update - AFA USAirways

update - AFA USAirways

update - AFA USAirways

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Together We Fly<br />

May 24, 2004<br />

UPDATE<br />

A plan to reshape US Airways<br />

Creating a new airline to compete for the future<br />

US Airways’ strategy to successfully compete in today’s difficult industry environment involves nothing less than a radical<br />

transformation of the airline.<br />

The changes will involve the route structure, our schedule,<br />

the way we set and distribute<br />

fares, and the products we offer<br />

our customers. Its success,<br />

however, depends on our<br />

ability to lower costs to the<br />

levels of successful airlines<br />

like AirTran, America West,<br />

Southwest and JetBlue. These<br />

carriers have demonstrated<br />

their ability to be consistently<br />

profitable in the new industry<br />

environment.<br />

Special Edition<br />

Because the content of this issue<br />

is important to the<br />

understanding of the<br />

Transformation Plan,<br />

US Airways is mailing it to<br />

homes for employees and their<br />

families.<br />

While the company’s<br />

Transformation Plan was<br />

outlined to labor leaders<br />

earlier this month, it involves<br />

much more than labor costs.<br />

This special edition is<br />

devoted to a summarized<br />

version of the plan as it<br />

relates to the company’s<br />

business model. What it<br />

does not include are details<br />

of how employees are being<br />

asked to contribute to the<br />

cost savings. Those are<br />

issues to be addressed in<br />

negotiations between the<br />

company and its labor<br />

groups.<br />

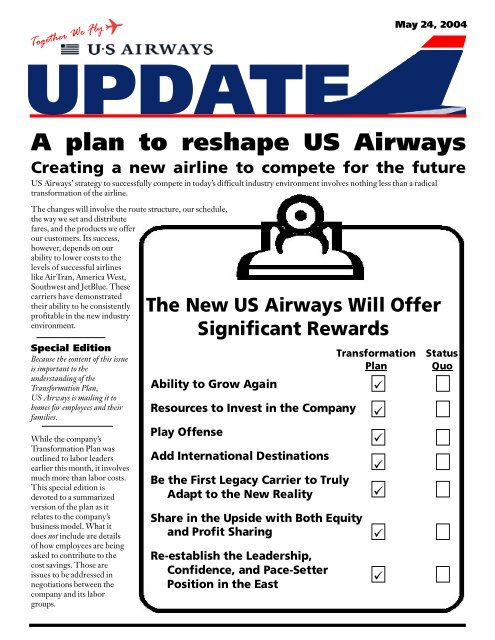

The New US Airways Will Offer<br />

Significant Rewards<br />

Ability to Grow Again<br />

Resources to Invest in the Company<br />

Play Offense<br />

Add International Destinations<br />

Be the First Legacy Carrier to Truly<br />

Adapt to the New Reality<br />

Share in the Upside with Both Equity<br />

and Profit Sharing<br />

Re-establish the Leadership,<br />

Confidence, and Pace-Setter<br />

Position in the East<br />

Transformation<br />

Plan<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Status<br />

Quo

2<br />

UPDATE<br />

Transforming … where we fly<br />

Focus to shift to larger local markets<br />

Local Markets’ Revenue<br />

<br />

<br />

New York<br />

Local Market Yields Are Higher Than Connect<br />

With Small Local Markets, CLT & PIT Rely More on Connecting Traffic<br />

3,788<br />

Wash, DC<br />

* *<br />

Chicago<br />

LAX<br />

1,683<br />

Dallas<br />

ATL<br />

Domestic Annual O&D Revenue ($mil)<br />

SFO<br />

BOS<br />

*<br />

DEN<br />

Houston<br />

MSP<br />

1,019<br />

PHL<br />

DTW<br />

MIA<br />

SLC<br />

478 473<br />

Like the rest of the so-called legacy carriers, US Airways<br />

primarily operates a hub-and-spoke network. Hundreds of<br />

flights from spoke cities converge in waves many times a day on<br />

our three hubs at Charlotte, Philadelphia and Pittsburgh, where<br />

passengers connect and fly out to their final destination.<br />

While the hub system is a marvelous collector of revenue, it is<br />

also more expensive to operate than point-to-point flights.<br />

Large numbers of gates, equipment and employees are needed<br />

to handle the peaks when aircraft are in the hubs. But during the<br />

down times, these resources sit idle. The hub system also limits<br />

the number of hours per day each aircraft can fly.<br />

Legacy carrier hubs also used to be a “safe haven” to hide in as<br />

the low-cost carriers (LCCs) expanded elsewhere, said Andrew<br />

Nocella, vice president of network and revenue management.<br />

Over the years, US Airways retreated from or downgraded most<br />

of its point-to-point routes to its hubs as low-cost carriers<br />

expanded. “With our hubs now under direct attack from the<br />

LCCs, we no longer have any place to retreat to,” he said.<br />

In the past, the revenue premiums generated by the hub system<br />

more than offset its incremental costs versus a point-to-point<br />

network. This was possible with higher fare levels offered in the<br />

hub local markets in exchange for nonstop service. Further, the<br />

LCCs had not tapped into the revenue stream in many smaller<br />

regional markets in the Northeast. However, this equation has<br />

changed, which requires a transformation of the way we do<br />

business and how we schedule the airline, Nocella explained.<br />

Local market yields (calculated by dividing passenger revenue<br />

by passenger miles and expressed in cents) are higher than in<br />

CLT<br />

PIT<br />

CLE<br />

IND<br />

385<br />

CVG<br />

MEM<br />

* US Airways’ asset strengths<br />

connecting markets. In a hub, the major<br />

carrier can command a premium for<br />

frequent non-stop flights. However,<br />

passengers in spoke cities, who will<br />

likely have to connect at some airline’s<br />

hub to get to their destination, have an<br />

array of choices. Their fares — and the<br />

yield to an airline – are lower, reflecting<br />

this competition.<br />

With their relatively small local market<br />

size, Pittsburgh and Charlotte rely far<br />

more on connecting traffic than<br />

originating passengers. Philadelphia,<br />

meanwhile, is the fifth largest<br />

metropolitan area in the U.S., and<br />

US Airways currently captures 48<br />

percent of the local traffic there.<br />

Under the Transformation Plan,<br />

US Airways’ schedule will be more<br />

focused on larger local markets because<br />

that’s where yields are highest - - and<br />

that is where people want to go. Our<br />

goal is to recapture the number one market share position in<br />

the East through more point-to-point flying and a stronger<br />

focus on LaGuardia, Boston and Washington National with the<br />

US Airways Shuttle as the centerpiece of the operation.<br />

Because of its large population size, Philadelphia will remain at<br />

the core of our network. US Airways has the single largest<br />

number of gates there, including new international and<br />

US Airways Express facilities, and Philadelphia’s geography<br />

also makes it a good gateway city to Europe and the Caribbean.<br />

New York and Washington, D.C., are the nation’s two largest<br />

O&D (origination and destination) markets and Boston is<br />

eighth. US Airways already has a large presence and superb<br />

facilities in all three locations, and these will be leveraged by<br />

providing more point-to-point service. Connecting traffic is<br />

important even in these markets but less so than local<br />

passengers.<br />

Non-stop service will be scheduled to key business and leisure<br />

markets from these three cities. Aircraft utilization will be high<br />

and turn times will be speedy — much like the operations of the<br />

low-cost carriers. The plan includes US Airways returning to<br />

many markets that were abandoned when our costs were higher<br />

than the competition, including New York La Guardia to<br />

Florida, Nocella said.<br />

Under the plan, Charlotte’s strategic position as an effective<br />

hub will permit more Caribbean service and will allow for<br />

more growth of both domestic and international service. It will<br />

operate closer to a traditional hub with more banks, but with<br />

some flattening, or de-peaking of flights, to add efficiency.<br />

Continued on page 3

UPDATE<br />

Transforming . . . where we fly (continued)<br />

Conversion to a point-to-point operation in Charlotte would<br />

have required a significant reduction in the number of flights<br />

and destinations as the local market is not large enough.<br />

Instead, US Airways will grow Charlotte and make it our<br />

primary connecting operation.<br />

The strategy also envisions that Pittsburgh will not operate as a<br />

traditional hub, but instead become a focus city, with<br />

US Airways remaining the leading carrier there, but with fewer<br />

flights and nonstop destinations. As the leading airline in<br />

Pittsburgh US Airways will continue to serve cities where<br />

people in Pittsburgh travel frequently and offer them lower<br />

fares in the process. Smaller markets that have little demand to<br />

and from Pittsburgh likely will lose service. In some situations,<br />

service to these smaller cities will be maintained to<br />

Philadelphia or Charlotte. The final mix of regional jet<br />

departures versus mainline jets will be determined upon how<br />

much local demand there is to and from Pittsburgh.<br />

Transforming … how we sell<br />

Reducing distribution costs will be key<br />

Simplifying our pricing structure will be another vital piece of<br />

US Airways’ successful transformation. Since pricing and<br />

distribution go hand in hand, the effort to simplify pricing and<br />

lower our distribution costs is paramount. These efforts are<br />

already under way and continue to be refined.<br />

The first example of US Airways’ simplified pricing structure is<br />

GoFares, which were introduced in the Philadelphia market on<br />

April 29 as a response to the competitive challenge there.<br />

GoFares is a new, permanent and simplified program of low<br />

prices featuring one-way fares starting as low as $29 and a cap<br />

of no more than $499.<br />

“We have heard our customers loudly and clearly,” said Senior<br />

Vice President of Marketing and Planning Ben Baldanza. “Low<br />

fares are a reality of the marketplace and US Airways is<br />

adapting to these changing realities.”<br />

As we continue to simplify our complex fare system, we will<br />

further reduce our distribution costs. Reductions in<br />

Reservations call times and in customer hold times will<br />

naturally result as change fees and other rules are eliminated.<br />

Airport processing delays also will diminish, along with<br />

customer wait times and complaints.<br />

Ongoing enhancements to usairways.com are helping to simplify<br />

how tickets are sold and distributed. US Airways’ Web site is<br />

the most efficient, low-cost distribution channel to maintain,<br />

and the goal is to double the percentage of online sales we<br />

receive at our Web site – from 10 percent to 20 percent – by<br />

year-end.<br />

To boost use of usairways.com and avoid expensive global<br />

distribution system charges, we are investing to make the site<br />

Operations at Philadelphia under the new plan will be “depeaked,”<br />

meaning domestic flights will not be bunched up in<br />

waves to accommodate connections, but scheduled more on a<br />

“rolling” basis targeted at local customers. Feed for<br />

transatlantic and Caribbean flights, however, will continue. Depeaking<br />

the schedule will allow US Airway to expand the<br />

number of flights it offers in Philadelphia while maintaining or<br />

improving reliability.<br />

As the schedule is de-peaked in various locations, operational<br />

cost reductions result. For instance, fewer gates and less ground<br />

equipment are required. With less congestion, there are<br />

reduced taxi-out and enroute delays. In this scenario fewer<br />

passengers and bags misconnect and there are more efficient<br />

crew pairings. Also, there are more and better maintenance<br />

opportunities to enhance schedule integrity.<br />

However, simply de-peaking the schedule without simplifying<br />

and lowering fares and other operating costs would put the<br />

company further in the red.<br />

more reliable and simpler to use, and will continue to promote<br />

usairways.com with special marketing campaigns to entice<br />

customers to use the Web site.<br />

Another key goal for usairways.com is to migrate a significant<br />

amount of service transactions to the Web site by adding new<br />

self-service features and making the site more intuitive and<br />

reliable for customers to use. This will enable customers to<br />

complete more of their travel transactions online.<br />

“Customers’ willingness to manage their travel experience online,<br />

coupled with the changes we are making to usairways.com,<br />

is fueling a lot of growth for our Web channel,” said Managing<br />

Director E-Commerce Mark Kuhns. “Customers are turning<br />

to the Web site to complete a number of transactions, from<br />

shopping and booking tickets, to printing boarding passes,<br />

applying upgrades and selecting seat assignments, to managing<br />

their Dividend Miles accounts on-line.”<br />

In addition, E-Commerce has been working to integrate<br />

functionality with airport kiosks to further enhance customer<br />

convenience. For example, if customers print their boarding<br />

pass at usairways.com and arrive at the airport without it, they<br />

can now proceed directly to the kiosk and re-print their<br />

boarding pass.<br />

“All of these changes are moving us toward our common goal,<br />

which is to provide our customers with a highly reliable, cost<br />

effective, preferred channel to manage their US Airways travel.<br />

When customers choose this channel, they will be rewarded<br />

with benefits, such as lower fares, or Dividend Miles, which<br />

may not be available through other more costly distribution<br />

channels.” said Kuhns.<br />

3

UPDATE<br />

Transforming … our cost structure<br />

Entire business plan hinges on lower expenses<br />

US Airways’ Transformation Plan hinges on successfully<br />

lowering our cost structure.<br />

Consumers are demanding lower, simpler fares and carriers<br />

like Southwest, America West, AirTran and JetBlue have been<br />

successful because they are able to provide what customers<br />

want. Budget airlines now account for nearly a third of<br />

domestic capacity, up nine percentage points just since 2000<br />

and are expected to top 40 percent by the end of the decade.<br />

To maintain current market share and to even entertain notions of<br />

growth will require US Airways to be competitive in this low-fare<br />

environment. But without lower costs, the initiative to provide<br />

10.02<br />

CASM excluding fuel, Q1 2004<br />

9.04 8.61 8.46 8.39 7.85 7.73<br />

6.57 6.42 6.08 5.86<br />

4.88<br />

US DL AS UA NW CO AA WN FL HP TZ B6<br />

simpler, lower fares cannot be sustained. And without changing the<br />

fare structure, de-peaking our schedule and remaking the network<br />

would only result in larger financial losses.<br />

Cost savings will come primarily from two important sources<br />

— more efficient operations and labor savings.<br />

US Airways Web site are designed to attract more online<br />

bookings and use of e-tickets, thereby lowering distribution<br />

costs.<br />

· Advertising low fares. With advertising driving more<br />

consumers to usairways.com, the amount of fees the company<br />

pays to CRS systems will drop.<br />

These are radical changes to the US Airways business model,<br />

but without them, the company will not be able to compete on<br />

price. Regrettably, as productivity increases are realized, some<br />

of these changes will result in furloughs. But once US Airways is<br />

cost-competitive, growth and recalls can become a reality — a<br />

situation that simply cannot occur<br />

under the status quo.<br />

Employee costs will need to be<br />

compared along five dimensions: rates<br />

of pay; seniority; benefits; productivity<br />

and scope. President and CEO Bruce<br />

Lakefield said the approach to lower<br />

labor costs must be fair. No single work<br />

group will subsidize another’s lack of<br />

marketplace competitiveness, nor can<br />

employees subsidize waste or mistakes<br />

made by management, he said.<br />

The new US Airways labor cost<br />

structure must be based on that of our<br />

profitable competitors, such as<br />

America West, which operates a<br />

network system, and JetBlue, which<br />

operates point-to-point.<br />

Every employee group will need to compare itself to the<br />

industry’s “best practices” for their respective group.<br />

Management has acknowledged that profit sharing with all<br />

employees must be a part of the plan so that employees can<br />

share in the upside of success.<br />

Management actions will provide the structure required to<br />

compete. These include:<br />

· Increased aircraft utilization. This will improve productivity<br />

of employees both in the air and on the ground.<br />

· De-peaking hub schedules. This also will improve<br />

employee productivity and lead to fewer misconnected<br />

passengers, lost bags and flight delays.<br />

· Lower, simpler fares. With a less complex fare structure,<br />

Reservations talk time goes down and productivity rises. The<br />

sales department will have fewer complex contracts to<br />

manage, resulting in lower selling costs. And customers will<br />

have fewer complaints.<br />

· Automation. In airports, increasing use of kiosks results in<br />

lower costs and higher productivity, as will gate readers when<br />

they begin to be installed this year. Improvements to the<br />

4<br />

UPDATE<br />

US Airways Corporate Communications<br />

2345 Crystal Dr. Arlington, VA 22227<br />

Tel: 703-872-5100 Fax: 703-872-5104<br />

Comat code: DCA H/850<br />

Lotus Notes/PROFS: usnews<br />

Email: usnews@usairways.com<br />

Editor: John Bronson, director of Corporate<br />

Communications<br />

Publisher: Office Services - Pittsburgh<br />

Contributors: Amy Phoenik, manager of Employee<br />

Communications