Nordea Fund of Funds Monthly Report - Nordea Bank Lietuva

Nordea Fund of Funds Monthly Report - Nordea Bank Lietuva

Nordea Fund of Funds Monthly Report - Nordea Bank Lietuva

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Nordea</strong> <strong>Fund</strong> <strong>of</strong> <strong>Fund</strong>s - Balanced<br />

<strong>Fund</strong> Data<br />

Manager<br />

PB Investment Team<br />

<strong>Fund</strong> Manager since 19.06.2009<br />

Base currency<br />

EUR<br />

Last NAV 135,37<br />

AUM (Mio. EUR) 24<br />

Number <strong>of</strong> holdings 18<br />

Fiscal year end<br />

31.December<br />

ISIN<br />

LU0091716570<br />

WKN 989078<br />

Bloomberg<br />

FRONBAB LX<br />

Launch date 03.11.1998<br />

Moningstar <strong>Fund</strong>-Rating ***<br />

Investment Strategy<br />

The <strong>Fund</strong> is intended for investors seeking a steady capital appreciation through a<br />

substantial commitment on the stock markets with low return volatility. The <strong>Fund</strong> is<br />

actively managed based on a philosophy, at the center <strong>of</strong> the total proceeds will.<br />

Investment decisions are based on scenarios and always wear a factor <strong>of</strong> time and a certain<br />

degree <strong>of</strong> uncertainty into account. The scenarios can be in the form <strong>of</strong> a general mood <strong>of</strong> a<br />

new trend, a seasonal or regional impact or specific forms. These are factors that lead to<br />

fund managers on potential investment opportunities. The investment decision is<br />

ultimately dependent on the extent to which the manager is convinced <strong>of</strong> this scenario. The<br />

selected investment vehicles are funds <strong>of</strong> <strong>Nordea</strong> or external managers. The focus is on the<br />

diversification and the consistent application <strong>of</strong> investment style.<br />

Source: © 2012 Morningstar, Inc. All Rights Reserved<br />

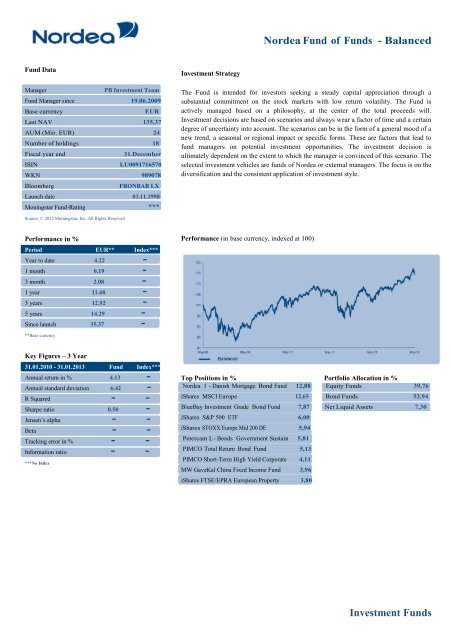

Performance in %<br />

Performance (in base currency, indexed at 100)<br />

Period EUR** Index***<br />

Year to date 4.22 -<br />

1 month 0.19 -<br />

3 month 2.08 -<br />

1 year 11.68 -<br />

3 years 12.92 -<br />

5 years 14.29 -<br />

Since launch 35.37 -<br />

**Base currency<br />

Key Figures – 3 Year<br />

31.01.2010 - 31.01.2013 <strong>Fund</strong> Index***<br />

Annual return in % 4.13 -<br />

Annual standard deviation 6.42 -<br />

R Squared - -<br />

Sharpe ratio 0.50 -<br />

Jensen’s alpha - -<br />

Beta - -<br />

Tracking error in % - -<br />

Information ratio - -<br />

***No Index<br />

Top Positions in % Portfolio Allocation in %<br />

<strong>Nordea</strong> 1 - Danish Mortgage Bond <strong>Fund</strong> 12,88 Equity <strong>Fund</strong>s 39,76<br />

iShares MSCI Europe 12,65 Bond <strong>Fund</strong>s 52,94<br />

BlueBay Investment Grade Bond <strong>Fund</strong> 7,87 Net Liquid Assets 7,30<br />

iShares S&P 500 ETF 6,00<br />

iShares STOXX Europe Mid 200 DE 5,94<br />

Petercam L - Bonds Government Sustain 5,81<br />

PIMCO Total Return Bond <strong>Fund</strong> 5,13<br />

PIMCO Short-Term High Yield Corporate 4,11<br />

MW GaveKal China Fixed Income <strong>Fund</strong> 3,96<br />

iShares FTSE/EPRA European Property 3,80<br />

Investment <strong>Fund</strong>s