Annual Report 1998 - Omron

Annual Report 1998 - Omron

Annual Report 1998 - Omron

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2. Translation<br />

into United<br />

States Dollars<br />

The consolidated financial statements are stated in Japanese yen, the currency of the country in which<br />

the Company is incorporated and operates. The translations of Japanese yen amounts into U.S. dollar<br />

amounts are included solely for convenience and have been made at the rate of ¥132 to $1, the<br />

approximate free rate of exchange at March 31, <strong>1998</strong>. Such translations should not be construed as<br />

representations that the Japanese yen amounts could be converted into U.S. dollars at the above or any<br />

other rate.<br />

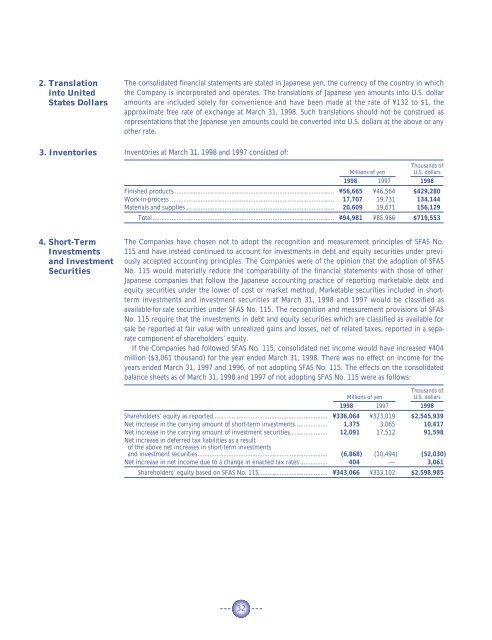

3. Inventories Inventories at March 31, <strong>1998</strong> and 1997 consisted of:<br />

Millions of yen<br />

Thousands of<br />

U.S. dollars<br />

<strong>1998</strong> 1997 <strong>1998</strong><br />

Finished products ............................................................................................. ¥56,665 ¥46,564 $429,280<br />

Work-in-process ................................................................................................ 17,707 19,731 134,144<br />

Materials and supplies....................................................................................... 20,609 19,671 156,129<br />

Total .......................................................................................................... ¥94,981 ¥85,966 $719,553<br />

4. Short-Term<br />

Investments<br />

and Investment<br />

Securities<br />

The Companies have chosen not to adopt the recognition and measurement principles of SFAS No.<br />

115 and have instead continued to account for investments in debt and equity securities under previously<br />

accepted accounting principles. The Companies were of the opinion that the adoption of SFAS<br />

No. 115 would materially reduce the comparability of the financial statements with those of other<br />

Japanese companies that follow the Japanese accounting practice of reporting marketable debt and<br />

equity securities under the lower of cost or market method. Marketable securities included in shortterm<br />

investments and investment securities at March 31, <strong>1998</strong> and 1997 would be classified as<br />

available-for-sale securities under SFAS No. 115. The recognition and measurement provisions of SFAS<br />

No. 115 require that the investments in debt and equity securities which are classified as available for<br />

sale be reported at fair value with unrealized gains and losses, net of related taxes, reported in a separate<br />

component of shareholders’ equity.<br />

If the Companies had followed SFAS No. 115, consolidated net income would have increased ¥404<br />

million ($3,061 thousand) for the year ended March 31, <strong>1998</strong>. There was no effect on income for the<br />

years ended March 31, 1997 and 1996, of not adopting SFAS No. 115. The effects on the consolidated<br />

balance sheets as of March 31, <strong>1998</strong> and 1997 of not adopting SFAS No. 115 were as follows:<br />

Thousands of<br />

Millions of yen<br />

U.S. dollars<br />

<strong>1998</strong> 1997 <strong>1998</strong><br />

Shareholders’ equity as reported .................................................................. ¥336,064 ¥323,019 $2,545,939<br />

Net increase in the carrying amount of short-term investments................... 1,375 3,065 10,417<br />

Net increase in the carrying amount of investment securities ..................... 12,091 17,512 91,598<br />

Net increase in deferred tax liabilities as a result<br />

of the above net increases in short-term investments<br />

and investment securities............................................................................ (6,868) (10,494) (52,030)<br />

Net increase in net income due to a change in enacted tax rates ................ 404 — 3,061<br />

Shareholders’ equity based on SFAS No. 115........................................ ¥343,066 ¥333,102 $2,598,985<br />

32