The Gambian Tourist Value Chain and Prospects for Pro-Poor Tourism

The Gambian Tourist Value Chain and Prospects for Pro-Poor Tourism

The Gambian Tourist Value Chain and Prospects for Pro-Poor Tourism

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Tourism</strong> in <strong>The</strong> Gambia: International ‘Best Practice’ in Poverty Reduction & <strong>Pro</strong>-<strong>Poor</strong> Growth Through <strong>Tourism</strong><br />

Draft Report (Friday 22 nd December 2006)<br />

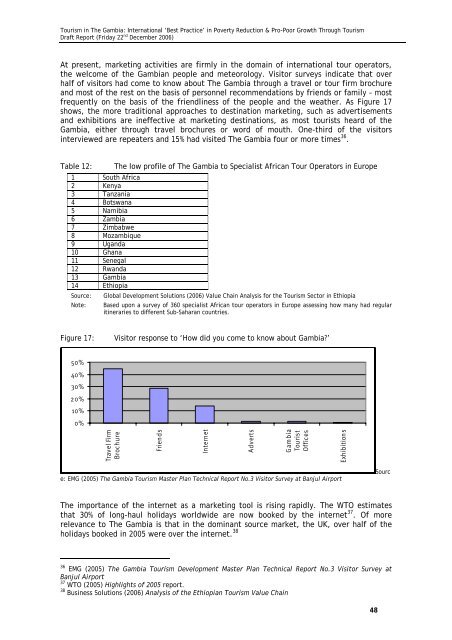

At present, marketing activities are firmly in the domain of international tour operators,<br />

the welcome of the <strong>Gambian</strong> people <strong>and</strong> meteorology. Visitor surveys indicate that over<br />

half of visitors had come to know about <strong>The</strong> Gambia through a travel or tour firm brochure<br />

<strong>and</strong> most of the rest on the basis of personnel recommendations by friends or family – most<br />

frequently on the basis of the friendliness of the people <strong>and</strong> the weather. As Figure 17<br />

shows, the more traditional approaches to destination marketing, such as advertisements<br />

<strong>and</strong> exhibitions are ineffective at marketing destinations, as most tourists heard of the<br />

Gambia, either through travel brochures or word of mouth. One-third of the visitors<br />

interviewed are repeaters <strong>and</strong> 15% had visited <strong>The</strong> Gambia four or more times 36 .<br />

Table 12:<br />

1 South Africa<br />

2 Kenya<br />

3 Tanzania<br />

4 Botswana<br />

5 Namibia<br />

6 Zambia<br />

7 Zimbabwe<br />

8 Mozambique<br />

9 Ug<strong>and</strong>a<br />

10 Ghana<br />

11 Senegal<br />

12 Rw<strong>and</strong>a<br />

13 Gambia<br />

14 Ethiopia<br />

Source:<br />

Note:<br />

<strong>The</strong> low profile of <strong>The</strong> Gambia to Specialist African Tour Operators in Europe<br />

Global Development Solutions (2006) <strong>Value</strong> <strong>Chain</strong> Analysis <strong>for</strong> the <strong>Tourism</strong> Sector in Ethiopia<br />

Based upon a survey of 360 specialist African tour operators in Europe assessing how many had regular<br />

itineraries to different Sub-Saharan countries.<br />

Figure 17:<br />

Visitor response to ‘How did you come to know about Gambia?’<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Travel Firm<br />

Brochure<br />

Friends<br />

Internet<br />

Adverts<br />

Gambia<br />

<strong>Tourist</strong><br />

Offices<br />

Exhibitions<br />

e: EMG (2005) <strong>The</strong> Gambia <strong>Tourism</strong> Master Plan Technical Report No.3 Visitor Survey at Banjul Airport<br />

Sourc<br />

<strong>The</strong> importance of the internet as a marketing tool is rising rapidly. <strong>The</strong> WTO estimates<br />

that 30% of long-haul holidays worldwide are now booked by the internet 37 . Of more<br />

relevance to <strong>The</strong> Gambia is that in the dominant source market, the UK, over half of the<br />

holidays booked in 2005 were over the internet. 38<br />

36 EMG (2005) <strong>The</strong> Gambia <strong>Tourism</strong> Development Master Plan Technical Report No.3 Visitor Survey at<br />

Banjul Airport<br />

37 WTO (2005) Highlights of 2005 report.<br />

38 Business Solutions (2006) Analysis of the Ethiopian <strong>Tourism</strong> <strong>Value</strong> <strong>Chain</strong><br />

48