download pdf - Oil and Gas Investor

download pdf - Oil and Gas Investor

download pdf - Oil and Gas Investor

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

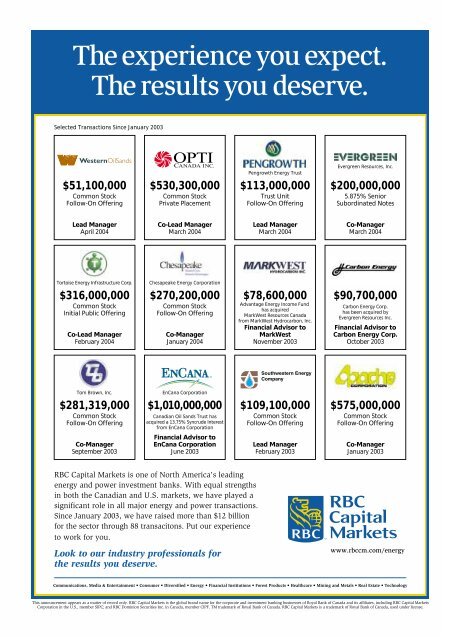

The experience you expect.<br />

The results you deserve.<br />

Selected Transactions Since January 2003<br />

$51,100,000<br />

Common Stock<br />

Follow-On Offering<br />

$530,300,000<br />

Common Stock<br />

Private Placement<br />

Pengrowth Energy Trust<br />

$113,000,000<br />

Trust Unit<br />

Follow-On Offering<br />

Evergreen Resources, Inc.<br />

$200,000,000<br />

5.875% Senior<br />

Subordinated Notes<br />

Lead Manager<br />

April 2004<br />

Co-Lead Manager<br />

March 2004<br />

Lead Manager<br />

March 2004<br />

Co-Manager<br />

March 2004<br />

Tortoise Energy Infrastructure Corp.<br />

$316,000,000<br />

Common Stock<br />

Initial Public Offering<br />

Co-Lead Manager<br />

February 2004<br />

Chesapeake Energy Corporation<br />

$270,200,000<br />

Common Stock<br />

Follow-On Offering<br />

Co-Manager<br />

January 2004<br />

$78,600,000<br />

Advantage Energy Income Fund<br />

has acquired<br />

MarkWest Resources Canada<br />

from MarkWest Hydrocarbon, Inc.<br />

Financial Advisor to<br />

MarkWest<br />

November 2003<br />

$90,700,000<br />

Carbon Energy Corp.<br />

has been acquired by<br />

Evergreen Resources Inc.<br />

Financial Advisor to<br />

Carbon Energy Corp.<br />

October 2003<br />

Tom Brown, Inc.<br />

$281,319,000<br />

Common Stock<br />

Follow-On Offering<br />

EnCana Corporation<br />

$1,010,000,000<br />

Canadian <strong>Oil</strong> S<strong>and</strong>s Trust has<br />

acquired a 13.75% Syncrude Interest<br />

from EnCana Corporation<br />

$109,100,000<br />

Common Stock<br />

Follow-On Offering<br />

$575,000,000<br />

Common Stock<br />

Follow-On Offering<br />

Co-Manager<br />

September 2003<br />

Financial Advisor to<br />

EnCana Corporation<br />

June 2003<br />

Lead Manager<br />

February 2003<br />

Co-Manager<br />

January 2003<br />

RBC Capital Markets is one of North America's leading<br />

energy <strong>and</strong> power investment banks. With equal strengths<br />

in both the Canadian <strong>and</strong> U.S. markets, we have played a<br />

significant role in all major energy <strong>and</strong> power transactions.<br />

Since January 2003, we have raised more than $12 billion<br />

for the sector through 88 transacitons. Put our experience<br />

to work for you.<br />

Look to our industry professionals for<br />

the results you deserve.<br />

www.rbccm.com/energy<br />

Communications, Media & Entertainment • Consumer • Diversified • Energy • Financial Institutions • Forest Products • Healthcare • Mining <strong>and</strong> Metals • Real Estate • Technology<br />

This announcement appears as a matter of record only. RBC Capital Markets is the global br<strong>and</strong> name for the corporate <strong>and</strong> investment banking businesses of Royal Bank of Canada <strong>and</strong> its affiliates, including RBC Capital Markets<br />

Corporation in the U.S., member SIPC; <strong>and</strong> RBC Dominion Securities Inc. in Canada, member CIPF. TM trademark of Royal Bank of Canada. RBC Capital Markets is a trademark of Royal Bank of Canada, used under license.