Product Highlights Sheet - Nikko AM Asia Limited

Product Highlights Sheet - Nikko AM Asia Limited

Product Highlights Sheet - Nikko AM Asia Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

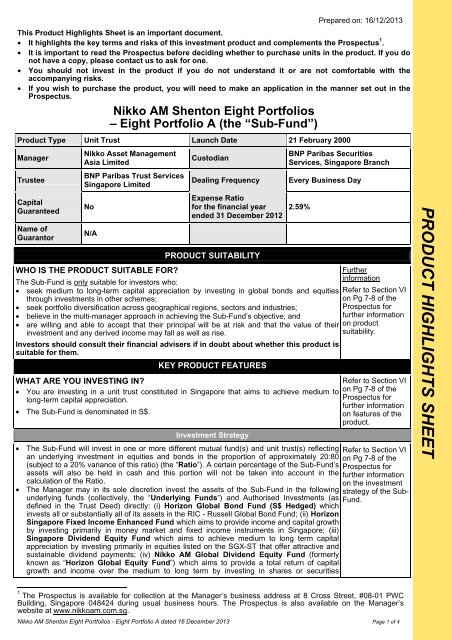

Prepared on: 16/12/2013<br />

This <strong>Product</strong> <strong>Highlights</strong> <strong>Sheet</strong> is an important document.<br />

• It highlights the key terms and risks of this investment product and complements the Prospectus 1 .<br />

• It is important to read the Prospectus before deciding whether to purchase units in the product. If you do<br />

not have a copy, please contact us to ask for one.<br />

• You should not invest in the product if you do not understand it or are not comfortable with the<br />

accompanying risks.<br />

• If you wish to purchase the product, you will need to make an application in the manner set out in the<br />

Prospectus.<br />

<strong>Nikko</strong> <strong>AM</strong> Shenton Eight Portfolios<br />

– Eight Portfolio A (the “Sub-Fund”)<br />

<strong>Product</strong> Type Unit Trust Launch Date 21 February 2000<br />

Manager<br />

Trustee<br />

Capital<br />

Guaranteed<br />

Name of<br />

Guarantor<br />

<strong>Nikko</strong> Asset Management<br />

<strong>Asia</strong> <strong>Limited</strong><br />

BNP Paribas Trust Services<br />

Singapore <strong>Limited</strong><br />

No<br />

N/A<br />

WHO IS THE PRODUCT SUITABLE FOR?<br />

Custodian<br />

Dealing Frequency<br />

Expense Ratio<br />

for the financial year<br />

ended 31 December 2012<br />

PRODUCT SUITABILITY<br />

BNP Paribas Securities<br />

Services, Singapore Branch<br />

Every Business Day<br />

2.59%<br />

The Sub-Fund is only suitable for investors who:<br />

• seek medium to long-term capital appreciation by investing in global bonds and equities<br />

through investments in other schemes;<br />

• seek portfolio diversification across geographical regions, sectors and industries;<br />

• believe in the multi-manager approach in achieving the Sub-Fund’s objective; and<br />

• are willing and able to accept that their principal will be at risk and that the value of their<br />

investment and any derived income may fall as well as rise.<br />

Investors should consult their financial advisers if in doubt about whether this product is<br />

suitable for them.<br />

KEY PRODUCT FEATURES<br />

WHAT ARE YOU INVESTING IN?<br />

• You are investing in a unit trust constituted in Singapore that aims to achieve medium to<br />

long-term capital appreciation.<br />

• The Sub-Fund is denominated in S$.<br />

Investment Strategy<br />

• The Sub-Fund will invest in one or more different mutual fund(s) and unit trust(s) reflecting<br />

an underlying investment in equities and bonds in the proportion of approximately 20:80<br />

(subject to a 20% variance of this ratio) (the “Ratio”). A certain percentage of the Sub-Fund’s<br />

assets will also be held in cash and this portion will not be taken into account in the<br />

calculation of the Ratio.<br />

• The Manager may in its sole discretion invest the assets of the Sub-Fund in the following<br />

underlying funds (collectively, the “Underlying Funds”) and Authorised Investments (as<br />

defined in the Trust Deed) directly: (i) Horizon Global Bond Fund (S$ Hedged) which<br />

invests all or substantially all of its assets in the RIC - Russell Global Bond Fund; (ii) Horizon<br />

Singapore Fixed Income Enhanced Fund which aims to provide income and capital growth<br />

by investing primarily in money market and fixed income instruments in Singapore; (iii)<br />

Singapore Dividend Equity Fund which aims to achieve medium to long term capital<br />

appreciation by investing primarily in equities listed on the SGX-ST that offer attractive and<br />

sustainable dividend payments; (iv) <strong>Nikko</strong> <strong>AM</strong> Global Dividend Equity Fund (formerly<br />

known as “Horizon Global Equity Fund”) which aims to provide a total return of capital<br />

growth and income over the medium to long term by investing in shares or securities<br />

Further<br />

information<br />

Refer to Section VI<br />

on Pg 7-8 of the<br />

Prospectus for<br />

further information<br />

on product<br />

suitability.<br />

Refer to Section VI<br />

on Pg 7-8 of the<br />

Prospectus for<br />

further information<br />

on features of the<br />

product.<br />

Refer to Section VI<br />

on Pg 7-8 of the<br />

Prospectus for<br />

further information<br />

on the investment<br />

strategy of the Sub-<br />

Fund.<br />

PRODUCT HIGHLIGHTS SHEET<br />

1 The Prospectus is available for collection at the Manager’s business address at 8 Cross Street, #08-01 PWC<br />

Building, Singapore 048424 during usual business hours. The Prospectus is also available on the Manager’s<br />

website at www.nikkoam.com.sg.<br />

<strong>Nikko</strong> <strong>AM</strong> Shenton Eight Portfolios - Eight Portfolio A dated 16 December 2013 Page 1 of 4

equivalent to shares listed on stock exchanges globally in Developed Markets and Emerging<br />

Markets; (v) Russell Global Bond Fund which aims to provide income and capital growth<br />

by investing primarily in investment grade bonds denominated in a variety of currencies and<br />

(vi) Russell US Equity Fund, Russell Continental European Equity Fund, Russell Japan<br />

Equity Fund, Russell UK Equity Fund and Russell Pacific Basin Equity Fund which aim<br />

to achieve capital appreciation by investing in equity securities, including common stock,<br />

convertibles and warrants listed on the stock exchanges in the United States, United<br />

Kingdom, Europe, Japan and the <strong>Asia</strong>-Pacific countries (as the case may be). The<br />

Underlying Funds in (i) to (iv) are each a sub-fund of <strong>Nikko</strong> <strong>AM</strong> Shenton Horizon Investment<br />

Funds, while the Underlying Funds in (v) and (vi) are each a sub-fund of the RIC.<br />

• A comprehensive investment plan implemented using the Sub-Fund will have 3 levels of<br />

diversification: Multi-Asset, Multi-Style and Multi-Manager.<br />

• The Underlying Funds may invest in financial derivatives instruments (“FDIs”).<br />

WHO ARE YOU INVESTING WITH?<br />

Parties Involved<br />

• The Manager is <strong>Nikko</strong> Asset Management <strong>Asia</strong> <strong>Limited</strong> and the Trustee/Registrar is BNP<br />

Paribas Trust Services Singapore <strong>Limited</strong>.<br />

• The Sub-Fund is a sub-fund of the umbrella unit trust called the <strong>Nikko</strong> <strong>AM</strong> Shenton Eight<br />

Portfolios.<br />

• The Custodian is BNP Paribas Securities Services, Singapore Branch.<br />

WHAT ARE THE KEY RISKS OF THIS INVESTMENT?<br />

KEY RISKS<br />

You should be aware that the price of Units can go down as well as up. The value of the<br />

Sub-Fund and its distributions (if any) may rise or fall. The following are key risk factors<br />

that may cause you to lose some or all of your investment:<br />

Market and Credit Risks<br />

• You are exposed to market risk<br />

o The price of the securities comprised in the portfolio of the Sub-Fund and the Units, and<br />

the income from them, may be influenced by political and economic conditions, changes<br />

in interest rates, earnings of the corporations whose securities are comprised in the<br />

portfolio, and the market’s perception of the securities.<br />

• You are exposed to interest rate risk and credit risk<br />

o Investments in debt securities are subject to interest rate fluctuations and credit risks,<br />

such as risk of default by the issuer and are subject to adverse changes in general<br />

economic conditions, the financial condition of the issuer, or both, or an unanticipated rise<br />

in interest rates, which may impair the issuer’s ability to make payments of interest and<br />

principal, resulting in a possible default by the issuer.<br />

• You are exposed to foreign currency risk<br />

o As the investments of the Sub-Fund (which is denominated in SGD) may be denominated<br />

in foreign currencies, any appreciation of the SGD against the relevant currencies may<br />

negatively affect the value of the Units.<br />

Liquidity Risks<br />

• The Sub-Fund is not listed and you can redeem only on Dealing Days<br />

o There is no secondary market for the Units. All realisation requests must be made to the<br />

Manager through its approved distributors.<br />

o If there is a surge in realisations at any particular time, the Manager may impose a gate<br />

on realisations and payment of realisation proceeds to you may be delayed.<br />

o In addition, you may not realise your Units during any period where realisation is<br />

suspended.<br />

• You are exposed to liquidity risk<br />

o The extent of market liquidity depends on the size and state of the markets and therefore<br />

affects the Sub-Fund’s ability to acquire or dispose of assets at the desired price and<br />

time.<br />

<strong>Product</strong>-Specific Risks<br />

• You are exposed to emerging market risk<br />

o Certain Underlying Funds may invest in emerging markets securities which are generally<br />

more volatile than those of developed countries, with the result that Units may be subject<br />

to greater price volatility.<br />

• You are exposed to equity risk<br />

o The Sub-Fund may invest in stocks and other equity securities, which are subject to<br />

Refer to Section II<br />

to Section IV on Pg<br />

4-7 and the<br />

Appendix of the<br />

Prospectus for<br />

further information<br />

on the role and<br />

responsibilities of<br />

these entities.<br />

Refer to Section IX<br />

on Pg 10-16 of the<br />

Prospectus for<br />

further information<br />

on risks of the Sub-<br />

Fund.<br />

PRODUCT HIGHLIGHTS SHEET<br />

<strong>Nikko</strong> <strong>AM</strong> Shenton Eight Portfolios - Eight Portfolio A dated 16 December 2013 Page 2 of 4

market risks and are generally more volatile than investment-grade fixed income<br />

securities. The Units may therefore be subject to greater price volatility.<br />

• You are exposed to the risk associated with the investment strategy of the Sub-Fund<br />

o The performance of the Sub-Fund is subject to the performance of the Underlying Funds<br />

which the Sub-Fund invests in and also to the proportion of the Sub-Fund’s assets<br />

allocated to each of the Underlying Funds. Holders should be aware that the Manager<br />

has limited discretion to vary the allocations to equities and bonds for the Sub-Fund and<br />

this will in turn limit the Manager’s ability to react to changes in market conditions.<br />

• You are exposed to financial derivatives risk<br />

o The Manager may in its absolute discretion, invest in FDIs for the purposes of<br />

hedging, efficient portfolio management and/or optimising returns. While the<br />

prudent and judicious use of derivatives can be beneficial, derivatives involve risks<br />

different from, and in some cases, greater than, the risks presented by more traditional<br />

investments.<br />

You should be aware that your investment in the Sub-Fund may be exposed to other<br />

risks of an exceptional nature from time to time.<br />

FEES AND CHARGES<br />

Payable directly by you<br />

• You will need to pay the following fees and charges as a percentage of your gross<br />

investment sum:<br />

Initial Sales Charge Current: 5% (Maximum 5%)<br />

Realisation Charge Current: NIL (Maximum 1%)<br />

Conversion Fee (for<br />

conversion of Units within<br />

<strong>Nikko</strong> <strong>AM</strong> Shenton Eight<br />

Portfolios)<br />

Exchange Fee (for<br />

exchange of Units for units<br />

of any other Group Trust)<br />

Not exceeding 1% of the value converted or S$200,<br />

whichever is lower<br />

Where Initial Sales Charge for the Units being exchanged is<br />

less than the initial sales charge payable for the units of the<br />

Group Trust being acquired, the difference will be charged.<br />

Payable by the Sub-Fund from invested proceeds<br />

• The Sub-Fund will pay the following fees and charges to the Manager, Trustee and other<br />

parties:<br />

Management Participation Current: 1.25% p.a. ; (Maximum 2.0% p.a.)<br />

Trustee’s Fee<br />

Fees charged by the<br />

Underlying Funds which<br />

the Sub-Fund invests in:<br />

(i) trustee/custodian fee<br />

(ii) Management fee<br />

Any other substantial<br />

fee/charge<br />

Currently below 0.05% p.a. ; (Maximum 0.2% p.a.)<br />

Not exceeding 0.1% p.a.<br />

Waived*<br />

For the financial year ended 31 December 2012:<br />

Transaction fees : 0.11%<br />

* The management fee charged by each Underlying Fund that the Sub-Fund invests in, is<br />

currently borne by the Managers.<br />

VALUATIONS AND EXITING FROM THIS INVESTMENT<br />

HOW OFTEN ARE VALUATIONS AVAILABLE?<br />

The issue price and realisation price of Units will be available on the Business Day following<br />

each Dealing Day. The issue price and realisation price may be obtained from the Manager’s<br />

website (www.nikkoam.com.sg).<br />

HOW CAN YOU EXIT FROM THIS INVESTMENT AND WHAT ARE THE RISKS AND<br />

COSTS IN DOING SO?<br />

Cancellation of Units<br />

If applicable to you, you may cancel your subscription for Units within 7 calendar days from the<br />

date of your subscription or purchase of the Units by sending a cancellation request to the<br />

Managers through the approved distributor from whom you purchased your Units. Any Initial<br />

Sales Charge paid will be refunded to you. However, you will have to take the risk for any price<br />

changes in the NAV of the Sub-Fund since you purchased the Units.<br />

Refer to Section<br />

VIII on Pg 9-10 of<br />

the Prospectus for<br />

further information<br />

on fees and<br />

charges.<br />

Refer to Para 23 on<br />

Pg 18, Section XII<br />

on Pg 18-19 and<br />

Section XIV on Pg<br />

20 of the<br />

Prospectus for<br />

further information<br />

on valuation and<br />

exiting from the<br />

product.<br />

PRODUCT HIGHLIGHTS SHEET<br />

Realisation of Units<br />

You can exit the Sub-Fund by completing a realisation request and forwarding the same to the<br />

Managers through the approved distributor from whom you purchased your Units.<br />

<strong>Nikko</strong> <strong>AM</strong> Shenton Eight Portfolios - Eight Portfolio A dated 16 December 2013 Page 3 of 4

If your realisation request is received and accepted by 5 p.m. on a Dealing Day, you will be paid<br />

a price based on the value of the Sub-Fund for that Dealing Day. If your realisation request is<br />

received and accepted after 5 p.m., you will be paid a price based on the value of the Sub-Fund<br />

on the immediate following Dealing Day.<br />

The realisation proceeds that you will receive are calculated by multiplying the number of Units<br />

to be realised by the realisation price, less any applicable charges.<br />

An example is as follows:<br />

Units to be realised x Realisation price (i.e. NAV per Unit) = Realisation proceeds<br />

1,000 x S$1.05 = S$1,050.00<br />

Currently, there is no Realisation Charge payable.<br />

The cancellation or realisation proceeds will normally be paid within seven Business Days after<br />

the relevant Dealing Day subject to the provisions of the Trust Deed.<br />

CONTACT INFORMATION<br />

HOW DO YOU CONTACT US?<br />

• You can contact the distributor from whom you purchased your Units if you have any query<br />

regarding your investment in the Sub-Fund.<br />

• You can also call us, <strong>Nikko</strong> Asset Management <strong>Asia</strong> <strong>Limited</strong>, at 1800 535 8025 or visit our<br />

website at (www.nikkoam.com.sg).<br />

• Our business address is at 8 Cross Street, #08-01 PWC Building, Singapore 048424.<br />

APPENDIX: GLOSSARY OF TERMS<br />

Business Day means any day (other than a Saturday or a Sunday) on which commercial banks in Singapore<br />

and the SGX-ST are open for business<br />

Dealing Day in relation to Units of the Sub-Fund, means such day or days as the Manager may from time to<br />

time with the approval of the trustee of the Sub-Fund determine, but so that:-<br />

(i) unless and until the Manager (with the approval of the trustee of the Sub-Fund) otherwise<br />

determine, each Business Day after the Commencement Date (as defined in the Trust Deed)<br />

in relation to the Sub-Fund shall be a Dealing Day in relation to the Sub-Fund; and<br />

(ii) without prejudice to the generality of the foregoing, if on any day which would otherwise be a<br />

Dealing Day in relation to Units of the Sub-Fund the recognised stock exchange or exchanges<br />

on which the authorised investment or other property comprised in, and having in aggregate<br />

values amounting to at least 50 per cent. of the value (as of the immediately preceding<br />

valuation point) of the Sub-Fund of which such Units relate are quoted, listed or dealt in is or<br />

are not open for normal trading, the Manager may, with the approval of the trustee of the Sub-<br />

Fund, determine that such day shall not be a Dealing Day in relation to Units of the Sub-Fund<br />

Developed Markets include but are not limited to Australia, Austria, Belgium, Canada, Denmark, Finland, France,<br />

Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway,<br />

Portugal, Singapore, Spain, Sweden, Switzerland, United Kingdom and United States of<br />

America<br />

Emerging Markets include but are not limited to Brazil, Chile, China, Colombia, Czech Republic, Hungary, India,<br />

Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa,<br />

Taiwan, Thailand, Turkey and the United Arab Emirates<br />

Group Trust means a unit trust scheme the manager of which (a) is the Manager or a corporation under its<br />

control or under common control with it or at least 50 per cent of the share capital of which is<br />

held by a corporation which is a shareholder of the Manager; and (b) approve the terms of any<br />

exchange which may be made pursuant to Clause 12(JA) of the Trust Deed<br />

Holder<br />

means a unitholder of the Sub-Fund<br />

Launch Date for the purposes of this <strong>Product</strong> <strong>Highlights</strong> <strong>Sheet</strong> only, means the inception date of the Sub-<br />

Fund.<br />

NAV<br />

means net asset value<br />

Prospectus means the prospectus of the <strong>Nikko</strong> <strong>AM</strong> Shenton Eight Portfolios<br />

RIC<br />

means the Russell Investment Company plc<br />

S$ or SGD means Singapore dollars<br />

SGX-ST<br />

means Singapore Exchange Securities Trading <strong>Limited</strong><br />

Trust Deed means the trust deed constituting the <strong>Nikko</strong> <strong>AM</strong> Shenton Eight Portfolios<br />

Units<br />

means units in the Sub-Fund<br />

PRODUCT HIGHLIGHTS SHEET<br />

<strong>Nikko</strong> <strong>AM</strong> Shenton Eight Portfolios - Eight Portfolio A dated 16 December 2013 Page 4 of 4