The economic contribution of small to medium-sized grocery ...

The economic contribution of small to medium-sized grocery ...

The economic contribution of small to medium-sized grocery ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Executive Summary<br />

<br />

<br />

Gross Value Added (GVA) <strong>of</strong> retail trade, food, beverage and alcohol<br />

manufacturing, road transport, and transport services and s<strong>to</strong>rage was<br />

approximately equal <strong>to</strong> over 11% <strong>of</strong> GDP in financial year 2006, indicating the<br />

strong <strong>economic</strong> <strong>contribution</strong> that retailing and its support services make <strong>to</strong> the<br />

national economy<br />

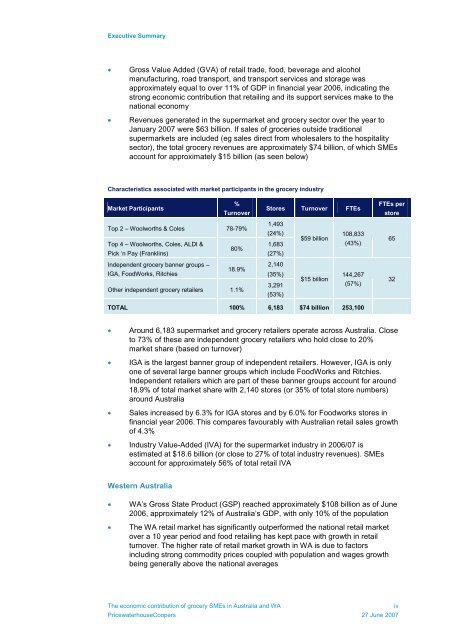

Revenues generated in the supermarket and <strong>grocery</strong> sec<strong>to</strong>r over the year <strong>to</strong><br />

January 2007 were $63 billion. If sales <strong>of</strong> groceries outside traditional<br />

supermarkets are included (eg sales direct from wholesalers <strong>to</strong> the hospitality<br />

sec<strong>to</strong>r), the <strong>to</strong>tal <strong>grocery</strong> revenues are approximately $74 billion, <strong>of</strong> which SMEs<br />

account for approximately $15 billion (as seen below)<br />

Characteristics associated with market participants in the <strong>grocery</strong> industry<br />

Market Participants<br />

%<br />

Turnover<br />

Top 2 – Woolworths & Coles 78-79%<br />

Top 4 – Woolworths, Coles, ALDI &<br />

Pick ‘n Pay (Franklins)<br />

80%<br />

Independent <strong>grocery</strong> banner groups –<br />

IGA, FoodWorks, Ritchies<br />

18.9%<br />

Other independent <strong>grocery</strong> retailers 1.1%<br />

S<strong>to</strong>res Turnover FTEs<br />

1,493<br />

(24%)<br />

108,833<br />

$59 billion<br />

1,683<br />

(43%)<br />

(27%)<br />

2,140<br />

(35%)<br />

144,267<br />

$15 billion<br />

3,291<br />

(57%)<br />

(53%)<br />

FTEs per<br />

s<strong>to</strong>re<br />

65<br />

32<br />

TOTAL 100% 6,183 $74 billion 253,100<br />

<br />

<br />

<br />

<br />

Around 6,183 supermarket and <strong>grocery</strong> retailers operate across Australia. Close<br />

<strong>to</strong> 73% <strong>of</strong> these are independent <strong>grocery</strong> retailers who hold close <strong>to</strong> 20%<br />

market share (based on turnover)<br />

IGA is the largest banner group <strong>of</strong> independent retailers. However, IGA is only<br />

one <strong>of</strong> several large banner groups which include FoodWorks and Ritchies.<br />

Independent retailers which are part <strong>of</strong> these banner groups account for around<br />

18.9% <strong>of</strong> <strong>to</strong>tal market share with 2,140 s<strong>to</strong>res (or 35% <strong>of</strong> <strong>to</strong>tal s<strong>to</strong>re numbers)<br />

around Australia<br />

Sales increased by 6.3% for IGA s<strong>to</strong>res and by 6.0% for Foodworks s<strong>to</strong>res in<br />

financial year 2006. This compares favourably with Australian retail sales growth<br />

<strong>of</strong> 4.3%<br />

Industry Value-Added (IVA) for the supermarket industry in 2006/07 is<br />

estimated at $18.6 billion (or close <strong>to</strong> 27% <strong>of</strong> <strong>to</strong>tal industry revenues). SMEs<br />

account for approximately 56% <strong>of</strong> <strong>to</strong>tal retail IVA<br />

Western Australia<br />

<br />

<br />

WA’s Gross State Product (GSP) reached approximately $108 billion as <strong>of</strong> June<br />

2006, approximately 12% <strong>of</strong> Australia’s GDP, with only 10% <strong>of</strong> the population<br />

<strong>The</strong> WA retail market has significantly outperformed the national retail market<br />

over a 10 year period and food retailing has kept pace with growth in retail<br />

turnover. <strong>The</strong> higher rate <strong>of</strong> retail market growth in WA is due <strong>to</strong> fac<strong>to</strong>rs<br />

including strong commodity prices coupled with population and wages growth<br />

being generally above the national averages<br />

<strong>The</strong> <strong>economic</strong> <strong>contribution</strong> <strong>of</strong> <strong>grocery</strong> SMEs in Australia and WA<br />

PricewaterhouseCoopers 27 June 2007<br />

iv