The PERE Forum: Asia - PEI Media

The PERE Forum: Asia - PEI Media

The PERE Forum: Asia - PEI Media

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

REGISTER<br />

BEFORE 18TH<br />

DECEMBER TO<br />

SAVE USD$300<br />

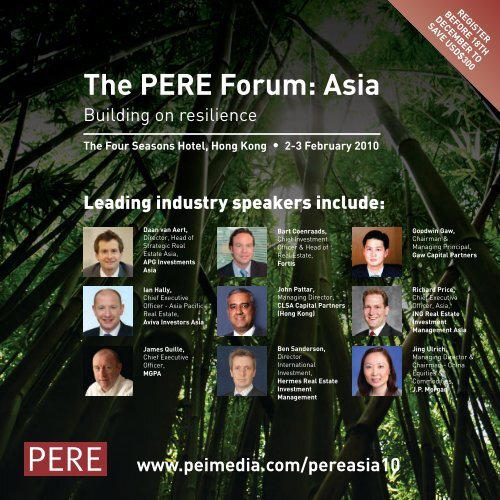

<strong>The</strong> <strong>PERE</strong> <strong>Forum</strong>: <strong>Asia</strong><br />

Building on resilience<br />

<strong>The</strong> Four Seasons Hotel, Hong Kong • 2-3 February 2010<br />

Leading industry speakers include:<br />

Daan van Aert,<br />

Director, Head of<br />

Strategic Real<br />

Estate <strong>Asia</strong>,<br />

APG Investments<br />

<strong>Asia</strong><br />

Bart Coenraads,<br />

Chief Investment<br />

Officer & Head of<br />

Real Estate,<br />

Fortis<br />

Goodwin Gaw,<br />

Chairman &<br />

Managing Principal,<br />

Gaw Capital Partners<br />

Ian Hally,<br />

Chief Executive<br />

Officer - <strong>Asia</strong> Pacific<br />

Real Estate,<br />

Aviva Investors <strong>Asia</strong><br />

James Quille,<br />

Chief Executive<br />

Officer,<br />

MGPA<br />

John Pattar,<br />

Managing Director,<br />

CLSA Capital Partners<br />

(Hong Kong)<br />

Ben Sanderson,<br />

Director<br />

International<br />

Investment,<br />

Hermes Real Estate<br />

Investment<br />

Management<br />

Richard Price,<br />

Chief Executive<br />

Officer, <strong>Asia</strong>,<br />

ING Real Estate<br />

Investment<br />

Management <strong>Asia</strong><br />

Jing Ulrich,<br />

Managing Director &<br />

Chairman - China<br />

Equities &<br />

Commodities,<br />

J.P. Morgan<br />

www.peimedia.com/pereasia10

<strong>The</strong> <strong>PERE</strong> <strong>Forum</strong>: <strong>Asia</strong><br />

Building on resilience<br />

REGISTER<br />

BEFORE 18TH<br />

DECEMBER TO<br />

SAVE USD$300<br />

<strong>The</strong> Four Seasons Hotel, Hong Kong • 2-3 February 2010<br />

A sample of the experts confirmed to speak:<br />

Daan van Aert,<br />

Director, Head of Strategic<br />

Real Estate <strong>Asia</strong>,<br />

APG Investments <strong>Asia</strong><br />

Stanley Ching,<br />

Senior Managing Director &<br />

Head of Real Estate Group,<br />

CITIC Capital<br />

Holdings Limited<br />

Bart Coenraads,<br />

Chief Investment Officer<br />

& Head of Real Estate,<br />

Fortis<br />

Pietro Doran,<br />

Chairman &<br />

Principal Partner,<br />

Doran Capital Partners<br />

Frank Forelle,<br />

Managing Director -<br />

Corporate Investments,<br />

Deutsche Bank AG<br />

Goodwin Gaw,<br />

Chairman &<br />

Managing Principal,<br />

Gaw Capital Partners<br />

Ian Hally,<br />

Chief Executive Officer -<br />

<strong>Asia</strong> Pacific Real Estate,<br />

Aviva Investors <strong>Asia</strong><br />

Edmund Ho,<br />

Managing Director -<br />

Commercial Real Estate<br />

Origination & Client Coverage,<br />

Standard Chartered<br />

Nirav Kachalia,<br />

Managing Director<br />

of Investments,<br />

Morgan Creek Capital<br />

Management <strong>Asia</strong><br />

Wilson T. Leung,<br />

Managing Director,<br />

Angelo, Gordon <strong>Asia</strong><br />

Victor Lor,<br />

Managing Director,<br />

TAN-EU Capital<br />

Nick Loup,<br />

Chief Executive,<br />

Grosvenor <strong>Asia</strong> Pacific<br />

Peter Mitchell,<br />

Chief Executive Officer,<br />

APREA<br />

John Pattar,<br />

Managing Director,<br />

CLSA Capital Partners<br />

(Hong Kong)<br />

Richard Price,<br />

Chief Executive Officer, <strong>Asia</strong>,<br />

ING Real Estate Investment<br />

Management <strong>Asia</strong><br />

James Quille,<br />

Chief Executive Officer,<br />

MGPA<br />

Ben Sanderson,<br />

Director International<br />

Investment,<br />

Hermes Real Estate<br />

Investment Management<br />

Fred Schmidt,<br />

Managing Director,<br />

Morgan Stanley<br />

Capital K.K.<br />

Albert C. Tan,<br />

Partner,<br />

Haynes and Boone, LLP<br />

Jon-Paul Toppino,<br />

Representative Director,<br />

Secured Capital Japan

Simon Treacy,<br />

Chief Executive Officer -<br />

<strong>Asia</strong> Investments,<br />

MGPA<br />

Sponsors:<br />

Cocktail Reception Sponsor:<br />

Jing Ulrich,<br />

Managing Director &<br />

Chairman - China Equities<br />

& Commodities,<br />

J.P. Morgan<br />

Eddie Wong,<br />

CEO,<br />

Winnington<br />

Capital Limited<br />

Timothy Zee,<br />

Managing Director -<br />

Head of <strong>Asia</strong> Pacific<br />

Real Estate Group,<br />

Daiwa Securities<br />

SMBC<br />

Third and<br />

subsequent<br />

delegates recieve<br />

a 50% discount -<br />

call for more<br />

details<br />

Lead Sponsors:<br />

Host Publication:<br />

Data Partner:<br />

Supporting Associations:

Welcome to the third annual <strong>PERE</strong> <strong>Forum</strong>: <strong>Asia</strong><br />

After the extraordinary happenings in the global and <strong>Asia</strong>n economies of recent times, <strong>PEI</strong> is delighted to<br />

once again provide you with a forum for the Private Equity Real Estate industry in <strong>Asia</strong> to meet, reflect and<br />

perhaps most importantly strategise for the future.<br />

<strong>The</strong> relative strength of many of the <strong>Asia</strong>n economies still contrasts favourably with the conditions found in<br />

other parts of the world. <strong>The</strong> prospects perhaps of a more stable and positive environment in Japan and<br />

Korea, the extraordinary growth trajectory of China and the continued emergence of India will all be key<br />

factors for those making decisions about <strong>Asia</strong>n real estate over the months ahead.<br />

Balancing with these positive aspects, of course, lay considerable challenges. <strong>The</strong> continued overhang of debt in some markets,<br />

damaged balance sheets, concerned investors and over development in some sectors are just some of these challenges. Capital<br />

shortages have surfaced in places also.<br />

However, new sources of capital may be on the horizon, as increasingly investors from <strong>Asia</strong> are seeking broader growth<br />

opportunities within the region. Others are moving more broadly outside of <strong>Asia</strong>, some for the first time. Whatever the strategy<br />

behind the emerging capital, existing global investment patterns must be viewed in the context of the renewed and growing<br />

strength of <strong>Asia</strong>. <strong>The</strong> scale, sophistication and growth of <strong>Asia</strong> simply cannot be ignored.<br />

<strong>The</strong>se two days in Hong Kong will offer us time to discuss these themes frankly and openly. Many see 2010 as the year that a much<br />

more positive road is defined. As always you will benefit from a mixture of thoughtful presentations, lively and relevant discussions<br />

and the opportunity to participate either during the principle discussions themselves, the roundtable debates or more simply during<br />

the time allotted for networking.<br />

<strong>The</strong>re will be a broad range of senior figures from the real estate industry taking part and we very much look forward to<br />

welcoming you to Hong Kong to join us.<br />

Yours sincerely,<br />

Richard A Johnson<br />

Chairman

Just some of the<br />

companies that attended<br />

our <strong>PERE</strong> events in 2009:<br />

Aberdeen Property Investors Eastern Europe ■ ADAM<br />

Realty Partners ■ Advanced Capital ■ Aedas ■ Aetos<br />

Capital <strong>Asia</strong> ■ AEW Europe ■ AG Holdings ■ Ajia Partners<br />

Inc. Korea Ltd ■ Allianz Real Estate ■ Altan Capital ■<br />

Alter Domus ■ AM alpha GmbH ■ Angelo Gordon <strong>Asia</strong> ■<br />

APG Asset Management ■ APG Investments <strong>Asia</strong> ■ APREA<br />

■ ARA Managers (<strong>Asia</strong> Dragon) ■ Arcapita ■ Ascendas Pte<br />

Ltd ■ Ashurst ■ <strong>Asia</strong> Evolution Korea ■ <strong>Asia</strong>n Real Estate<br />

Association ■ Augentius Fund Administration ■ Aviva<br />

Investors <strong>Asia</strong> ■ AXA REIM ■ Bae, Kim & Lee ■ Baker &<br />

McKenzie ■ Barclays Capital ■ Bartlet Asset Management<br />

BAZO Investments (<strong>Asia</strong>) ■ Brockton Capital ■ Brookfield<br />

Asset Management ■ Brooks Properties ■ Brunei ■<br />

Investment Agency ■ Calyon ■ Canada Pension Plan<br />

Investment Board ■ Catalyst Capital ■ CB Richard Ellis<br />

■ CBRE Investors ■ Centerboard Group ■ Century Bridge<br />

Capital ■ Citco Hong Kong ■ CITCO REIF Services ■ Citi<br />

Alternative Investment Services ■ Citi Property Investors<br />

CITIC Capital ■ Citigate Dewe Rogerson ■ Civil Service<br />

Employees Pension Fund of Oman ■ Clifford Chance ■<br />

Colyzeo Investment Management ■ Composition Capital<br />

Partners ■ Corestate Capital ■ Corpfin Capital Real Estate<br />

Partners ■ Credit Suisse ■ Daiwa Securities SMBC ■<br />

Deloitte ■ Delta Holding ■ Deutsche Bank ■ Deutsche<br />

Bank International ■ Deutsche Bank Tokyo AG ■ DLA Piper<br />

Hong Hong ■ Doran Capital Partners (Hong Kong) ■<br />

Doughty Hanson ■ Doughty Hanson & Co ■ Eastdil<br />

Secured & Wells Fargo Securities ■ EBRD ■ EG Capital<br />

■ Ernst & Young LLP ■ Europa Capital ■ FF&P Private<br />

Equity Limited ■ FF&P Private Equity Limited ■ FLAG<br />

Capital ■ Fleming Family and Partners ■ FM Logistic<br />

Fortis Investments ■ <strong>Forum</strong> Partners ■ Franklin<br />

Templeton Real Estate Advisors ■ Freshfields Bruckhaus<br />

Deringer 1 ■ Fried Frank ■ Frogmore Property Company ■<br />

Gaw Capital Partners ■ GE RE IM ■ GED Real Estate ■<br />

Gibson Dunn & Crutcher ■ GIC Real Estate Pte Ltd ■<br />

GoldenTree Insite Partners ■ Goldman Sachs (Singapore)<br />

Goodman <strong>Asia</strong> ■ Goodwin Procter LLP ■ Grindrod Bank<br />

Grosvenor <strong>Asia</strong> ■ Hang Lung Properties Limited ■ Harvest<br />

Capital Partners Limited LLC ■ Haynes and Boone, LLP<br />

Hines ■ IL&FS Investment Managers ■ ING Real Estate<br />

<strong>Asia</strong> ■ ING Real Estate Investment Management <strong>Asia</strong> ■<br />

Inmobiliaria Norte Sur ■ International Finance<br />

Corporation (IFC) ■ Internos Real Investors ■ Investment<br />

Property Databank ■ IPES ■ J. P. Morgan Securities (<strong>Asia</strong><br />

Pacific) ■ Jen Capital Advisors ■ Jones Lang LaSalle<br />

JP Morgan Securities (<strong>Asia</strong> Pacific) ■ JSM ■ JT Partners<br />

LLC ■ Kaizen Global Limited ■ Kirkpatrick Executive<br />

Search & Selection ■ Knight Frank ■ Landmark Partners<br />

Langham Hall Hong Kong ■ LaSalle Investment<br />

Management ■ Lehman Brothers Real Estate Partners<br />

Lend Lease Investment Management - <strong>Asia</strong> ■ Liquid<br />

Realty Partners ■ M3 Capital Partners ■ Macquarie<br />

Capital Advisors ■ Macquarie Goodman Japan ■ Marathon<br />

Asset Management ■ Mayer Brown International LLP ■<br />

MEAG Pacific Star <strong>Asia</strong> ■ Merrill Lynch (<strong>Asia</strong> Pacific) ■<br />

MetLife Investments ■ MetLife Real Estate Investments<br />

Meyer Bergman ■ MGPA Singapore ■ Minter Ellison ■<br />

Mirvac ■ Monument Group ■ Morgan Creek Capital<br />

Management <strong>Asia</strong> ■ Morgan Stanley <strong>Asia</strong> ■ Mosaic<br />

Property Llp ■ Mourant Fund Service Singapore ■ Mousse<br />

Partners ■ NEINVER ■ NIBC Infrastructure Partners ■<br />

Nitesh Estates ■ Nomura International ■ Nomura<br />

Securities ■ O'Melveny & Myers ■ Oxley Capital Group<br />

Pacific Alliance ■ Pacific Star <strong>Asia</strong> Pte Ltd ■ Palatium<br />

Investment Management ■ Partners Group ■ Patron<br />

Capital UK ■ Pension Protection Fund ■ Pradera <strong>Asia</strong><br />

Pramerica Real Estate Investors ■ Presidio Partners<br />

PricewaterhouseCoopers ■ Probitas Partners ■<br />

Property & Portfolio Research ■ Prudential Property<br />

Investment Management, Singapore ■ Quilvest<br />

Rankvale Holdings Plc ■ Raven Russia ■ RBS ■ Real<br />

Capital Analytics ■ Realdania ■ Red Fort Advisors ■<br />

Retalia Retail Invest S.L. ■ Reynolds Ventures ■ Rio Bravo<br />

Investimentos ■ Rockpoint Group ■ RREEF ■<br />

Sachverständigen Kanzlei Schlicht ■ SC Consulting ■<br />

Schroder Investment Management (Hong Kong) ■ Secure<br />

Management ■ Secured Capital Japan ■ Simmons &<br />

Simmons ■ SJ Berwin ■ SK D&D ■ Squadron Capital<br />

Standard Chartered IL&FS <strong>Asia</strong> Infrastructure Growth<br />

Fund ■ Surbana Fund Management ■ Susterra Partners<br />

Syntrus Achmea Real Estate ■ Taubman <strong>Asia</strong> Limited<br />

Taxand ■ Temasek Holdings ■ <strong>The</strong> Blackstone Group ■<br />

<strong>The</strong> Hong Kong Jockey Club ■ <strong>The</strong> Investment Fund for<br />

Foundations (TIFF) ■ <strong>The</strong> Norinchukin Bank ■ <strong>The</strong><br />

Townsend Group ■ <strong>The</strong> Wellcome Trust ■ Tishman Speyer<br />

Touchstone Capital Securities ■ Trafalgar Asset Managers<br />

Tristan Capital Partners ■ TRW <strong>Asia</strong> ■ UBS ■<br />

VinaCapital Group ■ Wachovia Securities ■ Warburg<br />

Pincus ■ Wayne Capital Partners ■ Westbrook Partners ■<br />

WestImmo ■ Yardi Systems<br />

"<strong>The</strong> <strong>PERE</strong> <strong>Asia</strong> <strong>Forum</strong> was a successful<br />

conference, bringing together the major players<br />

in the real estate industry in <strong>Asia</strong>."<br />

Jason Lee,<br />

Managing Director and Head of Carlyle <strong>Asia</strong> Real Estate Group,<br />

<strong>The</strong> Carlyle Group<br />

Programme highlights:<br />

Day One, 2nd February<br />

Day Two, 3rd February<br />

Delegates at the 2009 forum<br />

Opening Keynote:<br />

A bird's eye view on how to make meaningful returns in real<br />

estate in <strong>Asia</strong><br />

<strong>The</strong> Big Debate:<br />

<strong>The</strong> House believes that the “blind pool” is dead - club style<br />

fund structures with LPs is the way for <strong>PERE</strong> funds to invest<br />

for the future<br />

Panel Session:<br />

Distressed opportunities: have they arrived?<br />

<strong>The</strong> China Panel:<br />

More hype than a<br />

fundamentally solid<br />

market?<br />

<strong>The</strong> <strong>PEI</strong> Interview:<br />

with a veteran real<br />

estate investor:<br />

James Quille, MGPA<br />

<strong>The</strong> LP Panel:<br />

<strong>The</strong>ir perspectives<br />

• Managing the LP-GP<br />

relationship: are<br />

cracks showing?<br />

• Co-investments: to what<br />

extent are LPs ready?<br />

• Calibrating realistic return<br />

expectations from 2010<br />

vintage funds<br />

www.peimedia.com/pereasia10<br />

REGISTER TODAY<br />

Visit www.peimedia.com/pereasia10<br />

Or call +65 6838 4563

Day 1: February 2 2010<br />

08:15 - 09:00 Registration and coffee<br />

09:00 - 09:15 <strong>PERE</strong> welcome & chairman's opening remarks<br />

Richard Johnson,<br />

Chairman of the forum<br />

11:45 - 12:30 <strong>The</strong> Big Debate: This House believes that the “blind<br />

pool” is dead - club style fund structures with LPs<br />

is the way for <strong>PERE</strong> funds to invest for the future<br />

09:15 - 09:45 Opening keynote: Is the growth story in <strong>Asia</strong> still<br />

compelling given the distressed opportunities in<br />

North America and Europe?<br />

A bird's eye view on how to make meaningful returns in real<br />

estate in <strong>Asia</strong><br />

09:45 - 10:30 Scene setting panel: <strong>Asia</strong>n <strong>PERE</strong> in the<br />

macro-context<br />

• How do key <strong>Asia</strong>n real estate markets compare with the 2009 hotspots<br />

of UK, US and Australia?<br />

• In the wake of fund fallouts in the past 12 months, will <strong>PERE</strong> fund<br />

managers have to review their strategies?<br />

• Should sponsored funds make way for more independent ownership<br />

fund structures?<br />

Richard Price,<br />

ING Real Estate<br />

Wilson Leung,<br />

Angelo Gordon <strong>Asia</strong><br />

Simon Treacy,<br />

MGPA<br />

10:30 - 11:00 Coffee break<br />

11:00 - 11:45 Deal Panel: Securing financing in the current<br />

economic environment<br />

• Are lenders more confident financing core strategies than<br />

opportunistic plays?<br />

• Are banks more willing to back developers than fund investors?<br />

• Capital commitment financing - working capital or quasipermanent<br />

financing?<br />

• Key distinctions in the bank loan market of <strong>Asia</strong> versus rest of the world<br />

Albert C. Tan,<br />

Haynes and Boone, LLP<br />

Victor Lor,<br />

Tan-Eu-Capital<br />

Frank Forelle,<br />

Deutsche Bank AG<br />

Timothy Zee,<br />

Daiwa Securities SMBC<br />

Edmund Ho,<br />

Standard Chartered<br />

John Pattar,<br />

CLSA<br />

Daan Van Aert,<br />

APG Asset Management <strong>Asia</strong><br />

Pietro Doran,<br />

Doran Capital Partners<br />

12:30 - 14:00 Lunch<br />

14:00 - 15:00 Workshops A & B – See below<br />

15:00 - 15:30 Coffee break<br />

15:30 - 16:30 Workshops C & D – See below<br />

16:30 - 17:30 Panel: Distressed opportunities: have they arrived?<br />

• Did most <strong>Asia</strong>n markets dodge the full-blown effects of the global<br />

financial crisis, or are there more dire consequences pending in 2010?<br />

• Is Japan officially in distress?<br />

• Are asset sales in 2010 evidence of the region’s resilience?<br />

• What’s the story Down Under?<br />

Jon-Paul Toppino,<br />

Secured Capital Japan<br />

Fred Schmidt,<br />

Morgan Stanley<br />

17:30 - 19:30 Cocktail reception hosted by:<br />

"<strong>PEI</strong> have differentiated themselves<br />

through the quality of the content of<br />

their conferences in <strong>Asia</strong>, bringing<br />

a fresh approach to the <strong>Asia</strong>n<br />

private equity conference circuit."<br />

Hugh Dyus,<br />

Senior Vice President,<br />

Macquarie Funds Group

"A great conference with a club-like environment among senior practitioners<br />

in Private Equity Real Estate. Truly a forum like experience. <strong>The</strong> high energy<br />

and high level of participants allow free flow of information, making the event<br />

highly informative."<br />

Goodwin Gaw,<br />

Chairman & Managing Principal,<br />

Gaw Capital Partners<br />

Workshops<br />

14:00 - 15:00 WORKSHOPS I - FUND OPERATIONS<br />

Workshop A: Building a solid, amicable and equitable<br />

GP-LP relationship<br />

• Does it boil down to reviewing fund terms and conditions especially for<br />

new funds being raised?<br />

• Veto rights of LPs: more money, more say?<br />

• Makeup of an investment committee: criteria for selection of LP<br />

representatives<br />

Workshop B: Diversifying portfolio risks for opportunistic strategies<br />

• Are emerging markets such as India, Vietnam and Malaysia markets<br />

fund managers should consider making investments into if they have<br />

not done so already?<br />

• Why are most <strong>Asia</strong>n funds staying away from India but flocking to China?<br />

• Are country-focused funds the best way to access India and Vietnam?<br />

15:30 - 16:30 WORKSHOPS II - MARKET OPERATIONS<br />

Workshop C: Looking at alternative sectors<br />

• What are they?<br />

• Rewards & challenges<br />

• Healthcare and private nursing/ aged care facilities and service<br />

apartments are not quite opportunistic as much as riding on the<br />

region’s growth story - true or false?<br />

Workshop D: Are grade-A offices still a sure bet?<br />

• Casting the spotlight on Singapore, Tokyo, Sydney and Shanghai<br />

• Will revamping Grade-B buildings make more sense in some cities?<br />

• Are mixed use developments a safer bet than office buildings?<br />

REGISTER TODAY<br />

Visit www.peimedia.com/pereasia10<br />

Or call +65 6838 4563

Day 2: February 3 2010<br />

09:00 - 09:15 Chairman’s recap<br />

Richard Johnson,<br />

Chairman of the forum<br />

11:00 - 11:30 <strong>The</strong> <strong>PEI</strong> Interview: with a veteran real estate investor<br />

James Quille,<br />

MGPA<br />

09:15 - 0945 Opening Keynote: Diversifying your real estate<br />

portfolio risks<br />

A strategist shares his thoughts on how to approach investing<br />

into real estate from a macro-perspective: across assets<br />

classes and geography<br />

Ben Sanderson,<br />

Hermes Real Estate Investment Management<br />

09:45 - 10:30 <strong>The</strong> China Panel: More hype than a fundamentally<br />

solid market?<br />

• Rationale of a RMB fund<br />

• Beyond Shanghai and Beijing: are second and third-tier<br />

cities worth the trouble?<br />

• Is China a pure opportunistic play or is it a value-add strategy?<br />

Stanley Ching,<br />

CITIC Capital<br />

11:30 - 12:30 <strong>The</strong> LP Panel: <strong>The</strong>ir perspectives<br />

• Managing the LP-GP relationship: are cracks showing?<br />

• Co-investments: to what extent are LPs ready?<br />

• Calibrating realistic return expectations from 2010 vintage funds<br />

Ian Hally,<br />

Aviva Investors<br />

Nirav Kachalia,<br />

Morgan Creek Capital<br />

Management <strong>Asia</strong><br />

12:30 - 14:30 Networking lunch and close of conference<br />

Goodwin Gaw,<br />

Gaw Capital Partners<br />

Eddie Wong,<br />

Winnington Capital Limited<br />

10:30 - 11:00 Coffee break<br />

"Thought provoking subjects, expert<br />

panelists, excellent organization. A<br />

"must do" conference for anyone<br />

seeking the latest trends and<br />

opinions regarding the Private<br />

Equity Real Estate Market"<br />

Charles L. Voss,<br />

Managing Director,<br />

Aberdeen Property Investors St. Petersburg OOO<br />

"<strong>The</strong> <strong>PERE</strong> <strong>Forum</strong> was very well<br />

attended and offered a focused<br />

program and format which allowed<br />

participants to learn more about the<br />

<strong>Asia</strong>n market, the opportunities and<br />

the risks."<br />

Simon Treacy,<br />

CEO - <strong>Asia</strong> Investments,<br />

MGPA

Venue:<br />

Four Seasons Hotel, Hong Kong<br />

8 Finance Street, Central, Hong Kong, China<br />

T +852 3196-8888 F +852 3196-8899<br />

W www.fourseasons.com/hongkong<br />

On the waterfront overlooking Victoria Harbour and the financial district, Four<br />

Seasons redefines luxury and excellence in a city renowned for exceptional<br />

accommodation. As part of the prestigious International Finance Centre, it offers<br />

unrivalled links to Hong Kong Station, with the famed Star Ferry steps away.<br />

We have negotiated special room rates for the forum:<br />

■ Deluxe Peak View Room at HK$2,200<br />

■ Deluxe Harbour View Room at HK$3,000<br />

(Rates are subject to 10% service charge)<br />

Please quote<br />

020110<strong>PEI</strong><br />

when booking<br />

About <strong>PEI</strong> <strong>Media</strong>:<br />

<strong>PEI</strong> <strong>Media</strong> is the leading financial information group dedicated to alternative assets<br />

globally - private equity, real estate and infrastructure.<br />

We provide news, intelligence and insight of the highest value to the private equity industry<br />

globally in a number of different formats. We publish five magazines, host four news<br />

websites, manage what is probably the most extensive set of databases dedicated to<br />

alternative assets, run 22 annual conferences globally, publish a library of 20 books and<br />

directories and have a fast growing training business.<br />

Over the years we have grown into a widely-known and highly-regarded business that<br />

delivers detailed coverage to our customers. We have members of our award-winning<br />

editorial team sat in all three of our offices [London, New York and Singapore] and<br />

likewise our conference business runs events based from each of these locations.<br />

We feel strongly that the industries we cover are inherently international and resolutely<br />

cross-border - so to cover them effectively we must be able to connect with them in every<br />

market and in any time zone.<br />

We take great pride in designing and delivering forums that are substantive, topical, well<br />

organised and, as a result, well attended. Combining education with interaction, you will gain<br />

both practical and strategic knowledge whilst significantly developing your network of contacts.<br />

caption:<br />

caption:<br />

For forthcoming events see:<br />

www.peimedia.com/events<br />

<strong>PEI</strong> <strong>Media</strong> Ltd,<br />

winners of:<br />

Magazines<br />

Books<br />

Conferences<br />

Data<br />

REGISTER TODAY<br />

Visit www.peimedia.com/pereasia10<br />

Or call +65 6838 4563

Regional breakdown<br />

of delegates from<br />

the 2009 forum:<br />

■ Hong Kong<br />

■ Singapore<br />

■ Europe<br />

■ Korea<br />

■ India<br />

■ Japan<br />

■ China<br />

■ USA<br />

■ Other<br />

<strong>PERE</strong> funds closed -<br />

<strong>Asia</strong> ahead in 2009:<br />

■ <strong>Asia</strong>/RoW 29%<br />

■ Americas 27%<br />

■ Europe 23%<br />

■ Global 21%<br />

Percentage of total fundraising by geographic focus<br />

for funds closed in 2009.<br />

Key themes<br />

for 2010:<br />

• Is <strong>Asia</strong> looking at a bubble or<br />

is a sustainable recovery<br />

well underway?<br />

• How do opportunities in<br />

<strong>Asia</strong> compare to US and<br />

Western Europe?<br />

• Is China more hype or truly a<br />

market that investors cannot<br />

afford to ignore?<br />

• Is Japan officially in distress?<br />

If so, is now the time for<br />

bargain-hunters?<br />

• Are limited partners’ rising<br />

inclinations toward co-investing<br />

misguided especially at<br />

resource-starved institutions?<br />

"Timely and topical, the <strong>PERE</strong> event provided a<br />

forum for discussion and debate that was more<br />

sharply focused on emerging issues for private<br />

equity investors than other real estate<br />

conferences in <strong>Asia</strong>."<br />

Timothy Bellman,<br />

Global Head of Research and Strategy,<br />

ING Real Estate Investment Management<br />

For further information on the<br />

agenda contact:<br />

Eric Chiu on +852 2836 6884 or<br />

eric.c@peimedia.com<br />

REGISTER TODAY<br />

Visit www.peimedia.com/pereasia10<br />

Or call +65 6838 4563

Five easy ways to register<br />

Online<br />

www.peimedia.com/pereasia10<br />

Email<br />

Xinyan.k@peimedia.com<br />

Telephone<br />

+65 6838 4563<br />

Fax<br />

+65 6334 4391<br />

Post with payment to<br />

Conference Registrations,<br />

<strong>PEI</strong> <strong>Media</strong> Group Ltd,<br />

11 Stamford Road<br />

#02-07 Capitol Building<br />

Singapore<br />

178884<br />

<strong>The</strong> <strong>PERE</strong> <strong>Forum</strong>: <strong>Asia</strong>, 2-3 February 2010, Hong Kong<br />

Mr/Ms/Mrs ........................ First name ........................................ Last name ...................................<br />

Job Title .............................................................................................................................................<br />

Delegate 2 ..........................................................................................................................................<br />

Extra delegates from the same company receive a discount on the full registration fee<br />

Company name ..................................................................................................................................<br />

Address ..............................................................................................................................................<br />

City .................................... Post/Zip code .................................... Country .......................................<br />

Tel ...................................................................... Email .....................................................................<br />

Area of interest ..................................................................................................................................<br />

Register<br />

Early bird bookings<br />

Regular price<br />

valid until 18th December 2009 valid after 18th December 2009<br />

One Person $2150 $2450<br />

Two People $4000 $4700<br />

Qualified limited<br />

partners from<br />

public and private<br />

pension funds as well as<br />

endowment funds are<br />

eligible for complimentary<br />

passes to this event*.<br />

quote promotion<br />

code <strong>PERE</strong>ASIALP<br />

Third and subsequent delegates get a 50% discount - contact Xin Yan for details<br />

Payment<br />

Payment can be made by American Express, Visa, MasterCard or by wire transfer. Full payment<br />

must be received prior to the event. If registering four weeks or less prior to the event, payment<br />

must be made by credit card.<br />

By Wire Transfer<br />

By Credit Card - American Express/Visa/MasterCard<br />

Name on card ....................................................Card number .........................................................<br />

Expiry date ........................................................Signature ...............................................................<br />

Cancellation policy<br />

Please read our terms and conditions on www.peimedia.com/conferences. For more<br />

information regarding administrative policies please contact Xin Yan on +65 6838 4563<br />

* Institutional investors and limited partners from foundations, endowments and public and private pension funds will receive<br />

a complimentary pass to attend this event. Excludes fund of funds. Promo codes cannot be applied to existing registrations.<br />

Please do not make any travel arrangements until we have confirmed your eligibility.

<strong>PEI</strong> <strong>Media</strong> Singapore<br />

11 Stamford Road<br />

#02-07 Capitol Building<br />

Singapore 178884<br />

T: +65 6838 4563<br />

F: +65 6334 4391<br />

<strong>PEI</strong> <strong>Media</strong> London<br />

Sycamore House<br />

Sycamore Street<br />

London<br />

EC1Y 0SG<br />

T: +44 20 7566 5444<br />

F: +44 20 7566 5455<br />

<strong>PEI</strong> <strong>Media</strong> New York<br />

3 East 28th Street<br />

7th Floor<br />

New York, NY 10016<br />

T: +1 212 645 1919<br />

F: +1 212 633 2904<br />

www.peimedia.com/pereasia10