />

new aircraft in 2007 to an expected 1,231 this<br />

year. More than a third of those are headed<br />

for the Asia-Pacific.<br />

While some deliveries will be offset by<br />

retiring less fuel efficient aircraft, real yields<br />

(adjusted for inflation and the U.S. dollar) are<br />

expected to decline 4.1% this year, compared<br />

to a 3.2% drop in 2007, according to IATA.<br />

Herdman said high oil prices encourage<br />

the retirement of older aircraft, which are<br />

much less fuel efficient.<br />

“You might have been able to operate an<br />

old aircraft at $90 a barrel, but at $120 it’s<br />

simply uneconomic. We are seeing signs of<br />

people retiring first generation B747-200s.<br />

<strong>Airlines</strong> are planning to do this in Asia and we<br />

are seeing some carriers reducing utilization<br />

or even grounding these old aircraft and<br />

other types as well. It’s just pure economics,”<br />

he said.<br />

What does seem certain is the threat of<br />

a spill over from the U.S. will not be shortlived.<br />

“I believe the U.S. recession will be<br />

longer than expected because the banking<br />

system is in such a mess it is going to take a<br />

long time to repair it,” said Pearce.<br />

“That’s a longer period during which there<br />

could be effects.<br />

“But I think the Asia-Pacific region has<br />

got so much internal strength at the moment<br />

that while there will be some slowdown,<br />

it seems likely to remain a strong growing<br />

region.” ■<br />

20 ORIENT AVIATION june 2008

Fast forward for your business.<br />

In recent years no other Central European airport could match the passenger growth rate Vienna<br />

International Airport has experienced. With almost twice the growth as compared to the European<br />

average, in 2007 Vienna International Airport served 18.8 million passengers flying directly<br />

to and from over 190 destinations worldwide and increased its passenger volume by 11.3 %.<br />

Owing to major investments such as the new terminal Skylink Vienna International Airport will<br />

meet the surging demand. Vienna International Airport – right in the heart of Europe and ready to<br />

face the change.<br />

For additional information please go to www.viennaairport.com

news backgrounder<br />

The gloves are off<br />

There’s nothing new about fare<br />

wars in the airline business. But<br />

when Malaysia <strong>Airlines</strong> last month<br />

hit the market with 1.3 million<br />

free tickets – excluding taxes – it<br />

sparked a major turf war with local<br />

low-cost carrier AirAsia,<br />

reports TOM BALLANTYNE.<br />

Ex a c t ly t wo ye a r s a go<br />

Malaysia <strong>Airlines</strong> (MAS)<br />

ch ief exe cut ive, Id r is<br />

Jala, and his low-cost carrier<br />

counterpart, AirAsia<br />

chief executive, Tony<br />

Fernandes, were phot<br />

og r a phed shaking<br />

hands, broad grins on<br />

their faces, celebrating a<br />

government-ordered deal<br />

that would see them cease<br />

damaging competition and<br />

work together for the good<br />

of the country’s aviation<br />

industry. “Flying together”<br />

declared local newspapers.<br />

How times have changed.<br />

When Jala announced last<br />

month he was putting 1.3<br />

million “zero-fare” domestic<br />

seats up for grabs – tickets<br />

had to be booked by May 19 for<br />

travel between June 10 and December<br />

14 - Fernandes was not amused and<br />

accused MAS of “unfairly” venturing into<br />

his budget business.<br />

“MAS and AirAsia will go to war and<br />

the only beneficiary will be Singapore<br />

<strong>Airlines</strong>,” he declared.<br />

Jala, having brought MAS back from<br />

the brink of bankruptcy to record profits<br />

in two years, is unrepentant. According to<br />

sources he will soon extend the zero fare<br />

offer to destinations outside Malaysia, to<br />

ports within Asean (Association of South<br />

East Asian Nations). Fernandes’ criticism,<br />

he said, is unwarranted.<br />

“Our ‘Everyday Low Fares’, launched<br />

to offer zero fares to all domestic destinations,<br />

is meant to create new demand and<br />

to encourage people who are not planning<br />

to travel to do so. The new product is also<br />

aimed at boosting domestic tourism and<br />

countering inflation,” said the MAS boss<br />

in a statement.<br />

MAS was making money from seats that<br />

otherwise would go unsold. “On average,<br />

domestic MAS flights are only 70% full.<br />

So the remaining 30% would not have<br />

been sold anyway. By offering zero-fare for<br />

these seats it’s giving us some incremental<br />

revenue,” said Jala. “It’s profitable in the<br />

sense that rather than letting them go empty,<br />

we have some revenue for them.<br />

“AirAsia has always said they have<br />

created new demands from low fares and<br />

War of words: MAS and AirAsia bosses,<br />

Idris Jala ( left) and Tony Fernandes<br />

no longer “flying together”<br />

I entirely agree with them. When we come<br />

out to do this, we are also creating new<br />

demand.”<br />

Fernandes claims the move means MAS<br />

is now competing directly with his LCC<br />

model, but at the same time he is not allowed<br />

to compete against the national airline. This<br />

is a reference to the fact that while AirAsia<br />

and other LCCs were cleared for the first<br />

time earlier this year to operate limited<br />

flights on the previously MAS-Singapore<br />

<strong>Airlines</strong> monopolised Kuala Lumpur<br />

to Singapore route, AirAsia hasn’t yet<br />

been given permission to fly from other<br />

Malaysian cities to Singapore.<br />

“The first thing they should do is to<br />

allow us to fly more flights to Singapore,”<br />

said Fernandes. He said MAS should work<br />

together with AirAsia instead of competing<br />

and accused the full service airline<br />

of “surrendering” to Singapore <strong>Airlines</strong><br />

(SIA). “Our two airlines are dedicated to<br />

turn KLIA [Kuala Lumpur International<br />

Airport] into a major Asian hub again.<br />

MAS should join us in this mission,” said<br />

Fernandes.<br />

Jala’s rejoinder is that AirAsia should<br />

take advantage of the several open skies<br />

agreements Malaysia has with the U.S.,<br />

the United Arab Emirates, New Zealand,<br />

Taiwan and Scandinavian countries.<br />

“AirAsia is free to fly to any of these<br />

destinations. Malaysia has also liberalized<br />

agreements with countries<br />

such as <strong>China</strong>, the<br />

Maldives, Britain and<br />

Germany. AirAsia is<br />

also free to fly to these<br />

destinations,” he added.<br />

Apart from the verbal<br />

attack, Fernandes isn’t<br />

taking the fare attack lying<br />

down. He countered the<br />

MAS campaign with two<br />

new initiatives: AirAsia<br />

will pay the difference to<br />

any of his passengers if they<br />

can find any MAS airfare<br />

that is lower than the cheapest<br />

offered by AirAsia and what<br />

he called a “sub-zero fare”<br />

campaign, details of which were yet to<br />

be announced.<br />

Fernandes said he was “very flattered”<br />

by MAS’ initiative because it was a copy<br />

of what AirAsia had been doing. “This is<br />

the 10th time that MAS has copied us. I<br />

guess imitation is the best form of flattery,”<br />

he said.<br />

And he boasted that AirAsia has “newer<br />

aircraft, better and hot food – although<br />

passengers have to buy meals on board<br />

– better seats which are more spacious and<br />

we definitely have better crew ... we also<br />

have more frequency to local destinations<br />

and more point-to-point routes.”<br />

Besides, said Fernandes, AirAsia had<br />

started selling hot roti canai (a popular<br />

Malaysian flatbread) on board flights and<br />

would introduce chicken rice and satay<br />

soon. Over to you Mr Jala! ■<br />

22 ORIENT AVIATION june 2008

AIRPORTS<br />

By Tom Ballantyne<br />

After less than two years<br />

of operations, Bangkok’s<br />

troubled Suvarnabhumi<br />

International Airport is<br />

approaching capacity. Now,<br />

despite ongoing anti-airport demonstrations<br />

by local protest groups, the Thai government<br />

has decided to bite the bullet and fast track<br />

expansion.<br />

The US$2.3 billion second phase development<br />

will increase Suvarnabhumi’s airport<br />

capacity from 45 million passengers a year<br />

to 60 million by 2013.<br />

Work on a $114 million third runway will<br />

begin this year, as well as construction of<br />

a $190 million domestic terminal that will<br />

eventually allow the closure of the city’s<br />

original airport at Don Muang. The old airport<br />

re-opened for domestic flights in March<br />

last year after cracks appeared in taxiways at<br />

Suvarnabhumi limiting its capacity.<br />

The decision to expand, originally put<br />

on hold last year as a government budgetary<br />

measure, was taken at a meeting between<br />

Thai transport minister, Santi Prompat, and<br />

senior officials of the Airports Authority<br />

of Thailand (AoT) and the country’s Civil<br />

<strong>Aviation</strong> Department in late April.<br />

The decision is almost certain to add to<br />

the protests from local residents who have<br />

been complaining about noise from the new<br />

airport and campaigning for compensation<br />

since it opened.<br />

The government has promised to<br />

compensate residents suffering most by<br />

building new houses and helping to relocate<br />

them to quieter neighbourhoods. Other<br />

residents are waiting for their homes to be<br />

soundproofed.<br />

As recently as April the Bangkok Post<br />

reported police had arrested two villagers for<br />

endangering air traffic after they allegedly<br />

sent lighted paper lanterns into the night sky<br />

near the airport.<br />

In January, residents also released more<br />

than 100 balloons around the airport, causing<br />

flights to be delayed for two hours. The AoT<br />

had to pay around $500,000 in compensation<br />

to airlines affected by the delay.<br />

More protests expected as …<br />

Suvarnabhumi<br />

granted fast<br />

track expansion<br />

The first plane lands at Bangkok’s Suvarnabhumi International Airport two<br />

years ago. It has already reached capacity<br />

Resident protests and cracked taxiways<br />

are not the only issues to have plagued the<br />

airport. Since its opening it has suffered<br />

operational problems and other construction<br />

flaws, complaints about poor sanitation and<br />

corruption scandals involving procurement<br />

of equipment for the airport and contracts<br />

written for its construction.<br />

The expansion plan involves 10 projects.<br />

Apart from a third runway and a domestic<br />

terminal, to be built separately from the<br />

existing international terminal, other facilities<br />

planned include an automated people<br />

mover, a new car park and a noise pollution<br />

reduction scheme.<br />

The decision to build a separate<br />

domestic terminal at Suvarnabhumi – it<br />

will be completed by 2010 – removes any<br />

lingering doubts Don Muang will remain in<br />

operation. There has been a fierce debate in<br />

Thailand about the second airport’s future.<br />

<strong>Airlines</strong> want a single airport handling<br />

both international and domestic traffic<br />

while some sections of the government<br />

argued Don Muang should remain open<br />

to give the city two airports and relieve<br />

pressure on Suvarnabhumi.<br />

A transport ministry source was quoted<br />

in local media as saying the government “has<br />

a clear single airport policy” and that Don<br />

Muang will be used only for such operations<br />

as charter flights and air shows.<br />

No date has been set to move domestic<br />

flights back to Suvarnabhumi, but this is<br />

expected to occur when the new domestic<br />

terminal opens. ■<br />

<strong>Orient</strong> <strong>Aviation</strong> is available on<br />

<br />

www.orientaviation.com<br />

june 2008 ORIENT AVIATION 23

ECHNO<br />

SUPER<br />

S U P E R I O R T E A M O F E X P E R T S<br />

Seldom has such a list of the finest aviation companies collaborated on one project. The Sukhoi Superjet 100<br />

family of 75 and 95 seat regional jets is the brainchild of the elite aerospace companies of Europe and America.<br />

With Boeing as a consultant and marketed jointly with Superjet International along with after sales support,<br />

the results are as you’d expect. Aircraft superior to everything else in their sector. Aircraft created to tick<br />

every box on every airline’s wish list. Superior technology. Superior reliability. Superior savings. Superior<br />

capacity optimisation. Superior passenger comfort. Superior range. The Sukhoi Superjet 100 family is also<br />

lighter. And it delivers unprecedented reliability, lower maintenance and operating costs. With 10% lower<br />

fuel consumption than its rivals. It’s a family that gives you flexibility of range and fleet. A range with higher<br />

passenger comfort levels. With wider seats and wider aisles. More headroom and 27% more bin capacity.<br />

Visit www.sukhoi.superjet100.com and discover the result of great companies thinking alike.<br />

sukhoi superjet100 is designed, developed and built by sukhoi civil aircraft company. superjet international is a joint venture between

LOGY<br />

TEAM<br />

T O A N Y O T H E R R E G I O N A L J E T<br />

sukhoi and alenia aeronautica. for sales, aftersales and marketing visit www.sukhoi.superjet100.com and www.superjetinternational.com

COMMUTER AVIATION<br />

KAL to launch LCC<br />

South Korean flag carrier, Korean offices in Pusan and Jeju as well as Gimpo<br />

Air, said it would launch its airport, near Seoul, are 100% Internet booking,<br />

free seating divided into three zones and<br />

low-cost carrier (LCC), Air<br />

Korea, with a B737-800 service staff and crew who will “multi-task”.<br />

between Seoul and the<br />

tourist island, Jeju, in July.<br />

Chief executive of the airline,<br />

Jae Kun Kim, said the LCC, which<br />

was first announced in January, had<br />

received its scheduled air transportation<br />

business licence and had applied<br />

for its Air Operator’s Certificate.<br />

Air Korea plans to launch the<br />

carrier with a start-up staff of 70 and<br />

progressively build the new network<br />

with the addition of two B737-800s<br />

this year and two A300-600s in 2009, Korean Air: to launch LCC by the end of July<br />

bringing the fleet to five airliners 12<br />

months after launch.<br />

“Air Korea is not your average low-cost<br />

The chief executive said the airline would carrier. It is focussed on short-haul routes<br />

have 120 staff by year-end.<br />

with simple, but sophisticated services at<br />

Features of Air Korea, which has opened affordable prices,” said Kim.<br />

Air Korea will face domestic competition<br />

from low-cost operator, Tiger Airways,<br />

which has announced plans to launch a<br />

Korean joint venture LCC, Incheon Tiger<br />

Airways, by December.<br />

Tiger <strong>Aviation</strong>, the parent company<br />

of Singapore-based LCC, Tiger<br />

Airways, formed the joint venture<br />

LCC with the city of Incheon, home of<br />

Seoul’s international airport, in 2007.<br />

At a press conference announcing<br />

the new airline in Seoul, Tiger Airways<br />

chief executive, Tony Davis, said Tiger<br />

<strong>Aviation</strong> would hold 49% of the new<br />

carrier with 51% controlled by Incheon<br />

City and South Korean investors. The<br />

airline will have a start-up fleet of<br />

five A320s.<br />

Korea’s first LCC, Jeju Air, was launched<br />

in 2006 using five Bombardier Q400s.<br />

Earlier this year, it ordered five 737-800s to<br />

boost its network. ■<br />

Smart Thinking.<br />

ILSmart Thinking.<br />

Paul’s job is to keep his airline’s fl eet<br />

fl ying. That takes the right parts being<br />

in the right place at the right time.<br />

ILS can help Paul manage his inventory,<br />

analyze supply and demand trends<br />

in the aftermarket, quickly address<br />

AOG situations, and even turn surplus<br />

into cash. He can also cut costs,<br />

increase operational readiness, and<br />

make the supply chain more effi cient.<br />

That’s smart.<br />

That’s ILSmart.<br />

More Than The Sum Of The Parts<br />

I L S m a r t . c o m<br />

ILS <strong>Orient</strong>Av half pg 2color.indd 1<br />

26 ORIENT AVIATION june 2008<br />

12/20/07 4:54:10 PM

International Perspectives.<br />

Our airport know-how travels the globe.<br />

From global hubs like Frankfurt<br />

to booming low-cost airports<br />

like Frankfurt-Hahn, we serve as<br />

an integrated provider of complete<br />

airport and consulting services<br />

– all from a single source.<br />

Our services range from ground<br />

handling to traffic and terminal<br />

management, from retail management<br />

to real estate. Based<br />

on some 80 years of aviation<br />

history, Fraport AG’s<br />

multifaceted experience<br />

is highly recognized and<br />

sought after around the<br />

world: for example, in New<br />

Delhi, Kairo, Lima, Antalya,<br />

Hong Kong and Shanghai.<br />

So isn’t it time you became<br />

one of our valued partners?<br />

Contact us at:<br />

marketing@fraport.com<br />

www.fraport.com<br />

Fraport.<br />

The Airport Managers.

COVER STORY<br />

ALASTAIR CARTHEW<br />

reports from Tokyo<br />

Photos: YASUO SASAMURA<br />

rob finlayson<br />

GOLDEN<br />

HARVEST<br />

Record profits highlight boss<br />

Mineo Yamamoto’s transformation of ANA<br />

Mineo Yamamoto, All<br />

Nippon Air ways’<br />

amiable president<br />

and chief executive,<br />

thinks four years as<br />

head of one of the world’s top airlines is<br />

about right. “It’s like going to university,”<br />

he said.<br />

But three years into his term, he is not<br />

ready to make more time to return to his<br />

passion for scuba diving in Okinawa, off<br />