Annual Report 1998 - Omron

Annual Report 1998 - Omron

Annual Report 1998 - Omron

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Company has not provided for Japanese income taxes on unremitted earnings of subsidiaries to<br />

the extent that they are believed to be indefinitely reinvested. The unremitted earnings of the foreign<br />

subsidiaries which are considered to be indefinitely reinvested and for which Japanese income taxes<br />

have not been provided were ¥35,315 million ($267,538 thousand) and ¥29,282 million for the years<br />

ended March 31, <strong>1998</strong> and 1997, respectively. It is not practicable to estimate the amount of unrecognized<br />

deferred Japanese income taxes on these unremitted earnings. Dividends received from domestic<br />

subsidiaries are expected to be substantially free of tax.<br />

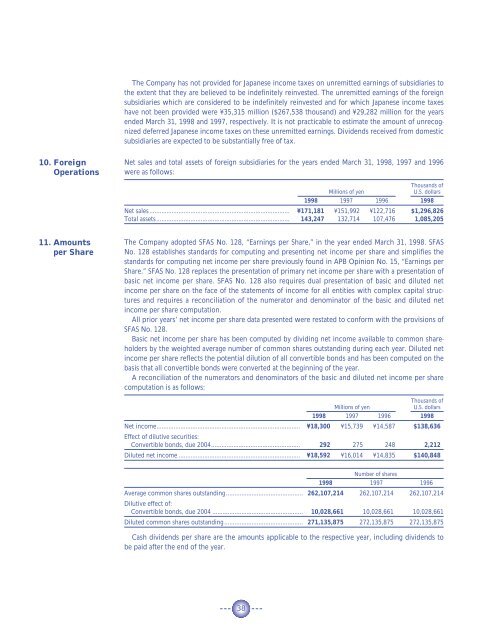

10. Foreign<br />

Operations<br />

Net sales and total assets of foreign subsidiaries for the years ended March 31, <strong>1998</strong>, 1997 and 1996<br />

were as follows:<br />

Thousands of<br />

Millions of yen<br />

U.S. dollars<br />

<strong>1998</strong> 1997 1996 <strong>1998</strong><br />

Net sales.................................................................................. ¥171,181 ¥151,992 ¥122,716 $1,296,826<br />

Total assets.............................................................................. 143,247 132,714 107,476 1,085,205<br />

11. Amounts<br />

per Share<br />

The Company adopted SFAS No. 128, “Earnings per Share,” in the year ended March 31, <strong>1998</strong>. SFAS<br />

No. 128 establishes standards for computing and presenting net income per share and simplifies the<br />

standards for computing net income per share previously found in APB Opinion No. 15, “Earnings per<br />

Share.” SFAS No. 128 replaces the presentation of primary net income per share with a presentation of<br />

basic net income per share. SFAS No. 128 also requires dual presentation of basic and diluted net<br />

income per share on the face of the statements of income for all entities with complex capital structures<br />

and requires a reconciliation of the numerator and denominator of the basic and diluted net<br />

income per share computation.<br />

All prior years’ net income per share data presented were restated to conform with the provisions of<br />

SFAS No. 128.<br />

Basic net income per share has been computed by dividing net income available to common shareholders<br />

by the weighted average number of common shares outstanding during each year. Diluted net<br />

income per share reflects the potential dilution of all convertible bonds and has been computed on the<br />

basis that all convertible bonds were converted at the beginning of the year.<br />

A reconciliation of the numerators and denominators of the basic and diluted net income per share<br />

computation is as follows:<br />

Thousands of<br />

Millions of yen<br />

U.S. dollars<br />

<strong>1998</strong> 1997 1996 <strong>1998</strong><br />

Net income.................................................................................... ¥18,300 ¥15,739 ¥14,587 $138,636<br />

Effect of dilutive securities:<br />

Convertible bonds, due 2004.................................................... 292 275 248 2,212<br />

Diluted net income ....................................................................... ¥18,592 ¥16,014 ¥14,835 $140,848<br />

Number of shares<br />

<strong>1998</strong> 1997 1996<br />

Average common shares outstanding............................................. 262,107,214 262,107,214 262,107,214<br />

Dilutive effect of:<br />

Convertible bonds, due 2004 ..................................................... 10,028,661 10,028,661 10,028,661<br />

Diluted common shares outstanding.............................................. 271,135,875 272,135,875 272,135,875<br />

Cash dividends per share are the amounts applicable to the respective year, including dividends to<br />

be paid after the end of the year.<br />

38