Annual Report 1998 - Omron

Annual Report 1998 - Omron

Annual Report 1998 - Omron

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Derivatives<br />

The fair value of derivatives generally reflects the estimated amounts that the Companies would receive<br />

or pay to terminate the contracts at the reporting date, thereby taking into account the current unrealized<br />

gains or losses of open contracts. Dealer quotes are available for most of the Companies’ derivatives; otherwise,<br />

pricing or valuation models are applied to current market information to estimate fair value. The<br />

Companies do not use derivatives for trading purposes.<br />

(1) Interest rate swap contracts:<br />

The Companies enter into interest rate swap agreements to manage exposure to fluctuations in<br />

interest rates. These agreements involve the exchange of interest obligations on fixed and floating<br />

interest rate debt without exchange of the underlying principal amounts. The agreements generally<br />

mature at the time the related debt matures. The differential paid or received on interest rate swap<br />

agreements is recognized as an adjustment to interest expenses. Notional amounts are used to<br />

express the volume of interest rate swap agreements. The notional amounts do not represent cash<br />

flows and are not subject to risk of loss. In the unlikely event that the counterparty fails to meet the<br />

terms of an interest rate swap agreement, the Companies’ exposure is limited to the interest rate<br />

differential. Management considers the exposure to credit risk to be minimal since the counterparties<br />

are major financial institutions.<br />

At March 31, <strong>1998</strong> and 1997, the notional amounts on which the Companies had interest rate<br />

swap agreements outstanding aggregated ¥6,000 million ($45,455 thousand) and ¥12,500 million,<br />

respectively. The estimated fair values of interest rate swap contracts are based on the present values<br />

of discounted future cash flow analysis.<br />

(2) Foreign exchange forward contracts and foreign currency options:<br />

The Companies enter into foreign exchange forward contracts and engage in the purchase and<br />

writing of foreign currency option contracts to hedge foreign currency transactions (primarily the<br />

U.S. dollar, the deutsche mark and other European currencies) on a continuing basis for periods<br />

consistent with their committed exposure. Some of the contracts involve the exchange of two foreign<br />

currencies, according to local needs in foreign subsidiaries. The terms of the currency derivatives<br />

are rarely more than 10 months. The credit exposure of foreign exchange contracts and<br />

currency purchase options are represented by the positive fair value of the contracts at the reporting<br />

date. Management considers the exposure to credit risk to be minimal since the counterparties<br />

are major financial institutions.<br />

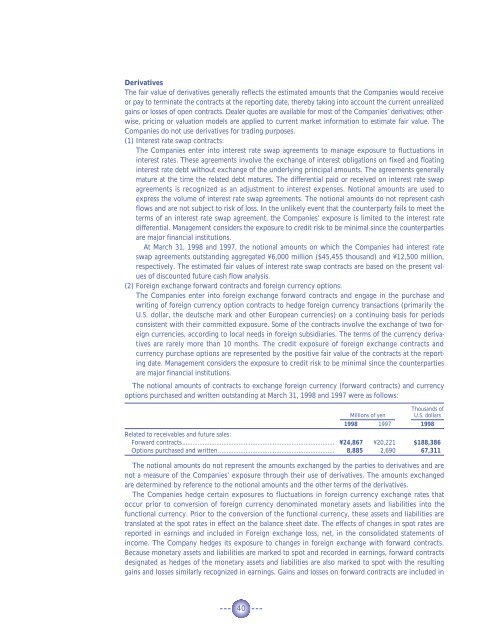

The notional amounts of contracts to exchange foreign currency (forward contracts) and currency<br />

options purchased and written outstanding at March 31, <strong>1998</strong> and 1997 were as follows:<br />

Thousands of<br />

Millions of yen<br />

U.S. dollars<br />

<strong>1998</strong> 1997 <strong>1998</strong><br />

Related to receivables and future sales:<br />

Forward contracts......................................................................................... ¥24,867 ¥20,221 $188,386<br />

Options purchased and written.................................................................... 8,885 2,690 67,311<br />

The notional amounts do not represent the amounts exchanged by the parties to derivatives and are<br />

not a measure of the Companies’ exposure through their use of derivatives. The amounts exchanged<br />

are determined by reference to the notional amounts and the other terms of the derivatives.<br />

The Companies hedge certain exposures to fluctuations in foreign currency exchange rates that<br />

occur prior to conversion of foreign currency denominated monetary assets and liabilities into the<br />

functional currency. Prior to the conversion of the functional currency, these assets and liabilities are<br />

translated at the spot rates in effect on the balance sheet date. The effects of changes in spot rates are<br />

reported in earnings and included in Foreign exchange loss, net, in the consolidated statements of<br />

income. The Company hedges its exposure to changes in foreign exchange with forward contracts.<br />

Because monetary assets and liabilities are marked to spot and recorded in earnings, forward contracts<br />

designated as hedges of the monetary assets and liabilities are also marked to spot with the resulting<br />

gains and losses similarly recognized in earnings. Gains and losses on forward contracts are included in<br />

40