2012 Annual Report - Hong Kong Monetary Authority

2012 Annual Report - Hong Kong Monetary Authority

2012 Annual Report - Hong Kong Monetary Authority

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

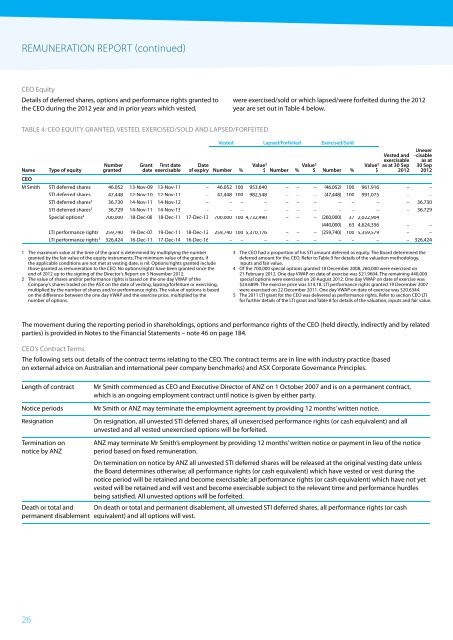

REMUNERATION REPORT (continued)<br />

CEO Equity<br />

Details of deferred shares, options and performance rights granted to<br />

the CEO during the <strong>2012</strong> year and in prior years which vested,<br />

were exercised/sold or which lapsed/were forfeited during the <strong>2012</strong><br />

year are set out in Table 4 below.<br />

TABLE 4: CEO EQUITY GRANTED, VESTED, EXERCISED/SOLD AND LAPSED/FORFEITED<br />

Name<br />

CEO<br />

Type of equity<br />

Number<br />

granted 1<br />

Grant First date<br />

date exercisable<br />

Date<br />

of expiry Number %<br />

Vested Lapsed/Forfeited Exercised/Sold<br />

Value 2<br />

$ Number % Value2<br />

$ Number %<br />

Value 2<br />

$<br />

Vested and<br />

exercisable<br />

as at 30 Sep<br />

<strong>2012</strong><br />

Unexer<br />

-cisable<br />

as at<br />

30 Sep<br />

<strong>2012</strong><br />

M Smith STI deferred shares 46,052 13-Nov-09 13-Nov-11 – 46,052 100 953,640 – – – (46,052) 100 961,916 – –<br />

STI deferred shares 47,448 12-Nov-10 12-Nov-11 – 47,448 100 982,548 – – – (47,448) 100 991,075 – –<br />

STI deferred shares 3 36,730 14-Nov-11 14-Nov-12 – – – – – – – – – – – 36,730<br />

STI deferred shares 3 36,729 14-Nov-11 14-Nov-13 – – – – – – – – – – – 36,729<br />

Special options 4 700,000 18-Dec-08 18-Dec-11 17-Dec-13 700,000 100 4,732,490 – – – (260,000) 37 2,022,904<br />

(440,000) 63 4,624,356 – –<br />

LTI performance rights 259,740 19-Dec-07 19-Dec-11 18-Dec-12 259,740 100 5,370,176 – – – (259,740) 100 5,359,579 – –<br />

LTI performance rights 5 326,424 16-Dec-11 17-Dec-14 16-Dec-16 – – – – – – – – – – 326,424<br />

1 The maximum value at the time of the grant is determined by multiplying the number<br />

granted by the fair value of the equity instruments. The minimum value of the grants, if<br />

the applicable conditions are not met at vesting date, is nil. Options/rights granted include<br />

those granted as remuneration to the CEO. No options/rights have been granted since the<br />

end of <strong>2012</strong> up to the signing of the Director’s <strong>Report</strong> on 5 November <strong>2012</strong>.<br />

2 The value of shares and/or performance rights is based on the one day VWAP of the<br />

Company’s shares traded on the ASX on the date of vesting, lapsing/forfeiture or exercising,<br />

multiplied by the number of shares and/or performance rights. The value of options is based<br />

on the difference between the one day VWAP and the exercise price, multiplied by the<br />

number of options.<br />

3 The CEO had a proportion of his STI amount deferred as equity. The Board determined the<br />

deferred amount for the CEO. Refer to Table 9 for details of the valuation methodology,<br />

inputs and fair value.<br />

4 Of the 700,000 special options granted 18 December 2008, 260,000 were exercised on<br />

21 February <strong>2012</strong>. One day VWAP on date of exercise was $21.9604. The remaining 440,000<br />

special options were exercised on 20 August <strong>2012</strong>. One day VWAP on date of exercise was<br />

$24.6899. The exercise price was $14.18. LTI performance rights granted 19 December 2007<br />

were exercised on 22 December 2011. One day VWAP on date of exercise was $20.6344.<br />

5 The 2011 LTI grant for the CEO was delivered as performance rights. Refer to section CEO LTI<br />

for further details of the LTI grant and Table 8 for details of the valuation, inputs and fair value.<br />

The movement during the reporting period in shareholdings, options and performance rights of the CEO (held directly, indirectly and by related<br />

parties) is provided in Notes to the Financial Statements – note 46 on page 184.<br />

CEO’s Contract Terms<br />

The following sets out details of the contract terms relating to the CEO. The contract terms are in line with industry practice (based<br />

on external advice on Australian and international peer company benchmarks) and ASX Corporate Governance Principles.<br />

Length of contract<br />

Notice periods<br />

Resignation<br />

Mr Smith commenced as CEO and Executive Director of ANZ on 1 October 2007 and is on a permanent contract,<br />

which is an ongoing employment contract until notice is given by either party.<br />

Mr Smith or ANZ may terminate the employment agreement by providing 12 months’ written notice.<br />

On resignation, all unvested STI deferred shares, all unexercised performance rights (or cash equivalent) and all<br />

unvested and all vested unexercised options will be forfeited.<br />

Termination on<br />

notice by ANZ<br />

Death or total and<br />

permanent disablement<br />

ANZ may terminate Mr Smith’s employment by providing 12 months’ written notice or payment in lieu of the notice<br />

period based on fixed remuneration.<br />

On termination on notice by ANZ all unvested STI deferred shares will be released at the original vesting date unless<br />

the Board determines otherwise; all performance rights (or cash equivalent) which have vested or vest during the<br />

notice period will be retained and become exercisable; all performance rights (or cash equivalent) which have not yet<br />

vested will be retained and will vest and become exercisable subject to the relevant time and performance hurdles<br />

being satisfied. All unvested options will be forfeited.<br />

On death or total and permanent disablement, all unvested STI deferred shares, all performance rights (or cash<br />

equivalent) and all options will vest.<br />

26