2012 Annual Report - Hong Kong Monetary Authority

2012 Annual Report - Hong Kong Monetary Authority

2012 Annual Report - Hong Kong Monetary Authority

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

REMUNERATION REPORT (continued)<br />

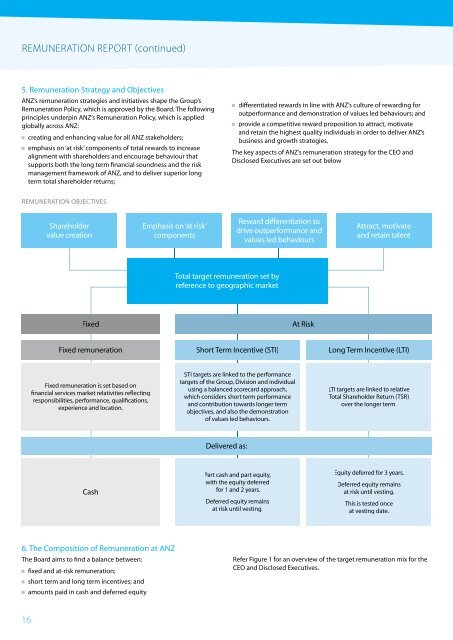

5. Remuneration Strategy and Objectives<br />

ANZ’s remuneration strategies and initiatives shape the Group’s<br />

Remuneration Policy, which is approved by the Board. The following<br />

principles underpin ANZ’s Remuneration Policy, which is applied<br />

globally across ANZ:<br />

creating and enhancing value for all ANZ stakeholders;<br />

emphasis on ‘at risk’ components of total rewards to increase<br />

alignment with shareholders and encourage behaviour that<br />

supports both the long term financial soundness and the risk<br />

management framework of ANZ, and to deliver superior long<br />

term total shareholder returns;<br />

differentiated rewards in line with ANZ’s culture of rewarding for<br />

outperformance and demonstration of values led behaviours; and<br />

provide a competitive reward proposition to attract, motivate<br />

and retain the highest quality individuals in order to deliver ANZ’s<br />

business and growth strategies.<br />

The key aspects of ANZ’s remuneration strategy for the CEO and<br />

Disclosed Executives are set out below:<br />

REMUNERATION OBJECTIVES<br />

Shareholder<br />

value creation<br />

Emphasis on ‘at risk’<br />

components<br />

Reward differentiation to<br />

drive outperformance and<br />

values led behaviours<br />

Attract, motivate<br />

and retain talent<br />

Total target remuneration set by<br />

reference to geographic market<br />

Fixed<br />

At Risk<br />

Fixed remuneration<br />

Short Term Incentive (STI)<br />

Long Term Incentive (LTI)<br />

Fixed remuneration is set based on<br />

financial services market relativities reflecting<br />

responsibilities, performance, qualifications,<br />

experience and location.<br />

STI targets are linked to the performance<br />

targets of the Group, Division and individual<br />

using a balanced scorecard approach,<br />

which considers short term performance<br />

and contribution towards longer term<br />

objectives, and also the demonstration<br />

of values led behaviours.<br />

LTI targets are linked to relative<br />

Total Shareholder Return (TSR)<br />

over the longer term.<br />

Delivered as:<br />

Cash<br />

Part cash and part equity,<br />

with the equity deferred<br />

for 1 and 2 years.<br />

Deferred equity remains<br />

at risk until vesting.<br />

Equity deferred for 3 years.<br />

Deferred equity remains<br />

at risk until vesting.<br />

This is tested once<br />

at vesting date.<br />

6. The Composition of Remuneration at ANZ<br />

The Board aims to find a balance between:<br />

fixed and at-risk remuneration;<br />

short term and long term incentives; and<br />

amounts paid in cash and deferred equity.<br />

Refer Figure 1 for an overview of the target remuneration mix for the<br />

CEO and Disclosed Executives.<br />

16