Nordea Fund of Funds Monthly Report - Nordea Bank Lietuva

Nordea Fund of Funds Monthly Report - Nordea Bank Lietuva

Nordea Fund of Funds Monthly Report - Nordea Bank Lietuva

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

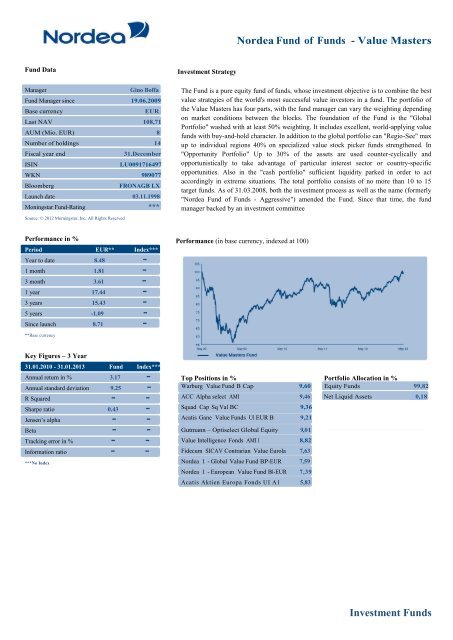

<strong>Nordea</strong> <strong>Fund</strong> <strong>of</strong> <strong>Fund</strong>s - Value Masters<br />

<strong>Fund</strong> Data<br />

Manager<br />

Gino B<strong>of</strong>fa<br />

<strong>Fund</strong> Manager since 19.06.2009<br />

Base currency<br />

EUR<br />

Last NAV 108,71<br />

AUM (Mio. EUR) 8<br />

Number <strong>of</strong> holdings 14<br />

Fiscal year end<br />

ISIN<br />

31.December<br />

LU0091716497<br />

WKN 989077<br />

Bloomberg<br />

FRONAGB LX<br />

Launch date 03.11.1998<br />

Moningstar <strong>Fund</strong>-Rating ***<br />

Source: © 2012 Morningstar, Inc. All Rights Reserved<br />

Investment Strategy<br />

The <strong>Fund</strong> is a pure equity fund <strong>of</strong> funds, whose investment objective is to combine the best<br />

value strategies <strong>of</strong> the world's most successful value investors in a fund. The portfolio <strong>of</strong><br />

the Value Masters has four parts, with the fund manager can vary the weighting depending<br />

on market conditions between the blocks. The foundation <strong>of</strong> the <strong>Fund</strong> is the "Global<br />

Portfolio" washed with at least 50% weighting. It includes excellent, world-applying value<br />

funds with buy-and-hold character. In addition to the global portfolio can "Regio-See" max<br />

up to individual regions 40% on specialized value stock picker funds strengthened. In<br />

"Opportunity Portfolio" Up to 30% <strong>of</strong> the assets are used counter-cyclically and<br />

opportunistically to take advantage <strong>of</strong> particular interest sector or country-specific<br />

opportunities. Also in the "cash portfolio" sufficient liquidity parked in order to act<br />

accordingly in extreme situations. The total portfolio consists <strong>of</strong> no more than 10 to 15<br />

target funds. As <strong>of</strong> 31.03.2008, both the investment process as well as the name (formerly<br />

"<strong>Nordea</strong> <strong>Fund</strong> <strong>of</strong> <strong>Fund</strong>s - Aggressive") amended the <strong>Fund</strong>. Since that time, the fund<br />

manager backed by an investment committee<br />

Performance in %<br />

Period EUR** Index***<br />

Year to date 8.48 -<br />

1 month 1.81 -<br />

3 month 3.61 -<br />

1 year 17.44 -<br />

3 years 15.43 -<br />

5 years -1.09 -<br />

Since launch 8.71 -<br />

**Base currency<br />

Performance (in base currency, indexed at 100)<br />

Key Figures – 3 Year<br />

31.01.2010 - 31.01.2013 <strong>Fund</strong> Index***<br />

Annual return in % 3.17 -<br />

Annual standard deviation 9.25 -<br />

R Squared - -<br />

Sharpe ratio 0.43 -<br />

Jensen’s alpha - -<br />

Beta - -<br />

Tracking error in % - -<br />

Information ratio - -<br />

***No Index<br />

Top Positions in % Portfolio Allocation in %<br />

Warburg Value <strong>Fund</strong> B Cap 9,60 Equity <strong>Fund</strong>s 99,82<br />

ACC Alpha select AMI 9,46 Net Liquid Assets 0,18<br />

Squad Cap Sq Val BC 9,36<br />

Acatis Gane Value <strong>Fund</strong>s UI EUR B 9,21<br />

Gutmann – Optiselect Global Equity 9,01<br />

Value Intelligence Fonds AMI I 8,82<br />

Fidecum SICAV Contrarian Value Eurola 7,63<br />

<strong>Nordea</strong> 1 - Global Value <strong>Fund</strong> BP-EUR 7,59<br />

<strong>Nordea</strong> 1 - European Value <strong>Fund</strong> BI-EUR 7,39<br />

Acatis Aktien Europa Fonds UI A1 5,83<br />

Investment <strong>Fund</strong>s