You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COVER STORY<br />

ANA to fly to key cities like Seoul, Beijing,<br />

Shanghai, Hong Kong, Hanoi and Taipei<br />

within four hours. Even Bangkok is only<br />

four and a half hours from Okinawa.<br />

On July 1, ANA will operate the world’s<br />

first B767-300BCF [Boeing Converted<br />

Freighter]. By 2011, ANA expects to be<br />

operating four widebody aircraft and 10<br />

B767 freighters including BCFs.<br />

Meanwhile, the airline has entered<br />

a strategic cargo alliance with Asiana.<br />

Yamamoto conceded his personal attempt<br />

to establish a cargo alliance with Star<br />

Alliance had so far not advanced as he<br />

would have liked, so the Asiana partnership<br />

is one way of expanding the cargo<br />

business.<br />

“We are aiming for businesses with high<br />

yield. Japanese manufacturers are very<br />

demanding so our service must be good,”<br />

he said. Target markets for goods such as<br />

semi conductors are intra-Asia and from<br />

Asia to North America in the first instance,<br />

with Eastern Europe and Central/South<br />

America being eyed for the future.<br />

A new freight oriented IT infrastructure<br />

is being developed internally for use with a<br />

new express delivery service, All Express<br />

(Allex). ANA will be marketing Allex on<br />

the side of its B767-300BCF freighters.<br />

Referring to the current debate about<br />

aviation’s contribution to climate change<br />

and the industry’s efforts to mitigate its<br />

impact, Yamamoto said ANA was working<br />

with authorities to enable it to fly over<br />

the large Yokota U.S. military air base in<br />

Japan.<br />

ANA flights from western Japan to<br />

Haneda must skirt around the base for<br />

security reasons. Direct flights would<br />

reduce fuel burn. ANA also supports reafforestation<br />

and coral farming initiatives<br />

in Japan.<br />

Mineo Yamamoto is a man in charge,<br />

comfortable with where his airline is, but<br />

conscious of finishing the job he set out to<br />

do in 2005. Perhaps his philosophy could<br />

be summed up by his company’s mission<br />

statement. He says he wanted to give<br />

ANA’s staff and customers “dreams and<br />

experiences”.<br />

Meanwhile his dream of more scuba<br />

diving in Okinawa will have to wait a little<br />

bit longer. ■<br />

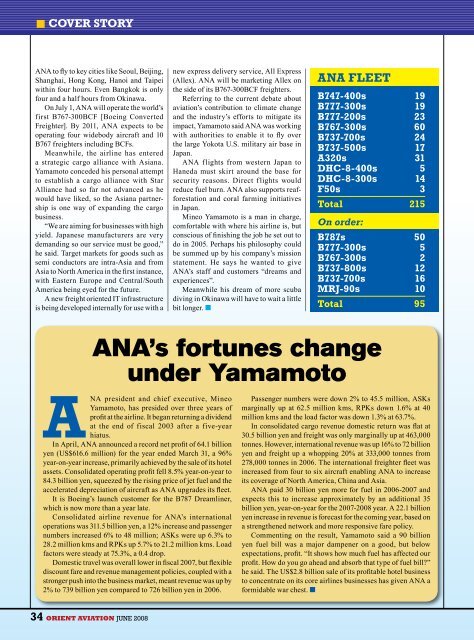

ANA FLEET<br />

B747-400s 19<br />

B777-300s 19<br />

B777-200s 23<br />

B767-300s 60<br />

B737-700s 24<br />

B737-500s 17<br />

A320s 31<br />

DHC-8-400s 5<br />

DHC-8-300s 14<br />

F50s 3<br />

Total 215<br />

On order:<br />

B787s 50<br />

B777-300s 5<br />

B767-300s 2<br />

B737-800s 12<br />

B737-700s 16<br />

MRJ-90s 10<br />

Total 95<br />

ANA’s fortunes change<br />

under Yamamoto<br />

ANA president and chief executive, Mineo<br />

Yamamoto, has presided over three years of<br />

profit at the airline. It began returning a dividend<br />

at the end of fiscal 2003 after a five-year<br />

hiatus.<br />

In April, ANA announced a record net profit of 64.1 billion<br />

yen (US$616.6 million) for the year ended March 31, a 96%<br />

year-on-year increase, primarily achieved by the sale of its hotel<br />

assets. Consolidated operating profit fell 8.5% year-on-year to<br />

84.3 billion yen, squeezed by the rising price of jet fuel and the<br />

accelerated depreciation of aircraft as ANA upgrades its fleet.<br />

It is Boeing’s launch customer for the B787 Dreamliner,<br />

which is now more than a year late.<br />

Consolidated airline revenue for ANA’s international<br />

operations was 311.5 billion yen, a 12% increase and passenger<br />

numbers increased 6% to 48 million; ASKs were up 6.3% to<br />

28.2 million kms and RPKs up 5.7% to 21.2 million kms. Load<br />

factors were steady at 75.3%, a 0.4 drop.<br />

Domestic travel was overall lower in fiscal 2007, but flexible<br />

discount fare and revenue management policies, coupled with a<br />

stronger push into the business market, meant revenue was up by<br />

2% to 739 billion yen compared to 726 billion yen in 2006.<br />

Passenger numbers were down 2% to 45.5 million, ASKs<br />

marginally up at 62.5 million kms, RPKs down 1.6% at 40<br />

million kms and the load factor was down 1.3% at 63.7%.<br />

In consolidated cargo revenue domestic return was flat at<br />

30.5 billion yen and freight was only marginally up at 463,000<br />

tonnes. However, international revenue was up 16% to 72 billion<br />

yen and freight up a whopping 20% at 333,000 tonnes from<br />

278,000 tonnes in 2006. The international freighter fleet was<br />

increased from four to six aircraft enabling ANA to increase<br />

its coverage of North America, <strong>China</strong> and Asia.<br />

ANA paid 30 billion yen more for fuel in 2006-2007 and<br />

expects this to increase approximately by an additional 35<br />

billion yen, year-on-year for the 2007-2008 year. A 22.1 billion<br />

yen increase in revenue is forecast for the coming year, based on<br />

a strengthened network and more responsive fare policy.<br />

Commenting on the result, Yamamoto said a 90 billion<br />

yen fuel bill was a major dampener on a good, but below<br />

expectations, profit. “It shows how much fuel has affected our<br />

profit. How do you go ahead and absorb that type of fuel bill?”<br />

he said. The US$2.8 billion sale of its profitable hotel business<br />

to concentrate on its core airlines businesses has given ANA a<br />

formidable war chest. ■<br />

34 ORIENT AVIATION june 2008

![OAMag-V7N4-Cover [Converted] - Orient Aviation](https://img.yumpu.com/48598575/1/190x255/oamag-v7n4-cover-converted-orient-aviation.jpg?quality=85)