Marks & Spencer Final Salary Pension Scheme - PRAG

Marks & Spencer Final Salary Pension Scheme - PRAG

Marks & Spencer Final Salary Pension Scheme - PRAG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

i<br />

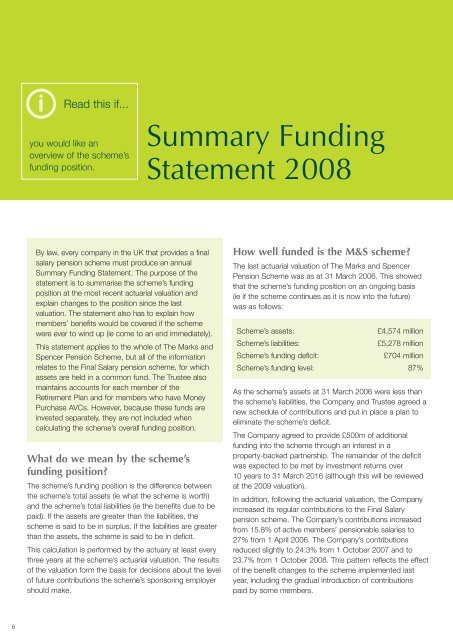

Read this if...<br />

you would like an<br />

overview of the scheme’s<br />

funding position.<br />

Summary Funding<br />

Statement 2008<br />

By law, every company in the UK that provides a final<br />

salary pension scheme must produce an annual<br />

Summary Funding Statement. The purpose of the<br />

statement is to summarise the scheme’s funding<br />

position at the most recent actuarial valuation and<br />

explain changes to the position since the last<br />

valuation. The statement also has to explain how<br />

members’ benefits would be covered if the scheme<br />

were ever to wind up (ie come to an end immediately).<br />

This statement applies to the whole of The <strong>Marks</strong> and<br />

<strong>Spencer</strong> <strong>Pension</strong> <strong>Scheme</strong>, but all of the information<br />

relates to the <strong>Final</strong> <strong>Salary</strong> pension scheme, for which<br />

assets are held in a common fund. The Trustee also<br />

maintains accounts for each member of the<br />

Retirement Plan and for members who have Money<br />

Purchase AVCs. However, because these funds are<br />

invested separately, they are not included when<br />

calculating the scheme’s overall funding position.<br />

What do we mean by the scheme’s<br />

funding position?<br />

The scheme’s funding position is the difference between<br />

the scheme’s total assets (ie what the scheme is worth)<br />

and the scheme’s total liabilities (ie the benefits due to be<br />

paid). If the assets are greater than the liabilities, the<br />

scheme is said to be in surplus. If the liabilities are greater<br />

than the assets, the scheme is said to be in deficit.<br />

This calculation is performed by the actuary at least every<br />

three years at the scheme’s actuarial valuation. The results<br />

of the valuation form the basis for decisions about the level<br />

of future contributions the scheme’s sponsoring employer<br />

should make.<br />

How well funded is the M&S scheme?<br />

The last actuarial valuation of The <strong>Marks</strong> and <strong>Spencer</strong><br />

<strong>Pension</strong> <strong>Scheme</strong> was as at 31 March 2006. This showed<br />

that the scheme’s funding position on an ongoing basis<br />

(ie if the scheme continues as it is now into the future)<br />

was as follows:<br />

<strong>Scheme</strong>’s assets:<br />

£4,574 million<br />

<strong>Scheme</strong>’s liabilities:<br />

£5,278 million<br />

<strong>Scheme</strong>’s funding deficit:<br />

£704 million<br />

<strong>Scheme</strong>’s funding level: 87%<br />

As the scheme’s assets at 31 March 2006 were less than<br />

the scheme’s liabilities, the Company and Trustee agreed a<br />

new schedule of contributions and put in place a plan to<br />

eliminate the scheme’s deficit.<br />

The Company agreed to provide £500m of additional<br />

funding into the scheme through an interest in a<br />

property-backed partnership. The remainder of the deficit<br />

was expected to be met by investment returns over<br />

10 years to 31 March 2016 (although this will be reviewed<br />

at the 2009 valuation).<br />

In addition, following the actuarial valuation, the Company<br />

increased its regular contributions to the <strong>Final</strong> <strong>Salary</strong><br />

pension scheme. The Company’s contributions increased<br />

from 15.8% of active members’ pensionable salaries to<br />

27% from 1 April 2006. The Company’s contributions<br />

reduced slightly to 24.3% from 1 October 2007 and to<br />

23.7% from 1 October 2008. This pattern reflects the effect<br />

of the benefit changes to the scheme implemented last<br />

year, including the gradual introduction of contributions<br />

paid by some members.<br />

6