Forms & instructions - State of West Virginia

Forms & instructions - State of West Virginia

Forms & instructions - State of West Virginia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

S e n i o r C i t i z e n s R e f u n d a b l e C r e d i t I n f o r m a t i o n<br />

If you recently received a WV/SCTC-1 in the mail from the <strong>West</strong> <strong>Virginia</strong><br />

<strong>State</strong> Tax Department for the Homestead Exemption program<br />

administered at the county level, you may be entitled to claim a refundable<br />

state income tax credit. The credit is based on the amount <strong>of</strong> ad valorem<br />

property taxes paid on the first $20,000, or portion there<strong>of</strong>, <strong>of</strong> the taxable<br />

assessed value over the $20,000 Homestead Exemption. Persons who pay<br />

the federal alternative minimum tax are not eligible to claim this credit.<br />

The refundable income tax credit eligibility is restricted to those who<br />

participate in the Homestead Exemption Program through the County<br />

Assessor’s <strong>of</strong>fice and meet the following criteria:<br />

1. You must owe and pay a property tax liability on the homestead exemption<br />

eligible home (i.e. the assessed value <strong>of</strong> the eligible home must be greater<br />

than $20,000 prior to the application <strong>of</strong> the homestead exemption) and;<br />

2. Your Federal Adjusted Gross Income must meet the low-income test.<br />

FEDERAL ADJUSTED GROSS INCOME means the income<br />

reported on your federal tax return (e.g., Form 1040, 1040A, or 1040EZ).<br />

If you were NOT required to file a federal tax return, complete the<br />

following income worksheet to determine your income for the year. Do<br />

not include social security benefits.<br />

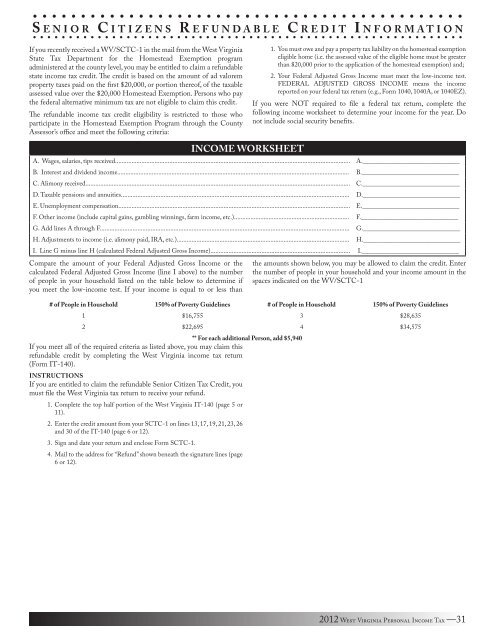

INCOME WORKSHEET<br />

A. Wages, salaries, tips received............................................................................................................................................... A.______________________________<br />

B. Interest and dividend income............................................................................................................................................. B.______________________________<br />

C. Alimony received................................................................................................................................................................. C.______________________________<br />

D. Taxable pensions and annuities........................................................................................................................................... D.______________________________<br />

E. Unemployment compensation............................................................................................................................................. E.______________________________<br />

F. Other income (include capital gains, gambling winnings, farm income, etc.)...................................................................... F.______________________________<br />

G. Add lines A through F........................................................................................................................................................ G.______________________________<br />

H. Adjustments to income (i.e. alimony paid, IRA, etc.)......................................................................................................... H.______________________________<br />

I. Line G minus line H (calculated Federal Adjusted Gross Income)..................................................................................... I.______________________________<br />

Compare the amount <strong>of</strong> your Federal Adjusted Gross Income or the<br />

calculated Federal Adjusted Gross Income (line I above) to the number<br />

<strong>of</strong> people in your household listed on the table below to determine if<br />

you meet the low-income test. If your income is equal to or less than<br />

the amounts shown below, you may be allowed to claim the credit. Enter<br />

the number <strong>of</strong> people in your household and your income amount in the<br />

spaces indicated on the WV/SCTC-1<br />

# <strong>of</strong> People in Household 150% <strong>of</strong> Poverty Guidelines # <strong>of</strong> People in Household 150% <strong>of</strong> Poverty Guidelines<br />

1 $16,755 3 $28,635<br />

2 $22,695 4 $34,575<br />

** For each additional Person, add $5,940<br />

If you meet all <strong>of</strong> the required criteria as listed above, you may claim this<br />

refundable credit by completing the <strong>West</strong> <strong>Virginia</strong> income tax return<br />

(Form IT-140).<br />

INSTRUCTIONS<br />

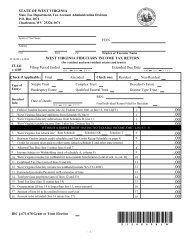

If you are entitled to claim the refundable Senior Citizen Tax Credit, you<br />

must file the <strong>West</strong> <strong>Virginia</strong> tax return to receive your refund.<br />

1. Complete the top half portion <strong>of</strong> the <strong>West</strong> <strong>Virginia</strong> IT-140 (page 5 or<br />

11).<br />

2. Enter the credit amount from your SCTC-1 on lines 13, 17, 19, 21, 23, 26<br />

and 30 <strong>of</strong> the IT-140 (page 6 or 12).<br />

3. Sign and date your return and enclose Form SCTC-1.<br />

4. Mail to the address for “Refund” shown beneath the signature lines (page<br />

6 or 12).<br />

2012 <strong>West</strong> <strong>Virginia</strong> Personal Income Tax —31