oakland university tuition reduction â application & affidavit of taxability

oakland university tuition reduction â application & affidavit of taxability

oakland university tuition reduction â application & affidavit of taxability

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

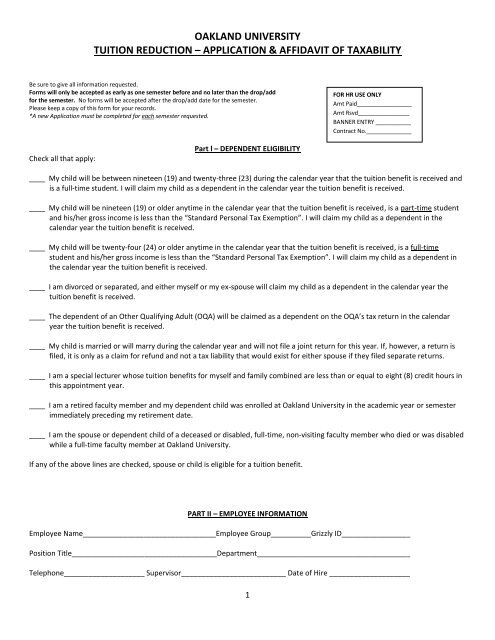

OAKLAND UNIVERSITY<br />

TUITION REDUCTION – APPLICATION & AFFIDAVIT OF TAXABILITY<br />

Be sure to give all information requested.<br />

Forms will only be accepted as early as one semester before and no later than the drop/add<br />

for the semester. No forms will be accepted after the drop/add date for the semester.<br />

Please keep a copy <strong>of</strong> this form for your records.<br />

*A new Application must be completed for each semester requested.<br />

FOR HR USE ONLY<br />

Amt Paid_________________<br />

Amt Rsvd________________<br />

BANNER ENTRY ___________<br />

Contract No.______________<br />

Check all that apply:<br />

Part l – DEPENDENT ELIGIBILITY<br />

____ My child will be between nineteen (19) and twenty-three (23) during the calendar year that the <strong>tuition</strong> benefit is received and<br />

is a full-time student. I will claim my child as a dependent in the calendar year the <strong>tuition</strong> benefit is received.<br />

____ My child will be nineteen (19) or older anytime in the calendar year that the <strong>tuition</strong> benefit is received, is a part-time student<br />

and his/her gross income is less than the “Standard Personal Tax Exemption”. I will claim my child as a dependent in the<br />

calendar year the <strong>tuition</strong> benefit is received.<br />

____ My child will be twenty-four (24) or older anytime in the calendar year that the <strong>tuition</strong> benefit is received, is a full-time<br />

student and his/her gross income is less than the “Standard Personal Tax Exemption”. I will claim my child as a dependent in<br />

the calendar year the <strong>tuition</strong> benefit is received.<br />

____ I am divorced or separated, and either myself or my ex-spouse will claim my child as a dependent in the calendar year the<br />

<strong>tuition</strong> benefit is received.<br />

____ The dependent <strong>of</strong> an Other Qualifying Adult (OQA) will be claimed as a dependent on the OQA’s tax return in the calendar<br />

year the <strong>tuition</strong> benefit is received.<br />

____ My child is married or will marry during the calendar year and will not file a joint return for this year. If, however, a return is<br />

filed, it is only as a claim for refund and not a tax liability that would exist for either spouse if they filed separate returns.<br />

____ I am a special lecturer whose <strong>tuition</strong> benefits for myself and family combined are less than or equal to eight (8) credit hours in<br />

this appointment year.<br />

____ I am a retired faculty member and my dependent child was enrolled at Oakland University in the academic year or semester<br />

immediately preceding my retirement date.<br />

____ I am the spouse or dependent child <strong>of</strong> a deceased or disabled, full-time, non-visiting faculty member who died or was disabled<br />

while a full-time faculty member at Oakland University.<br />

If any <strong>of</strong> the above lines are checked, spouse or child is eligible for a <strong>tuition</strong> benefit.<br />

PART II – EMPLOYEE INFORMATION<br />

Employee Name_________________________________Employee Group__________Grizzly ID_________________<br />

Position Title____________________________________Department______________________________________<br />

Telephone____________________ Supervisor__________________________ Date <strong>of</strong> Hire ____________________<br />

1

OAKLAND UNIVERSITY<br />

TUITION REDUCTION – APPLICATION & AFFIDAVIT OF TAXABILITY<br />

PART III – STUDENT INFORMATION (IF EMPLOYEE IS NOT THE STUDENT)<br />

Relationship to Employee ________________________________________________________________________<br />

Name__________________________________Date <strong>of</strong> Birth___________________Grizzly ID_________________<br />

PART IV – COURSE DATA<br />

Degree__________________________________Area <strong>of</strong> Specialization____________________________________<br />

Certificate Granting Program _________________________________ Start Date ___________________________<br />

Completion Date ____________________________________________ Amount ____________________________<br />

Student will attend (please check one): Year ___________ Level (please check one):<br />

O Fall<br />

O Undergraduate FR/SO<br />

O Winter<br />

O Undergraduate JR/SR<br />

O Summer 1<br />

O Graduate<br />

O Summer 2<br />

O Other<br />

Course Title & Name Course# Credits Class Meeting Day/Time<br />

I authorize the Human Resources Office to verify evidence <strong>of</strong> my grades for classes taken at Oakland University for the semester(s)<br />

for which the <strong>tuition</strong> benefit was paid.<br />

Student Signature_______________________________________________________Date_________________<br />

STAFF ONLY. The course(s) listed above are held during my regular work schedule: O YES O NO<br />

If yes, please specify the hours in class ___________________________________________________________<br />

2

OAKLAND UNIVERSITY<br />

TUITION REDUCTION – APPLICATION & AFFIDAVIT OF TAXABILITY<br />

PART V – AFFIDAVIT OF TAXABILITY<br />

This <strong>affidavit</strong> must be completed by all employees requesting TUITION REDUCTION (TR) to determine whether Oakland University<br />

must treat the requested TR as taxable income to the employee under Federal Internal Revenue regulations. In most cases, TR is not<br />

taxable for undergraduate courses taken by an employee or by a spouse or child who qualifies as the employee’s dependent under<br />

federal tax law. In addition, specific IRS rules govern the <strong>taxability</strong> <strong>of</strong> TR for graduate education, OQA and their children, and<br />

children <strong>of</strong> divorced and separated parents. This <strong>affidavit</strong> is necessary to comply with federal tax law and to protect you and<br />

Oakland University from potential tax liabilities and penalties. To complete the <strong>affidavit</strong>, read the following statements and INITIAL<br />

any statement that applies to you.<br />

1. UNDERGRADUATE TUITION REDUCTION FOR SELF, A SPOUSE, OR OQA<br />

If you are seeking TR for your own education or that <strong>of</strong> a spouse, or OQA, initial ALL applicable statements:<br />

____ I certify that I am applying for my own education in courses BELOW the graduate level and I understand that undergraduate<br />

<strong>tuition</strong> benefits are not taxable to <strong>university</strong> employees.<br />

____ I certify that the person for whom I am requesting TR: (a) is my spouse and that we have entered into a marriage recognized<br />

under federal tax law, and we are not estranged, and that he/she does not maintain a separate domicile.<br />

____ I am seeking TR for an OQA and I understand that 100% <strong>of</strong> the value <strong>of</strong> the TR is taxable income to me.<br />

2. UNDERGRADUATE TUITION REDUCTION FOR AN EMPLOYEE’S CHILD OR A DEPENDENT OF AN OQA<br />

A. If you are seeking undergraduate TR for a child whom you WILL CLAIM as a dependent on your income tax return for the year<br />

20___, initial the following:<br />

____ I certify that the person for whom I am requesting TR is a child that I intend to claim as my dependent on my federal income<br />

tax return for the 20___ calendar year. If I do not claim my child as a dependent on my income tax return for the 20___ calendar<br />

year as indicated above, I WILL NOTIFY the HR Office as soon as possible and no later than November 15 th . I understand that the<br />

value <strong>of</strong> the TR will be rescinded and I agree to be liable for all charges.<br />

B. If you are seeking undergraduate TR for a child, as a divorced or separated parent, whom you WILL NOT CLAIM as a dependent<br />

on your income tax return for the year 20___, initial the following:<br />

____ I do not intend to declare my biological child, stepchild or legally adopted child as a dependent on my federal income tax<br />

return for the 20___ calendar year and:<br />

(a) I am currently divorced or separated from the child’s parent;<br />

(b) My child’s other parent will claim the child as a dependent on his/her federal income tax return for the 20___ calendar<br />

year; and<br />

(c) My marriage to the other parent was one that is recognized under federal law, (i.e., not an other qualified adult).<br />

If the child’s other parent does not claim my child as a dependent for this tax year, I WILL NOTIFY the HR Office as soon as<br />

possible and no later than November 15 th . I understand that the value <strong>of</strong> the TR will be rescinded and I agree to be liable for all<br />

charges.<br />

3

OAKLAND UNIVERSITY<br />

TUITION REDUCTION – APPLICATION & AFFIDAVIT OF TAXABILITY<br />

C. If you are seeking undergraduate TR for a child, as a dependent <strong>of</strong> an Other Qualifying Adult (OQA), for the year 20___, initial<br />

the following:<br />

____ I am seeking TR for the dependent <strong>of</strong> an OQA and I understand that 100% <strong>of</strong> the value <strong>of</strong> the TR taxable income to me.<br />

If the OQA does not claim the child as a dependent for this tax year, I WILL NOTIFY the HR Office as soon as possible and no<br />

later than November 15 th . I understand that the value <strong>of</strong> the TR will be rescinded and I agree to be liable for all charges.<br />

3. TUITION REDUCTION FOR GRADUATE EDUCATION<br />

If you are seeking TR for graduate education for yourself or a family member, initial ONE applicable statement:<br />

____ I am applying for TR for my own education in courses at the graduate level and I understand that I will be taxed for the value <strong>of</strong><br />

the TR that may exceed $5,250.<br />

____ I am applying for TR for the education <strong>of</strong> my spouse, child, OQA, or dependent <strong>of</strong> an OQA in courses at the graduate level, and I<br />

understand that I will be taxed for the full value <strong>of</strong> the TR.<br />

4. GENERAL ACKNOWLEDGEMENTS - All applicants must INITIAL EACH <strong>of</strong> the following:<br />

I understand that the following requirements are applicable to my <strong>application</strong> for and receipt <strong>of</strong> Tuition Reduction:<br />

____ I understand the obligations set forth by Oakland University and my collective bargaining agreement or policy manual apply to<br />

me. I certify that the listed student is eligible per guidelines set forth by my current collective bargaining agreement and/or policy<br />

manual. This <strong>application</strong> and those documents provide the information necessary to ascertain eligibility and <strong>taxability</strong> <strong>of</strong> the benefit.<br />

____ To the extent that any TR is taxable income under IRS regulations, the value <strong>of</strong> the TR will be added to my salary for taxation<br />

over designated pay periods during the semester when TR is used.<br />

5. I HEREBY AFFIRM THAT:<br />

The information given above is true and accurate; and for compliance and audit purposes, I agree to provide to the University a copy<br />

<strong>of</strong> any documentation (including relevant tax returns) that the HR Office deems necessary to ascertain my eligibility or the tax status<br />

<strong>of</strong> my spouse, child, OQA, or dependent <strong>of</strong> an OQA. I understand that failure to timely provide all requested information may result<br />

in Oakland University rescinding the benefit.<br />

I understand that I must notify the HR Office as soon as possible and no later than November 15 th <strong>of</strong> any change in the information<br />

that I have provided in this Affidavit. I understand that the value <strong>of</strong> the TR may be taxable income to me and applied retroactively<br />

to the appropriate taxable year. I further understand that in the event any <strong>of</strong> the statements set forth herein are not true, or if I fail<br />

to notify the University <strong>of</strong> any changes, the <strong>tuition</strong> for which this <strong>affidavit</strong> is being submitted will be rescinded and I will be liable for<br />

all expenses incurred under this program.<br />

Signature <strong>of</strong> Employee:__________________________________________________________ Date: _______________________<br />

Signature <strong>of</strong> Supervisor (staff forms only)___________________________________________ Date: _______________________<br />

Human Resources:______________________________________________________________ Date: _______________________<br />

4