Nikko AM Asia Investment Funds POSB InvestSteady Fund

Nikko AM Asia Investment Funds POSB InvestSteady Fund

Nikko AM Asia Investment Funds POSB InvestSteady Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

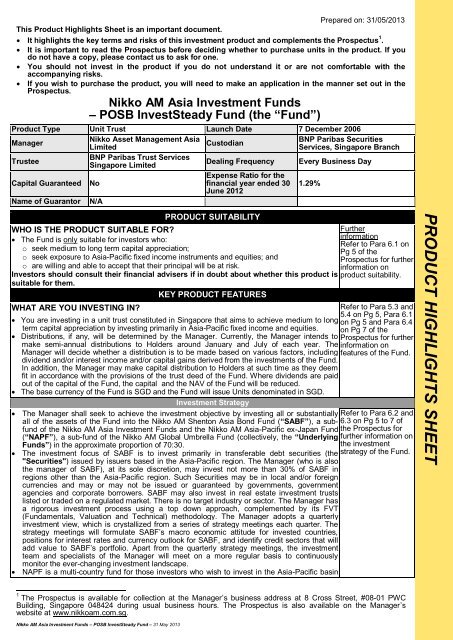

PRODUCT HIGHLIGHTS SHEET<br />

Prepared on: 31/05/2013<br />

This Product Highlights Sheet is an important document.<br />

It highlights the key terms and risks of this investment product and complements the Prospectus 1 .<br />

It is important to read the Prospectus before deciding whether to purchase units in the product. If you<br />

do not have a copy, please contact us to ask for one.<br />

You should not invest in the product if you do not understand it or are not comfortable with the<br />

accompanying risks.<br />

If you wish to purchase the product, you will need to make an application in the manner set out in the<br />

Prospectus.<br />

<strong>Nikko</strong> <strong>AM</strong> <strong>Asia</strong> <strong>Investment</strong> <strong><strong>Fund</strong>s</strong><br />

– <strong>POSB</strong> <strong>InvestSteady</strong> <strong>Fund</strong> (the “<strong>Fund</strong>”)<br />

Product Type Unit Trust Launch Date 7 December 2006<br />

Manager<br />

<strong>Nikko</strong> Asset Management <strong>Asia</strong><br />

BNP Paribas Securities<br />

Custodian<br />

Limited<br />

Services, Singapore Branch<br />

Trustee<br />

BNP Paribas Trust Services<br />

Singapore Limited<br />

Dealing Frequency Every Business Day<br />

Capital Guaranteed No<br />

Expense Ratio for the<br />

financial year ended 30 1.29%<br />

June 2012<br />

Name of Guarantor N/A<br />

PRODUCT SUITABILITY<br />

WHO IS THE PRODUCT SUITABLE FOR?<br />

Further<br />

The <strong>Fund</strong> is only suitable for investors who:<br />

information<br />

Refer to Para 6.1 on<br />

o seek medium to long term capital appreciation;<br />

Pg 5 of the<br />

o seek exposure to <strong>Asia</strong>-Pacific fixed income instruments and equities; and<br />

Prospectus for further<br />

o are willing and able to accept that their principal will be at risk.<br />

information on<br />

Investors should consult their financial advisers if in doubt about whether this product is product suitability.<br />

suitable for them.<br />

KEY PRODUCT FEATURES<br />

WHAT ARE YOU INVESTING IN?<br />

Refer to Para 5.3 and<br />

5.4 on Pg 5, Para 6.1<br />

You are investing in a unit trust constituted in Singapore that aims to achieve medium to long on Pg 5 and Para 6.4<br />

term capital appreciation by investing primarily in <strong>Asia</strong>-Pacific fixed income and equities. on Pg 7 of the<br />

Distributions, if any, will be determined by the Manager. Currently, the Manager intends to Prospectus for further<br />

make semi-annual distributions to Holders around January and July of each year. The information on<br />

Manager will decide whether a distribution is to be made based on various factors, including features of the <strong>Fund</strong>.<br />

dividend and/or interest income and/or capital gains derived from the investments of the <strong>Fund</strong>.<br />

In addition, the Manager may make capital distribution to Holders at such time as they deem<br />

fit in accordance with the provisions of the trust deed of the <strong>Fund</strong>. Where dividends are paid<br />

out of the capital of the <strong>Fund</strong>, the capital and the NAV of the <strong>Fund</strong> will be reduced.<br />

The base currency of the <strong>Fund</strong> is SGD and the <strong>Fund</strong> will issue Units denominated in SGD.<br />

<strong>Investment</strong> Strategy<br />

The Manager shall seek to achieve the investment objective by investing all or substantially Refer to Para 6.2 and<br />

all of the assets of the <strong>Fund</strong> into the <strong>Nikko</strong> <strong>AM</strong> Shenton <strong>Asia</strong> Bond <strong>Fund</strong> (“SABF”), a subfund<br />

of the <strong>Nikko</strong> <strong>AM</strong> <strong>Asia</strong> <strong>Investment</strong> <strong><strong>Fund</strong>s</strong> and the <strong>Nikko</strong> <strong>AM</strong> <strong>Asia</strong>-Pacific ex-Japan <strong>Fund</strong> the Prospectus for<br />

6.3 on Pg 5 to 7 of<br />

(“NAPF”), a sub-fund of the <strong>Nikko</strong> <strong>AM</strong> Global Umbrella <strong>Fund</strong> (collectively, the “Underlying further information on<br />

<strong><strong>Fund</strong>s</strong>”) in the approximate proportion of 70:30.<br />

the investment<br />

The investment focus of SABF is to invest primarily in transferable debt securities (the strategy of the <strong>Fund</strong>.<br />

"Securities") issued by issuers based in the <strong>Asia</strong>-Pacific region. The Manager (who is also<br />

the manager of SABF), at its sole discretion, may invest not more than 30% of SABF in<br />

regions other than the <strong>Asia</strong>-Pacific region. Such Securities may be in local and/or foreign<br />

currencies and may or may not be issued or guaranteed by governments, government<br />

agencies and corporate borrowers. SABF may also invest in real estate investment trusts<br />

listed or traded on a regulated market. There is no target industry or sector. The Manager has<br />

a rigorous investment process using a top down approach, complemented by its FVT<br />

(<strong>Fund</strong>amentals, Valuation and Technical) methodology. The Manager adopts a quarterly<br />

investment view, which is crystallized from a series of strategy meetings each quarter. The<br />

strategy meetings will formulate SABF’s macro economic attitude for invested countries,<br />

positions for interest rates and currency outlook for SABF, and identify credit sectors that will<br />

add value to SABF’s portfolio. Apart from the quarterly strategy meetings, the investment<br />

team and specialists of the Manager will meet on a more regular basis to continuously<br />

monitor the ever-changing investment landscape.<br />

NAPF is a multi-country fund for those investors who wish to invest in the <strong>Asia</strong>-Pacific basin<br />

1 The Prospectus is available for collection at the Manager’s business address at 8 Cross Street, #08-01 PWC<br />

Building, Singapore 048424 during usual business hours. The Prospectus is also available on the Manager’s<br />

website at www.nikkoam.com.sg.<br />

<strong>Nikko</strong> <strong>AM</strong> <strong>Asia</strong> <strong>Investment</strong> <strong><strong>Fund</strong>s</strong> – <strong>POSB</strong> <strong>InvestSteady</strong> <strong>Fund</strong> – 31 May 2013

PRODUCT HIGHLIGHTS SHEET<br />

(ex-Japan). The investment universe includes Taiwan, China, Hong Kong, Singapore,<br />

Malaysia, Thailand, Indonesia, the Philippines, Korea, Australia and New Zealand. Two<br />

thirds of the issuers shall have their registered office or the majority of their business in the<br />

mentioned countries respectively in the <strong>Asia</strong>-Pacific basin. NAPF will pursue an investment<br />

strategy that blends bottom-up fundamental research and top down views within the context<br />

of a centralized decision-making approach. The portfolio is designed to add value by<br />

exploiting stock price volatility, divergence of company quality and circumstances across the<br />

region. This is captured in the strategy’s top-down approach and portfolio construction<br />

process. NAPF may use financial derivative instruments (“FDIs”) for hedging, efficient<br />

portfolio management and to enhance returns.<br />

The <strong>Fund</strong> and SABF may use FDIs for the purposes of optimising returns, hedging<br />

and/or efficient portfolio management.<br />

Parties Involved<br />

WHO ARE YOU INVESTING WITH?<br />

Refer to Para (d), (e)<br />

and (f) on Pg 2-3 of<br />

The <strong>Fund</strong> is a sub-fund of <strong>Nikko</strong> <strong>AM</strong> <strong>Asia</strong> <strong>Investment</strong> <strong><strong>Fund</strong>s</strong>.<br />

the First<br />

The Manager is <strong>Nikko</strong> Asset Management <strong>Asia</strong> Limited.<br />

Supplementary<br />

The manager of the SABF is the Manager. The management company of the NAPF is <strong>Nikko</strong> Prospectus and Para<br />

Asset Management Luxembourg S.A..<br />

2 to 5 on Pg 4-5 of<br />

The Trustee and Registrar is BNP Paribas Trust Services Singapore Limited.<br />

the Prospectus for<br />

The Custodian is BNP Paribas Securities Services, Singapore Branch.<br />

further information on<br />

the role and<br />

responsibilities of<br />

these entities.<br />

KEY RISKS<br />

WHAT ARE THE KEY RISKS OF THIS INVESTMENT?<br />

Refer to Para 6.3 on<br />

Pg 6-7 and Para 9 on<br />

You should be aware that the price of Units can go down as well as up. The value of the Pg 8-16 of the<br />

<strong>Fund</strong> and its distributions (if any) may rise or fall. The following are key risk factors that Prospectus for further<br />

may cause you to lose some or all of your investment:<br />

information on risks<br />

of the <strong>Fund</strong>.<br />

Market and Credit Risks<br />

You are exposed to market risk in the <strong>Asia</strong>-Pacific region.<br />

o The <strong>Fund</strong> has exposure primarily to Securities issued by issuers based in the <strong>Asia</strong>-Pacific<br />

region through its investments in the Underlying <strong><strong>Fund</strong>s</strong>. Please note that the price of the<br />

securities comprised in the portfolios of the Underlying <strong><strong>Fund</strong>s</strong>, and the income from them,<br />

may be influenced by political and economic conditions, changes in interest rates, the<br />

earnings of the corporations whose securities are comprised in the portfolios, and the<br />

market’s perception of the securities.<br />

You are exposed to interest rate and credit risks.<br />

o The SABF’s investments in debt securities are subject to interest rate fluctuations and<br />

credit risks, such as risk of default by the issuer, and are subject to adverse changes in<br />

general economic conditions, the financial condition of the issuer, or both, or an<br />

unanticipated rise in interest rates, which may impair the issuer’s ability to make payments<br />

of interest and principal, resulting in a possible default by the issuer.<br />

Liquidity Risks<br />

The <strong>Fund</strong> is not listed and you can redeem only on Dealing Days.<br />

o There is no ready secondary market for the Units. All realisation requests should be made<br />

to the Manager or its approved distributors.<br />

o If there is a surge in realisations at any particular time, the Manager may impose a gate on<br />

realisations. If that happens, payment of realisation proceeds to you may be delayed.<br />

o<br />

In addition, you may not realise your Units during any period where realisation is<br />

suspended.<br />

You are exposed to liquidity risk.<br />

o The extent of market liquidity is dependent on the size and state of the markets and<br />

therefore affects the ability of each Underlying <strong>Fund</strong> to acquire or dispose of assets at the<br />

price and time it so desires. As a result of the <strong>Fund</strong>’s investment in the Underlying <strong><strong>Fund</strong>s</strong>,<br />

you are exposed to the same risk.<br />

Product-Specific Risks<br />

You are exposed to currency risk.<br />

o The Underlying <strong><strong>Fund</strong>s</strong> may have investments that are denominated in foreign currencies.<br />

Fluctuations of the exchange rates of foreign currencies against the respective base<br />

currencies of the Underlying <strong><strong>Fund</strong>s</strong> may have an impact on the income of the Underlying<br />

<strong><strong>Fund</strong>s</strong> and affect the value of their units.<br />

You are exposed to emerging markets risk.<br />

o Through the <strong>Fund</strong>’s investment in the Underlying <strong><strong>Fund</strong>s</strong>, it has exposure to emerging<br />

markets securities which are in general more volatile than those of developed countries,<br />

with the result that Units may be subject to greater price volatility.<br />

o Some emerging markets do not have well-developed or consolidated bodies of securities<br />

laws and regulatory frameworks, may have less public information on companies listed on<br />

such markets, may use auditing and financial reporting methods that differ from<br />

internationally recognised standards, may experience lower trading volume and liquidity,<br />

<strong>Nikko</strong> <strong>AM</strong> <strong>Asia</strong> <strong>Investment</strong> <strong><strong>Fund</strong>s</strong> – <strong>POSB</strong> <strong>InvestSteady</strong> <strong>Fund</strong> – 31 May 2013

PRODUCT HIGHLIGHTS SHEET<br />

and lack other key characteristics of a developed market.<br />

You are exposed to foreign securities risk.<br />

o Furthermore, the investments of the Underlying <strong><strong>Fund</strong>s</strong> may be affected by political<br />

instability as well as exchange controls, changes in taxation, foreign investment policies<br />

and other restrictions and controls which may be imposed by the relevant authorities in the<br />

other countries.<br />

o The legal infrastructure and accounting, auditing and reporting standards in certain<br />

countries in which an investment may be made may not provide the same degree of<br />

investor protection or information to investors as would generally apply in major securities<br />

markets. Foreign ownership restrictions in some markets may mean that corporate action<br />

entitlements in relation to any collective investment schemes or other investments the<br />

Underlying <strong><strong>Fund</strong>s</strong> are invested in may not always be secured or may be restricted.<br />

You are exposed to derivatives risk.<br />

o The Manager may invest in FDIs for the purposes of optimising returns, hedging and/or<br />

efficient portfolio management. Derivatives involve risks different from, and in some cases,<br />

greater than, the risks presented by more traditional investments. Some of the risks<br />

associated with derivatives are market risk, management risk, credit risk, liquidity risk,<br />

moratorium risk, capital control risk, tax risk and leverage risk. Kindly note that the<br />

Underlying <strong><strong>Fund</strong>s</strong> may use FDIs for hedging and/or for efficient portfolio management as<br />

well.<br />

You should be aware that your investment in the <strong>Fund</strong> may be exposed to other risks of<br />

an exceptional nature from time to time.<br />

FEES AND CHARGES<br />

Payable directly by you<br />

You will need to pay the following fees and charges as a percentage of your gross investment<br />

sum:<br />

Initial Sales Charge Currently 4% (Maximum 5%)<br />

Realisation Charge Currently NIL (Maximum 1%)<br />

Conversion Fee Currently NIL (Maximum 1%)<br />

Anti-dilution levy<br />

As determined at the discretion of the Manager (Please<br />

refer to the “Appendix: Glossary of Terms” of this PHS for<br />

more information).<br />

Payable by the <strong>Fund</strong> from invested proceeds<br />

The <strong>Fund</strong> will pay the following fees and charges to the Manager, Trustee and other parties,<br />

as well as in respect of its investments into the Underlying <strong><strong>Fund</strong>s</strong>:<br />

Annual Management Fee Current: 1.25%; Maximum: 2%<br />

Annual Trustee’s Fee Current: less than 0.06%; Maximum: 0.2%<br />

Other Substantial<br />

Nil.<br />

Fees/Charges (for the financial<br />

year ended 30 June 2012):<br />

Fees and charges of the SABF<br />

Initial sales charge Currently: 3%; Maximum: 5%<br />

The current initial sales charge which may be imposed on<br />

subscriptions into SABF will be waived in respect of the<br />

<strong>Fund</strong>’s investment into SABF.<br />

Realisation charge Current: Nil; Maximum: 1%<br />

Annual management fee<br />

(S$ class B units)<br />

Annual trustee’s fee<br />

Other Substantial<br />

Fees/Charges (for the financial<br />

year ended 30 June 2012):<br />

Fees and charges of the NAPF<br />

Management fee (Class B<br />

shares)<br />

Current: 0.8% p.a.; Maximum: 2.0% p.a.<br />

The annual management fee of SABF will be rebated back<br />

to the <strong>Fund</strong> in relation to the <strong>Fund</strong>’s investment into the<br />

SABF.<br />

Current: less than 0.06% p.a.; Maximum: 0.2% p.a.<br />

Custody fees: 0.10%<br />

Current: 0.75% p.a. of NAPF’s asset value<br />

The management fee of NAPF will be rebated back to the<br />

<strong>Fund</strong> in relation to the <strong>Fund</strong>’s investment into the NAPF.<br />

Current: 0.15% p.a. of NAPF’s asset value<br />

Custodian and administration<br />

fees<br />

Sales charge Current: Nil; Maximum: 5%<br />

The sales charge which may be imposed on subscriptions<br />

into NAPF will be waived in respect of the <strong>Fund</strong>’s<br />

investment into NAPF.<br />

Other Substantial<br />

Fees/Charges:<br />

There may be other fees and charges such as transaction<br />

& safekeeping fees and auditors’ fees which may each<br />

exceed 0.1% per annum of NAPF’s asset value,<br />

depending on the proportion that each fee or charge<br />

bears to the NAV of NAPF.<br />

Refer to Para 8 on<br />

Pg 7-8 of the<br />

Prospectus for further<br />

information on fees<br />

and charges.<br />

<strong>Nikko</strong> <strong>AM</strong> <strong>Asia</strong> <strong>Investment</strong> <strong><strong>Fund</strong>s</strong> – <strong>POSB</strong> <strong>InvestSteady</strong> <strong>Fund</strong> – 31 May 2013

PRODUCT HIGHLIGHTS SHEET<br />

VALUATIONS AND EXITING FROM THIS INVESTMENT<br />

HOW OFTEN ARE VALUATIONS AVAILABLE?<br />

The issue price and realisation price of Units will be available on the Business Day following each<br />

Dealing Day.<br />

The issue price and realisation price of Units may be obtained from the Manager’s website<br />

(www.nikkoam.com.sg).<br />

HOW CAN YOU EXIT FROM THIS INVESTMENT AND WHAT ARE THE RISKS AND COSTS<br />

IN DOING SO?<br />

Cancellation of Units<br />

If applicable to you, you may cancel your subscription for Units within 7 calendar days from the<br />

date of your subscription or purchase of the Units by providing notice in writing to the Manager or<br />

its approved distributor. Any Initial Sales Charge paid will be refunded to you. However, you will<br />

have to take the risk for any price changes in the NAV of the <strong>Fund</strong> since you purchased the<br />

Units.<br />

Realisation of Units<br />

You can exit the <strong>Fund</strong> by writing to the Manager or through its approved distributor.<br />

If your realisation request is received and accepted by 5 p.m. on a Dealing Day, you will be paid<br />

a price based on the value of the <strong>Fund</strong> for that Dealing Day. If your realisation request is received<br />

and accepted after 5 p.m., you will be paid a price based on the value of the <strong>Fund</strong> on the<br />

immediate following Dealing Day.<br />

The net realisation proceeds that you will receive are calculated by multiplying the number of<br />

Units to be realised by the realisation price, less any applicable charges. An example is as<br />

follows:<br />

Units to be realised x Realisation Price = Gross Realisation Proceeds<br />

1,000 x S$1.050 = S$1,050.00<br />

Gross Realisation Proceeds - Realisation Charge = Net Realisation Proceeds payable<br />

S$1,050.00 - Nil = S$1,050.00<br />

The cancellation or realisation proceeds will normally be paid within six Business Days after the<br />

relevant Dealing Day on which the cancellation or realisation request is received.<br />

CONTACT INFORMATION<br />

HOW DO YOU CONTACT US?<br />

You can call us, <strong>Nikko</strong> Asset Management <strong>Asia</strong> Limited, at 1800 535 8025 if you have queries<br />

regarding your investment in the <strong>Fund</strong>. You can also visit our website at<br />

(www.nikkoam.com.sg).<br />

Our business address is at 8 Cross Street, #08-01 PWC Building, Singapore 048424.<br />

APPENDIX: GLOSSARY OF TERMS<br />

Anti-Dilution<br />

Levy<br />

Business<br />

Day<br />

Dealing<br />

Day<br />

Holder<br />

Initial<br />

Sales<br />

Charge<br />

Refer to Para 10.11,<br />

12 and 14 on Pg 18-<br />

20 of the Prospectus<br />

for further information<br />

on valuation and<br />

exiting from the<br />

product.<br />

is an amount that the Manager shall be entitled to deduct from the investment amount (in the case of<br />

subscriptions) and from the redemption proceeds (in the case of redemptions). The Anti-Dilution Levy is<br />

to provide for market spreads (the difference between the prices at which assets are valued and/or<br />

bought or sold), duties and charges and other dealing costs relating to the acquisition or disposal of the<br />

investments constituting the assets of the <strong>Fund</strong> in the event of receipt for processing of large subscription<br />

or redemption requests (as determined at the discretion of the Manager) including subscriptions and/or<br />

repurchases which would be effected as a result of exchange or conversion requests made pursuant to<br />

the trust deed of the <strong>Fund</strong> or in the event of market dislocation where the liquidity of underlying assets of<br />

the <strong>Fund</strong> is substantially impaired.<br />

means any day (other than Saturdays, Sundays or public holiday) on which commercial banks in<br />

Singapore are generally open for business, or any other day as the Manager and the Trustee may agree<br />

in writing.<br />

in relation to the subscription and realisation of Units means a Business Day or such other day as<br />

provided in the trust deed of the <strong>Fund</strong>.<br />

means a holder of units in the <strong>Fund</strong>.<br />

a charge upon the issue of Units of such amount as the Manager may from time to time determine<br />

generally or in relation to any specific transaction or class of transactions provided that such charge shall<br />

not exceed five per cent. of the gross investment sum, or such other percentage as the Manager and<br />

Trustee may from time to time agree. Such expression in the context of a given date shall refer to the<br />

charge or charges determined by the Manager pursuant to the trust deed of the <strong>Fund</strong> and applicable on<br />

that date.<br />

Launch Date for the purposes of this Product Highlights Sheet only, means the inception date of the <strong>Fund</strong>.<br />

NAV means net asset value.<br />

SGD<br />

Units<br />

means Singapore dollars.<br />

means a unit of the <strong>Fund</strong>.<br />

<strong>Nikko</strong> <strong>AM</strong> <strong>Asia</strong> <strong>Investment</strong> <strong><strong>Fund</strong>s</strong> – <strong>POSB</strong> <strong>InvestSteady</strong> <strong>Fund</strong> – 31 May 2013