Cutler Center 2012-2013 Annual Report - Babson College

Cutler Center 2012-2013 Annual Report - Babson College

Cutler Center 2012-2013 Annual Report - Babson College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Addendum D: TopMBA Interview<br />

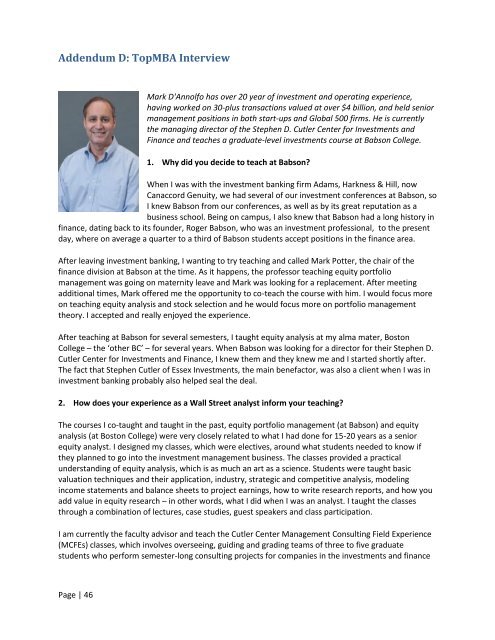

Mark D'Annolfo has over 20 year of investment and operating experience,<br />

having worked on 30-plus transactions valued at over $4 billion, and held senior<br />

management positions in both start-ups and Global 500 firms. He is currently<br />

the managing director of the Stephen D. <strong>Cutler</strong> <strong>Center</strong> for Investments and<br />

Finance and teaches a graduate-level investments course at <strong>Babson</strong> <strong>College</strong>.<br />

1. Why did you decide to teach at <strong>Babson</strong>?<br />

When I was with the investment banking firm Adams, Harkness & Hill, now<br />

Canaccord Genuity, we had several of our investment conferences at <strong>Babson</strong>, so<br />

I knew <strong>Babson</strong> from our conferences, as well as by its great reputation as a<br />

business school. Being on campus, I also knew that <strong>Babson</strong> had a long history in<br />

finance, dating back to its founder, Roger <strong>Babson</strong>, who was an investment professional, to the present<br />

day, where on average a quarter to a third of <strong>Babson</strong> students accept positions in the finance area.<br />

After leaving investment banking, I wanting to try teaching and called Mark Potter, the chair of the<br />

finance division at <strong>Babson</strong> at the time. As it happens, the professor teaching equity portfolio<br />

management was going on maternity leave and Mark was looking for a replacement. After meeting<br />

additional times, Mark offered me the opportunity to co-teach the course with him. I would focus more<br />

on teaching equity analysis and stock selection and he would focus more on portfolio management<br />

theory. I accepted and really enjoyed the experience.<br />

After teaching at <strong>Babson</strong> for several semesters, I taught equity analysis at my alma mater, Boston<br />

<strong>College</strong> – the ‘other BC’ – for several years. When <strong>Babson</strong> was looking for a director for their Stephen D.<br />

<strong>Cutler</strong> <strong>Center</strong> for Investments and Finance, I knew them and they knew me and I started shortly after.<br />

The fact that Stephen <strong>Cutler</strong> of Essex Investments, the main benefactor, was also a client when I was in<br />

investment banking probably also helped seal the deal.<br />

2. How does your experience as a Wall Street analyst inform your teaching?<br />

The courses I co-taught and taught in the past, equity portfolio management (at <strong>Babson</strong>) and equity<br />

analysis (at Boston <strong>College</strong>) were very closely related to what I had done for 15-20 years as a senior<br />

equity analyst. I designed my classes, which were electives, around what students needed to know if<br />

they planned to go into the investment management business. The classes provided a practical<br />

understanding of equity analysis, which is as much an art as a science. Students were taught basic<br />

valuation techniques and their application, industry, strategic and competitive analysis, modeling<br />

income statements and balance sheets to project earnings, how to write research reports, and how you<br />

add value in equity research – in other words, what I did when I was an analyst. I taught the classes<br />

through a combination of lectures, case studies, guest speakers and class participation.<br />

I am currently the faculty advisor and teach the <strong>Cutler</strong> <strong>Center</strong> Management Consulting Field Experience<br />

(MCFEs) classes, which involves overseeing, guiding and grading teams of three to five graduate<br />

students who perform semester-long consulting projects for companies in the investments and finance<br />

Page | 46